Environmental, social, and corporate governance issuance in emerging markets has become a thing in recent years. The draw has been diversification and larger order books. The greenium is of lesser influence. It is there though, varying from 1bp to 5bp, but can also flip negative.

Chile is a huge player in the ESG space. Pictured: Santiago

Central European pioneers in green and sustainable issuance

In Central Europe, Poland has been the pioneer, launching its first green bonds in 2019, followed by Hungary in 2020 and Serbia in 2021. In every case, they are EUR-denominated bonds. All of them share the positives of having heavily oversubscribed books at issuance, and all can claim a material greenium in terms of where they trade on the secondary market.

Slovenia also issued a EUR-denominated sustainable bond in 2021, which trades with a definite greenium, at some 5bp through the grey curve. Hungary also launched local currency green bonds, one in 2022 and a second one earlier this year. They trade tight to the grey curve, with an ad hoc moderate greenium.

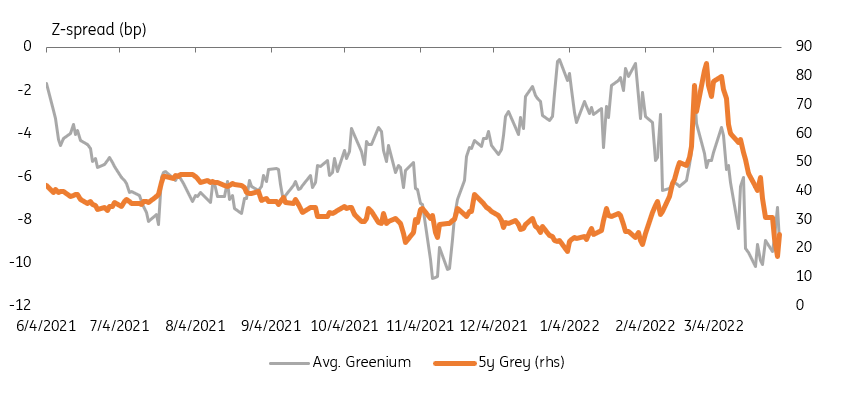

The greenium does jump around a bit. We saw that as spreads came under widening pressure recently, the greenium fell away, and the subsequent re-tightening helped reassert the greenium. However, we've also seen the reverse correlation. At times it can be determined by the types of players driving the market. We also don't read it as a lack of liquidity in environmental, social, and corporate governance (ESG) bonds. Rather, sometimes the easier to sell product can be sold first, resulting in a perceived underperformance.

Example of emerging market sovereign issuer average greenium vs grey spread movement (bp)

Source: Macrobond, ING estimates

The rationale here for green issuance is threefold. First, ESG issuance still comes with a novelty value that helps secure a strong book at issuance. Second, and in a parallel fashion, ESG issuance has a captive audience that will show up at issuance. And third, ESG issuance is seen to place the issuer in a positive light. Stakeholders – from investors to citizens to international observers – take note with a positive gloss.

Apart from the various hurdles that need to be overcome in terms of documentation, project identification and subsequent monitoring, issuers come away with an overall glow of positive kudos for going down that route in the first place. So-much-so that it in a way places pressure on other comparable issuers to step up and do the same.

Selected ESG issuers in emerging markets

Source: iNG estimates

Looking forward, Turkey, for example, is well advanced in structuring its sustainable framework and will use this to look at opportunities for green, social or sustainability bonds in the future. Other issuers in the Central and Eastern Europe space are also looking at options in ESG issuance, but in many cases, it is a bit of a slow process.

Key Latin American players: Chile is a huge player in the ESG space

One of the more interesting players in the emerging markets sovereign ESG space is Chile. Issuance of Chilean green, sustainable, sustainable-linked and social has seen its CHILE hard currency ticker on Bloomberg littered with ESG issuance options in the USD space. In fact, there are more ESG lines (11) than there are grey lines (4). Similar proportions are in evidence for EUR-denominated Chilean bonds.

