Are Current Interest Rates Too High? What Is Normal?

- Interest rates on Treasury Bills are currently 1.7% above their historic norm, supporting President Trump's call for rate cuts.

- Long-term Treasury Bond rates are in line with historical averages, suggesting no need for adjustment at the long end of the curve.

- The unusual U-shaped yield curve reflects investor concerns about tariffs, boosting demand for intermediate maturities.

- If inflation stays around 2.5%, short-term rates have room to decline, benefiting investors in short-term government securities if Trump's view prevails.

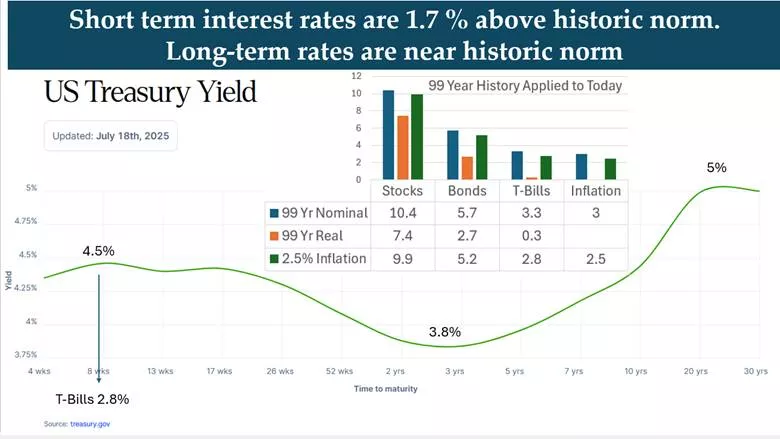

Is President Trump correct in his assertion that interest rates need to come down? He presumably wants to stimulate the economy, but doing so risks exacerbating inflation especially if the economy doesn’t need stimulation at this time. Let’s look at the 99-year history of capital market returns spanning 1926-2024 as our guide. Over this time period, Treasury Bills earned a mere 0.3% above inflation and Treasury Bonds earned 2.7% above inflation.

The following picture shows how the current situation stacks up against history:

Applying the long-term Treasury Bill .3% premium to the current inflation rate of 2.5%, we say 2.8% is the “norm”. But T-Bills actually yield 4.5%, which is 1.7% above the historic norm. Treasury Bill rates are high by this standard. One point for President Trump.

But long-term Treasury Bond rates at 5% are in line with historic norms.

Note also that intermediate term bonds are lower yielding, creating an unusual U-shaped term structure that is likely due to investor concerns about the effects of tariffs in the near future that have increased demand for these maturities.

Shape Shifting

Based on history, short-term interest rates have plenty of room to decline IF inflation remains around 2.5%. Intermediate and long-term bonds are currently near historic norms, so no need for adjustment. The Treasury controls the short end of the yield curve, but the Federal Reserve has stepped in the long end to control interest rates there. The good news is that the Fed won’t need to step in. Reductions in short term government T-bill yields will put the yield curve near historic norms.

Conclusion

Investors counting on President Trump to prevail should expect short-term interest rates to decline, creating capital gains on these maturities. The rest of the yield curve might not be affected at all.

More By This Author:

High Earnings Growth Will Not Forestall Stock Market Losses

A Concise And Comprehensive Review Of Asset Class Investment Performance In The First Half Of 2025

Why Is The U.S. Treasury Yield Curve U-Shaped And Why Did The Treasury Buy Back $10 Billion In Notes?