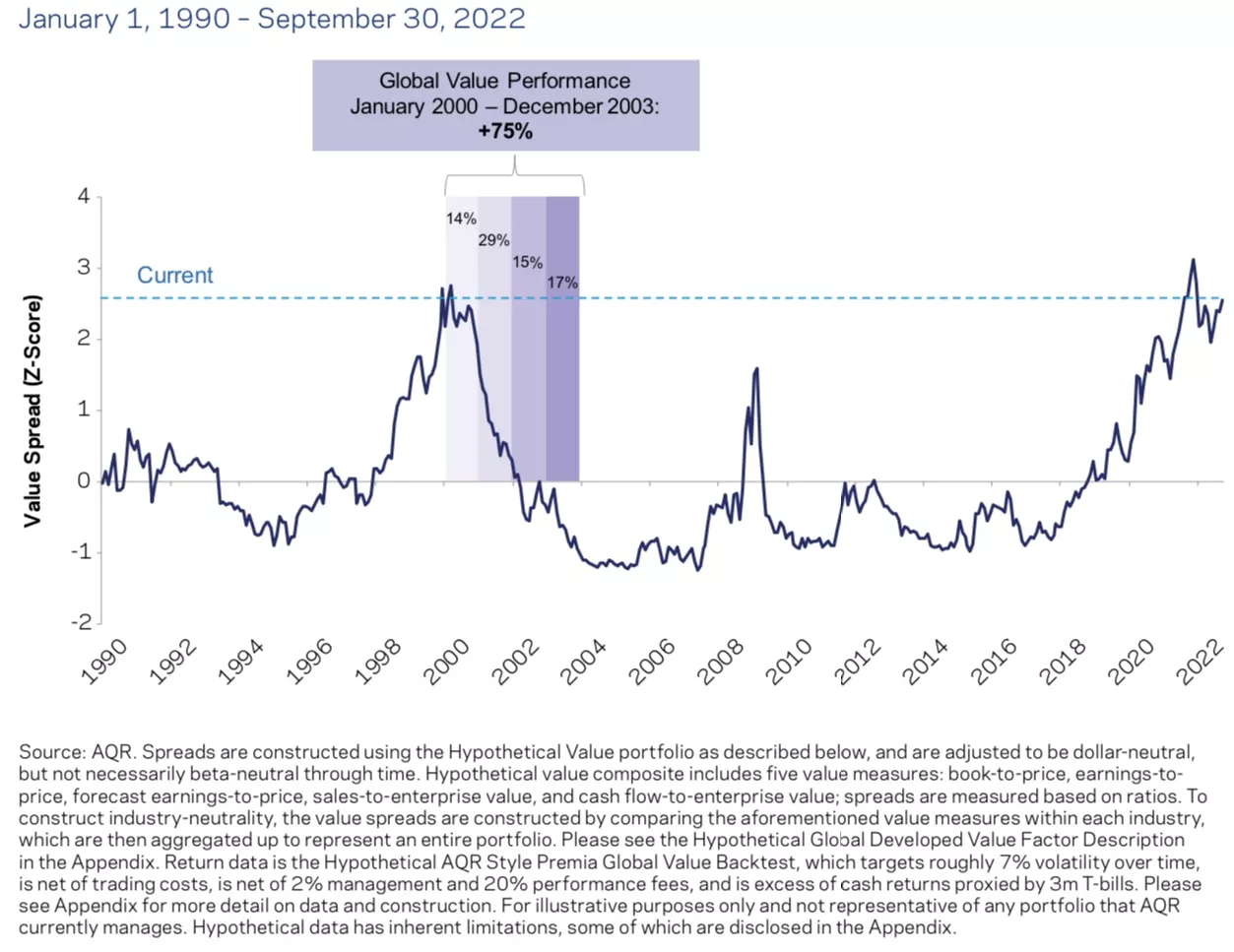

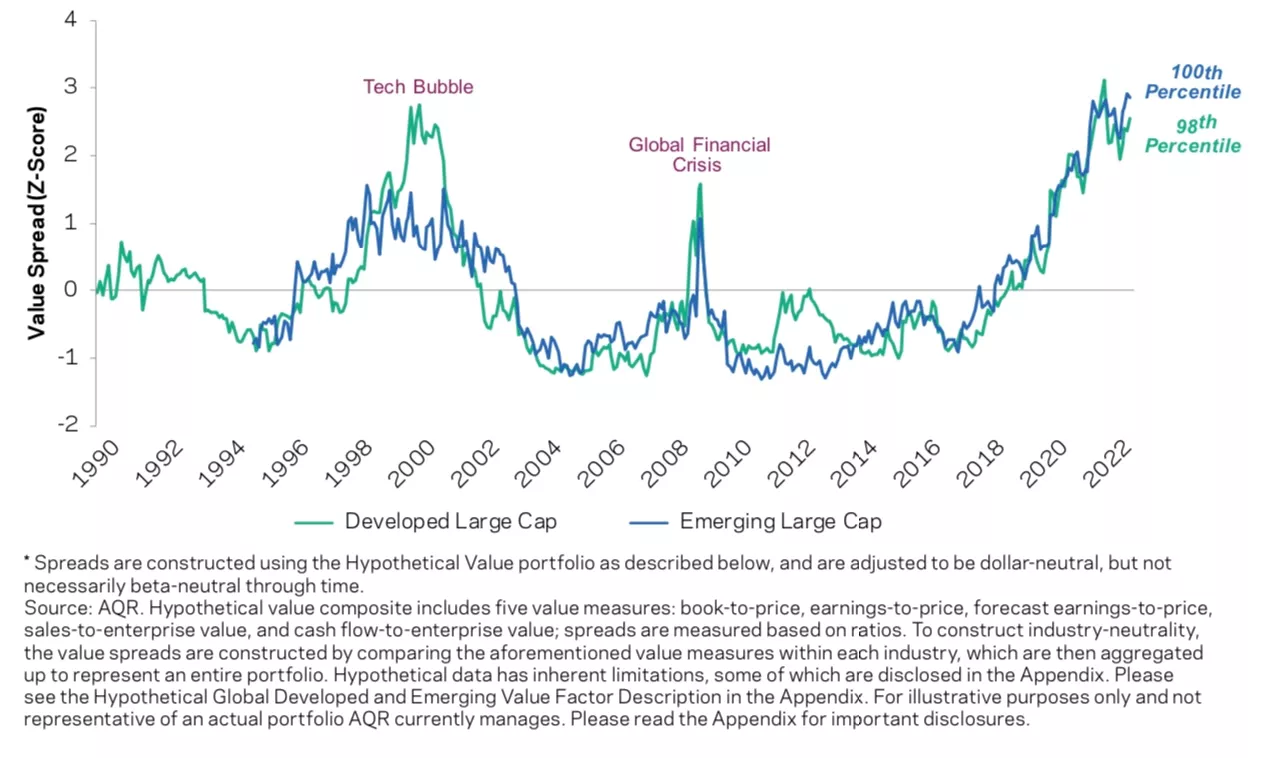

Value spreads, which measure the difference in valuation multiples between cheap and expensive companies within industry, are at extreme levels - levels similar to what we observed around the tech bubble.

In the US, for example, expensive companies are currently trading at a price-to-earnings multiple more than 3x that of cheap companies within industry, i.e. 34 times earnings vs 10, which is significantly higher than the 2x ratio observed historically within industry.