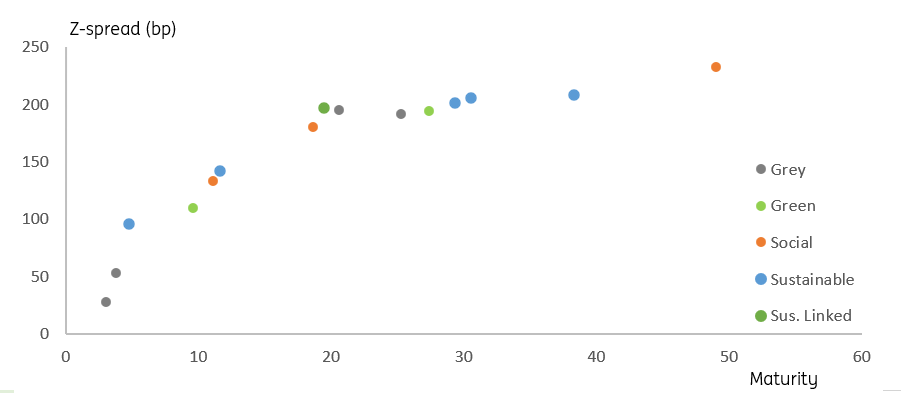

Chile issues along the whole spectrum of ESG bonds

Source: ING estimates

Interestingly, in this case, there is more of an ESG bond discount in evidence than a greenium. Certainly the ESG lines in the belly of the curve trade at a discount to and extrapolation between grey bonds, and for longer maturities, ESG lines tend to trade flat to or at a higher yield versus grey lines. We calculate a generic ESG bond discount of some 10bp for Chile USD paper; no greenium there.

But this is an interesting case in point. Of its last 12 USD lines issued since 2019, 11 of them are ESG bonds. And four of those have been issued in 2022 year-to-date, despite the existence of an ESG discount. This is a clear example of an issuer that has flipped towards ESG. All new lines issued in 2021 were also ESG bonds.

This is an example of an issuer that is not in ESG issuance for the greenium. Rather Chile sees itself in the pioneering space for sovereign issuance and followed that through by being the first sovereign to issue a sustainability-linked bond in March 2022. The positives don’t have to be in the price; that sustainability-linked bond was eight times oversubscribed, although it is also the cheapest bond on the Chile curve.

Other interesting issuers

- Peru has also dipped into the space with two USD-denominated sustainable bonds launched in 2021 and one EUR-denominated social bond. The EUR bond does seem to exhibit a moderate greenium versus an extrapolated grey curve, while the longer-dated USD bond trades at an ESG discount to the interpolated grey curve.

- Mexico has issued two EUR-denominated sustainable bonds, one in 2020 and the second in 2021. Both trade about flat to the grey curve, maybe a tad through at times for a very moderate greenium.

- In Asia, there are some examples of ESG issuance to note. Indonesia issued its first sustainable bond in 2021, which traded flat to a moderate pickup versus the grey curve. So no material greenium here.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

Bert Colijn is a Senior Eurozone Economist at ING. He joined the firm in July 2015 and covers the global economy with a specific focus on the Eurozone. Prior to this, he worked at The Conference Board, a global think-tank, in Brussels focusing mostly on long-term economic growth. He holds an undergraduate and graduate degree in International Economics and Business from the University of Groningen.

Bert Colijn is a Senior Eurozone Economist at ING. He joined the firm in July 2015 and covers the global economy with a specific focus on the Eurozone. Prior to this, he worked at The Conference Board, a global think-tank, in Brussels focusing mostly on long-term economic growth. He holds an undergraduate and graduate degree in International Economics and Business from the University of Groningen.

Carsten Brzeski is Chief Economist in Germany. He covers economic and political developments in Germany and the Eurozone, including the monetary policy of the ECB. Previously, he has worked at ABN Amro, the Dutch Ministry of Finance and the European Commission. Carsten has studied at the Free University of Berlin, Northeastern University in Boston and Harvard University in Cambridge, USA.

Carsten Brzeski is Chief Economist in Germany. He covers economic and political developments in Germany and the Eurozone, including the monetary policy of the ECB. Previously, he has worked at ABN Amro, the Dutch Ministry of Finance and the European Commission. Carsten has studied at the Free University of Berlin, Northeastern University in Boston and Harvard University in Cambridge, USA.

Jeroen is Global Head of Sector Research, based in Amsterdam. He started working for ING Financial Markets in 2001. His main focus is investment grade credit strategy with a particular focus on relative value. Previously, he was with ABN AMRO.

Jeroen is Global Head of Sector Research, based in Amsterdam. He started working for ING Financial Markets in 2001. His main focus is investment grade credit strategy with a particular focus on relative value. Previously, he was with ABN AMRO.

