The Future of the Global Wine Industry: Boxes, Bulk and Blends

Elliott R. Morss ©All Rights Reserved

Introduction

Good data are available on what is happening in the wine industry. Nielsen surveys US off-premise (non-restaurant) wine sales and Wine by the Numbers has just issued a report on global wine trading that includes and informative piece by Mike Veseth. In what follows, I summarize key features from each and offer a few thoughts on where they suggest the industry is going. Tables 1 and 2 provide data from the Nielsen surveys. Off-Premise sales exclude restaurants. It is perhaps the best indication of what customers want when given all options.

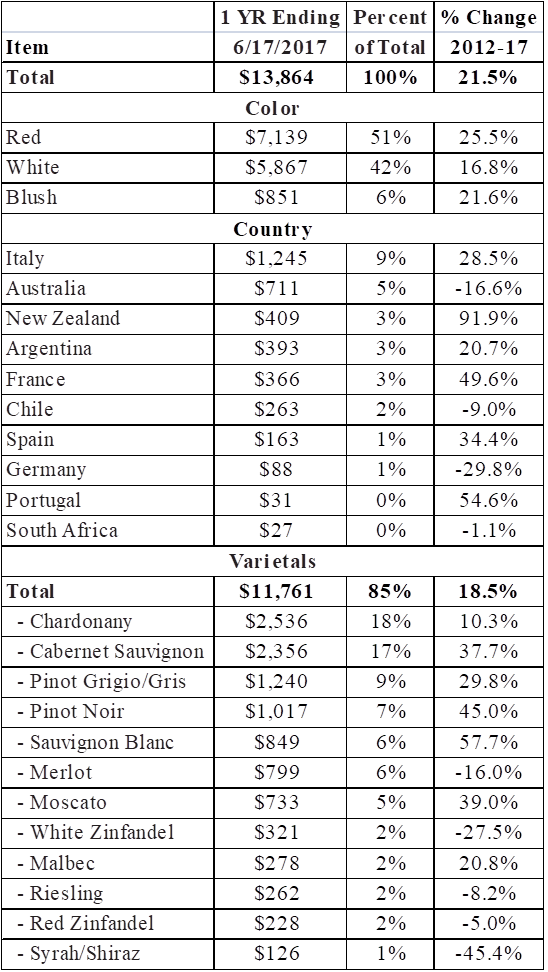

Several points in Table 1 are worth noting. Red wines outsell whites and they are growing more rapidly. Italian wines outsell other countries by a large margin. In sales to the West, Australia has yet to recover from the boom and bust resulting from declining interest in Shirazes and its overproduction. However, the country is benefiting from the rapidly growing Chinese demand. In 2008, Argentine wines sold $420 million in the US. It has yet back to that number, in part because of heavy taxes levied during the Kirchner regime.

France continues to sell well in the US. France is getting a real boost from the popularity of its Bordeaux in China. There was a time when Chile was a leading supplier of well-known branded wines to the US. Times have changed. Spain has worked hard to under-price almost all competitors. The demand for German wines in the US is flagging. At least for now, Portuguese wines are increasingly popular in the US. South Africa has shown no interest in launching a serious effort to sell its wines in the US.

Overall, varietal sales are growing more slowly than the total wine sales. Antonio Rallo, the president of Unione Italiana Vini, explains this as follows: “It should be noted that this has less and less the character of a specific varietal and increasingly often a more or less convinced embrace of a philosophy: the eco-friendly, the sustainable, the generational or lifestyle wines, expressly because it is clear that a varietal can no longer be used as a valid mantra for all time periods and generations.”

He has lost me. I wonder what he really means.

Changes in the sales of individual varietals reflect changing “fashions” among US consumers. “Light wines” including Pinot Grigios, Sauvignon Blancs and Pinot Noirs are in. At the same time, a couple of “Heavy Reds” – Merlots and Shirazes - have lost favor.

