This year we are in the market phase where a weak economy is looked upon as positive. It implies that the Fed will cut rates, which Wall Street seems to think will stimulate the economy.

That is a false belief. Near a market top, the negative implications of a weaker economy will outweigh the expectations of a Fed rate cut.

However, last Friday’s (July 5) employment report came in much stronger than had been expected by analysts. That brought fears that the Fed would not cut interest rates due to the “good number”, which led to the stock market decline that day.

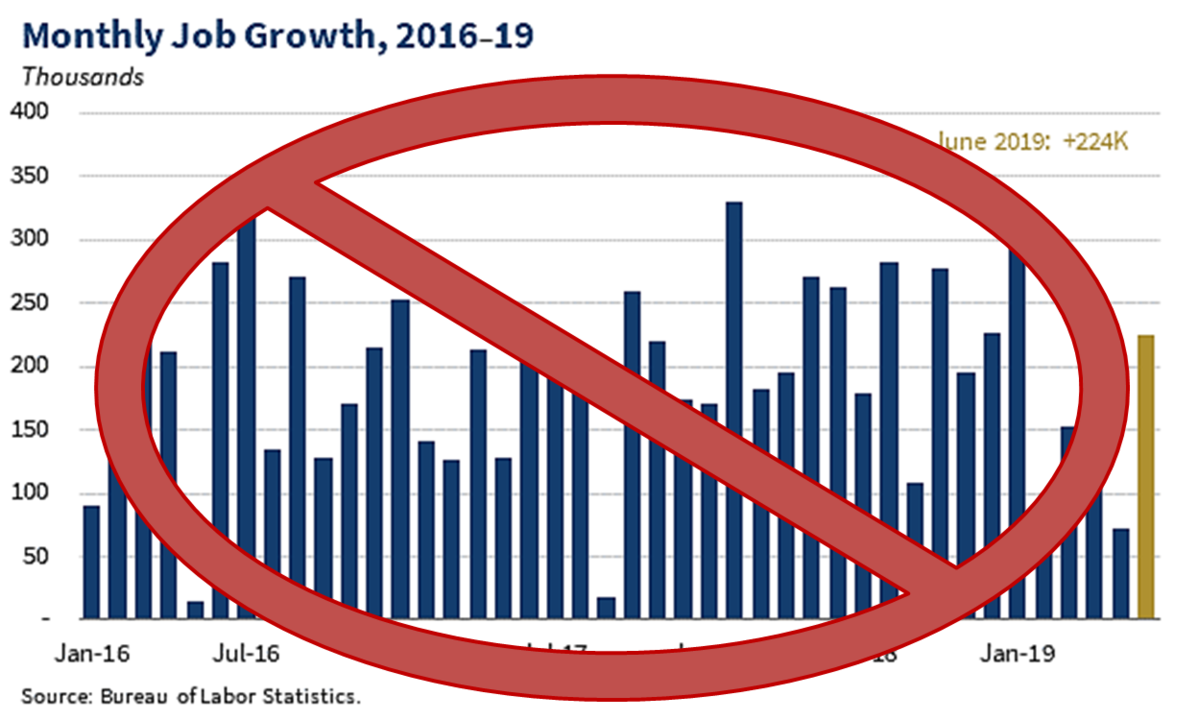

As you may know, we believe the employment reports have been manipulated by many Administrations for decades to serve their purpose of promoting the image of strong growth. The report said 224,000 new jobs were created. But looking under the surface showed different results.

Actual employment declined by 97,000. It didn’t gain the 224,000. The gain was from the “estimation”, statistical adjustments for people that may not be counted, the “birth/death model.” Former ace chief economist of Merrill Lynch, David Rosenberg, now with a Canadian firm Gluskin Shelf, confirmed this.

We have explained for years that multiple jobs of one person during the month are each counted as a ‘new’ job. If someone mowed the lawn for his father four times, that is counted as 4 jobs, even if he didn’t get paid for it. That’s how Obama had 800,000 the month prior to the midterm elections, a ridiculously high number.

Furthermore, there is the “adjustment” for jobs possibly added by small businesses, which cannot be counted. The “adjustment” is a guess based on new business formations.

But that is a phony basis because about 80% of new business formations never have a paid employee. They are trusts, or firms formed for tax purposes. And that’s how ‘strong’ employment numbers are manufactured.

Amazingly, perhaps 95% of analysts are not aware of this. They should spend one hour on the Department of Labor website.

Our four decades of financial markets experience tell us that these employment reports mean nothing for the Fed’s rate cut. Investors need not fear that economic strength is recovering and that interest rates will rise. Any talk of a rebounding economy will be short term.

In the latest issue of our award-winning Wellington Letter, we sort out the noise from the truly important factors impacting your investments now and over the next two months.

Find out which important stocks could be signaling a coming turn in the markets. Also, we examine what smart investors should do if (and when) the Fed starts cutting interest rates and why.

Get more of our key insights and valuable market analysis today at DohmenCapital.com