Maarten Leen is the Head of Macroeconomics. Previously, he worked at Rabobank and the Central Bureau of Statistics in the Netherlands. Between 1986 and 1992, he was a policy advisor to the Dutch minister of Finance. Maarten studied Economics at the Erasmus University in Rotterdam and has been with ING since 1995.

Maarten Leen is the Head of Macroeconomics. Previously, he worked at Rabobank and the Central Bureau of Statistics in the Netherlands. Between 1986 and 1992, he was a policy advisor to the Dutch minister of Finance. Maarten studied Economics at the Erasmus University in Rotterdam and has been with ING since 1995.

Charlotte de Montpellier is an Economist in ING Belgium covering Switzerland. She joined the firm in February 2018. Prior to this, she worked as a research and teaching assistant at Université Catholique de Louvain and at the economic research institute IRES in Belgium.

Charlotte de Montpellier is an Economist in ING Belgium covering Switzerland. She joined the firm in February 2018. Prior to this, she worked as a research and teaching assistant at Université Catholique de Louvain and at the economic research institute IRES in Belgium.

Franziska is an Economist in Frankfurt. She mainly covers the German and Austrian economies. She joined ING in September 2020 after finishing her masters’ degree in economics at Justus-Liebig-University Gießen. Prior to joining ING, she worked at ODDO BHF’s Investment office.

Franziska is an Economist in Frankfurt. She mainly covers the German and Austrian economies. She joined ING in September 2020 after finishing her masters’ degree in economics at Justus-Liebig-University Gießen. Prior to joining ING, she worked at ODDO BHF’s Investment office.

Alyssa joined ING’s Credit Research team in 2019 covering European consumer goods, having worked in the Equity department at ING since 2016. Prior to this, Alyssa worked at NIBC markets as part of the equity sales team covering the UK market from 2014 to 2016.

Alyssa joined ING’s Credit Research team in 2019 covering European consumer goods, having worked in the Equity department at ING since 2016. Prior to this, Alyssa worked at NIBC markets as part of the equity sales team covering the UK market from 2014 to 2016.

Antoine is a Senior Rates Strategist covering developed rates markets. He bases his views on macro developments spanning economics, central banks, supply, and cross-markets dynamics, and finds the optimal way to implement them using quantitative methods. He previously worked at Mizuho international as a Rates Strategist and at MUFG as a Rates Trader.

Antoine is a Senior Rates Strategist covering developed rates markets. He bases his views on macro developments spanning economics, central banks, supply, and cross-markets dynamics, and finds the optimal way to implement them using quantitative methods. He previously worked at Mizuho international as a Rates Strategist and at MUFG as a Rates Trader.

Benjamin Schroeder is a senior rates strategist at ING in Amsterdam. Before joining ING in 2016, he worked in fixed income research at Dresdner Kleinwort and Commerzbank in Frankfurt, Germany. Benjamin holds a master’s degree in economics from the University of Bonn, Germany.

Benjamin Schroeder is a senior rates strategist at ING in Amsterdam. Before joining ING in 2016, he worked in fixed income research at Dresdner Kleinwort and Commerzbank in Frankfurt, Germany. Benjamin holds a master’s degree in economics from the University of Bonn, Germany.

Chris is Head of FX Strategy at ING. Together with his team, he provides short and medium-term FX recommendations for ING’s corporate and institutional client base. Prior to joining ING in 2005, he was a senior partner and head of FX research at IDEAglobal, a research consultancy specialising in independent financial market research for the investment banking, hedge fund and central bank community. He holds a BSc in Economics and Accounting from Bristol University.

Chris is Head of FX Strategy at ING. Together with his team, he provides short and medium-term FX recommendations for ING’s corporate and institutional client base. Prior to joining ING in 2005, he was a senior partner and head of FX research at IDEAglobal, a research consultancy specialising in independent financial market research for the investment banking, hedge fund and central bank community. He holds a BSc in Economics and Accounting from Bristol University.

Francesco is an FX Strategist and has been with the firm since May 2019. His main focus is on the G10 space and, in particular, commodity currencies. He began his career at Credit Agricole CIB and holds an MSc in Financial Markets and Investments

Francesco is an FX Strategist and has been with the firm since May 2019. His main focus is on the G10 space and, in particular, commodity currencies. He began his career at Credit Agricole CIB and holds an MSc in Financial Markets and Investments

Dimitry Fleming is a Senior Economist in Amsterdam. He joined the firm in 2001 and in addition to covering macroeconomic developments, he focuses on the banking market. Dimitry studied International Financial Economics at the University of Amsterdam.

