Who Is Who In China Retail

- We present a deep-dive of the major trends shaping China retail, an overview of key players, and the investment potential in the industry.

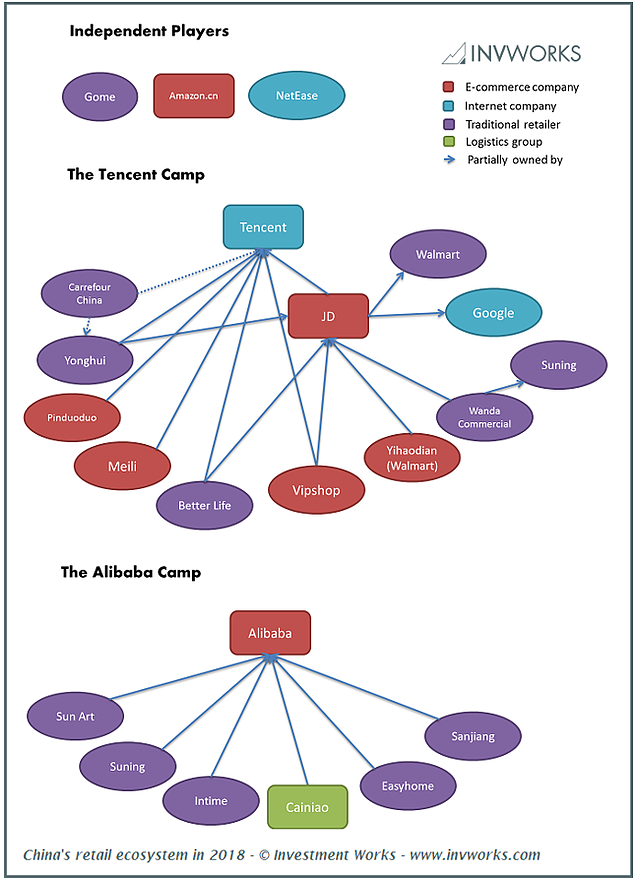

- An overriding trend in the China retail sector is the consolidation of major players into either the Alibaba camp or the Tencent camp.

- We analyze the business model of the top 10 players, and reveal their strategic partnerships with and ownership ties to either camp.

- We discuss the merits of investing in market leaders Alibaba, Tencent and JD.

With most U.S. tech stocks richly priced, we have been hard at work researching China tech. In fact, we are determined to make China one of our core competencies, so expect ticker-focused articles on the likes of Alibaba (BABA) (BBAAY), Tencent (TCEHY) (TCTZF) and Baidu (BIDU) in the coming weeks.

Earlier this month, we initiated a long position in JD.com (JD) in the mid $30s, to which we added at lower prices. JD is our third stock pick of the year, following The Trade Desk (TTD) and Alphabet (GOOG) (GOOGL), which are up some 130% and 20%, respectively, since we published our long theses.

We refer those interested in our existing long positions to the original TTD long thesis, published in January, the original GOOG thesis, published in April, and the original JD thesis, published earlier this month..

In this article, we explore the current status of the thriving Chinese retail ecosystem. At the core of the article lies a diagram, which highlights the increasing clustering of the myriad retail players into either one of two large, dominant camps: the Alibaba camp and the Tencent camp, with JD playing a major role in the latter.

The clustering of China retail players around the Alibaba and Tencent camps is becoming increasingly evident (source: Investment Works Research)

On what follows, we briefly introduce the main trends that are shaping China retail. We then go one by one over the most relevant players. For each player, we provide a snippet with:

- a description of the business activities relevant to retail,

- rough measures of size, growth and brand value, when available, and

- the strategic and ownership ties to the other players, if any.

The focus of the article is on retailers of physical goods. We exclude providers of local services such as Tencent-backed Meituan-Dianping (MEIT) and Alibaba's Ele.me and Koubei, as well as pure B2B marketplaces such as DHgate.com.