Table 1. – US Off-Premise Sales, Color, Country and Varietal (mil. US$)

Source: Nielsen Surveys

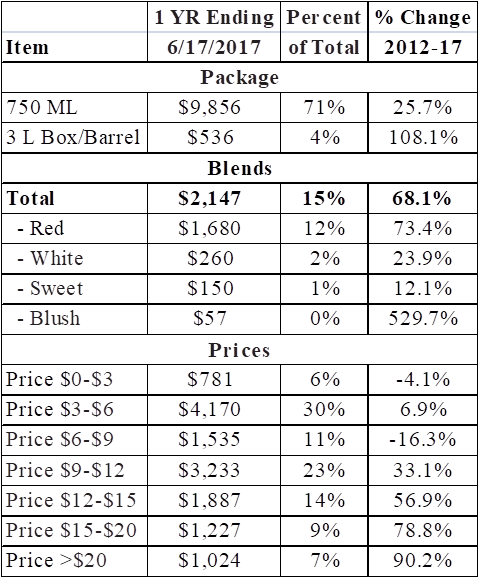

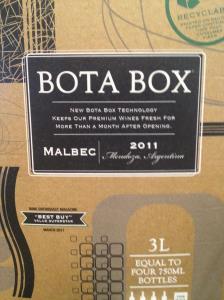

Table 2 highlights several important points about the changing US demand. The growth in the sale of 3-liter box wines is notable. In part, this reflects a growing awareness among US customers that they don’t have to pay high prices for wines they like (the 3 liter boxes sell for around $16 or $4 per 750 ML bottle equivalent. The growth in blends is also notable. It means customers are focusing less on specific grapes and region and trusting more on the bottler. As the blend demand grows, so will the demand for bulk wines for the “urban vintners” and other vintners that do not grow their own grapes.

There is one other point in Table 2 worth noting: the growth in the purchase of higher-priced ones. More on this later.

Table 2. – US Off-Premise Sales, Packages, Blends and Prices (mil. US$)

Source: Nielsen Surveys

Bulk Wines

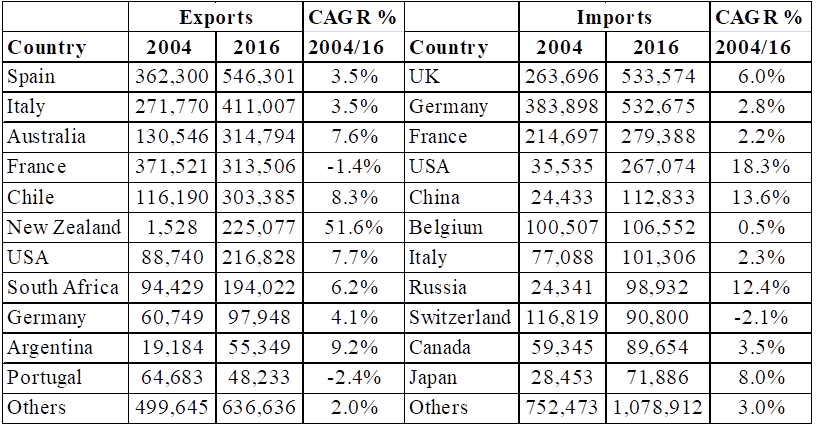

Two factors drive bulk wine exports: the inability to sell bottled wines for a profit and low production prices. Spain has very low costs while Argentina, South Africa, Chile and Australia have had to increase bulk exports because of the lack in demand for its premium brands. New Zealand is a special case with a growing demand for both its bottles and bulk, with much of its bulk going to Australia.

For imports, the UK, Germany, Russia, Switzerland and Canada, growing seasons are short and bulk supplements the limited local wine production. China imports considerable bulk because of its limited (but rapidly growing production facilities. One does wonder how France and the US use their bulk imports. In an earlier piece, I raised the question of whether they are added to some of their high-priced bottled wines for export.

Table 3. – Compound Annual Growth Rates in Bulk Imports/Exports, Leading Countries (mil. US$)

Source: Wine by the Numbers

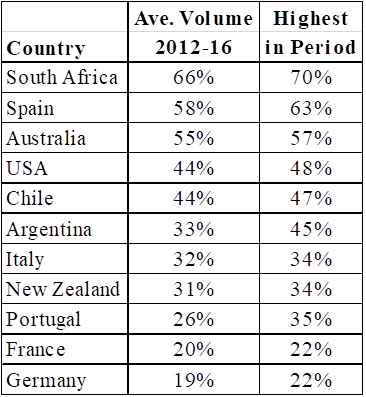

Table 4 indicates how important bulk sales are relative to their total exports. South Africa would prefer to export more bottled wine but has not invested in a marketing strategy to make that work. As a low-cost wine producer, Spain does well on its bulk exports. Australia would like to reduce is bulk share. And there is hope: since 2011, China’s wine imports have doubled and Australia is its leading provider.

