Playing The Odds On US Stocks In August & September 2025

Image Source: Pexels

- August historically offers strong returns for US stocks, with a 64% chance of gains and the highest average return among asset classes.

- September is the worst month for US stocks, with a 50/50 chance of losses and the only month with a negative average return.

- To improve odds in September, overweight gold and international bonds, which have outperformed, and underweight US technology stocks.

- Diversification beyond US stocks has added value in 2025, reversing the trend of US stock dominance over the past 15 years.

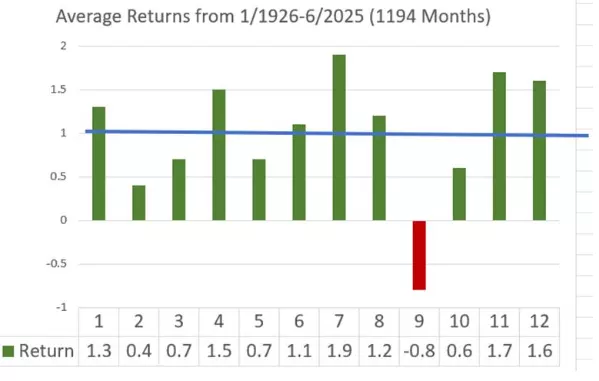

There is a seasonality in asset class investment performance that is revealed in the history of calendar month returns. Based on history, investors should be “all in” US stocks this August but “mostly out” in September. Over the past 99 years, the best Asset Class to invest in during August has been the US Total Stock Market. It has achieved an average return of 1.20% and the investment has been profitable 66% of the time. By contrast, in September the US Total Stock market ranks 11th and is profitable only 50% of the time.

In the following, I report on the best and worst months for US stocks alone, and then I extend my analysis to include most asset classes, moving beyond US stocks. August has historically been a pretty good month for US stocks, but it is followed by the worst month for US stocks -- September.

Playing the US Stock Market Game

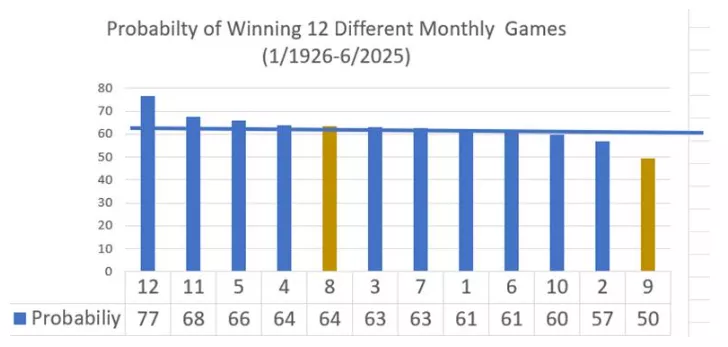

Playing the stock market is a gamble and each month this game has different odds for success, as shown in the following:

The best odds are in December when you have a 77% chance of making money – i.e., having a positive return. The odds are in your favor (better than 50/50) in most of the other months, except September when there’s only a 50/50 chance of profiting in the stock market.

In Las Vegas, skilled gamblers base their bets on the probability of winning. Should you play the September 2025 game? Should you bet the same as you do in the high odds months, like December?

August has been a good month with a 64% chance of a positive return, a little above the average 63% probability.

That time of year again

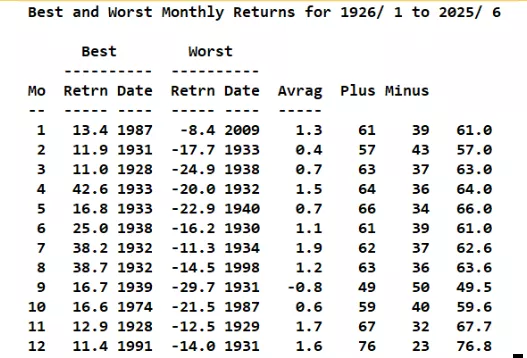

It’s August-September again so any number of articles will remind us that September has been the worst month for US stock markets, but no one will comment on August as being a pretty good month. Here’s a recap on the history of monthly returns on the S&P500 over the past 99.5 years (1194 months):

Shown graphically, September leaps off the page as being the only month with an average negative return, and the magnitude of average loss is serious at -0.8%. While August’s 1.2% average return is above the overall average 1.0% monthly return.

September has been the worst performing month because:

- It has the lowest average return. The average loss in September has been -0,8%, due in part to the fact that the worst month ever happened in a September. A 29.7% loss in September 1931 is the worst monthly loss ever. All of the other 11 months have positive average returns.

- 49 of the past 99 Septembers – 49.5% -- have suffered losses, contrasted to the other months that have had positive returns 64% of the time.

Momentum or reversal

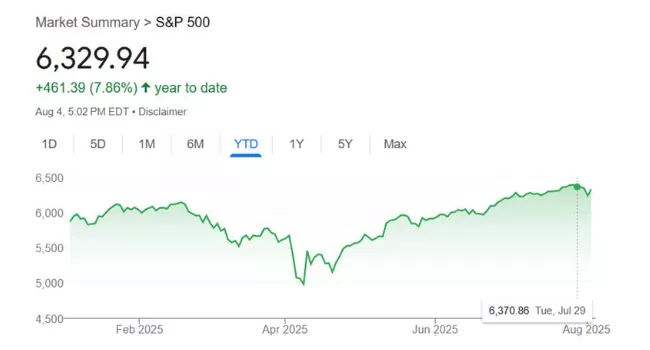

The US stock market has earned 7.86% so far this year, so on pace for a 14% annual 2025 return. Based on history, August should see a continuation of the bull run. But this September could disappoint if the current bull market reverses, or it will surprise to the upside if the bull runs. Which do you think will be the case.