As a proxy for brand value, we use the BrandZ China ranking, which combines research on consumer data with financial analysis to produce a list of the top 100 global brands for each year. We see BrandZ's scores as a valuable indicator of business strength, while its year-over-year change figures serve as insightful indicators of momentum. Moreover, according to BrandZ's analysis, there has been a strong correlation between companies’ BrandZ scores and stock returns.

While we have attempted to keep it short, this article covers over 20 companies in China retail, making it an ideal starting point for more focused analyses of the sector (including online, offline and hybrid models).

To our knowledge, this article is the most comprehensive up-to-date report yet to have been published in the English language on the interplay between Chinese retail players. Third-party authors are welcome to build on this work by ensuring relevant reference to this article.

China retail

Within the span of two decades, Chinese Internet companies have transformed from skilled imitators, operating within the confines of the Great Firewall, to visionary leaders.

Today, the Chinese Internet ecosystem is arguably more dynamic and daring than its Western counterpart. In fact, Chinese Internet companies are starting to become a major source of innovation throughout the world. And the trend is only expected to become more widespread, as Chinese companies continue to capitalize on the strengths developed in China by adapting these to the idiosyncrasies of international markets in order to prolong their growth.

Indeed, in no other segment is the vitality of the Chinese market more apparent than in retail. Incessant innovation and consolidation are blurring the boundaries between offline and online, shopping and social, and retail and tech – all at an incredible pace.

E-commerce and B2C

The rise of the Chinese consumer is and will continue to be a secular tailwind for retail.

Within retail, e-commerce entrepreneurs have capitalized on the rapid expansion of Internet access and its widespread adoption, as well as the underdevelopment of brick-and-mortar retail franchises, to outgrow incumbents. Relentless innovation and deep pockets have helped speed up the process.

Within online retail, B2C keeps grabbing market share from C2C, as affluent urban consumers demand increasing levels of service and product authenticity (every year, some 20 million Chinese people move to the city and a commensurate number joins the middle class [1]).

New retail

Amazon's (AMZN) acquisition of Whole Foods about a year ago raised a few eyebrows, but for those acquainted with China retail, Amazon was just taking a page from Alibaba's playbook.

Alibaba's Jack Ma calls it new retail, JD's Richard Lui, boundaryless retail. What both have in mind is the use of technology to seamlessly combine the virtues of online and offline retail to offer all players along the value chain the best possible experience.

Indeed, new retail is the fundamental force driving the consolidation of China retail around the Alibaba and Tencent camps. Each camp is trying to shore up its control of the value chain, filling missing links with strategic partnerships and acquisitions.

As we shall see, the links of the new retail value chain include mobile sales channels, online marketplaces, advertising platforms, payments and other consumer and merchant financial services, supply chain solutions, warehouses, last-mile delivery and brick-and-mortar stores.

Cracking the customer experience code

Experience, be it customer, merchant or brand experience, is the key word here.

Before the Internet, the main competitive advantage a retailer had was the degree of market power in relation to suppliers, with the needs of customers and other stakeholders relegated to a secondary role.

Today, thanks to the ubiquitous access to the Internet, consumers across the globe are flooded with an overabundance of product and pricing information amid the disintermediation of the middle man, forcing retailers to shift their focus away from suppliers to consumers and other platform stakeholders. Therefore, the retailers gaining advantages of scale are those who are willing and capable to offer best-in-class —customer, merchant and brand— experiences.

This is an ongoing phenomenon in every economy that boasts broad Internet penetration, but it is particularly apparent in China, where the shift is taking place faster for the reasons outlined above.

The Alibaba camp

Alibaba Group

Alibaba, which was founded in 1999 by Jack Ma, was originally established as a B2B website to connect small and medium-sized Chinese manufacturers with overseas buyers.

In 2014, to fight eBay's (EBAY ) entrance into the Chinese market, Alibaba launched Taobao — China's largest C2C platform — and Alipay — China's first payment system.

Alipay was created out of necessity, to support the C2C business at a time when credit cards were held by just 1% of the population [2]. Since then, Alipay has grown to become one of the two largest mobile payment platforms in the country, the other being Tencent's Weixin Pay.

