Monthly Macro Monitor: Investors And Voters Are In A Sour Mood

Image Source: Pexels

Our view of the economy is somewhat obscured by the lack of official data but what information we do have from the last month points to an economy that continues to weaken – continuing a trend that has prevailed all year. The most obvious negative pronouncement about the economy came from voters last week who produced some big surprises in last Tuesday’s elections. Democrats overperformed most everywhere and the exit polling was pretty clear about why. While immigration policy enforcement likely played a role in swinging some Hispanic voters back toward blue, the overwhelming reason voters showed up in droves was anger about the economy. Voters are in no mood to wait for the results President Trump and his economic team keep promising. There is an undercurrent of economic discontent in this country that has persisted for most of the post 2008 crisis period and it has gotten worse since COVID. This discontent isn’t found in aggregate economic statistics but it is expressed fully in the political arena against whatever political party is in power.

This discontent is also seen in the University of Michigan Consumer Sentiment polls released last Friday. The preliminary readings for November were near the all time worst in this survey that dates back to 1952; the only reading lower than the current 50.3 is the 50 reading in June of 2022, in the midst of a sharp inflation surge. The Current Conditions reading, at 52.3 was an all time low while the 49 reading on Consumer Expectations was the worst since 1979/1980 in the midst of the Iranian hostage crisis and a double dip recession. What’s somewhat odd is that stocks have weathered this negativity in fine shape; despite falling consumer sentiment, stocks are still near all time highs.

In the past, stocks tended to follow consumer sentiment pretty closely, performing poorly when sentiment was falling and vice versa. In general, it has been profitable to buy stocks when consumer sentiment is poor and sell when it it is exuberant. In 1980, sentiment fell to 51.7, right before starting one of the greatest bull runs in history; stocks rose over 200% over the balance of the decade. The all time high in sentiment occurred in January of 2000; the rest of that decade included two bear markets with nearly 50% drawdowns and a total return for the decade of -24.1%. The low sentiment reading in the next decade came in August of 2011 during the Euro crisis; the S&P rose165% by the end of the decade. More recently, sentiment hit its all time low in June of 2022 and is up 77.8% since then. The most recent peak was in March of 2024 at 79.4 – which is still below the long term average – but the market is up 28.1% since then even as sentiment has fallen back to near its all time low.

Other measures of sentiment are more mixed. The NFIB Small Business Optimism index peaked at 105.1 in December last year but has consistently disappointed this year with the latest reading at 98.8. The regional Fed surveys have been a near equal mix of positive and negative: Empire State +10.7, Philly Fed -12.8, Dallas Fed -5, Richmond -4 and KC +6. The RealClearMarkets/TIPP Economic Optimism poll has been trending down and fell 9.1% in November to 43.9 (50 is neutral). The ISM manufacturing survey was released last week and is still below 50, indicating contraction; there have only been 3 months above 50 since November of 2022. Comments in the survey indicate continued difficulty dealing with tariffs:

- “Business continues to remain difficult, as customers are cancelling and reducing orders due to uncertainty in the global economic environment and regarding the ever-changing tariff landscape.” (Chemical Products)

- “Sales continue to underperform in our automotive OEM and industrial divisions. Our aerospace and automotive aftermarket are the only areas performing slightly above budget. This is the third month of lower-than-expected sales, and the remainder of the year outlook is not looking better. Sales are expected to be slightly less than in 2024.” (Fabricated Metal Products)

- “Tariffs continue to be a large impact to our business. The products we import are not readily manufactured in the U.S., so attempts to reshore have been unsuccessful. Overall, prices on all products have gone up, some significantly. We are trying to keep up with the wild fluctuations and pass along what costs we can to our customers.” (Machinery)

- “The tariff trade war has negatively impacted agricultural export markets, driving down demand and price. This negatively impacts farmer revenue and the likelihood of farmers investing in new equipment.” (Machinery)