Dimitry Fleming is a Senior Economist in Amsterdam. He joined the firm in 2001 and in addition to covering macroeconomic developments, he focuses on the banking market. Dimitry studied International Financial Economics at the University of Amsterdam.

Dmitry is Chief Economist covering Russia and CIS countries. He joined ING in 2018 and has a decade of experience in macroeconomics and FX strategy with Alfa-Bank and Gazprombank. Dmitry graduated from the Lomonosov Moscow State University and has also studied at the Plekhanov Russian University of Economics and ESSEC Business School.

Dmitry is Chief Economist covering Russia and CIS countries. He joined ING in 2018 and has a decade of experience in macroeconomics and FX strategy with Alfa-Bank and Gazprombank. Dmitry graduated from the Lomonosov Moscow State University and has also studied at the Plekhanov Russian University of Economics and ESSEC Business School.

As an economist with an affinity for IT and digital topics, Teunis researches trends in digital finance, innovation and their regulation (such as the increasing importance of data, fintech, platforms, digital currencies, blockchain, …) on banks and the broader economy. He started his career at the Dutch central bank and has been with ING since 2010. Teunis holds MA degrees in both Economics and Philosophy of Science from Tilburg University.

As an economist with an affinity for IT and digital topics, Teunis researches trends in digital finance, innovation and their regulation (such as the increasing importance of data, fintech, platforms, digital currencies, blockchain, …) on banks and the broader economy. He started his career at the Dutch central bank and has been with ING since 2010. Teunis holds MA degrees in both Economics and Philosophy of Science from Tilburg University.

Egor is a senior credit analyst with 15-years of experience in the Russian debt market. He joined ING in 2011 and covers more than 60 non-financial and financial issuers from Russia, Ukraine, Kazakhstan, Georgia and Azerbaijan, offers credit opinion and provides in-depth analysis on Russian and CIS credit markets. Prior to this, he was at the Bank of Moscow and has a Masters in finance diploma from State University - Higher School of Economics.

Egor is a senior credit analyst with 15-years of experience in the Russian debt market. He joined ING in 2011 and covers more than 60 non-financial and financial issuers from Russia, Ukraine, Kazakhstan, Georgia and Azerbaijan, offers credit opinion and provides in-depth analysis on Russian and CIS credit markets. Prior to this, he was at the Bank of Moscow and has a Masters in finance diploma from State University - Higher School of Economics.

Oleksiy Soroka is a senior high yield credit research analyst with extensive experience in global emerging markets and the European high yield market. Previously, he was with Allianz Global Investors, Credit Suisse and BNP Paribas. He joined the firm in 2019 and is based in London. Oleksiy is a CFA charterholder.

Oleksiy Soroka is a senior high yield credit research analyst with extensive experience in global emerging markets and the European high yield market. Previously, he was with Allianz Global Investors, Credit Suisse and BNP Paribas. He joined the firm in 2019 and is based in London. Oleksiy is a CFA charterholder.

Gerben Hieminga is a Senior Economist covering energy markets and sustainability. He joined the firm in 2004 and previously used to work for the real estate team. He holds an undergraduate degree in economics and building engineering and a graduate degree in monetary economics from the University of Tilburg.

Gerben Hieminga is a Senior Economist covering energy markets and sustainability. He joined the firm in 2004 and previously used to work for the real estate team. He holds an undergraduate degree in economics and building engineering and a graduate degree in monetary economics from the University of Tilburg.

Thijs Geijer is a Senior Economist covering the Food and Agriculture sector. He joined ING in 2012 after three years at Rabobank. Thijs studied Economic Geography at Utrecht University.

Thijs Geijer is a Senior Economist covering the Food and Agriculture sector. He joined ING in 2012 after three years at Rabobank. Thijs studied Economic Geography at Utrecht University.

Timothy Rahill is a credit strategist at ING Bank in Amsterdam. He joined the Bank straight out of University in 2019, after relocating to the Netherlands from Dublin. He graduated from Technical University Dublin, with a Finance degree. Timothy’s strategy coverage includes European and US markets, ranging from investment grade to high yield credit.

Timothy Rahill is a credit strategist at ING Bank in Amsterdam. He joined the Bank straight out of University in 2019, after relocating to the Netherlands from Dublin. He graduated from Technical University Dublin, with a Finance degree. Timothy’s strategy coverage includes European and US markets, ranging from investment grade to high yield credit.