Alibaba also operates TMall, the country's largest B2C marketplace by GMV, and new retail initiatives including fresh-food supermarket chain Hema Xiansheng and department store chain operator Intime.

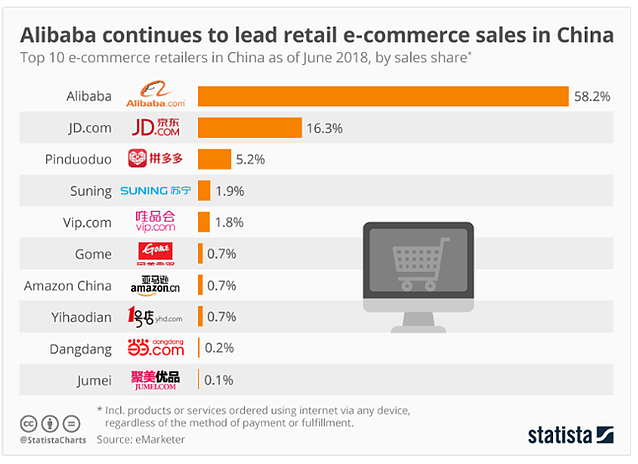

Overall, 58% of China's e-commerce GMV is transacted in Alibaba marketplaces, cementing its position as the undisputed e-commerce leader. But unlike Amazon and JD, Alibaba operates an asset-light business model. With the exception of the new retail initiatives, Alibaba does not sell directly to consumers. Instead, it provides marketplaces and value-added services (advertising, financial, etc.) to third-party brands and merchants while the brands and merchants carry the merchandise in their inventories. Retail income is generated through sale commissions, advertising and financial services.

Alibaba’s payments affiliate Ant Financial, which owns and operates Alipay, is valued at $150 billion, making it the most valuable fintech company in the world.

Historically, low-cost delivery services were provided by a number of independent courier companies based in Alibaba's home province of Zhejiang, with Alibaba by far their largest customer [3]. Alibaba's affiliate Cainiao was established to coordinate the operations of the courier companies and provide them funding. Last September, Alibaba took a majority stake in Cainiao and pledged to spend $15 billion over five years to build out a global logistic network, in another step towards assuming more direct control of its logistic operations.

Beyond retail and finance, Alibaba operates a rapidly-growing cloud business, as well as local services, and digital media and entertainment platforms, including Youku (video streaming) and UC (the leading web browser in China).

The company has a market capitalization of $465 billion and its ADS has been trading in the NYSE under the ticker BABA since its $25 billion IPO in 2014, the largest to date after Spotify's (SPOT) IPO earlier this year.

Fiscal year 2018 revenues (ended March 31 2018) were $39.9 billion, representing 58% YoY growth, thanks to expanding GMV (up 28%) and take rates. A bright spot was Tmall physical goods GMV, up 45% YoY.

Alibaba's asset-light business model results in large profit margins. For FY2018, the core commerce third-party business produced EBITA margins in excess of 60%, and overall profit margin of about 25%.

In 2018, BrandZ valued the Alibaba brand at $88.6 billion, a 53% YoY increase that places it second only to Tencent.

Alibaba holds partial or total ownership stakes in a number of retailers, including Suning, Sun Art, shopping mall and department store chain operator Intime, home improvement and furniture chain operator Easyhome and supermarket chain Sanjiang Shopping.

Market share of top 10 e-commerce retailers in China as of June 2018, by GMV (source:statista)

Suning

Founded in 1990 as an air-conditioner retail store, the company has since grown to become one of the largest retail consumer electronics retailers in China, integrating online and adjacent categories over the years.

Suning, which has a market cap of $17 billion, is listed on the Shenzhen Stock Exchange under the ticker 002024.

In 2017, it posted a 26% YoY jump in net revenue to $29 billion and low single-digit margins. 1H 2018 has confirmed the business momentum.

Its 2018 brand value was estimated at $3.4 billion, flat with respect to the previous year.

