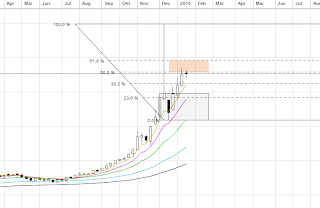

In the meanwhile let's take a technical look at the Russian Ruble again. With looking directly at the weekly bars chart, we can see that the market broke the potential balance area to the upside and one time framing higher since 3 weeks. The current week is a rotational inside week. We can also identify a potential resistance area between the 50% and 61.8% fibanocci levels. Currently the market rejecting the 50% level and balancing around below that area. With the installed EMAs we can cleary see that the bullish short-term as well as long-term trend is intact.

Moving forward to the daily bars perspective, we can observe with installed EMAs an intact bullish short-term and long-term trend as well. The 10EMA served as support on several days.

Since five days the market trading in a balance behavior and rejecting the bracket high. In the next days one of the potential scenarios could be a test of the lower balance area and the next support level. A break above the balance area to test the next resistance level is porbable as well.

We should also consider a closer look with the 240 minute chart. With this timeframe we can identify two balance areas and a break of the bullish trendline that strengthens our conclusion of a move to the balance area low and maybe lower. It is interesting to see how the market react to these balance levels.

Since our last post the value of the Russian Ruble has worsened. Anyway, there are good technical signs to move this market lower but like usual: everything can happen!