Words For Wednesday: Hurry Up And Wait (For The Fed)

The stock market had been grinding higher sideways all summer. That came to an end on Monday when stocks reversed direction and pulled back sharply, the Evergrande fiasco in China being cited as the primary catalyst.

Image Source: Unsplash

During Tuesday's trading there were plenty of balls bouncing higher but most of them hit the floor by market close.

Chart: The New York Times

Yesterday the S&P 500 closed at 4,354, down 4 points, the Dow closed at 33,920, down 50 points and the Nasdaq Composite closed at 14,746, down 32 points. This morning S&P futures are trading up 24 points, Dow futures 179 points higher and Nasdaq 100 futures are up 46 points.

Asian markets were mixed with the Hang Seng up and the Nikkei down. In Europe both the FTSE and the DAX have opened higher.

TalkMarkets contributor Jesse of Jesse's Cafe Americain takes a look at the mess in his article Stocks And Precious Metals Charts - FOMC Tomorrow - Evergrande Debt Contagion Concerns. While dutifully including key market charts for readers to review Jesse seems as skittish as the markets themselves.

"Stocks made a valiant attempt to rally off the bottom today— and failed. At least in the futures markets, which both finished in the red as of this posting.

There will be an FOMC rate decision announced tomorrow afternoon, with the attendant press conference and other Delphic pronouncements.

Gold and silver managed to rally off their lows and held the gains (GLD, SLV).

The dollar was slightly lower (UDN).

The scandal about the Fed Presidents actively trading the stocks and bonds whose prices they were actively influencing is growing.

I am still sitting in cash in my trading accounts.

This market is skittish, and there is tension on the tape because of contagion risk from China's Evergrande (EGRNF).

There will be a key debt deadline this Thursday.

Let's see what the Fed has to say tomorrow (Wednesday), and see if it is somehow reassuring."

Contributor Graham Summers writing in This Is The Kind Of Environment In Which Crashes Can Happen? is clearly concerned about the latest shift in the wind.

"Stocks got creamed Monday, but thanks to late day manipulation, they ended up well off the bottom...It will be crucial to see how the markets act the next few days. We’ve had three significant breaks below the 50-DMA since the March 2020 bottom: one in September ’20, October ’20 and March ’21. All of those were resolved in a little over a week.

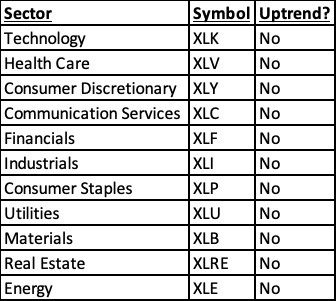

On the surface things don’t look that bad. But “underneath the hood” things are terrible. None of the S&P 500’s sectors are in uptrends."

Talk about charts no one wants to see.

"Moreover, four out of the five most heavily weighted stocks (AAPL, FB, AMZN, and GOOGL) have lost their 50-DMAs and are losing their uptrends.

This is the kind of environment in which actual crashes can happen."

And what about the culprit that caused the tumble?

TM contributor Daniel Lacalle in his article and short video Evergrande. The Tip Of The China Iceberg? provides some insights into Evergrande's troubles and the ensuing troubles it could cause.

"The bankruptcy of the Chinese real estate company Evergrande is much more than a “Chinese Lehman”. Lehman Brothers was much more diversified than Evergrande and better capitalized. In fact, the total assets of Evergrande that are on the brink of bankruptcy outnumber the entire subprime bubble of the United States.

Evergrande is much more dangerous than it seems:

The implications of an Evergrande collapse are far greater than what investment banks tell us.

The first risk is a domino effect in a very aggressively indebted sector. There is also a significant mpact on all those banks exposed to China and emerging markets, where China has financed ruinous projects in recent years. And there is also an impact on global growth and countries that export to China because the slowdown was already more than evident...

Evergrande represents less than 4% of the overall Chinese market but its model has been used by many Chinese promoters. The ten biggest real estate developers account for 34% of the market and aggressive leverage practices are widespread...

