Weekly Market Pulse: This Is Not The Economic Paper You’re Looking For

Image Source: Unsplash

President Trump announced last week that certain food products and some other goods will now be exempt from his “reciprocal”* tariffs. Some of these goods are things that we can’t produce here in the US, like bananas and coffee, but others are products that, for various reasons, happen to be in short supply, like beef. President Trump said these actions would reduce prices for consumers, an odd thing to say after insisting for months that tariffs don’t raise prices. I’ll come back to the raging debate about the impact of tariffs on the economy but first let’s take a look at the depth of the planning, the detail involved with imposing and then relaxing tariffs. From the Fact Sheet explaining the Executive Order:

Given…current domestic demand for certain products, and current domestic capacity to produce certain products, among other things, President Trump has now determined that it is necessary and appropriate to further modify the scope of the reciprocal tariffs. Specifically, certain qualifying agricultural products will no longer be subject to those tariffs, such as certain food not grown in the United States.

The President has thus determined that certain agricultural products shall no longer be subject to the reciprocal tariffs. Some of these products include:

coffee and tea;

tropical fruits and fruit juices;

cocoa and spices;

bananas, oranges, and tomatoes;

beef; and

additional fertilizers (some fertilizers have never been subject to the reciprocal tariffs).The products that will no longer be subject to the reciprocal tariffs have been added to Annex II of Executive Order 14257, as amended, and, as appropriate, have been removed from the “Potential Tariff Adjustments for Aligned Partners” (PTAAP) Annex.

Annex II runs to 37 pages of things most of us – and I’m sure President Trump – have never heard of, but have been carefully reviewed by someone at Customs. Or more likely, they are things that a lobbyist brought to the attention of someone with the contacts to get an exemption. They include such things as:

- Coral, shells, cuttlebone and similar materials, unworked or simply prepared, but not cut to shape; powder and waste thereof

- Light oil, from the distillation of high-temperature coal tar or similar products in which the weight of the aromatic constituents exceeds that of the nonaromatic constituents

- Rare-earth metals, scandium and yttrium, whether or not intermixed or interalloyed

- Niobium oxide

- Other unsaturated fluorinated derivatives of acyclic hydrocarbons

- Nonaromatic glycerol ethers

- Valproic acid

- Esters of salicylic acid and their salts, described in additional U.S. note 3 to section VI

- Coniferous wood in chips or particles

- Nonconiferous wood in chips or particles

- Children’s picture, drawing or coloring books

Remember the copper tariffs? There are pages and pages of copper products exempted from the tariffs listed in Annex II. How did these items gain exemptions but others didn’t? Do you think these exemptions were determined by someone in the administration based solely on the best interests of the country as a whole? That’s called a rhetorical question.

Annex I, which lists the things that have been added and deleted from Annex II includes these items that have been added and are now exempt:

- Etrogs

- Date palm branches, Myrtus branches or other vegetable material, for religious purposes only

- Bread, pastry, cakes, biscuits and similar baked products, nesoi (not elsewhere specified or included), and puddings, whether or not containing chocolate, fruit, nuts or confectionery, for religious purposes only

- Citrus juice of any single citrus fruit (other than orange, grapefruit or lime), of a Brix value not exceeding 20, concentrated, unfermented, except for lemon juice

- Tomatoes, fresh or chilled, if entered during the period from March 1 to July 14, or the period from September 1 to November 14 in any year

- Tomatoes, fresh or chilled, entered during the period from July 15 to August 31 in any year

- Dried Bambara beans, shelled, if entered for consumption during the period from May 1 through August 31, inclusive, in any year

- Cashew nuts, fresh or dried, in shell

- Cashew nuts, fresh or dried, shelled

- Vanilla beans, neither crushed nor ground

- Cocoa beans, whole or broken, raw or roasted

And on and on and on it goes for 97 pages. Does this look like deregulation to you? These tariffs were imposed under the IEEPA (International Emergency Economic Powers Act) but how exactly the previous tariff free importation of these items (Children’s picture, drawing or coloring books?) constituted a national emergency remains a mystery.

