This Week Only, August 4-8:

The book, “Fixing Target Date Funds: A Fiduciary Guide to Ameliorating Alarming Deficiencies,” is now available on Amazon, and in a special promotion is now available to download for free between Aug. 4-8.

Here’s why TDFs Need Repairing:

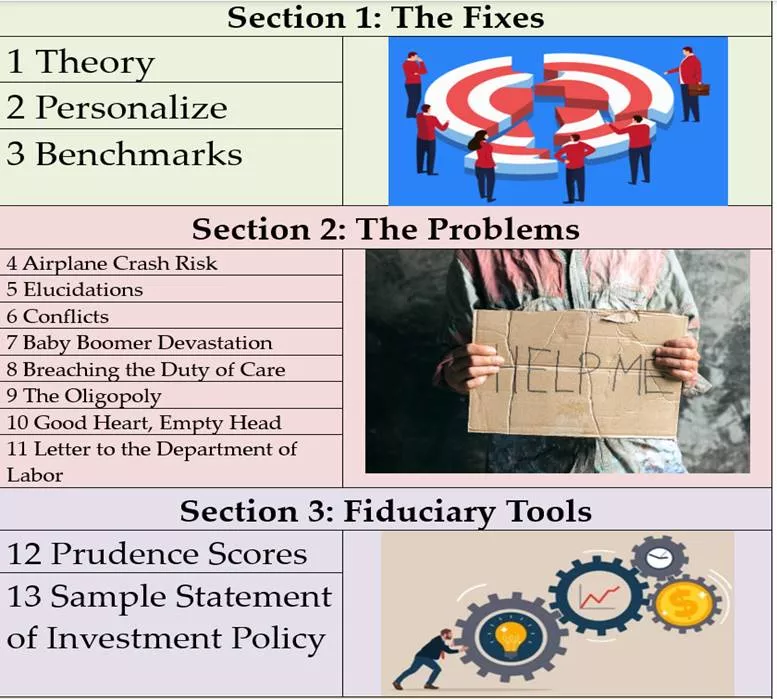

- Misaligned Risks: TDFs claim a solid investment theory, but the real-world application often strays dangerously from it.

- Proprietary Lock-In: All investments are controlled by fund managers of the TDF company who are unlikely to be the best in every asset class.

- Suppressed Innovation: A few large firms manage over 70% of TDF assets. Oligopolies quash innovation.

- Fiduciary Breaches: Fiduciaries are not vetting their TDF selection, opting to choose their bundled service provider, causing formation of theoligopoly.

Surz introduces innovative, patented glidepaths based on academic theories, offering a revolutionary U-shaped approach that ensures safer navigation “to” and “through” retirement. His personalized approach allows TDFs to truly deliver on their promises, prioritizing genuine customization and protecting investors’ futures.

More By This Author:

Playing The Odds On US Stocks In August & September 2025

Are Current Interest Rates Too High? What Is Normal?

High Earnings Growth Will Not Forestall Stock Market Losses