Key findings include:

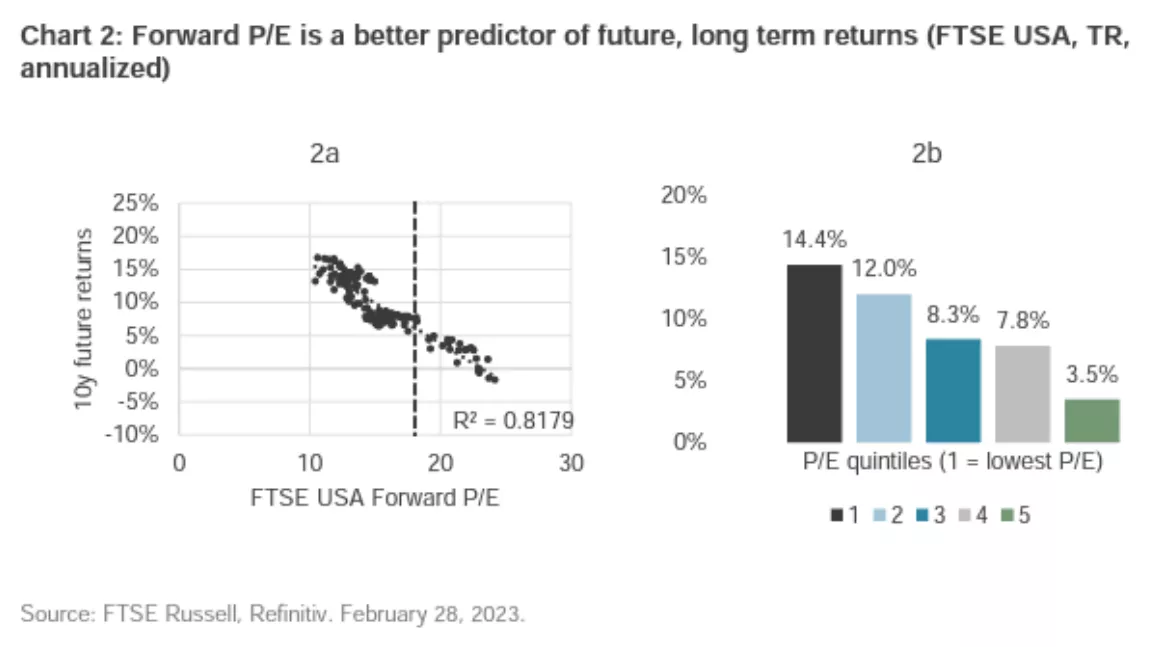

- Valuations have a strong predictive relationship with future returns of risky assets like equities and high yields.

- Using the monthly returns of the FTSE US High-Yield Market and Russell 1000 indices over the last five years, they found that the correlation between US equities and US high yield credits can be as high as 84% (end-February 2023).

- Statistical results indicate that the predictive power of starting valuation is higher in equities for longer periods (i.e.,10yr) and for shorter periods (i.e., 3yr) in US HY credits. This result is in line with the economic intuition that the predictive power aligns most closely with the duration of risky assets.