Weekly Market Pulse: Free Will

Image Source: Pixabay

Was that it? Was that the top?

A week ago, the market fell 2.7% as President Trump announced an additional 100% tariff on Chinese goods starting November 1st. Since that Friday selloff, the market has stabilized and recovered a little over half that one day loss. The S&P 500 is now down just about 1.5% from its all time high. Is that the beginning of something bigger? Or just a bump in the road on the way to new all-time highs?

If you’ve been reading my commentaries for any length of time, you know what my answer is going to be – I don’t know. Someone told me recently that we should put that phrase on our website as our motto and I have to admit I’m tempted. Of course, the person who said that didn’t mean it in a nice way but I took it as a compliment anyway. I’ve been writing for years, telling people that attempts to predict the future are a waste of time because the future is a fickle creature, often unfolding in ways that seem designed specifically to mock your careful planning. Don’t take it personally; God isn’t targeting you specifically, it just feels that way sometimes. He also doesn’t care who won this week’s college football games because surely if he did, the Gamecocks would have beaten those godless Sooners Saturday.

An inability to predict the future, however, does not mean we don’t have the ability to think and make occasional changes to our portfolios. Just don’t think you’re going to get them exactly right or even right at all. If you make tactical changes to your portfolio you are going to be wrong sometimes. In fact, you are probably going to be wrong a lot which is why tactical changes need to be small and reversible. Think about tactical changes as altering the time line of achieving your financial goals. If you get a change right, you can jump ahead on the timeline; if you get it wrong you’ll fall back. The key to investing – as opposed to speculating – is to keep those time changes fairly small and/or to make changes that offer an asymmetric payoff. In investing, the important statistic isn’t win percentage. What matters is how much you make when you’re right and how much you lose when you’re wrong.

Where do we find those asymmetric payoffs? We never know for sure but if you are going to get the odds in your favor, you have to find assets or markets that have reached some kind of extreme. There are times when very few things have reached an extreme that is exploitable. There are other times when it seems like the world has gone crazy and everything is at an extreme. I can’t say exactly where we are between those two poles but it sure feels like we’re a lot closer to the latter than the former. We live in a speculative age in what has become a gambling culture and in that environment anything that catches the public’s fancy can get taken to an extreme. Meme stocks, NFTs, crypto assets like Dogecoin, crypto treasury companies, SPACs, AI stocks, Taylor Swift. The last time I saw markets assign value to so many worthless things was the late 90s. There are certainly differences between then and now but it does feel familiar. The problem, of course, is that you don’t know when sanity will return worthless things to their proper price. And, to be fair to things I deem worthless, they might have a value I just haven’t grokked yet.

Asymmetric payoffs can also be found in assets that do have value but the current price is inconsistent with reality. Many – most? – of the AI stocks have value but that doesn’t mean they are good investments at current prices, which happen to be pricing in a lot of things going right over the next decade or so. And, at least so far, the results have not been all that impressive. This MIT study from earlier this year shows that 95% of organizations that have implemented AI pilots have gotten no return from their investment. That actually doesn’t mean what it seems to imply – that AI is mostly useless. If you actually read the study, a step that many commentators seem to have skipped, what it really says is that AI requires a learning curve. What may make AI potentially a bad investment today is that the payoff may be further in the future than current investors anticipate.

How does this translate into a tactical change to your portfolio? If you’ve been good or lucky enough to own one of the stocks that have ridden the AI wave, like Nvidia or Palantir* or any of the other darlings, you could sell some of your position to reduce your risk. Notice I didn’t say, sell all your AI stocks! Investing is not an all or nothing game. If, however, you don’t own any of these stocks then it probably doesn’t make sense to jump in now. Not doing something is also a tactical choice or as Rush once put it:

If you choose not to decide, you still have made a choice

Freewill, Rush, from the album Permanent Waves, 1980

What if you own an index, like the S&P 500, that is heavily dependent on the success of AI? The Magnificent Seven stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – are all in the top 10 holdings of the S&P 500 and represent 35% of the index right now. If you own the S&P 500, your future returns are dependent, more than you probably realize, on the success of AI. In that case, you might reduce your position or look for an alternate broad based index, like the equal weighted S&P 500. What you don’t do is, sell all your stocks! All or nothing investing is how you turn a mistake that costs you a few months on the road to your financial goals into one that costs you years.

