Investors could have been saved today, in one day, from $10,000 (individuals) in losses to well over $10 million for large portfolios with our forecast.

For the past several weeks, in our award-winning Wellington Letter, we have warned how our advanced technical analysis showed that a huge “demand vacuum” was being built underneath the stock market.

We noted the manipulation of a dozen or so widely-watched stocks and indices like the S&P 500, which gave the illusion of a continuing bull market. It was fake! And our advanced technical indicators confirmed that.

We had warned since early January that the COVID-19 virus was much more dangerous than the media reported. It fact, evidence showed that it was made in the lab and was weaponized to make it very infectious and immune to normal anti-viral agents. That told us it would be a global catastrophe.

With major economies around the world freezing up, it would eventually trigger a selling avalanche once the minions of Wall Street had done their job telling investors to buy, because the virus was just like the flu. Flagrant disinformation!

We were saying the opposite! Members in our HedgeFolios program had 50% to 60% cash as we wrote, “cash is not trash at this stage in the market.”

Yesterday, Sunday February 23, we issued a Special Bulletin for our valued subscribers. It was headlined: “The Financial Market Storm Begins.”

The Bulletin ended with “…the dam may break.” 24 hours later the dam broke! Could $69 have saved some investors millions today?

How is that for timing? It’s a continuation of 43 years of calling all important market plunges, not only bear markets, but sharp plunges as the Crash of 1987, the February 2008 and Q4 2018 plunges, all called within 1-2 days of the start.

Now you will hear all the bulls in the media talking about “buying opportunities, good earnings, strong economy, central banks flooding markets,” and all the other fables of the past.

The fact is that the global economies, including the U.S., have been in sector recessions since mid-2019, before the virus epidemic even started. Look at these charts:

U.S. Industrial Production has been in contraction since mid-2019, but analysts have only talked about the “strong economy.” We have pointed out the fallacy. See the chart below from Bloomberg.

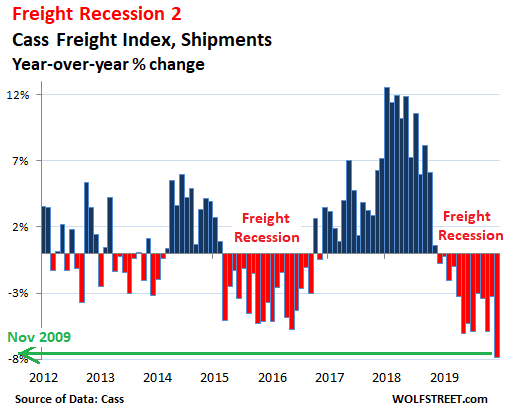

Additionally, the freight recession started mid-2019 as seen in the Cass Freight Index, which measures shipments by other than air or sea (chart by Wolf Richter).

Central banks will be counted on to reverse the selling avalanche. However, none of the bulls have explained how central bank artificial credit creation can cure a viral epidemic. What bank will even consider making new loans with this credit?

In a critical time like this, it is vital to stay up to date in what could be the most important time in the investment markets for the last 90 years. You won’t want to be without our continuing analysis and forecasts.

After an 11 year bull market, not counting the deceptions, there is a lot of fluff to take out of excessive prices. We foresee terrific profit opportunities the next two years for our valued subscribers, but unfortunately not where most investors will look. It will be very painful for those who are unprepared or misinformed.

The award winning Wellington Letter is now in its 44th year of excellence in guiding serious investors. Our rates will be rising soon, so make sure to lock in your subscription for just $69 per month or $599 per year. How much could it make or save you in these tumultuous markets? If your portfolio is not worth that, please forward this article to a friend.

Wishing you successful, active investing,

Dohmen Capital Research

DohmenCapital.com

Good stuff, by why are you publishing it on the personal blog section where so few will see it, and not submitting it to the editors to be published on the main site?

talkmarkets.com/.../why-be-a-contributor-to-talkmarkets