This installment in the Fairshare Model series offers perspective on venture capital and capital structures. The series introduction.

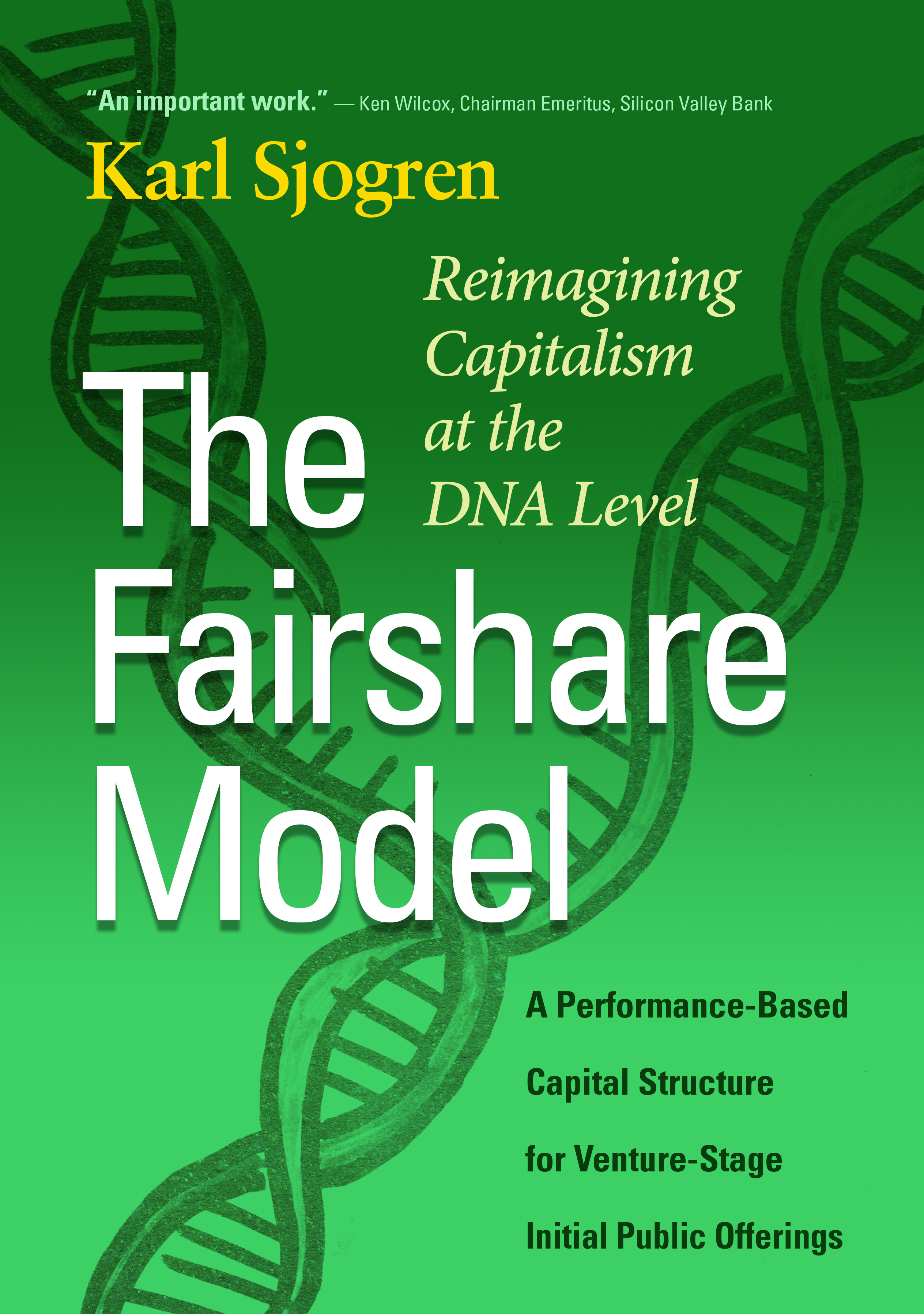

I was at a conference a few years ago where speakers reported that companies were raising larger amounts of money at a given stage than before. And that VC funds were increasingly investing after a company was generating revenue; angel investors were providing a larger proportion of funding for pre-revenue startups.

This inspired comments like “pre-seed is the new seed” and “Series A is the new Series B.” No one said that investments made by angels wasn't "venture capital," but I've heard it suggested elsewhere.

That’s because it is popular to define venture capital as an investment by a VC fund. Seed and pre-Seed distinctions rest on the idea that an investment by a VC firm "legitimizes" a startup. It largely has to do with valuation—until a Big Dog establishes one, no one really knows where to set it.