Alibaba holds a large stake in Suning, and Suning a stake in Alibaba. However, in recent years Suning has been reducing its stake in Alibaba, even as it invested in the Wanda Commercial initiative by the Tencent camp; this is a rare case of a Chinese retail player bridging the gap between the two prominent camps.

Sun Art

China’s leading hypermarket operator Sun Art Retail Group runs two well-known grocery physical store chains – Auchan and RT-Mart.

Founded in 2000, the company is publicly listed in Hong Kong under ticker 6808 and boasts a market cap of $12.2 billion.

The company recorded a 2% growth in 2017 revenue to $15 billion on low single-digit margins. Sun Art is not among China's 100 most valuable brands as per the BrandZ ranking.

Major shareholders include French Groupe Auchan and Taiwan’s Ruentex. In November 2017, Sun Art formed a strategic partnership with Alibaba, through which Alibaba also took a stake in Sun Art.

The Tencent camp

Tencent

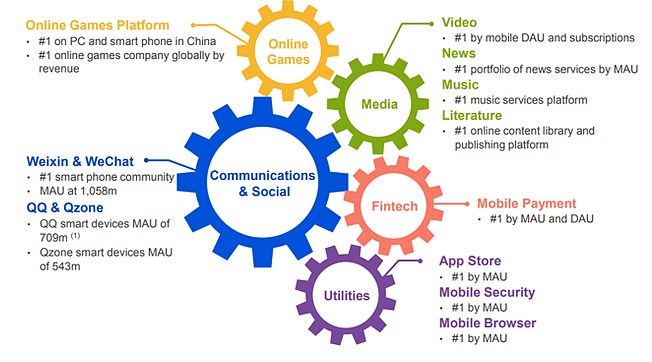

Founded in 1998, Shenzhen-based Tencent is the world's largest videogame company by revenue and operates the strongest portfolio of social and entertainment Internet assets in China.

On the PC and online gaming front, Tencent holds ownership stakes in a number of leading game studios around the world. The company derives income from international hits PUBG (through a stake in Bluehole and IP agreements), Fortnite (through a stake in Epic Games) and League of Legends (through wholly owned Riot Games), as well as an array of China's favorites, including Honor of Kings and QQ Speed.

Outside of games, Tencent operates Weixin/WeChat (China's super-app, with over 1 billion MAUs and counting), QQ & QQzone (messaging and social platforms targeted to younger audiences, an evolution of Tencent's original PC-based messaging platform QQ), the leading video and music streaming platforms, the number one mobile browser and Android app store, and leading mobile payment platform Weixin Pay (the other being Alibaba's Alipay).

Think Facebook + Netflix + Spotify + PayPal under one roof, but admittedly, with stronger competition than in the Western world. Very impressive indeed.

And although Tencent presents itself as an investment holding company, you can be certain that it is worth more than the value of its parts, with Weixin, QQ and QQ Browser acting as omni-present distribution networks for its social, entertainment, media and utility assets. The company also operates a rapidly expanding cloud initiative.

Tencent’s impressive portfolio of Internet assets in China, as of June 2018 (source:Tencent IR)

Not surprisingly, Tencent's retail strategy builds on Weixin's ubiquity. The company offers Weixin as a sales channel and payment platform to strategic partners such as JD, Vipshop and Pinduoduo. It also allows brands and merchants to open WeChat stores directly on the Weixin platform, skipping traditional marketplaces.

Last year, the company launched Weixin Mini Programs to increase engagement in the platform and augment use cases across the online and offline worlds. Mini Programs are applications smaller than 10 megabytes that can run instantly on Weixin's interface. Think of light apps within the Weixin app. Brands and merchants use Mini Programs to engage with potential customers and bridge the gap between the online and offline worlds – for example, through QR codes, extremely popular in China.

There is no question that the gradual market share gains made by JD in the past and the more recent rapid market share gains made by Pinduoduo are to a large extent due to the Weixin channel.

Tencent benefits financially through both ownership stakes in the strategic partners and value-added services, mainly advertising, payments and cloud, while maintaining an asset-light corporate structure.