Warren Patterson is Head of Commodities strategy based in Singapore. He joined the bank in April 2016 and covers the entire commodities complex. Previously, he worked at a commodities trade house in London. He graduated from Cass Business School, where he studied Investment and Financial Risk Management.

Warren Patterson is Head of Commodities strategy based in Singapore. He joined the bank in April 2016 and covers the entire commodities complex. Previously, he worked at a commodities trade house in London. He graduated from Cass Business School, where he studied Investment and Financial Risk Management.

Wenyu Yao is a senior commodity strategist covering industrial metals and energy markets. She joined ING in June 2019, having previously worked at Refinitiv in London. She began her career in a dual role at Antaike and the Chinese Nonferrous Metals Industry Association in Beijing and holds an MSc in Finance.

Wenyu Yao is a senior commodity strategist covering industrial metals and energy markets. She joined ING in June 2019, having previously worked at Refinitiv in London. She began her career in a dual role at Antaike and the Chinese Nonferrous Metals Industry Association in Beijing and holds an MSc in Finance.

Inga Fechner is an economist at ING in Germany, covering international economic developments with a specific focus on Austria. She joined the company in 2014 after graduating in Economics from the University of Münster, with studies abroad in Japan and Italy.

Inga Fechner is an economist at ING in Germany, covering international economic developments with a specific focus on Austria. She joined the company in 2014 after graduating in Economics from the University of Münster, with studies abroad in Japan and Italy.

Iris Pang is the economist for Greater China, joining ING Wholesale banking in 2017. Iris was previously employed by Natixis and OCBC Wing Hang Bank. She earned a PhD in economics from Hong Kong University of Science and Technology.

Iris Pang is the economist for Greater China, joining ING Wholesale banking in 2017. Iris was previously employed by Natixis and OCBC Wing Hang Bank. She earned a PhD in economics from Hong Kong University of Science and Technology.

James Knightley is the Chief International Economist in London. He joined the firm in 1998 and has been covering G7 and Western European economies. He studied economics at Durham University, UK.

James Knightley is the Chief International Economist in London. He joined the firm in 1998 and has been covering G7 and Western European economies. He studied economics at Durham University, UK.

James is a Developed Market economist, with primary responsibility for coverage of the UK economy and the Bank of England. As part of the wider team in London, he also spends time looking at the US economy, the Fed, Brexit and Trump's policies. He graduated from the University of Bath with a degree in Economics and joined ING in August 2015.

James is a Developed Market economist, with primary responsibility for coverage of the UK economy and the Bank of England. As part of the wider team in London, he also spends time looking at the US economy, the Fed, Brexit and Trump's policies. He graduated from the University of Bath with a degree in Economics and joined ING in August 2015.

Joanna Konings is a senior economist working on international trade issues and joined ING in 2017 from the Bank of England. She studied Philosophy, Politics and Economics at Durham University and holds an MSc in Economics from Birkbeck, University of London.

Joanna Konings is a senior economist working on international trade issues and joined ING in 2017 from the Bank of England. She studied Philosophy, Politics and Economics at Durham University and holds an MSc in Economics from Birkbeck, University of London.

Julien Manceaux is ING’s Senior Economist for France, Switzerland and Belgian real estate. He holds a MA in macroeconomics and is currently based in Brussels. Before joining ING, he worked in the public sector as an external trade specialist.

Julien Manceaux is ING’s Senior Economist for France, Switzerland and Belgian real estate. He holds a MA in macroeconomics and is currently based in Brussels. Before joining ING, he worked in the public sector as an external trade specialist.

Jurjen focuses on energy transition research and looks at developments in key sectors such as power, industrials, transport and real estate. He joined the firm in 2004 and holds a master’s degree in economics from the Vrije Universiteit Amsterdam.

Jurjen focuses on energy transition research and looks at developments in key sectors such as power, industrials, transport and real estate. He joined the firm in 2004 and holds a master’s degree in economics from the Vrije Universiteit Amsterdam.

Karol Pogorzelski is a member of the economic research team at ING Poland, responsible for public finance and macroeconomic research, as well as consumer finance surveys. Karol previously worked for the Institute for Structural Research and Deloitte. He holds a PhD in economics from the University of Warsaw and MA degrees in economics and philosophy.

Karol Pogorzelski is a member of the economic research team at ING Poland, responsible for public finance and macroeconomic research, as well as consumer finance surveys. Karol previously worked for the Institute for Structural Research and Deloitte. He holds a PhD in economics from the University of Warsaw and MA degrees in economics and philosophy.