Table 4. – Bulk Share of Wine Exports

Source: UN Comtrade

Analysis

So what does the future hold? We can get some way towards an answer by focusing on the key factors driving demand. These factors include:

- Branding;

- Ratings;

- Price (some like low price; others will only buy expensive);

- Store Salesmen;

- Wine knowledge and

- What people like.

It is inevitable that wine ignorance and vanity will continue to play major roles in diving wine demand. Ignorance leads consumers to depend on the advice of others (brands, ratings, store salesmen, etc.). Vanity drives people who want to be thought of as wine connoisseurs to buy only high priced wines.

With more knowledge, these factors become less important and what people like will play a more important role. So what do we know about what people like?

People do not prefer expensive to inexpensive wines. This conclusion comes from blind tastings in Paris (1976), Princeton (2012), Stellenbosch (2013), Ashton (2014), Lenox (2012-14), Lecocq and Visser, and Goldstein et al. The overriding conclusion from all of these tastings is that people do not prefer expensive wines to less expensive ones: there is no correlation between price and how people rate wines. And this conclusion is “robust” – it holds for the “expert” tasters and well as for the “hoi polloi.” Does this mean rating differences stem from wine drinkers have different taste preferences? Probably, but maybe not. Robert Hodgson has developed a test to see if tasters will rate the same wine consistently. When he applied his test to judges for the California State Fair wine competition, he found that only 10 percent of the judges were consistent in their ratings.

Where there is less knowledge, one can assume that the other factors mentioned – branding, ratings, price and salesmen will play a more important role. We can see lack of knowledge playing out most clearly in China where people are just being introduced to wine. In the US,

And it appears US consumers are learning more about wine. Scott Elliott, a senior VP at Nielsen spotlights “a population of ever-more discerning consumers….” So, is there evidence of these more discerning consumers? I would offer the following as evidence:

- The Growth of 3-Liter Boxes

- The growth of Blends

- The growth of Bulk wine shipments to supply them both.

Boxes: As the Nielsen surveys indicate, sales of box wines are growing rapidly. And the Lenox tastings indicate this was no fluke. There, a 3-liter box was included in 8 tastings: it got the top score in 6 tastings, a 2nd twice and 3rd once. And these results came against wines costing as much as $85. I take the growth in wine sales and its apparent good “taste” as a sign of growing wine knowledge among US wine consumers.

Blends: What can explain their growing popularity? They taste good: it is not hard to imagine that vintners who can buy grapes from anywhere in the world can come up with better tasting wine than vintners limited to a particular regions or varietals. Of course, those buying wines for reasons other than taste will continue to buy from regions and/or particular varietals.

Bulk: Its growth reflects a growing demand from Box and Blend producers. Most boxes indicate the country of origin of their wines. For example, a Bota Box Malbec says it came from Mendoza Argentina. It did not come in a box from Argentina. It was shipped to the US as bulk - far cheaper to ship it in bulk for packaging in the US.

One Final Point

It turns out that so-called wine experts do not agree on wines. From Richard Quandt in his review of wine ratings at the “Judgment of Princeton”: “…the rank order of the wines was mostly insignificant. That is, if the wine judges repeated the tasting, the results would most likely be different. From a statistically viewpoint, most wines were undistinguishable. Only the best white and the lowest ranked red were significantly different from the other wines.” Stuen, Miller and Stone reached a similar conclusion in their analysis of wine critics.

What does this all mean? My interpretation (with no documentation):

50 years ago there was general agreement on good and bad tasting wines. Thunderbird and Lancers Sparkling Rosés were bad wines while Chassagne-Montrachets were good wines. Today, bad wines won’t sell. All wines are good enough so that personal taste differences determine wine ratings.