Adding to the spectacular value of Tencent's Internet assets is a first-class management team of managers-investors, headed by Co-Founder, Chairman and CEO Pony Ma and President Martin Lau.

Tencent is listed on the Hong Kong Stock Exchange under the ticker SEHK 700, and US OTC with tickers TCEHY (the ADR) and TCTZF. It has a market capitalization of $420 billion.

2017 revenues were $34.7 billion, up 57% YoY, with net margin of 30%.

In 2018, BrandZ boosted the value of the Tencent brand to $132.2 billion, up 25% YoY and topping the ranking as China's most valuable brand for the fourth consecutive year, since it surpassed China Mobile (CHL) in the 2015 ranking.

Tencent has ownership interests in numerous retail players, notably JD, Vipshop (VIPS), Pinduoduo (PDD), Yonghui, Meili, Better Life and Carrefour China (CRRFY), of which the latter is under negotiation.

JD.com

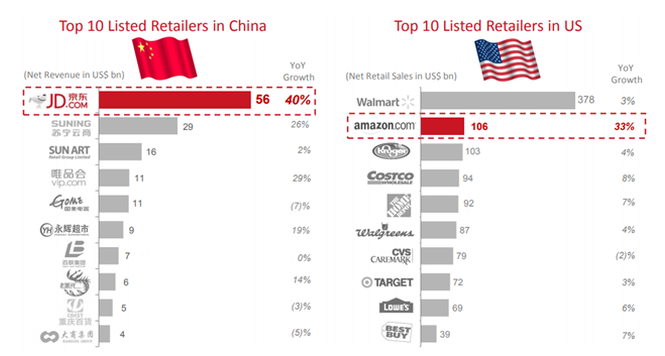

Beijing-based JD (Jingdong) is the largest retailer in China, in a category that excludes companies that operate marketplaces but do not carry inventory, notably Alibaba.

Founder and CEO Richard Liu has led the company all the way from a tiny 4 m2 market stall in Zhongguancun to an e-commerce powerhouse [4]. An unconditional commitment to customer experience and last-man-standing fighter spirit –never shying away from a price war– have served him well, beating many other larger competitors along the way, who were either cornered to insignificance (Dangdang, Newegg, Amazon.cn/Joyo.com) or forced to join JD (Walmart/Yihaodian -WMT).

(The casualties of China's e-commerce wars count other illustrious names such as eBay China and Jumei.com, but their demise was not directly related to JD's expansion.)

Top 10 listed retailers in China and US, by 2017 revenue (source: JD IR)

JD's core business is JD Mall, the second-largest-B2C marketplace after Alibaba's Tmall. Similar to Amazon, JD Mall operates through a mix of direct sales and third-party offerings.

Today, JD Mall dominates several categories including electronic products and home appliances, and is making important strides into fast-moving consumer goods (FMCG). Attempts to grab market share from Tmall in apparel have so far been decisively contested by Alibaba.

JD Mall has been built with a focus on product authenticity and service quality, at the expense of higher prices and smaller selection than in C2C marketplaces. As such, JD offerings cater especially to affluent consumers in higher-tier cities, but the ongoing urbanization phenomenon has been and should continue to be a tailwind for quality-oriented marketplaces going forward.

Beyond JD Mall, JD operates the most advanced nationwide logistics network in China through its subsidiary JD Logistics. Built in-house from the ground-up to retain full control of the customer experience, the logistics network is end-to-end, integrating fulfillment centers, warehouses and last-mile delivery assets, and can handle the entire spectrum of products, from heavy washing machines to fresh groceries. It offers same-day and next-day delivery in almost every corner of China. The company is in the process of ramping up third-party logistic and fulfillment services, building on the infrastructure built over the years for its own direct-sales business.

Another important affiliate is JD Finance, last valued at $19 billion and in which JD retains a 36% interest. JD Finance provides financial services to merchants and customers, capitalizing on big data gathered throughout the JD platform.