But no one knows how to reliably set a valuation for a startup! That’s why VCs insist on securing deal terms for their stock purchase that will mitigate their valuation risk. It also explains the popularity of convertible notes, and SAFE or KISS agreements.

The traditional view in Silicon Valley, on Wall Street, and elsewhere is that an IPO does not constitute another raise of venture capital. Indeed, its seen as an “exit”—a way for pre-IPO investors to liquidate their position by selling shares in the secondary market to public investors.

To me, this point of view is narrow. I define venture capital broadly—as an investment in a venture-stage company. A venture-stage company has these risk factors:

- Market for its products/services is new or uncertain.

- Unproven business model.

- Uncertain timeline to profitable operations.

- Negative cash flow from operations; which means it requires new money from investors to sustain itself.

- It expects to continue to have negative cash flow from operations; its future depends on its ability to raise more money later.

- Little or no sustainable competitive advantage.

- Execution risk; the team may not build value for investors.

These characteristics sound familiar, don't they? They routinely appear as risk factors in IPO prospectuses.

A foundational concept for the Fairshare Model is that capital provided to a venture-stage company is venture capital regardless of its source. Ergo, it doesn't matter whether the money is raised in a private or public offering.

Put another way, whether an investment is venture capital ought to be a question of “What”, not “Who.” That is, the question should be decided based on whether a company presents venture-stage risks, not by who invests.

The difference between these two views of venture capital is depicted below.

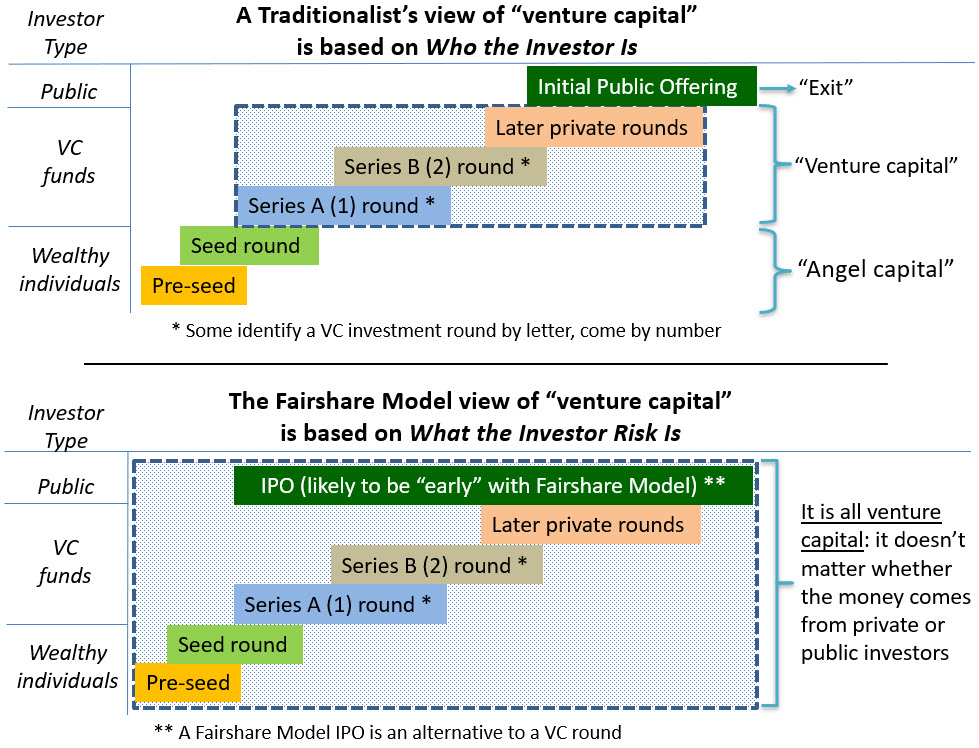

Let’s move on to capital structures; there are three types for an equity investment. They differ in when they value future performance.

Conventional Capital Structure

- Used in public offerings, and in private offerings with unsophisticated investors.

- Used by both established and venture-stage companies.

- The pre-money valuation places a value of future performance.

- The pre-money valuation is set without deal terms that mitigate valuation risk (i.e., no price protection).

Modified Conventional Capital Structure (a/k/a VC Model)

- Used in private offerings with sophisticated investors.

- Companies are venture-stage.

- The pre-money valuation places a value of future performance.

- Investors secure deal terms that provide price protection because they can increase the investor’s ownership if the company’s valuation doesn’t rise as high or fast as expected.

