I have been following Weatherford International WFT for nearly a year now. In July I laid out four reasons it could be a great short play. Those very same reasons could make the company the next Enron. I am not suggesting that Weatherford has engaged in fraudulent activities. However, there are dynamics that make the two companies very similar. Below is my rationale.

Enron Was Dependent Upon High Energy Prices

Enron's business model was dependent upon high energy prices. The boring utility company jumpstarted its earnings and share price by entering the energy trading business. Profitability was primarily driven by high energy prices, particularly in California, where Enron had at one time had a substantial share of the market. According to an SEC complaint against Enron's Ken Lay, Jeff Skilling and Richard Causey:

If disclosed to the public, this sudden and large increase in trading profits, which exceeded $1 billion, would have made it apparent that Wholesale's revenues were tied to the market price of energy, meaning Enron was exposed to the risk of a decline in such prices. This would have revealed Enron as a speculative (and therefore) trading company. To conceal the ... volatility of Enron's trading profits, Skilling, Causey ... hid hundreds of million of dollars in trading profits in reserve accounts maintained on an internal Enron ledger.

Weatherford Is Dependent Upon High Oil Prices

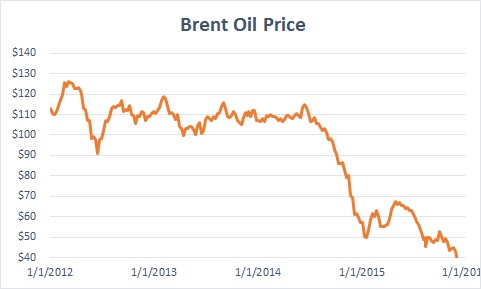

Weatherford provides equipment and services for oil and gas exploration and production. The company markets everything from pressure drilling to production and completion services. Its revenue is highly dependent on the price of oil; oil prices have fallen over 70% since their peak in Q2 2014, and big oil has bought less of the types of equipment and services Weatherford provides.

Meanwhile, the company's revenue and earnings have been crushed. Weatherford's respective Q3 2015 revenue and EBITDA (ex-items) were off Y/Y by 42% and 61%. North America, where the company derives the lion's share of its revenue fared even worse; North American revenue and EBITDA were down 55% and 118%, respectively. Meanwhile, income from operations was negative for three consecutive quarters.

Enron Had Cash Flow Problems

A lot of Enron's fraudulent activities -- inflating revenue, earnings and assets -- were designed to mask its cash flow problems and support its share price. According to the SEC complaint, in October 2001 one of Enron's major assets, Wessex Water Services, was worth much less than its $2.4 billion purchase price. A rate cut imposed post-deal had hurt Wessex's revenue and its valuation. In September 2001 Enron determined that total losses from the overstatement of its assets and liabilities were about $7 billion. In October 2001 Electro, its Brazilian power plant, was carried on its books at $2 billion but management knew it was grossly overvalued. That same month Enron was forced to offer up its "prized pipelines" to secure a $2 billion loan; Ken Lay later drew down on a $3 billion credit line as it was Enron's only source of liquidity.

Weatherford Also Has Cash Flow Problems

Weatherford had $519 million in cash on hand at Q3 2015. This amount could have been eroded by foreign exchange currency effects that have been reflected in "other comprehensive income." Through September 2015 Weatherford's cash flow from operations, less capex, was negative. Its cash flow from operations was $383 million, while capex was $542 million. I expect cash flow to be flat to negative going forward. Its lack of cash flow will make it difficult for the company to service its $7.7 billion debt which is at about 5.4x run-rate EBITDA. Moody's recently junked Weatherford due to its high debt load and dismal cash flow amid a downturn in the oil services space.

Enron Was Hiding Goodwill Impairments

By October 2001 Enron's accountants had determined that the goodwill at Wessex Water Services was impaired by approximately $700 million. However, Lay and Causey failed to disclosure it or take a goodwill impairment charge on Enron's financial statements. Lay and Causey knew that by disclosing the impairment, it would have a negative impact on Enron's financial statements and could potentially jeopardize its precarious credit rating.

