Will US Stock Market’s Outsized Leadership Persist In Q4?

American shares have been the upside outlier for performance leadership for much of the year for the major asset classes, based on set of proxy ETFs through Friday’s close (Oct. 6).

But applying a hefty dose of optimism to US equities may become increasingly challenged as various risk factors resonate in the fourth quarter.

For the moment, the year-to-date gap in favor of US stocks remains conspicuous. Vanguard Total US Stock Market ETF (VTI) is up nearly 13% so far in 2023. That’s a solid gain in absolute terms, and it looks even better when measured against the rest of global markets.

The next-best performance year to date is foreign developed-markets stocks (VEA), with a comparatively modest 5.4% advance. At the low end of this year’s performance ledger: losses in excess of 5% for foreign and US property shares (VNQI and VNQ, respectively).

A key driver of US stocks is the stellar run for tech shares, which dominate market-cap weighted funds such as VTI. Indeed, the Technology Select Sector SPDR ETF (XLK) is up 36% so far this year, helping to supercharge broad equity funds that hold stocks in terms of market values.

The attack by terrorists on Israel over the weekend is animating debate about the vulnerability of risk assets, US stocks in particular, after a strong rally this year, albeit a rally that has recently been stumbling. Heightened geopolitical risk follows concerns that rising bond yields pose a threat for high-flying American equities.

“Geopolitical risk doesn’t tend to linger long in markets, but there are many second order impacts that could come through in the weeks, months and years ahead from this weekends’ developments,” advises Deutsche Bank strategist Jim Reid.

The future is uncertain as ever, but the past is crystal clear, which raises the question of whether US stocks still deserve this year’s hefty performance premium over the rest of the field? To the extent that investors think it does, a large part of the answer relies on assuming that US tech shares will continue to outperform and provide ballast that’s unavailable elsewhere in the world.

Betting against US shares has been a losing proposition for several years, and so there’s a reluctance to assume that the trend is about to change. But that leads to the issue of rebalancing a multi-asset-class portfolio. For those who still see such strategies as practical for the longer-run horizons, the question of whether it’s timely to rebalance when an there’s such a stark performance outlier.

Note that US shares are not only leading by a wide margin this year, but over the trailing 10-year window too.

That leaves investors will some tough questions as the year winds down, including: Does rebalancing still matter? If the answer is “yes,” which is your editor’s view, then there’s the main topic to debate: If not now, when?

There are no easy answers, but rebalancing still looks relatively attractive from a longer-term perspective when there’s wide disparity in performance and risk. Those conditions will probably look increasingly ripe as the fourth quarter progresses.

More By This Author:

Several Corners Of Bond Market Manage To Shine This Year

Is Hard-Landing Risk Rising (Again) For The US Economy?

US Median Q3 GDP Nowcast Holds Above 3%

Disclosure: None.

The big 7 will take a hit but overall I see the US doing ok. I say why in this recent article https://talkmarkets.com/content/currenciesforex/the-us-dollar-is-the-main-safe-haven-currency?post=412490

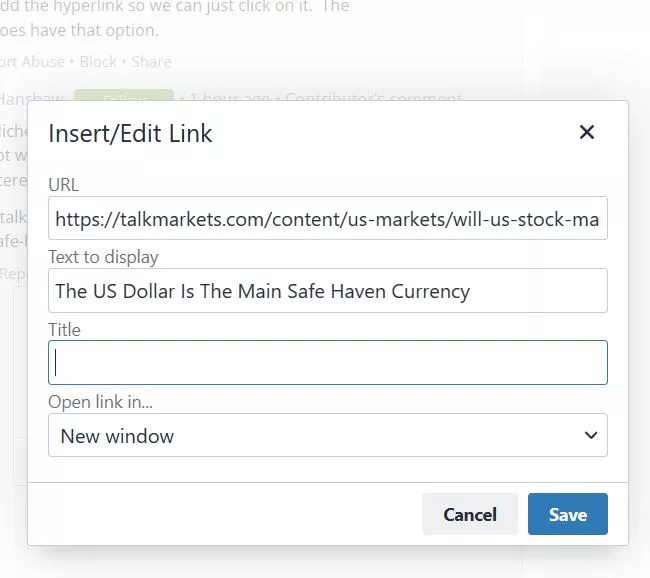

Easier when you add the hyperlink so we can just click on it. The comment editor does have that option.

Think I've got it! The US dollar is the main safe haven currency

Hello Michele, I am not sure how to do that but will try again. If that does not work the article can be found under my name. Thank you for your interest. James

https://talkmarkets.com/content/currenciesforex/the-us-dollar-is-the-main-safe-haven-currency?post=412490

Thanks and here you go:

The US Dollar Is The Main Safe Haven Currency