- “The unpredictability of the tariff situation continues to cause havoc and uncertainty on future pricing/cost. But even with the tariffs, the cost to import in many cases is still more attractive than sourcing within the U.S. Challenges with tariffs on production equipment necessary for internal production makes it difficult to justify expansion of capacity.” (Computer & Electronic Products)

- “Wonder has turned to concern regarding how the tariff threats are affecting our business. Orders are down across most divisions, and we’ve lowered our financial expectations for 2025.” (Chemical Products)

The ISM Services PMI is more upbeat and has been this entire cycle. The October reading was 52.4 with new orders at 56.2 but employment was under 50 at 48.2. There were some negative comments about tariffs and the government shutdown but the service sector is much less cyclical than manufacturing. Readings under 50 are rare for the Services PMI even during recession and there have been only 4 since December of 2022.

The CPI released last month was about as expected but core inflation rate is still running at 3% year over year and that is probably a big source of the public’s economic discontent. It will be interesting to see the impact of tariffs on prices in the coming months as inventories of pre-tariff products are now likely running low. With corporate profit margins back near their all time highs set in 2021, companies are obviously not eating the tariffs and with import prices flat, it doesn’t appear foreign companies are either. Import prices exclude tariffs so if companies exporting to the US were eating the tariffs, import prices would be falling. There are exceptions – foreign auto manufacturers for example – but overall it appears tariffs are being or will be passed on to consumers.

On a positive note, ADP reported a gain in jobs last month but it was only 14.25k. Jobless claims, which can be aggregated from the state level, may have ticked up some recently but are still historically low. Challenger, however, reported layoff announcements of 153k jobs in October, which is the most for that month since 2003. On the other hand, it is down considerably from the 275k announced in April this year. Redbook retail sales (same store sales) are still running in the 5% yoy range which is healthy. Existing and new home sales have also both improved recently as mortgage rates have come down, but demand is still quite weak.

Markets reflect this mixed picture of the economy.