Dawid Pachucki is a senior economist at ING in Poland, who joined the team in 2020. For almost 20 years, he has been working at the Ministry of finance, where his last position was Director of the Public Debt Department. He was educated at the University of Warsaw.

Dawid Pachucki is a senior economist at ING in Poland, who joined the team in 2020. For almost 20 years, he has been working at the Ministry of finance, where his last position was Director of the Public Debt Department. He was educated at the University of Warsaw.

Piotr Popławski is a member of the economic research team at ING Poland, primarily responsible for market research. Piotr previously worked as an economist and strategist in some of the key European banking groups such as BNP and Rabobank. He also was part of research projects in areas of healthcare and public finance, notably Fit for Work. Piotr is a Warsaw School of Economics graduate.

Piotr Popławski is a member of the economic research team at ING Poland, primarily responsible for market research. Piotr previously worked as an economist and strategist in some of the key European banking groups such as BNP and Rabobank. He also was part of research projects in areas of healthcare and public finance, notably Fit for Work. Piotr is a Warsaw School of Economics graduate.

Rafal Benecki is a Chief Economist at ING in Poland, joining in 2005. Prior to this, he was the head of the Economic Analysis Bureau at Millennium Bank in Warsaw. He has an MSc in Financial Economics from Queen Mary University of London.

Rafal Benecki is a Chief Economist at ING in Poland, joining in 2005. Prior to this, he was the head of the Economic Analysis Bureau at Millennium Bank in Warsaw. He has an MSc in Financial Economics from Queen Mary University of London.

Rico Luman is a senior sector economist with a focus on transport, logistics and the automotive industry. He also looks at ports economics and mobility in general. Formerly he worked as a credit analyst and joined ING in 2001. Rico studied economics as well as law at the University of Amsterdam.

Rico Luman is a senior sector economist with a focus on transport, logistics and the automotive industry. He also looks at ports economics and mobility in general. Formerly he worked as a credit analyst and joined ING in 2001. Rico studied economics as well as law at the University of Amsterdam.

Samuel Abettan is a Junior Economist, mainly covering France. He joined ING in October 2020 after graduating with a master's degree in international economics and business from Université Paris Dauphine-PSL in France. Samuel is based in Brussels.

Samuel Abettan is a Junior Economist, mainly covering France. He joined ING in October 2020 after graduating with a master's degree in international economics and business from Université Paris Dauphine-PSL in France. Samuel is based in Brussels.

Marcel Klok is a Senior Economist at ING Netherlands. Based in Amsterdam, he covers the Dutch economy. A graduate of the University of Groningen, Marcel has worked for the Ministry of Economic Affairs of the Netherlands and CPB Netherlands Bureau for Economic Policy Analysis.

Marcel Klok is a Senior Economist at ING Netherlands. Based in Amsterdam, he covers the Dutch economy. A graduate of the University of Groningen, Marcel has worked for the Ministry of Economic Affairs of the Netherlands and CPB Netherlands Bureau for Economic Policy Analysis.

Marieke Blom is Chief Economist, the Netherlands.

Marieke Blom is Chief Economist, the Netherlands.

Marten van Garderen is a senior economist based in the Netherlands. He has many years of experience in conducting research on consumer preferences. Before joining ING, he worked for the government as a financial policy advisor and has an MSc in economics from the University of Groningen.

Marten van Garderen is a senior economist based in the Netherlands. He has many years of experience in conducting research on consumer preferences. Before joining ING, he worked for the government as a financial policy advisor and has an MSc in economics from the University of Groningen.

Maurice van Sante is a Senior Economist covering the construction and real estate sectors. He joined ING in 1998 and till 2006 he was a treasury advisor and cash manager consultant. Maurice studied Economics at the Erasmus University in Rotterdam.

Maurice van Sante is a Senior Economist covering the construction and real estate sectors. He joined ING in 1998 and till 2006 he was a treasury advisor and cash manager consultant. Maurice studied Economics at the Erasmus University in Rotterdam.

Edse Dantuma is a Senior Economist covering Healthcare and the Public sector. After working for the government for a few years, he joined ING in 2006, where he was a sector banker for two years. Edse studied Economics at Groningen University.

Edse Dantuma is a Senior Economist covering Healthcare and the Public sector. After working for the government for a few years, he joined ING in 2006, where he was a sector banker for two years. Edse studied Economics at Groningen University.