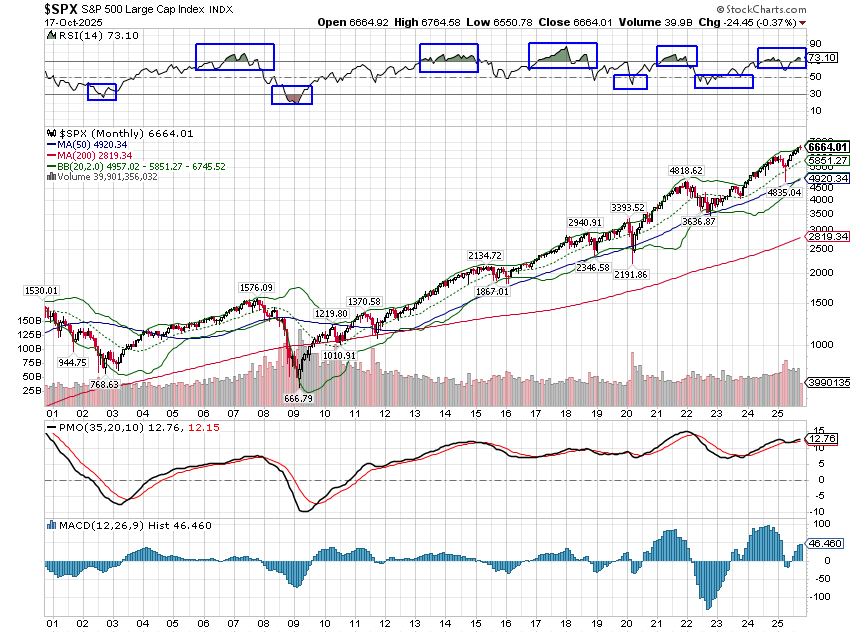

As for the US stock market more generally, after a big run up like we’ve seen since the April lows, investors probably ought to be more skeptical of buying than selling. Often times, tactical changes are about changes in your attitude about risk, recalibrations of your willingness to take it or not. We know stocks are historically expensive and that future returns from these levels are likely – but not assuredly – to be poor compared to history. What that means is that the risk of owning stocks right now is likely higher than it would be if valuations were cheaper. That being the case, a reduction in equity exposure is logically required to maintain your portfolio within your chosen risk tolerance. A moderate risk investor who has 60% of her portfolio in stocks in normal times, might have to reduce that to 55% or 50% to keep her overall risk at moderate when valuations are well above long term averages.

Technical analysis can also be used to judge whether an adjustment is warranted. You can use simple tools like RSI to judge when you ought to be more cautious and when you ought to be more aggressive. They aren’t precise timing tools because overbought and oversold conditions can last for months but they do help you adjust your mindset.

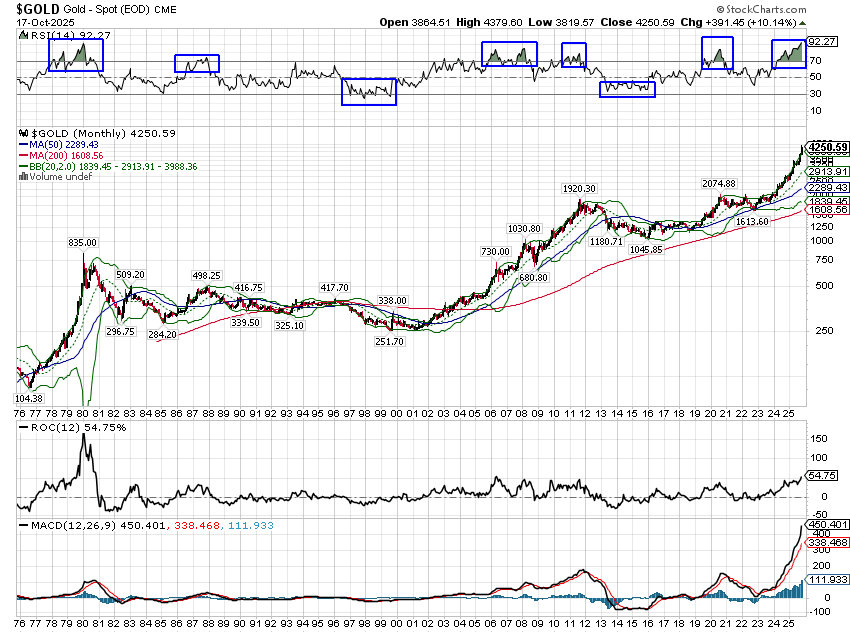

Exploitable extremes can also be found in rates of change. Rapid price changes in markets – individual securities are a different matter – are rarely sustainable. Big moves in one direction are often followed by big moves in the opposite direction. Rates of change also tend to accelerate near the end of a move so they can be more timely than other indicators. We see changes like this often in commodity markets, which are more thinly traded than stocks or bonds and more likely to move to extremes. Gold is an example today of a market that is exhibiting rates of change rarely seen. I suppose there are scenarios where gold just keeps rising 50%/year – see bitcoin – but history says probably not. Gold is up 61% this year and 116% over the last two years. That 2 year rate of change is only exceeded in modern history by the rapid run up in 1980 which set a high that wasn’t exceeded until 2007.

Is it possible that gold could rise from where it is today to $50,000 or $100,000? Bitcoin was less than the current price of gold in March of 2020 and stands today at over $108,000, so yes, I guess it is possible. Is it likely? I don’t think so which is why we sold some from our portfolios last week. I also sold some of our platinum and palladium holdings for similar reasons. But our portfolios still hold all three; the selling we did was to reduce our positions back to their original weighting. Gold is a strategic asset in our portfolios so we will always hold some. Platinum and palladium were tactical choices based on fundamental supply/demand factors that I believe still apply. But the opportunity to harvest a large gain made in a short period of time is not offered by the markets very often, so I take it when I get it.

Investing is not about making big, dramatic moves in your portfolio. Long term investors need a strategy – a long term plan expressed through asset allocation – that will allow them to achieve their financial goals. They need to make smart tactical choices, usually based on history, when implementing the plan. Markets do offer infrequent opportunities to make big strides toward your goals through tactical changes and you need to take advantage of them. But remember, there are no sure things in investing – or horse racing or sports betting or the casino – so make sure you know and can live with the consequences when you’re wrong.

More By This Author:

Investing Outside Of AI

Rare Earth Market Risk

U.S. Government Bets On Intel

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more