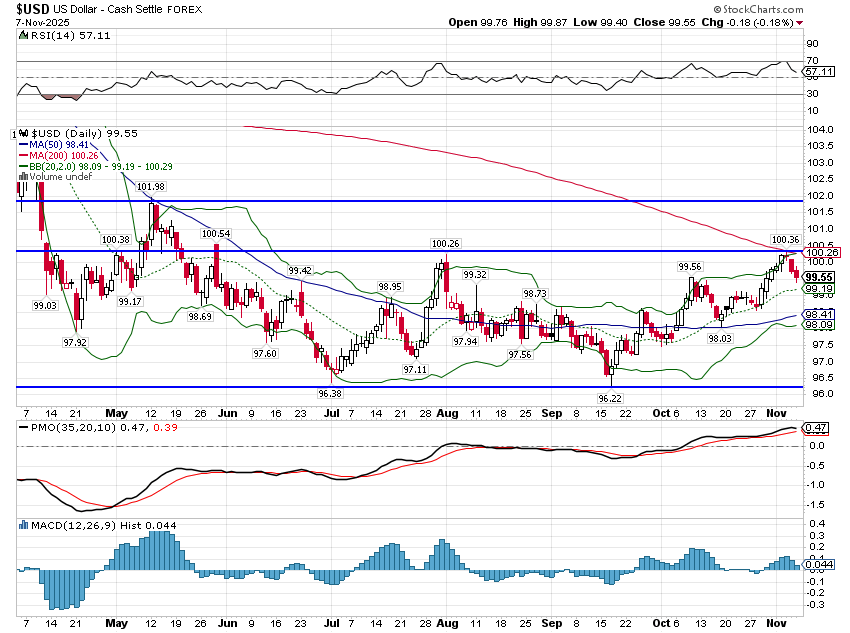

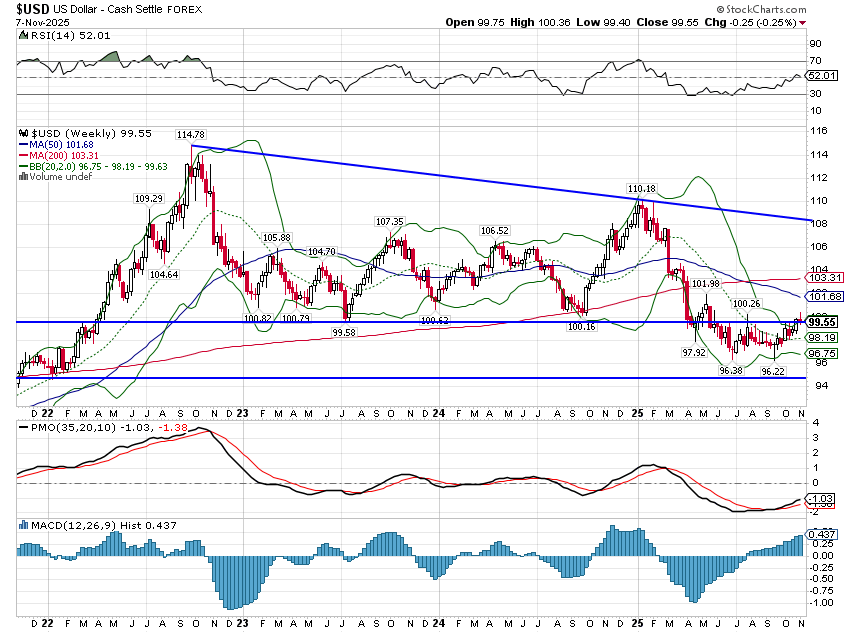

The dollar is still down YTD, 1 year and 3 years but has recently come off its lows. I wrote previously that a rally up to this 100 area was likely and that it could extend further, possibly up to the 103 area. The movements of the dollar can generally be interpreted as changes in relative growth expectations between the US and the rest of the world so this might indicate that our position has improved slightly recently. But frankly, I don’t see any reason to expect that the US economy can sustain growth faster than the rest of the world. AI infrastructure is somewhat focused in US companies but its application – assuming it is the big deal everyone believes – will be global. In any case, I remain somewhat skeptical that we will see any big benefit soon. Even if it is a productivity boost, the capital spend to date is so large that it will be difficult – very difficult – to generate a reasonable return on investment. There are other reasons to believe the dollar will continue to weaken – mainly that the Trump economic team wants a weak dollar – so any rally seems likely to be short lived.

The dollar shows little change in relative growth expectations.

