Value Investment Research

Contributor's Links:

IW Portfolio Stock Picks IW Newsletter

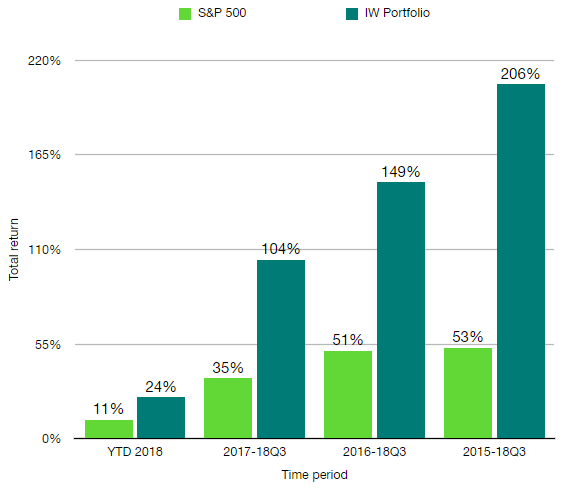

We are in a quest to redefine investment research, applying value investing to today's technologies and business models in search for asymmetric risk-reward. Since its inception in 2015, the IW Portfolio has yielded 206%, representing 38% annual compounded returns and outperforming the ...more

We are in a quest to redefine investment research, applying value investing to today's technologies and business models in search for asymmetric risk-reward. Since its inception in 2015, the IW Portfolio has yielded 206%, representing 38% annual compounded returns and outperforming the S&P 500 by 153%, or 25% annualized (as of 28 September 2018). Starting 2018, we are sharing with YOU:

- our principles

- our stock research

- the current holdings in the IW Portfolio and new stock picks.