Why I Think Private Employment Grew Through April (And Maybe Through July)

Private nonfarm payroll (NFP) employment slightly undershot consensus (172K vs. 179K). There’s been some discussion of how it’s likely that private nonfarm payroll growth is overstated in the CES, possibly due to distortions associated with the firm birth/death model. Here, I compare the official series against some other measures that are not susceptible to this critique.

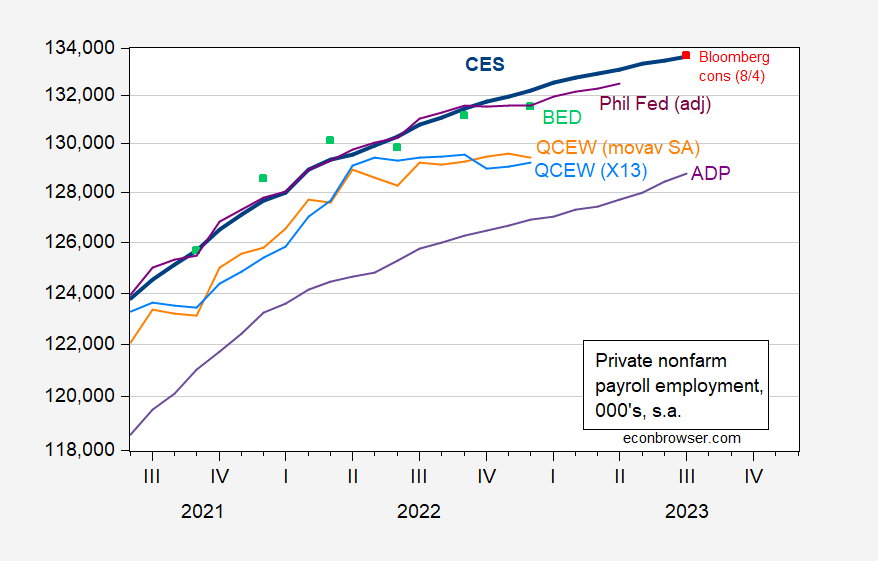

Figure 1: Private nonfarm payroll employment from CES (bold blue), Bloomberg consensus of 8/4 (red square), from ADP (purple), from QCEW adjusted by author using X13 on logged series (sky blue), from QCEW adjusted by author using geometric moving average (orange), from Business Employment Dynamics (BED) (light green squares), from Philadelphia Fed early benchmark (magenta), all in 000’s, s.a. Philadelphia Fed private nonfarm payroll estimated by subtracting off CES measured government employment. BED level is calculated by cumulating quarterly net change on reported private NFP for September 2021. Source: BLS employment situation release for July 2023 via FRED, ADP via FRED, BLS-QCEW, BLS-BED, Philadelphia Fed, Bloomberg, and author’s calculations.

While the QCEW based series (adjusted by the author) show a definite plateau at end-2022, the BED-based series (which relies on the same underlying data) does not (although, as pointed out by Steven Englander, it doesn’t rise as much as the CES series). Furthermore, the Philadelphia Fed’s early benchmark continues to rise through April. Finally, the ADP series (calculated using ADP’s own payroll processing data) show continued rise through April (and indeed through July). The potential failings of the birth/death model are irrelevant to all these alternative measures.

Hence, while one can’t be sure of the level of employment, it seems that private nonfarm payroll growth has continued into April, and likely through July.

More By This Author:

Business Cycle Indicators, With New Employment NumbersIs It Safe? Considering The End Of The Recession Call

Inflation Breakevens and Expected Inflation: 5, 10, 30 Year Horizons