Value Investment Research

Contributor's Links:

IW Portfolio Stock Picks IW Newsletter

We are in a quest to redefine investment research, applying value investing to today's technologies and business models in search for asymmetric risk-reward. Since its inception in 2015, the IW Portfolio has yielded 206%, representing 38% annual compounded returns and outperforming the ...more

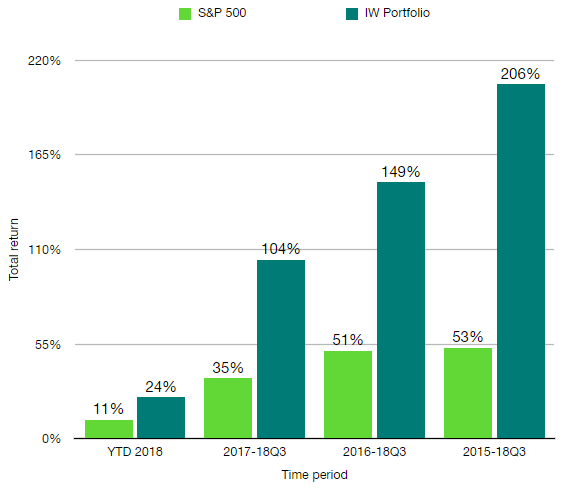

We are in a quest to redefine investment research, applying value investing to today's technologies and business models in search for asymmetric risk-reward. Since its inception in 2015, the IW Portfolio has yielded 206%, representing 38% annual compounded returns and outperforming the S&P 500 by 153%, or 25% annualized (as of 28 September 2018). Starting 2018, we are sharing with YOU:

- our principles

- our stock research

- the current holdings in the IW Portfolio and new stock picks.

Latest Comments

Facebook, Shame And Profits: The Long Thesis

I think your concerns are very valid.

Not a big fan of Facebook the platform as a user, either. But ultimately, FB the company has the tech (algorithms), data, know-how, business network etc. to quickly grow any social network they may acquire or develop organically.

It may well be that social networks have generational life cycles of 20 years of so. But the human need to connect with others will not go away. And while platform "brands" may age, competitive advantages in the underlying infrastructure (back-end) remain. Yesterday the trendy brand was Facebook, today it is Instagram and tomorrow it'll be something else. Chances are FB the company will keep reigning because they can afford to pay 2x as much as any other company for the next social "brand"/front-edge and still generate lots of value thanks to their advantages in the back-end.

With news curation: it is a problem to all platforms, not only FB. Not competitor will be able to allow fake-news/hate speech etc. on its platform and get away with it for very long...

Who Is Who In China Retail

Thank you for reading.

Subscribe to the IW Newsletter @ www.invworks.com/subscribe to keep up to date with our latest research and stock picks --no charge.

The Time Has Come For Apple To Buy Tesla

You're right that the case is more clear for $TSLA than for $AAPL.

I think for $AAPL, it boils down to the progress of Project Titan --their automotive program.

It Titan is in better shape than the consensus belief, then they may do well to pass on the opportunity. Although I'm very skeptical of Titan. Even if they are developing a 1st class self-driving solution consisting of sensors, chips and SW, it would be the first time they don't take full control of the overall product --the car.

Also, EV brand authenticity belongs to Tesla. It is too late for Apple to develop the brand power it has on handheld devices in EV, IMO.

The Time Has Come For Apple To Buy Tesla

Yes, that's why we think there would be a chance of Musk agreeing this time.

Although he is unlikely to relinquish control. That was apparently the deal breaker with Softbank one year ago.

That ideal for investors would be that he maintains control (and 20% ownership) but welcomes outside help (financial and operational).

The Time Has Come For Apple To Buy Tesla

Thanks for reading.

To be up-to-date with our weekly research and actionable stock ideas, subscribe free to the IW Newsletter @ www.invworks.com/subscribe

SolarEdge Q2 2018: Huawei Looms Large On The Horizon

Thank you for reading.

For the latest insights into SEDG and other wonderful stocks, subscribe to the IW Newsletter @ invworks.com/subscribe (free).

Google Q2 2018: AI And Cloud Driving The Show

For those of you that didn't know us :

you can subscribe to the IW Newsletter to learn about all future stock picks and research:

* www.invworks.com/subscribe *

It is free in 2018 and offers lots of actionable ideas.

Google Q2 2018: AI And Cloud Driving The Show

Hi Carol,

There will be many winners, and Google has everything on its favor to win big time.

Not only have they taken an early lead in deep learning academic research (as measured by contributions to key conferences, deep mind's achievements, etc.), but they also have the data and go-to-market platforms to capitalize that lead commercially (think Search, Android, Play, Maps, YouTube...).

The question is how well will they monetize those advantages. Admittedly, there are better executors than Alphabet management, but the advantages are so many and the stock price so moderate as to provide compelling risk-reward, in our view.

An Introduction To Spain’s Number 1 REIT: Merlin Properties

Thank you for reading.

Subscribe to the IW Newsletter to be notified about future research & stock picks:

www.invworks.com/subscribe

Asset Allocation For H2 2018: Stocks And Cash Equivalents

Thanks for reading.

To keep up to date with future asset allocation guidelines and investment opportunities, subscribe to the IW Investment Newsletter @ www.invworks.com/subscribe