Elliott R. Morss, Ph.D. ©All Rights Reserved

Introduction

With US stocks off 6% last week, one wonders if we are about to experience something similar to what happened in 2008 and following. At that time, global markets lost $36 trillion and property values fell an additional $14 trillion. And $50 trillion was a lot considering that global GDP in 2009 was only $60 trillion. Question: are we at the beginning of a similar downturn? Globally, there is plenty to worry about: • Growth in China is slowing and the stock markets are in total disarray;

• ISIS-inspired terrorists are causing problems world-wide;

• A Putin-led Russia is asserting its power and influence, and

• Just as there was hope the Syrian tragedy might be resolved, Saudi Arabia and its Sunni allies are squabbling with Iran and its Shiite allies.

So there is plenty to worry about. In what follows I will explain why things are different than 2008 and why US stocks are an excellent investment going forward.

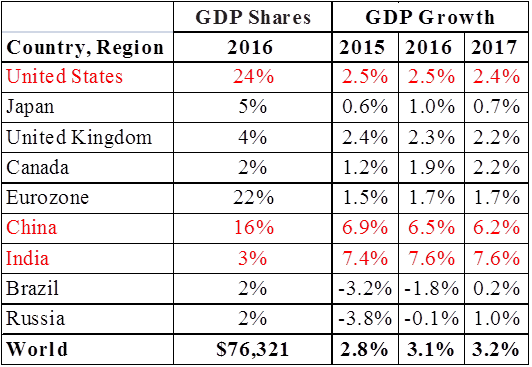

The Global Economic Setting Table 1 provides economic data on country importance and GDP growth rates as projected by approximately 20 banks and other economic institutions surveyed by FocusEconomics. I have highlighted the United States, China and India. Together, they constitute 43% of global GDP. Right now, China is experiencing some economic problems, but its GDP is still projected to grow at more than 6% into the foreseeable future. India is projected to grow even more rapidly. Together, their populations constitute 36% of the global total. Both have rapidly growing middle classes are demanding ever more goods and services. They are significant engines for global growth. When it comes to developed countries, the US is the bright light. While it has taken a while, the US is now on a sustainable growth path with unemployment projected to fall below 5% this year.

Table 1. – GDP Importance and Growth Rates, Selected Countries

Source: FocusEconomics

So what is the takeaway from Table 1? China and India remain formidable engines of growth for the global economy. And the US economy is once again healthy and much more so than other mature countries.

Global Capital

In a recent piece, I took note of the growing global flows of capital (primarily debt and equity). I illustrated how important they have become. In 2008, 2009, 2011, and 2013, US net capital inflows exceeded the trade balances for the same years. I quote from that earlier piece:

“Foreign holdings of US equities and debt have become important. The Federation of World Exchanges estimates the capitalization of the NYSE and NASDAQ to be $18 and $6 trillion, respectively. The US Treasury estimates foreign equity holdings at $5 trillion, or 21% of the total. A recent Congressional Research study found that foreigners own 47.1% of US Federal publicly held debt.”

Because of these huge and growing flows, the standard norms for US equities have to be reassessed. A price earnings ratio of X has to be considered against a global rather than just a US demand for equities. Of course, these flows can go both ways. There will be times when there is net outflow of global capital.

Today, the question is what are the institutions and individuals who are in a position to invest their funds anywhere thinking. I refer you back to Table 1. In these times of uncertainty, there is no country that looks as good as the US.

There is one other point here worthy of note. The Federal Reserve is in the process of increasing US interest rates. And this process is likely to continue with unemployment projected to fall below 5%. Globally, US government debt is considered one of the safest assets there is. Consequently, whenever the return on this debt grows, there is a major US capital inflow to buy this debt. Because this debt can only be bought with dollars, the demand for dollars grows which in turn strengthens the dollar against all other currencies. This means that investors not in US dollar assets will suffer dollar losses as the dollar strengthens.

Conclusions

US equity markets got spooked last week and sold off sharply. There is nothing fundamentally wrong with the US economy. In fact, it is in better shape than any other mature economy. Global capital is understandably worried about uncertainties. This will likely result in considerable “chop” going forward. But prospects for US equity markets are excellent. Global capital must be invested somewhere and nothing now or in the foreseeable future looks better than US equity markets.