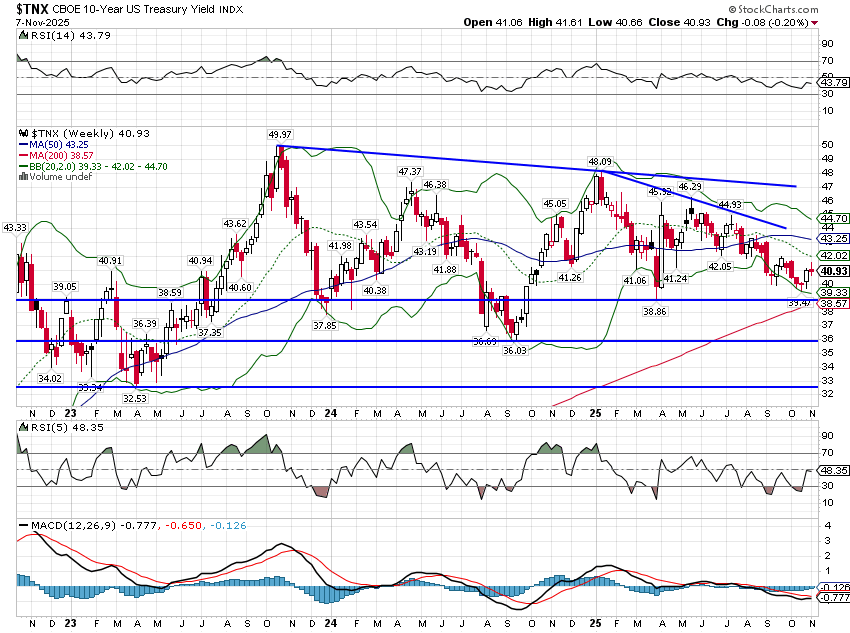

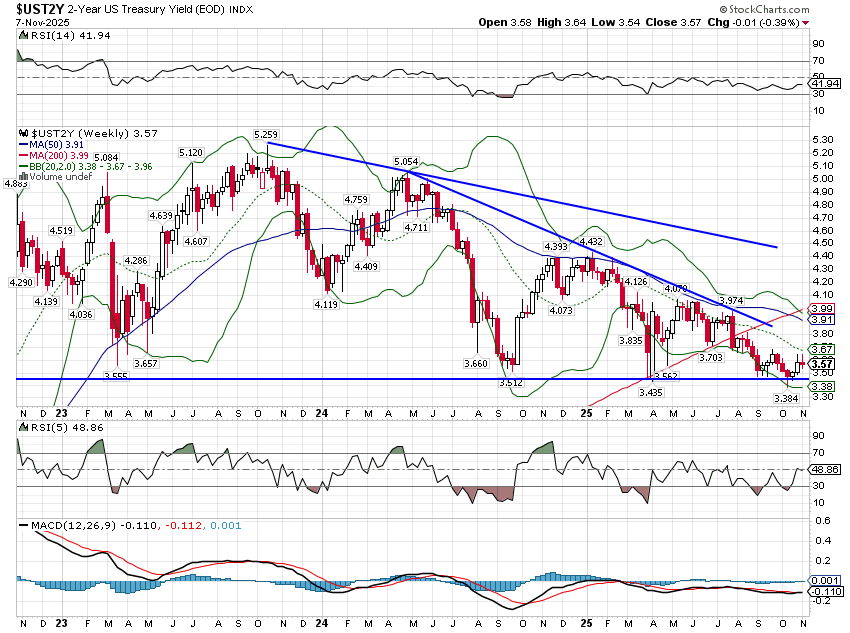

Interest rates across the curve continue their short term downtrend, an indication that nominal growth expectations continue to fall. Rates remain in the broad range they’ve been in for the last several years though so not much has changed. Rates are near the bottom of the range though so if they continue to fall, it could indicate more concern about growth. On the other hand real rates – the 10 year TIPS yield – have recently risen a bit so inflation expectations have fallen slightly over the last month. Still, these are small moves and one shouldn’t read too much into them. Overall, rates and the dollar show that the economic outlook hasn’t changed significantly over the last few months.

I’m not sure exactly what to make of the current situation, with sentiment near all time lows, stocks near all time highs and valuations at nosebleed levels. It doesn’t seem an ideal time to be a buyer of stocks and valuations argue that the upside is quite limited. Consumer sentiment is, however, only one way to view market sentiment and when it comes to stocks, the same people who say they are worried about the future economy also believe stocks will keep climbing. The University of Michigan’s October poll showed that 57% of the public thinks stocks will be higher a year from now. That percentage had fallen back to 46% in the second quarter of this year in the wake of the liberation day tariff shock. Other measures of market sentiment are contradictory . In the options market put/call ratios are moving up but are not at extremes, market breadth isn’t great but it is far from a washout and credit spreads have widened some but are historically tight. There’s some fear out there but not a lot.

Economic growth expectations have been falling all year and the last month was no exception. The current level of interest rates and other measures of growth are consistent with growth just below trend of 1.5-2% and inflation of 3%. That isn’t a good ratio and until it changes I’d expect consumer – and voter – sentiment to remain sour. Right now markets are mostly ignoring the foul mood but I do wonder how much long that can continue.

More By This Author:

Monthly Market Review: Is This A Bubble?

Weekly Market Pulse: Wanna Bet?

Weekly Market Pulse: Free Will

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more