Words For Wednesday: Farewell To Trump And Hail To The Chief

BlinxTheKitty, Public domain, via Wikimedia Commons

Donald Trump is set to leave Washington and the Presidency, prior to the inauguration of President-elect Joe Biden and Vice President-elect Kamala Harris. With the nation's capital and those of all 50 states braced for possible violence, U.S. market futures are currently green. While the Nikkei closed the day down - 0.38%, in Europe both the FTSE and DAX are up in morning trading. Tuesday the S&P 500 closed at 3,799, up 31 points, the Dow closed at 30,931, up 116 points and the Nasdaq Composite closed at 13,197, up 199 points.

TalkMarkets contributor David Vomund in his article The Roaring '20s remains optimistic about the market's direction as Joe Biden takes office despite signs of inflation and higher government deficits. Here are some of his thoughts:

"More and more there is talk of this decade being very much like one a century ago. After World War 1 and the Spanish flu pandemic, Americans and people across the globe were ready to spend, buy, invest and even speculate. Businesses did their part as well. What a time! But it didn't end well.

Pure speculation (is what is going on in the markets now). Not a good sign. The valuation levels alone should be cause for concern, not for many stocks, including industrials, banks and energy companies, but for some of the large tech companies. The same is true for IPOs, most of which have attracted a great deal of interest unrelated to company finances or realistic earnings prospects.

Investors anticipate a strengthening economy thanks to the vaccines, stimulus, the Fed...What could be a better environment for stocks? It was true last spring, it is true now. When will it not be true? Maybe rising inflation and with it higher interest rates...will change the outlook.

The yield on the ten-year Treasury is 1.1 percent, more than double its 2020 low, but not tempting...That is about to change."

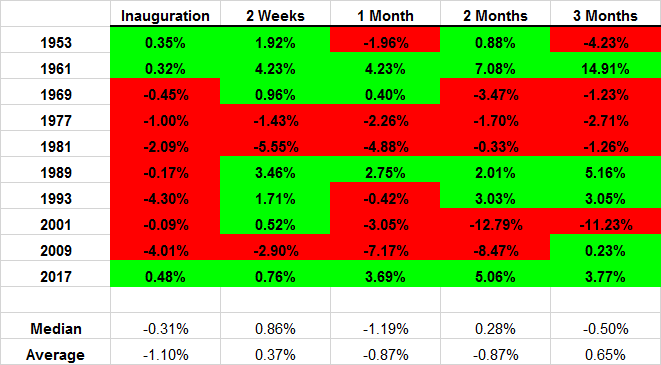

In honor of Inauguration Day, TalkMarkets contributor Paul Schatz takes a historical look how the stock market has fared on this day. Writing in How Stocks Fare On Inauguration Day & Beyond, Schatz says, "Intuitively, you would think that with all the positivity around ID, stocks would rally on the feel good mode...the data doesn’t support the claim. (It happens that) Donald Trump broke a 48 year ID losing streak." Schatz illustrates Inauguration Day market performance in the following chart:

Schatz continues with additional anecdotes about recent past inaugurations and market behavior and concludes with this prognosis: "...my takeaway is that if an incoming president takes power when all is well and stocks are humming, the stock market will continue heading higher over the coming few months or so on balance."

Mircea Vasiu pauses to take a look at market performance year to date in What To Make Of The First Two Trading Weeks Of The Year. Vasiu notes that the loudest noises are coming from commodities markets as shown in this Bloomberg chart:

Vasiu sees inflation as the main byproduct of the rise in commodities as economies reawaken and supply chains struggle to regain their footing. "(Food grains are up) Oil is up, too. The WTI crude oil price is up 9%, and that puts pressure on energy prices. What are higher food and energy prices indicative of? Hint – inflation...If the trends seen in the first two weeks of the trading year remain intact in the months ahead, we may see further pressure on the dollar as inflation picks up steam. On the other hand, precious metals indicate the opposite – hence, caution is needed while monitoring the developments on the energy and grain sectors."

We'll be staying tuned.

As some readers may have taken note during the Anthony Blinken confirmation hearings yesterday, relations with China will be at the forefront of issues confronting the incoming Biden administration. Jeffrey Snider takes a closer look at China's rebounding economy and asks how sharply is it really heading higher in his article No Sharp Turns From China’s Potential.

Snider makes the following observations:

"Chinese officials, particularly those at the central bank, declared an open “no sharp turns” policy for the year ahead – this year, 2021. What does “no sharp turns” actually mean? If you believe China’s economy is going gangbusters here, then this sounds terrific; the “stimulus” spigots to remain open for first the Chinese and then the rest of the world...

That’s not actually what the PBOC yes-men had said, though. Chen Yulu, a PBOC Vice Governor said (last week) " In accordance with the development in the pandemic, the economy and society at the current stage, PBOC will be flexible in implementing the intensity, pace and focus of monetary policy, and maintain the growth rates of money supply and [aggregate] social financing to basically match the nominal economic growth rate." and (another PBOC Vice Governor) Sun Guofeng declared dryly, " Currently, the Chinese economy has returned to its potential output level, corporate credit demand is strong, money and credit have grown reasonably, indicating that the current level of interest rates is appropriate."