Let’s shift now back to the debate about the impact of tariffs on the economy. The administration has maintained since its beginning that tariffs are not inflationary and I think the vast majority of economists would agree with that assessment. That doesn’t mean, however, that the tariffs don’t raise prices. Even Treasury Secretary Bessent has acknowledged that tariffs would have a one time effect on the price level. How much exactly is a matter of debate – tax incidence is hard to predict in advance – but that a tariff – or any tax for that matter – applied to any product would raise its price isn’t exactly controversial. That is after all, the stated purpose of tariffs – to raise the price of imports so consumers favor domestic goods. But inflation is a rate, not a level and while you might see a one time rise in prices, the rate of inflation should then fall back to its previous trend absent any changes in other policies. Keep that last part in mind because it’s important.

That brings us to a paper released by the San Francisco Fed last week that showed that tariffs actually reduce the inflation rate in the short term. That would seem, at first, to be good news for the administration, to support their position that tariffs aren’t inflationary and the White House press secretary seized on it:

Fed Study Vindicates Trump Trade Policy: 150 Years of Evidence Shows Tariffs Lower Inflation

Apparently she didn’t read the entire paper like I did. In fact she doesn’t even seem to have read the entire executive summary which states:

…we find that a tariff hike raises unemployment (lowers economic activity) and lowers inflation.

Doesn’t seem like something the administration should be bragging about but maybe I’m missing something. Yes, a tariff shock does lower the inflation rate but it does so by reducing economic activity. Why do tariffs reduce economic activity? As I’ve pointed out in these weekly scribblings many times, economic growth is about two things – workforce growth and productivity growth. Tariffs don’t have any impact on the former but they impact the latter in many negative ways. The most obvious is those two Annexes I mentioned above. There is no way one can look at these pages and pages of exemptions along with the different tariff rates applied to different countries and products and come to the conclusion that this is more efficient, a more productive way of doing business. Add in the uncertainty associated with the on-again, off-again implementation of the tariffs and it is easy to see why economic activity might be slowed.

I would also point out that this paper is only about the short run effects:

In this paper we exploit 150 years of tariff policy in the US and abroad to estimate the short-run effects of tariff shocks on macro aggregates.

The really negative aspects of high tariff barriers come over the long term including but not limited to:

- Reduced growth (see above)

- Lower real incomes

- Reduced investment

- Higher inflation (see below)

- Reduced innovation

- Ongoing supply chain disruptions

- Retaliation by trading partners that reduce exports

- Inefficient allocation of resources

As for inflation, it may fall in the short run due to the negative growth aspects of tariffs but that likely won’t be the case in the long run. As the SF Fed paper shows, tariffs reduce aggregate demand in the short term causing reduced economic growth. But in the long run, through a variety of channels, tariffs reduce aggregate supply. If monetary policy is used to return aggregate demand to its pre-tariff level the result will be lower real growth and higher inflation than prevailed in the pre-tariff era. And raising aggregate demand, by the way, is exactly what the administration is trying to do by brow beating the Fed to cut rates quicker.

What the administration believes is that it can replace the aggregate supply lost from tariffs with increased domestic production, but that seems unlikely. At best, it would take years to re-orient supply chains to favor US production and even that would require stability in the tariff regime, which does not appear to be forthcoming. And if the SF Fed paper is right that tariffs reduce economic growth in the short run, that would also imply a reduction in near term capital investment – which will further delay any increase in US production.

Economic growth and inflation have a direct impact on our investment portfolios. While the stock market is weathering the tariff storm in fine fashion right now – thanks to the AI boom – the impact of tariffs is having and will continue to have an effect on the economy. Less economic growth means less corporate earnings growth and higher inflation means higher interest rates. Lower earnings and a higher discount rate both point to lower stock prices. Quantifying the short term impact of tariffs is hard because tariffs aren’t the only thing going on in the economy but we have tons of economic research on the long term effects and they aren’t positive. Assuming the majority of the tariffs stay in place, our long term outlook has to be more negative than it was prior to the tariffs. How negative is open for debate but the direction of change is not.