A possible explanation

In his book The Beast on Wall Street, Dr. Robert Haugen argues that investors muck up market behavior with their emotions, so the news of the day frequently results in market moves that don’t make sense. Markets go up on bad news and down on good news.

During the Summer, many traders are on vacation so less mucking up in July through August. But then the mucking starts again when they return to their desks in September. Make sense?

Place your bets

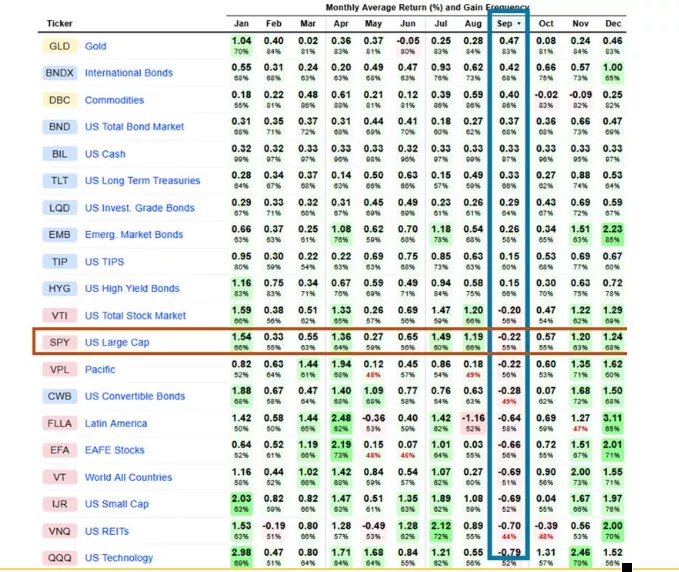

As shown in the following table from Lazy Portfolio ETF, sorted by best-to-worst September returns, winning and losing asset classes vary by month. In the case of September:

- Gold and International Bonds are the best performing asset classes in September with a .45% average return. Gold has delivered positive returns in September 83% of the time – very good odds. The best month for gold is January, and the worst is March. International Bonds have delivered positive September returns 68% of the time. December is the best month for this asset class and April is the worst month.

- US Technology stocks have the worst September performance, losing -0.79% on average. These stocks win 52% of the time in September, so not an even odds bet. February is the worst month for this asset class. January is the best month.

You can use this table every month to see where the odds are in and out of your favor.

Changing fortunes

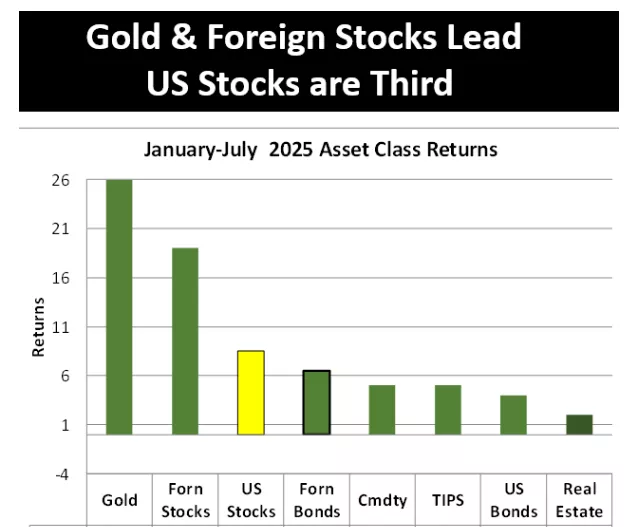

Coming into 2025, US stocks had dominated for the previous 15 years as the best performing asset class, so diversification beyond US stocks did not “work” -- it undermined performance. But that has changed so far this year. As shown in the following, US stocks are not the best performing so far this year, so diversification into foreign securities and gold has added value.

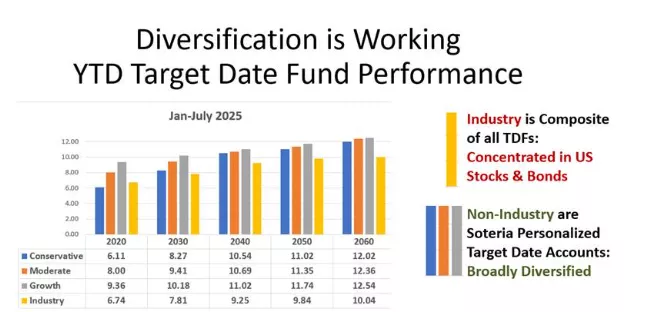

Investments in other assets have benefited performance, as can be seen in the performance of target date funds (TDFs). In the past 15 years, until now, diversification did not work because US stocks dominated.

Conclusion

This August is likely (64% probability) to deliver a positive US stock market return, plus US stocks have been the best performing asset class in August, so justification for staying the course.

But the historical odds place this September’s US stock market at a disadvantage with a 50/50 chance of a loss, but you can turn the odds more in your favor by overweighting gold and foreign bonds and underweighting US Technology stocks based on their September history of successes and failures.

Good luck!!

More By This Author:

Are Current Interest Rates Too High? What Is Normal?

High Earnings Growth Will Not Forestall Stock Market Losses

A Concise And Comprehensive Review Of Asset Class Investment Performance In The First Half Of 2025