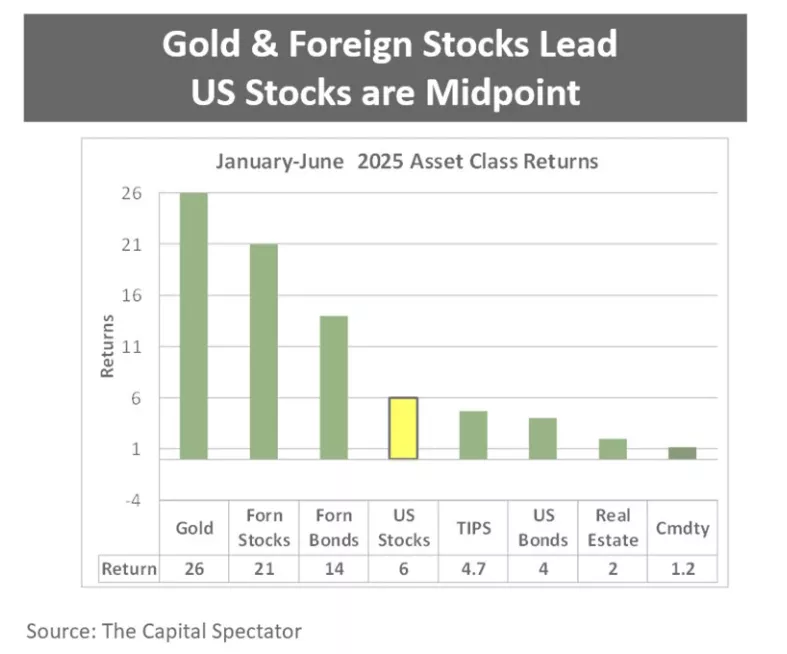

A Concise And Comprehensive Review Of Asset Class Investment Performance In The First Half Of 2025

Unlike the decade leading up to 2025, US stocks are no longer the best performing asset class this year. Most of the 6% year-to-date return on US stocks was earned in June, which returned 5%. Gold and foreign stocks are the best performers.

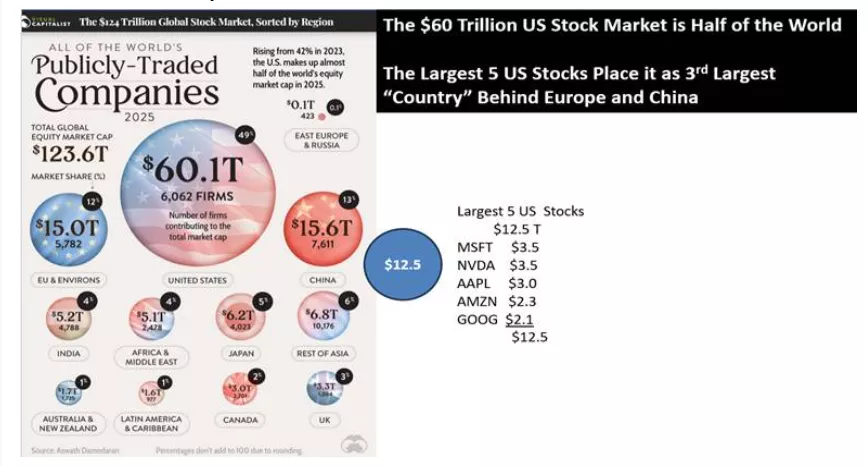

The Enormous Rich US Stock Market

Bear in mind that the US stock market is huge. Its capitalization is about half the world. So, when the US sneezes the world usually catches a cold, but this time the rest of the world doesn’t seem sick at all.