Taken together, “no sharp turns” means quite simply that this is what it is; what you see right now is what you’re going to get out of China over the year, and years, ahead. So far as policymakers are concerned, Q4 represents the finish line rather than merely the first step.

Full year, real GDP in China grew by 2.3% making the Chinese economy the lone entry in the plus column for 2020. As I wrote before, they’ve quite intentionally grabbed the label of “cleanest dirty shirt” and are content to run away with it."

Snider presents several charts regarding (less than stellar) economic activity in China from industrial output to retail sales and leaves readers with this concluding thought:

"When the Chinese economy is at its potential flattened out at these consistently low levels, this also and actually means no one should expect a sharp turn upward, either."

One wonders what Washington will make of these findings.

Thinking about investing on this Inauguration Day? Sweta Killa at Zacks Investment Research looks at 5 ETFs That Are Gaining Investors' Love To Start 2021. Killa suggest the following:

1. Financial Select Sector SPDR Fund XLF

XLF seeks to provide exposure to 65 companies in the diversified financial services, insurance, banks, capital markets, mortgage real estate investment trusts ("REITs"), consumer finance, and thrifts and mortgage finance industries. It has AUM of $30 billion and charges 13 bps in annual fees. The fund has a Zacks ETF Rank #2 (Buy).

2. iShares Core MSCI Emerging Markets ETF IEMG

IEMG holds a broad basket of 2,511 stocks of emerging markets with key holdings in information technology, consumer discretionary, financials and communication. China takes the largest share at 35.6% while South Korea and Taiwan make up for more than 14% share each. The product has AUM of $74.7 billion and charges 11 bps in annual fees. It trades in an average daily volume of about 13 million shares and has a Zacks ETF Rank #3 (Hold).

3. iShares Russell 2000 ETF IWM

IWM is the largest and the most-popular ETFs in the small-cap space with AUM of $64.9 billion and holding well-diversified 2,045 stocks in its basket. The fund has key holdings in healthcare, industrials, financials, information technology and consumer discretionary. It charges 19 bps in annual fees and has a Zacks ETF Rank #3.

4. Vanguard Total Stock Market ETF VTI

VTI provides broad exposure to the stock market and holds a large basket of well-diversified 3634 stocks with key holdings in technology, consumer discretionary, industrials, healthcare and financials. It charges 3 bps in fees per year from investors and has a Zacks ETF Rank #3.

5. ARK Innovation ETF ARKK

This ETF continued its last year’s trend with inflows of $1.7 billion in the initial two weeks of 2021 driven by Tesla TSLA and its innovative strategy. ARKK is an actively managed fund seeking long-term capital appreciation by investing in companies that benefit from the development of new products or services, technological improvements and advancements in scientific research. In total, the fund holds 51 securities in its basket and charges 75 bps in annual fees. The product has AUM of $21.9 billion."

Read the full article for additional information and references.

TalkMarkets contributor Manisha Chatterjee looks at General Motors in Is General Motors Stock Still A Buy After Reaching An All-Time High? and finds the answer to be yes.

"GM stock hit its all-time high of $51.87 on January 14 after Mary Barra, CEO, revealed the company’s ambitious EV goals at the Consumer Electronics Show (CES). GM even unveiled its Cadillac flying car and electric shuttle concepts at the show. GM has gained 20% year-to-date to close Friday’s trading session at $49.97.

The stock is currently trading 3.7% below its 52-week high...we think it is wise to buy its shares now because its EV journey has reached an “inflection point” and could grow significantly this year.

Analyst sentiment, which gives a good sense of a stock’s future price movement, is good for GM. It has an average broker rating of 1.5, indicating a favorable analyst sentiment. Of 18 Wall Street analysts that rated the stock, 4 rated it “Strong Buy,” and 11 rated it “Buy.”"

As always, caveat emptor.

Some TalkMarkets followers may remember that Donald Trump chose not to invite a poet to participate at his inaugural. The budding poet, Amanda Gorman has been chosen to deliver the poem for today's presidential inauguration. The title of the poem is "The Hill We Climb". Here are a few lines:

Have a good week.

I'll be impressed if we don't find Trump meddling in politics over the next 4 years.

The country will be worse off as a result. We may not always like hearing what Trump has to say, or how he says it, but if often needs to be said.

Agreed. This new cancel culture and Big Tech censorship is a real problem and will silence opposing views. I bet @[DRM](user:130312) would agree with us too.

I would have thought so too. But with Twitter effectively kneecapping Trump by banning him, they've managed to neuter/silence the guy. He's harmless without his pulpit and bullhorn.

Maybe, but there are many other ways for him to get his messages of hate out there. God helps us if he starts Trump TV.