Fairshare Model Structure

- To raise venture capital via an IPO (i.e. open to any investor).

- Pre-money valuation reflects actual performance as of the IPO.

- No value is placed on future performance. Instead, there is agreement on how to reward future performance. Issuer defines the performance measures and describes them in its offering document. By investing, IPO investors acquiesce to the terms.

NOTE: An issuer that defines its stock price to be a measure of performance has incentive to provide a low--really low--IPO pre-money valuation. Having one encourages investors to buy IPO shares AND makes it more likely that Performance Stock will convert.

The takeaway? The Fairshare Model adapts the VC Model for private offerings to the IPO market!

Finally, here’s a way to grasp the tao of the Fairshare Model, from an investor’s perspective.

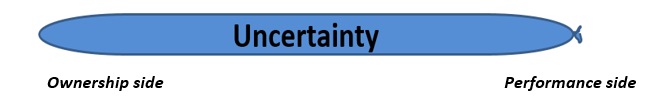

Imagine a long balloon, the kind that looks like a hot dog and can be twisted into animal shapes. But instead of air, this balloon is full of uncertainty. The left-end of this balloon represents ownership interests in a venture-stage company, while right-end represents the value of its future performance.

Pressing down on the balloon creates certainty, but it doesn’t uncertainty, it simply moves it. A weight symbolizes certainty in this imagery.

Thus, placing the weight at one end of the balloon creates certainty there, but causes uncertainty to bulge on the other end of the balloon.

This shows that when a venture-stage company raises equity capital, uncertainty can be moved, but it can’t be eliminated. This is true for private offerings and IPOs.

The next three balloons will depict the difference between the three types of capital structures. It is all about when the ownership split for investors and employees is set—before or after performance is established.

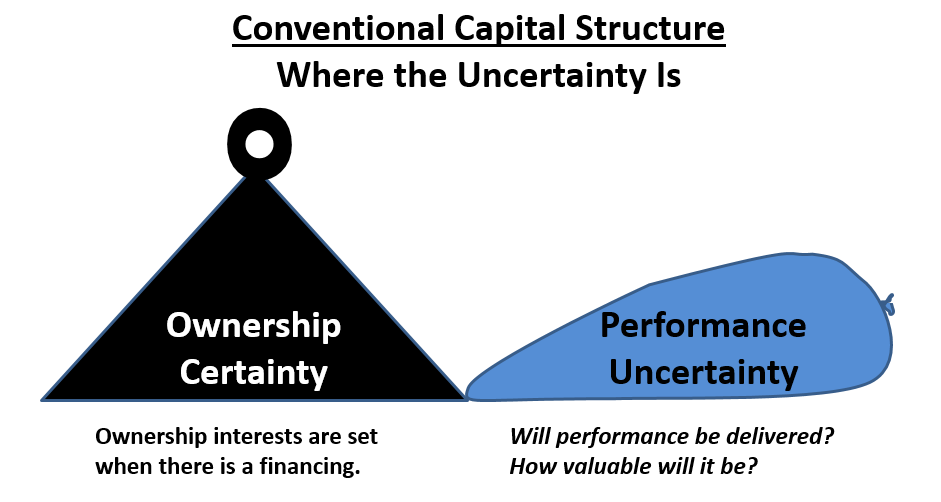

The following balloon illustrates what happens in a conventional capital structure. When equity is raised, the ownership it buys is set by the pre-money valuation. It is symbolized by weight of certainty on the ownership end of the balloon, which pushes the uncertainty to the performance end.

Will the the company deliver its product as expected? Will the market respond well to it? If the answers to such questions were known when the investment was made, it would influence the deal. But, in a conventional capital structure, ownership is set before the answers are known.