Muhammet Mercan is Chief Economist at ING, Turkey. Previously, he was an economist at Yapi Kredi and HSBC Securities. He is a part-time lecturer at Bilgi University and holds a PhD degree in banking from Marmara University.

Muhammet Mercan is Chief Economist at ING, Turkey. Previously, he was an economist at Yapi Kredi and HSBC Securities. He is a part-time lecturer at Bilgi University and holds a PhD degree in banking from Marmara University.

Ferdinand Nijboer is a Senior Economist covering the technology, media and telecoms sector. He joined ING in 2001, where he was a risk analyst for five years. Ferdinand holds a Master’s degree in Economics from Groningen University and in Risk Management from VU Amsterdam.

Ferdinand Nijboer is a Senior Economist covering the technology, media and telecoms sector. He joined ING in 2001, where he was a risk analyst for five years. Ferdinand holds a Master’s degree in Economics from Groningen University and in Risk Management from VU Amsterdam.

Nicholas is a senior economist covering the Philippines market from Manila. Before joining ING in September 2018, he worked as an associate economist at the Treasury Department of the Bank of the Philippine Islands and as a researcher at the University of Asia and the Pacific and the Central Bank of the Philippines. Nicholas has an MBA from the Kelley School of Business of Indiana University and an MA in Economics from Vanderbilt University.

Nicholas is a senior economist covering the Philippines market from Manila. Before joining ING in September 2018, he worked as an associate economist at the Treasury Department of the Bank of the Philippine Islands and as a researcher at the University of Asia and the Pacific and the Central Bank of the Philippines. Nicholas has an MBA from the Kelley School of Business of Indiana University and an MA in Economics from Vanderbilt University.

Owen Thomas is the Managing Editor of ING Research, based in London. He joined ING from Saxo Bank in Copenhagen in July 2015. He moved into the banking sector after a long career in journalism. For many years he was an anchor for some of the world’s most respected broadcasters, notably BBC World News, CNN and Bloomberg TV.

Owen Thomas is the Managing Editor of ING Research, based in London. He joined ING from Saxo Bank in Copenhagen in July 2015. He moved into the banking sector after a long career in journalism. For many years he was an anchor for some of the world’s most respected broadcasters, notably BBC World News, CNN and Bloomberg TV.

Padhraic Garvey is the Regional Head of Research, Americas. He's based in New York. His brief spans both developed and emerging markets and he specialises in global rates and macro relative value. He worked for Cambridge Econometrics and ABN Amro before joining ING. He holds a Masters degree in Economics from University College Dublin and is a CFA charterholder.

Padhraic Garvey is the Regional Head of Research, Americas. He's based in New York. His brief spans both developed and emerging markets and he specialises in global rates and macro relative value. He worked for Cambridge Econometrics and ABN Amro before joining ING. He holds a Masters degree in Economics from University College Dublin and is a CFA charterholder.

Paolo Pizzoli is a senior economist covering Italy and Greece. He joined the firm in 1997 after working at Banca Akros, Banca Euromobiliare, ENI, and Prometeia. Paolo studied at the University of Bologna and the Univerisity of Warwick and holds a Master's in Energy and Environmental Economics from ENI in Italy.

Paolo Pizzoli is a senior economist covering Italy and Greece. He joined the firm in 1997 after working at Banca Akros, Banca Euromobiliare, ENI, and Prometeia. Paolo studied at the University of Bologna and the Univerisity of Warwick and holds a Master's in Energy and Environmental Economics from ENI in Italy.

Peter Vanden Houte is Chief Economist, Belgium, Luxembourg. He has has been working with ING in various research functions for more than 20 years. He is also vice-chairman of the “economic commission” at the Belgian Employers Federation.

Peter Vanden Houte is Chief Economist, Belgium, Luxembourg. He has has been working with ING in various research functions for more than 20 years. He is also vice-chairman of the “economic commission” at the Belgian Employers Federation.

Peter Virovacz is a Senior Economist in Hungary, joining ING in 2016. Prior to that, he has worked at Szazadveg Economic Research Institute and the Fiscal Council of Hungary. Peter studied at the Corvinus University of Budapest.

Peter Virovacz is a Senior Economist in Hungary, joining ING in 2016. Prior to that, he has worked at Szazadveg Economic Research Institute and the Fiscal Council of Hungary. Peter studied at the Corvinus University of Budapest.

