Volatile S&P 500 Follows Downward Trajectory As Geopolitics Adds Noise

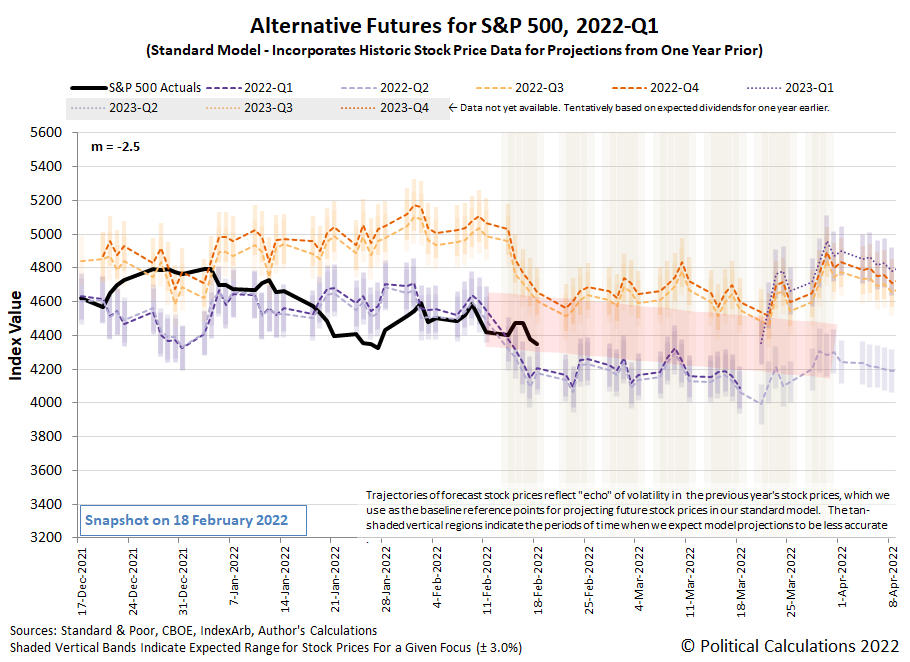

The S&P 500 (Index: SPX) continued following a volatile, downward trajectory in the trading week ending 18 February 2022. The latest update to the alternative futures chart reveals the index is falling within the projected range of the downward-pointing RedZone forecast, which assumes investors are focusing on the near-term future as they set current-day stock prices.

The news of the past week confirms that attention, with investors paying close attention to both when and how the U.S. Federal Reserve will begin implementing rate hikes, with noise contributed by the Biden administration's disjointed attempt at geopolitics through its seemingly Zeno's paradox-based media strategy featuring claims of an imminent Russian invasion of Ukraine that would start on 16 February 2022, but didn't, only to be replaced by regularly updated claims of an ever-imminent Russian invasion. This hadn't happened through the end of the trading week ending on Friday, 18 February 2022, but that was before the events of the long holiday weekend added more noise to the situation. Here is the market-moving news that did happen during the trading week that was:

Monday, 14 February 2022

- Signs and portents for the U.S. economy:

- Fed minions worried they are losing credibility, not expected to do a sneak rate hike:

- ECB minions would rather go green than fight inflation:

- BOE minions dealing with inflation:

- Japanese government minions want more inflation, BOJ minions happy to oblige:

- The S&P 500 closes lower as Russia-Ukraine tensions heat up

Tuesday, 15 February 2022

- Signs and portents for the U.S. economy:

- World Bank minion tells Fed minions what they should do, U.S. Treasury yield curve sends a different message:

- Bigger stimulus developing in China:

- ECB minions expected to boost deposit rate to -0.25% by end of 2022:

- Wall Street surges as Russia-Ukraine tensions cool

Wednesday, 16 February 2022

- Signs and portents for the U.S. economy:

- Fed minions provide tea leaves for investors to decipher, looks like they'll make things up as they go:

- Slowing growth, inflation developing in China:

- ECB minions say scary inflation coming from inside the housing:

- BOJ minions afraid of losing money unless it keeps stimulus going:

- The S&P 500 reverses losses, closes slightly higher after release of Fed minutes

Thursday, 17 February 2022

- Signs and portents for the U.S. economy:

- Fed minion calls for bigger, faster rate hikes, start thinking about selling off mortgage bonds:

- ECB minions like easy money policies, in no rush to end them as IMF approves:

- S&P 500 down 2% as Ukraine crisis sparks flight to safety

Friday, 18 February 2022

- Signs and portents for the U.S. economy:

- Fed minions say they have policy wrong, but can still stick a 'soft landing' for U.S. economy even though economists don't believe them:

- Bigger stimulus keeps rolling out in China:

- BOJ minions chill with inflation, ECB minions think about doing something about inflation later:

- Wall Street ends lower as investors eye Ukraine conflict

After trading closed on 18 February 2022, the CME Group's FedWatch Tool projects a total of six quarter-point rate hikes in 2022, starting in March 2022 (2022-Q1), followed by quarter pint rate hikes in May 2022 (2022-Q2), June 2022 (2022-Q2), July 2022 (2022-Q3), September 2022 (2022-Q3) and December (2022-Q4). Meanwhile, the Atlanta Fed's GDPNow tool has boosted its real GDP growth to 1.3% for the current first quarter of 2022, up from last week's estimate of 0.7% real growth.

Disclosure: None.