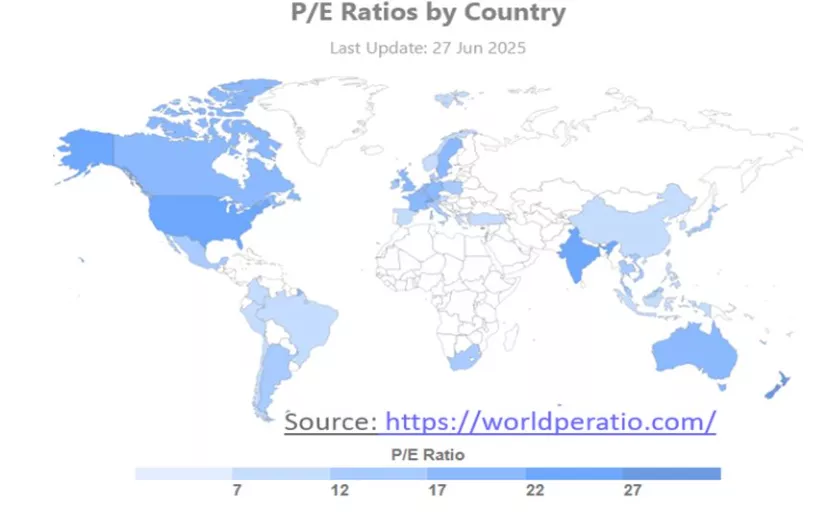

Most non-US stocks are cheaper than US stocks because the US stock market is very expensive. In theory, money seeks its best application. For now, best application may be outside the US.

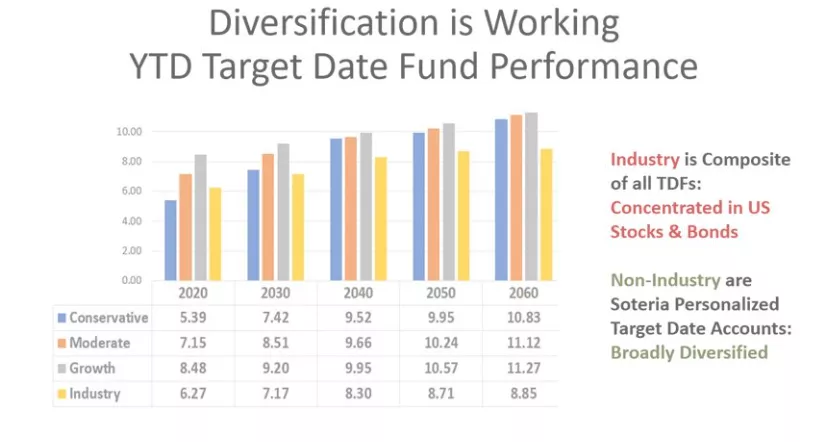

Diversification Works, Finally

Because US stocks are lagging, diversification has “worked.” Investments in other assets have benefited performance, as can be seen in the performance of target date funds (TDFs). In the past decade, until now, diversification did not work because US stocks dominated.

Risk Exposure in Target Date Funds (TDFs)

The TDF industry is an oligopoly dominated by just a few firms. Oligopolies stymie innovation, but the next market crash will generate an outcry for a movement to safety, especially from those near retirement, namely our 75 million baby boomers. TDFs can and should be safer.

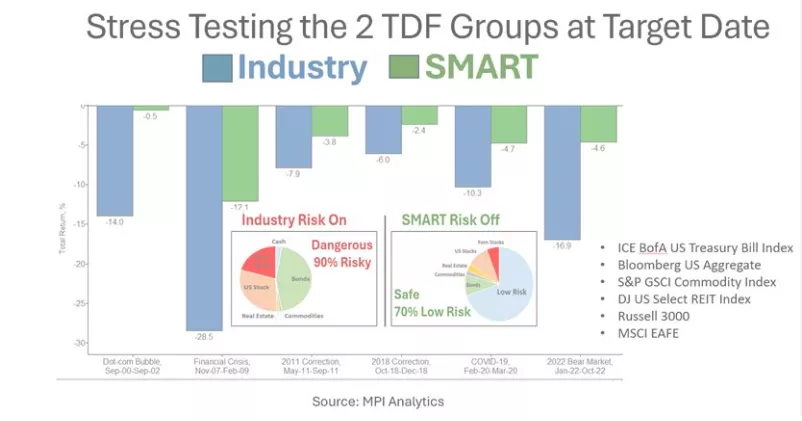

The concentration of TDFs in US stocks and bonds is a bet that has generally paid off, but a stress test reveals the exposure. The next crash of the US stock market will devastate, especially our 75 million baby boomers because they are in the retirement risk zone. There are two distinct groups of TDFs – Safe and Risky. Risky (“Industry” in the image below) has generally won, but Safe (“SMART”) will shine in the next crash, as it has in previous market downturns.