On October 22, 2001 Enron announced it was the subject of an SEC investigation. The next day Lay authorized Enron to enter into merger discussions with Dynegy, Inc. On November 8, 2001 Enron announced its intention to restate earnings from prior years which would reduce net income by $586 million. On November 9, 2001 Enron filed an 8-K announcing it had entered into a merger agreement with Dynegy. On November 21, 2001 rating agencies downgraded Enron's debt to junk status. On December 2, 2001 Enron filed for bankruptcy.

Weatherford's $3.2 Billion Goodwill And Intangibles Could Also Be Impaired

Weatherford has grown its operations via acquisition. Many of those acquisitions were made when oil prices were much higher. At Q3 2015, the company had goodwill of $2.8 billion and intangible assets of $380 million. $1.9 billion of the company's $3.0 billion goodwill at year-end 2014 was attributed to its North American operations.

Through year-to-date Sept. 30, 2015 North American operations have generated revenue of $2.8 billion, EBITDA of $133 million, and a pretax loss of $156 million. These figures do not include allocations for corporate costs and R&D which were a combined $326 million for September YTD. If corporate allocations were based on percentage of revenue, North America's percentage would be about 38% or $124 million; September YTD EBITDA and pretax loss would have been $9 million and $280 million, respectively. That said, the approximate $1.8-$1.9 billion in goodwill associated with it could be impaired.

Are North North American Operations Worthless?

My previous article, "Weatherford: Wait For $4," valued Weatherford's equity from $0-$4 per share. The analysis implies that its North American operations and potentially, the equity of entire company, could be worthless. This would potentially call into question the value of the company's entire $3.2 billion goodwill/intangibles.

Inventory Could Be Overstated By $540 Million

At Q3 2015 the company had approximately $2.8 billion in inventory. This is about 10% less than the $3.1 billion inventory balance at year-end 2014 and 14% less than the $3.2 billion balance at year-end 2013. While revenue and cost of sales have declined precipitously since 2013, inventory has not declined at a similar rate. That could imply that inventory is stale or overvalued. My previous article estimated that inventory could be overstated by $540 million - $730 million.

Asset Impairments Could Cause A Breach Of Debt Covenants

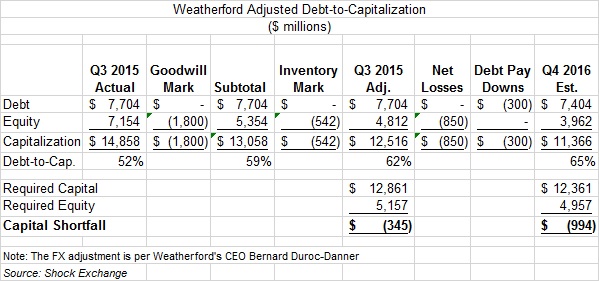

If Weatherford's assets were written down to fair value, it could cause the company to breach its debt covenants and/or jeopardize its ability to remain a going concern. The company has about $1.7 billion in short-term debt with a JPMorgan Chase JPM - led bank syndicate. The debt covenant requires Weatherford to maintain debt-to-capitalization of less than 60%.

Weatherford May Need $1 Billion To Avoid Bankruptcy

The following scenario projects [i] potential asset impairments and [ii] the capital required for Weatherford to remain in compliance with its debt-to-capitalization of less than 60%.

Based on [i] a $1.8 billion goodwill mark, [ii] $$542 million inventory mark, [iii] $850 million in net losses from Q3 2015 to Q4 2016 and [iv] $300 million in estimated debt pay downs, I project Weatherford would need to raise about $1 billion to remain in compliance with its debt covenants. Coincidentally, the company attempted to raise $1 billion in September for the purpose of "pre-funding acquisitions." In my opinion, Weatherford has already tipped its hand that it is in need a substantial capital raise.

Conclusion

In my opinion, the aforementioned issues make Weatherford similar to Enron. If asset impairments cause a breach of its debt covenants and/or an acceleration of its short-term debt, Weatherford also unravel like Enron.

Oppenheimer just recommended this stock today, what do you think about that?

What details did Oppenheimer give? The Shock Exchange's article is extremely detailed, with spot on analysis. WFT's bonds also trade at steep discounts, implying impending bankruptcy. SE would listen to bond investors before listening to an analyst who provides "de-facto PR" for companies.

Interesting perspective.

Thank you. SE