In order to justify current valuation multiples from a fundamental perspective, expensive companies in developed markets would have to outgrow their cheap industry peers by approximately 90% over the next five years.

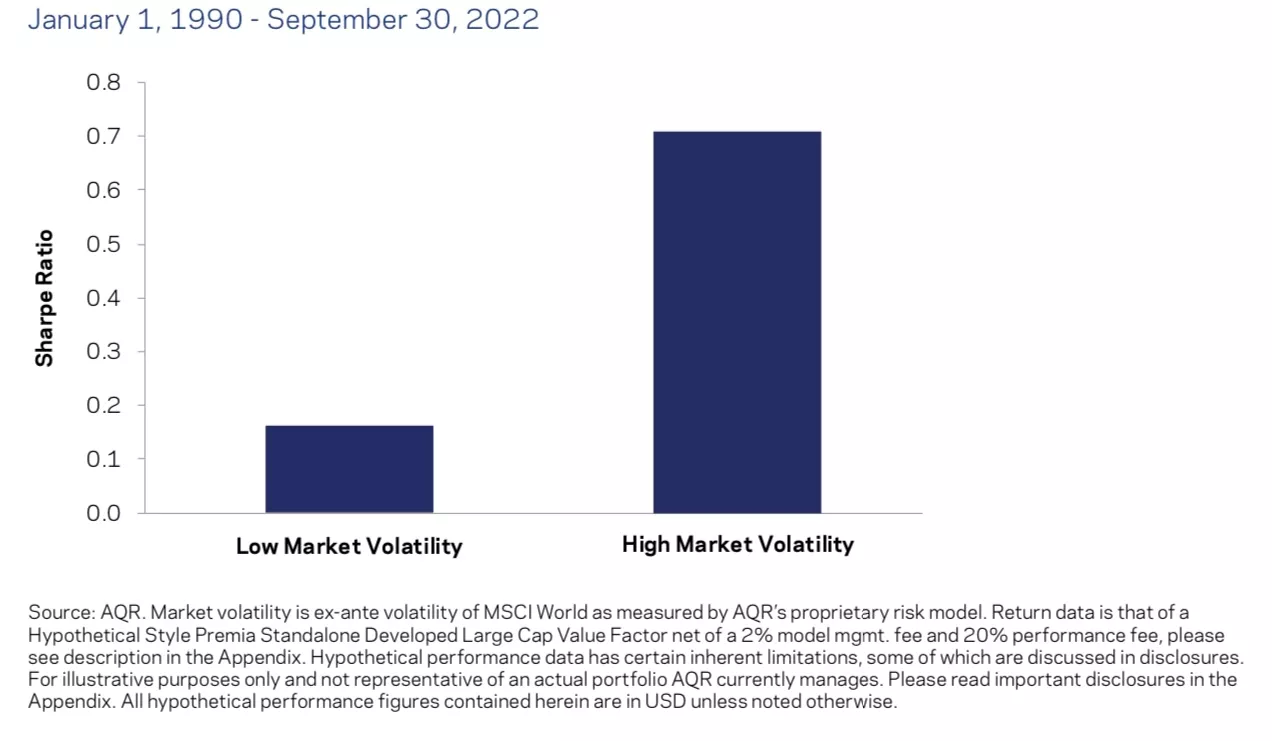

Also there is empirical in the current volatile environment adding evidence that value tends to do better in turbulent markets.

Today's extreme value spreads and the irrational growth rate differentials they imply make a value strategy in stocks exceptionally attractive.