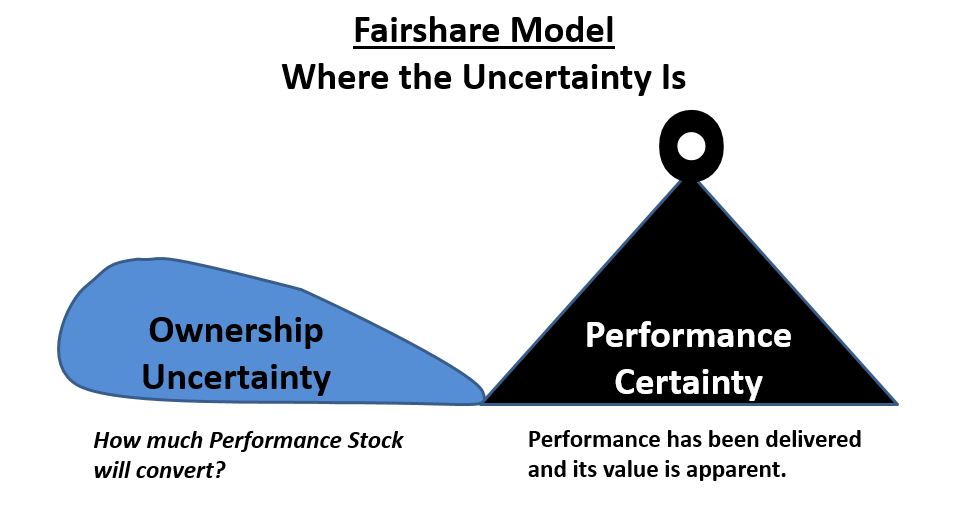

The next balloon illustrates how the Fairshare Model addresses uncertainty. The certainty is on the performance side of the balloon because it has been delivered. Placing it there moves the uncertainty to the ownership end. The question: “How much Performance Stock will convert?”

The answer will be in the rules the company defined in its offering document, or in post-IPO modifications agreed to by the two classes of shareholders (there may be a need to pivot on priorities). There will be variation in these rules that reflect a company’s industry, stage of development, and personalities of the shareholders.

The key question—will the value of Performance Stock conversions exceed the value of the performance? A company will have incentive to make sure that doesn't happen because a falling stock price will hurt investors and employees who hold Investor Stock. It could also promote negative market perceptions; management will seem opportunistic and dishonorable.

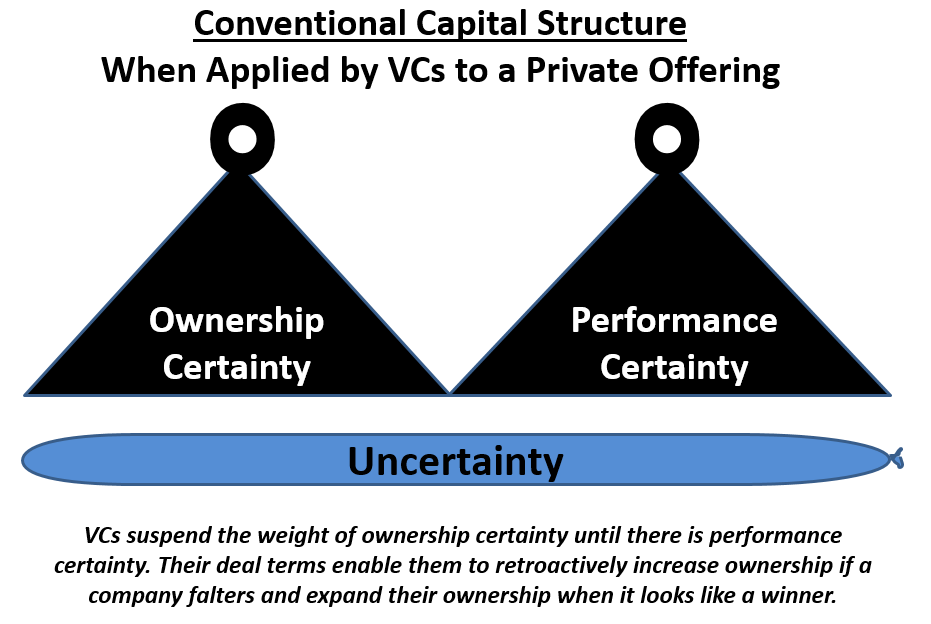

The final balloon illustrates a modified conventional capital structure. It's used by VCs when they invest in a private offering. Its deal terms suspend certainty about ownership until there is certainty about performance.

For employees, the ownership uncertainty comes from vesting schedules for stock issued for ideas and future performance. Shares already owned by employees may be subject to buyback or forfeiture agreements.

A VCs deal terms can create uncertainty for other investors too. They may find that their ownership is reduced (or even wiped out) to increase what the VC gets.

A final thought. Clearly, a conventional capital structure is simple, and the Fairshare Model is complex. But a modified conventional capital structure is complex too!

Entrepreneurs will want to raise private money from VCs if they are confident of their ability to secure a high valuation in an acquisition or IPO. If they are right, there is little risk to accepting VC deal terms.

Entrepreneurs willing to treat public investors as VC partners and confident in their ability to meet performance targets that they define will be intrigued by the Fairshare Model.

Other articles in this series:

More By This Author:

The Fairshare Model: Raise Venture Capital Via An IPO

The Drivers Of Valuation - The Video

A Better Way To Change Payroll Taxes