The problem with China is that the entire economy is a huge indebted model that needs almost10 units of debt to generate one unit of GDP, three times more than a decade ago...With total debt of 300% debt to GDP according to the IIF, China is not the strong economy swimming in with cash that it was a couple of decades ago...

The total liabilities of Evergrande account for more than double the official debt figure (more than two trillion yuan). Evergrande’s financial hole is equivalent to almost a third of Russia’s GDP. Its annual revenues do not reach 70 billion US dollars, and it is more than debatable whether those revenues are real since a relevant part comes from payment commitments of doubtful collection. Even if they were real, these revenues are not enough to address the bond maturities, which exceed $250 billion in the short term...

International investors are already concerned about corporate governance and intervention in China and now the fears of credit contagion make the risk even worse."

For more gore watch the video.

TalkMarkets contributor Nick Santiago in his article The Fed Is Caught Between A Rock And A Hard Place gives his take on what investors and traders can expect to hear from the bank today.

"As you all know, tomorrow (Wednesday) the Federal Open Market Committee (FOMC) meeting will convene. Federal Reserve Chairman Jay Powell is scheduled to release his interest rate policy decision for the United States...around 2:00 pm ET. Nobody in the trading world really expects the Fed to change its current stance.

At this time, the central bank is buying $120 billion a month of mortgage-backed securities and U.S. Treasuries. Prior to yesterday’s (Monday's) sharp stock market decline, there were many investors who thought the Fed could mention a possible taper of their asset purchasing program. Now the odds of that happening have really declined sharply.

Over the past few months, the central bank has said that inflationary pressures are transitory...Unfortunately, the public has seen a continued rise in gasoline, food, and many other products and services that most people use. The public does not see price inflation as transitory.

Bond yields will usually be a good indicator if a taper will occur. If yields move higher then there is a decent chance that a taper of asset prices are underway soon. If yields pullback or decline then the chance of a taper is likely off the table in the near term...the bond market is generally viewed as smarter than the stock market...while I don’t expect Chairman Powell to change his stance much tomorrow I do believe the bond market might be singing a different tune down the road."

There is too much noise in the market today to dip for winners IMHO. However contributors from the Staff at Bespoke Investment Group update TalkMarkets readers that Singles Miss Out On Housing Strength.

"Data on residential housing this morning surprised to the upside at the headline level in terms of both Building Permits and Housing Starts. Despite the better than expected results, the internals of the report weren’t great as all of the strength was in multi-family units. In fact, single-family Building Permits were only up 0.6% m/m and were down -0.1% y/y compared to a m/m gain of 15.8% and a y/y gain of 44.3% in multi-family permits. Similarly, single-family Housing Starts actually declined 2.8% m/m and only increased 5.2% y/y compared to multi-family units which rose 20.6% m/m and 52.7% y/y. An increase in multi-family units isn’t necessarily considered a bad thing, but single-family units tend to have more of an economic impact."

"Overall, Housing Starts are still trending higher. On a 12-month moving average basis, Housing Starts have been surging in recent months and just came in at the highest level since May 2007. Housing data tends to roll over well in advance of recessions, so as long as Starts keep trending higher, it’s a sign of economic strength."

See the full article for more details and charts.

Wild Quince, Photo Credit: David Marshall

While traders and investors anxiously await the market open, I remind readers that today is the second day of Fall (and the second day of Spring in the Southern Hemisphere) and leave you with these lines from "The Heat of Autumn" by Jane Hirshfield.

is different from the heat of summer.

One ripens apples, the other turns them to cider.

One is a dock you walk out on,

the other the spine of a thin swimming horse

and the river each day a full measure colder..."

Have a good rest of the week.

Thanks David Marshall for an interesting post.

Of course the crash in China will not only be heard around the world, I anticipate that there will be a great deal of actual damage. The emotional impact will be a big part of the problem simply because so much of our financial activity seems to be driven by emotions rather than any logic. And that gloom is completely aside from the actual financial impact on those entities owed by Evergrande.

Couple that impact with the very recent revelation that the corunovirus WAS intentionally designed, and what confidence will there be in any government anywhere?

Let me quote the CCR: "I see a bad moon rising, I see trouble on the way."