With the administration finally capitulating on some of the dumber aspects of their tariff policy – couldn’t they have figured out we don’t grow coffee and bananas here before they imposed tariffs? – I would expect the short run negative impact of tariffs to be reduced. Growth should now be somewhat better than was expected before the new exemptions were announced. Indeed, interest rates have been rising since word of this rollback first started to leak. The 10 year Treasury and 10 year TIPS yields are both up 20 basis points since late October. If we also assume that the “reciprocal” tariffs will be ruled illegal by the Supreme Court – which seems more likely after the recent hearing – the short term outlook for economic growth may continue to improve.

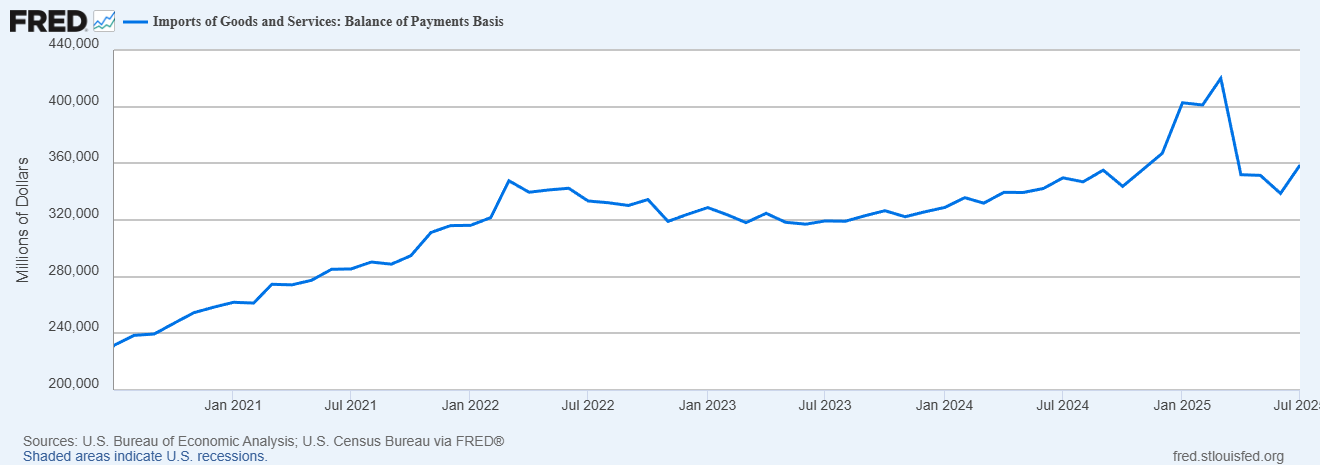

That isn’t, however, an all-clear for stock buyers. Stock prices do respond positively to better economic growth but interest rates matter too. We know that some companies stocked up on pre-tariff goods to avoid the tariffs as long as possible. How widespread that was is hard to say but it was enough to show up in the import numbers:

As that inventory is sold, it will have to be replaced with tariffed goods that are more expensive. If manufacturers, wholesalers and retailers can pass that along to customers, it will show up in the inflation numbers and tend to raise interest rates. If they aren’t able to pass along the higher costs it will come out of margins and reduce corporate profits. Either way, it isn’t a positive for stock prices. Over the next few months we’ll get the positive of reduced tariffs but possibly in conjunction with higher interest rates. How that nets out is impossible to tell right now but with consumer sentiment so negative, any improvement in grocery prices seems likely to have a salutary effect.

*I will stop putting quotation marks around reciprocal when someone in the administration demonstrates that they know the definition of the word.

More By This Author:

Monthly Macro Monitor: Investors And Voters Are In A Sour Mood

Monthly Market Review: Is This A Bubble?

Weekly Market Pulse: Wanna Bet?

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more