Philippe Ledent is a Senior Economist at ING Belgium. He’s responsible for economic scenario and structural research on Belgium and Luxembourg. Philippe also teaches in French and Belgian universities and since 2009 has been a regular columnist in the Belgian economic review. Previously, he worked at the Catholic University of Louvain.

Philippe Ledent is a Senior Economist at ING Belgium. He’s responsible for economic scenario and structural research on Belgium and Luxembourg. Philippe also teaches in French and Belgian universities and since 2009 has been a regular columnist in the Belgian economic review. Previously, he worked at the Catholic University of Louvain.

Prakash Sakpal is a Senior Economist in Asia where he covers the entire region, excluding Japan. He started his career with ING in 1995 in India, moved to Hong Kong in 1998 and is now in Singapore where he has been since 2004.

Prakash Sakpal is a Senior Economist in Asia where he covers the entire region, excluding Japan. He started his career with ING in 1995 in India, moved to Hong Kong in 1998 and is now in Singapore where he has been since 2004.

Robert Carnell is Regional Head of Research, Asia-Pacific, based in Singapore. For the previous 13 years, he was Chief International Economist in London and has also worked for Commonwealth Bank of Australia, Schroder Investment Management, and the UK Government Economic Service in a career spanning more than 25 years. Robert has a Masters degree in Economics from McMaster University, Canada, and a first-class honours degree from Salford University.

Robert Carnell is Regional Head of Research, Asia-Pacific, based in Singapore. For the previous 13 years, he was Chief International Economist in London and has also worked for Commonwealth Bank of Australia, Schroder Investment Management, and the UK Government Economic Service in a career spanning more than 25 years. Robert has a Masters degree in Economics from McMaster University, Canada, and a first-class honours degree from Salford University.

Timme is an economist covering International Trade. He joined ING in 2016 after finishing his studies at the University of Groningen and Robert Gordon University.

Timme is an economist covering International Trade. He joined ING in 2016 after finishing his studies at the University of Groningen and Robert Gordon University.

In his role as a consumer economist, Sebastian works on behavioural economics and financial literacy. He is also the German lead for the ING International survey. After graduating in economics and business administration from the Leibniz University of Hannover, he worked for ING as treasurer and investment product manager before joining the research team.

In his role as a consumer economist, Sebastian works on behavioural economics and financial literacy. He is also the German lead for the ING International survey. After graduating in economics and business administration from the Leibniz University of Hannover, he worked for ING as treasurer and investment product manager before joining the research team.

Maureen is a CFA charterholder.

Maureen is a CFA charterholder.

Steven Trypsteen joined ING in 2016 and covers Spain and Portugal. Prior to this, he lectured at the University of Nottingham from where he has a PhD in Economics and an MSc in Economics and Econometrics. Steven is based in Brussels.

Steven Trypsteen joined ING in 2016 and covers Spain and Portugal. Prior to this, he lectured at the University of Nottingham from where he has a PhD in Economics and an MSc in Economics and Econometrics. Steven is based in Brussels.

Suvi Platerink works as Senior Sector Strategist for the ING Credit Research team in Amsterdam. Her coverage spans from Benelux to large European banks. Suvi joined ING in 2014 from Nordea. She has gathered experience in financial markets since 2005 focusing on bank credit and equity research as well as European fixed income markets.

Suvi Platerink works as Senior Sector Strategist for the ING Credit Research team in Amsterdam. Her coverage spans from Benelux to large European banks. Suvi joined ING in 2014 from Nordea. She has gathered experience in financial markets since 2005 focusing on bank credit and equity research as well as European fixed income markets.

Raoul Leering is the Head of International Trade Analysis, joining ING in 2014. Previously he worked at the Ministry of Economic Affairs, Het Financieele Dagblad and the Dutch trade union FNV.

Raoul Leering is the Head of International Trade Analysis, joining ING in 2014. Previously he worked at the Ministry of Economic Affairs, Het Financieele Dagblad and the Dutch trade union FNV.

Valentin is an economist at ING in Bucharest, covering Romania, Bulgaria, Serbia and Croatia. He joined ING in 2007 as a trader and graduated with an MSc in Economics from the Bucharest Academy of Economic Studies.

Valentin is an economist at ING in Bucharest, covering Romania, Bulgaria, Serbia and Croatia. He joined ING in 2007 as a trader and graduated with an MSc in Economics from the Bucharest Academy of Economic Studies.