JD is also in the process of establishing an asset management subsidiary to develop, monetize and operate its massive logistics property portfolio.

Proceeds from the sale of properties are meant to offset aggressive investments in R&D, in an attempt to grow retail-as-a-service business lines built around technology. As an aside, we see the expansion towards retail services as a very smart move by JD, which diversifies risk away from the core JD Mall marketplace. Even if in the future other sale channels grab a share of the growth momentum from JD —likely, WeChat Stores in the apparel category —, JD will still benefit by providing logistic, customer management, data and other value-added services.

JD ADS trades on the Nasdaq under ticker JD, and the company has a market capitalization of $46.5 billion.

2017 revenue came in at $53 billion, up 40% YoY, with about breakeven margins, with losses in new initiatives more than offsetting razor-thin margins from JD Mall.

In 2018, BrandZ valued the JD brand at $14.6 billion, up 50% YoY, placing JD as the 12th most valuable brand in China.

JD's growth has been mostly organic, but since its partnership with Tencent (as part of which it absorbed Tencent's e-commerce assets and gained access to Weixin), the company has engaged in a spree of strategic arrangements and acquisitions. Today, it holds stakes in Vipshop, Yonghui, Better Life and Wanda Commercial. It also absorbed Yihaodian as part of a partnership with Walmart. Meanwhile, strategic owners of JD equity include Tencent, Walmart and Alphabet.

Pinduoduo

Pinduoduo (PDD) is a group-buying mobile platform established by former Google engineer Colin Huang in 2015.

Growth has been nothing short of spectacular, with GMV reaching $29 billion for the year endedMarch 31, 2018, up over 10x YoY, and MAUs surging to 166.2 million as of March 31, 2018 from just 15 million in early 2017.

This growth has been fueled by a strong social component, aggressive promotion strategies and preferential access to Weixin, thanks to its partnership with Tencent, which is one of the main backers.

Pinduoduo caters mainly to price-sensitive customers in rural China, and competes mainly against Alibaba's Taobao.

In July, the company priced its U.S. IPO at $19 per ADS and raised $1.63 billion. It is listed on the Nasdaq stock exchange under the ticker PDD, and has a market capitalization of $20 billion.

Despite best-in-class growth, its business model is still unproven. 2017 revenue came in at only $254 million, with net losses of $77 million. Moreover, the company will need to find and implement cost-effective ways to keep the platform free of counterfeit products, following a government probe announced right after the IPO.

The company did not make it to the 2018 BrandZ ranking.

Vipshop

China’s online discount retailer Vipshop offers Chinese consumers branded products at significant discounts. Catering mainly to young, female shoppers, Vipshop has been successful in creating a differentiated e-commerce model: the first profitable online discount retail business in China.

Founded in 2008, Vipshop has steadily grown the number of brand partners and customers.

Today, the company has more than 60 million members and is witnessing an increase in the average revenue per customer, although the number of members appears to have reached a plateau.

Vipshop ADR trades in the NYSE under the ticker VIPS, and the company has a market capitalization under $5 billion.

For full-year 2017, revenue was $10.6 billion, up 29% YoY, with net margin below 3%.

BrandZ estimated Vipshop's brand value at $1.9 billion, down 14% from a year earlier.

The company counts Tencent and JD among its stakeholders.

Yonghui

Yonghui Superstores is one of the main operators of supermarket and hypermarket franchises in China.

The company is listed on the Shanghai Stock Exchange under ticker 601933. It has a market capitalization of $12.8 billion.

Yonghui’s 2017 revenue was $10 billion, up 19%, with net margin below 3%.

Both Tencent and JD have invested stakes in the company, as part of China’s internet and e-commerce giants push into offline retail.

The independent players

NetEase

NetEase, an Internet portal pioneer founded in 1997, is still a leading Internet company, a notch below the BAT pedestal.

It develops and distributes online PC and mobile games in China, operates the popular news portal www.163.com and offers Internet services such as e-mail and online advertising.