The Risky TDF Industry is 85% risky at its target date, with 55% in equities plus 30% risky long-term bonds. By contrast, SMART is only 30% risky, with 70% in Treasury Bills and short-term TIPS. The Safe SMART glidepath is followed by Soteria Personalized Target Date Accounts. The $850 billion Federal Thrift Savings Plan’s TDFs are also 70% safe at their target dates, as are the TDFs of Dimensional Fund Advisors and the conservative RPAG flexPATH TDFs, The “Safe Group” is small but respected.

The Very Expensive US Stock Market

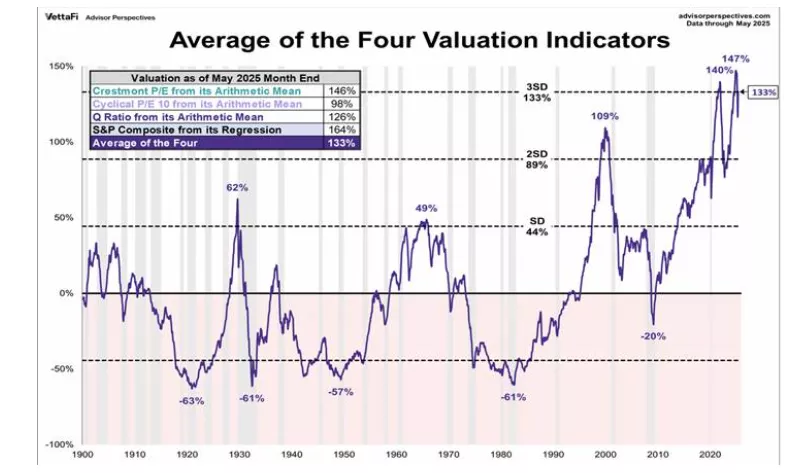

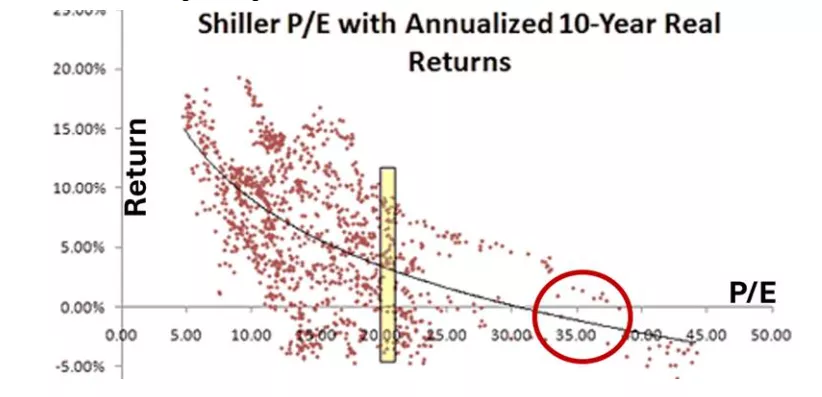

The US stock market is currently very expensive by every measure, placing it above the 3 standard deviation mark in expensiveness which is highly statistically significant, hence the words “very expensive.”

When this has happened in the past, markets have reacted by becoming less expensive – low or negative investment returns followed because return on investments is based on the price paid. That realization is setting in now in the US stock market. The higher the price paid, the lower the subsequent return. That’s just simple math.

Stein’s Law: If something cannot go on forever, it won’t.

Conclusion

Buddha said, “Impermanence is eternal.” The world is always changing. So far this year the US stock market has lost its dominance on the world stage, yet investors have been unfazed, so far.

What lies ahead? Are investors in the US stock market the optimists falling from the skyscraper? What do you think? Is it AI? Will the US stock market continue to reach new highs?

More By This Author:

Why Is The U.S. Treasury Yield Curve U-Shaped And Why Did The Treasury Buy Back $10 Billion In Notes?

401(k) Warns Baby Boomers In Target Date Funds To Get Out

Democracy Fails When The Majority Are In The Cart.

Next week I will publish my new book, Fixing Target Date Funds: A Fiduciary Guide to Ameliorating Alarming Deficiencies. Please let me know if you’d like to see it. I’ll provide free ...

more