The company has an important presence in e-commerce through its cross-border B2C platform Kaola —second only to Alibaba’s Tmall Global and ahead of JD Worldwide— and private label platform Yanxuan.

The company effectively capitalizes on its news portal’s popularity and tech-savvy online gaming users to boost traffic to its e-commerce platforms.

NetEase has a market capitalization of $27 billion, and its stock is listed on the Nasdaq under the NTES ticker.

In 2017, its revenue amounted to $7.9 billion, up 42% YoY, with net margin of 20%.

Its brand was valued at $3.6 billion in 2018, up 26% year on year.

Gome Electrical Appliances

Founded in 1987, Gome is a large electrical appliances and consumer electronics retailer.

The company, which operates 1,600 stores in China, has expanded its offerings to provide complete home coverage solution, including electrical appliances, home decoration, household products and home services.

With a market capitalization of $2.2 billion, Gome trades on the Hong Kong Stock Exchange under the ticker 0493.

In 2010, the company saw its founder Huang Guangyu, China's richest person for a while, sentenced to 14 years in prison for insider trading and bribery [1]. Although Gome survived, the company appears to be in decline, with revenues falling by 7% in 2017 to $11 billion in a growing retail market.

The company did not make it to the 2018 BrandZ ranking of China's most valuable brands.

Takeaways and future work

The consolidation of China's vibrant retail ecosystem around the leaderships of Alibaba and Tencent is becoming increasingly evident.

Both camps are striving to fill the missing links in their retail value chain, be it supply chain solutions and mobile sale channels or last-mile delivery and new retail initiatives.

Both Alibaba and Tencent are spectacular companies, armed with a breadth of scope and growth that is hardly any match for the large Western Internet companies. Retail is not a winner-takes all market, and there is enough room in China and worldwide for more than one dominant retail platform. As such, either of the two giants is likely to make for an excellent investment over the long term.

However, given the choice, we tend to prefer Tencent, as we believe that among the vast array of exceptional assets in each group's portfolio, Weixin is the one that the competitor –Alibaba– will not be able to replicate, owing to its massive platform effects.

And chances are that, over time, Weixin's ubiquity in Chinese pockets and Tencent's smarts to capitalize it, will end up tilting the balance towards the Tencent camp, with several of its e-commerce strategic partners sharing in the benefits.

A few examples of the Weixin impact: Alibaba pioneered digital payments in China, yet Tencent has caught up thanks to Weixin. Alibaba was the undisputed leader in e-commerce, yet JD has been taking share from Tmall year after year, and more recently Pinduoduo from Taobao, again, thanks to Weixin.

To be fair, Tmall has seen a comeback in 2017, with physical goods GMV accelerating to an impressive 45% YoY growth, above JD's growth. And Tmall completely dominates certain categories, notably fashion and apparel. And unlike JD, it grows while producing hefty profits. Still, mid-to-longer term, we expect JD to catch up to Tmall in terms of GMV.

Beyond the two giants, JD and Vipshop are trading at 0.8x and 0.4x TTM sales, respectively, which makes them interesting investments in their own right (JD's multiple is actually lower after accounting for the value of its multiple investments).

We believe that JD has survived what it had to survive (against all odds) and that its current size and strategic positioning provide them with staying power. Hence, at the current depressed price, we see JD as a relatively safe vehicle to gain direct exposure to China's e-commerce potential.

Offline references:

[1] The One Hour China Book, by Jeffrey Towson and Jonathan Woetzel

[2] China's Disruptors, by Edward Tse

[3] Alibaba – The House That Jack Ma Built, by Duncan Clark

[4] The JD.com Story: An E-commerce Phenomenon, by Li Zhigang

Disclosure: I am/we are long JD, GOOG (see all the current holdings in the IW Portfolio).

If you have enjoyed the read, more

Excellent read!

Thank you for reading.

Subscribe to the IW Newsletter @ www.invworks.com/subscribe to keep up to date with our latest research and stock picks --no charge.

Wow, a huge amount of information. And it totally backs up my prediction that one technically literate generation and China would be a HUGE world force in commerce.

I agree.