Weekly Market Pulse: Question Time

Special Note: Back in late March, I highlighted a charitable organization – Our Grounds – that I had had a very positive interaction with and asked that you consider donating. I also asked readers to send me recommendations for other charities they supported and today I am pleased to feature Sugar Plum Bakery in Virginia Beach, VA, recommended by Alhambra client Bruce.

The mission of Sugar Plum Bakery is to serve the needs of persons with disabilities through employment, education and training. Sugar Plum Bakery will promote the integration of persons with developmental disabilities into society by helping them become independent and evolve into working contributing members of our communities.

I haven’t been to Sugar Plum but I bet it’s a happy place just like Our Grounds. I’ve been working on my fitness and diet this year or I’d be ordering something but instead I’ve made a donation which you can do here. I believe strongly that it is organizations like Sugar Plum that have the biggest impact on our communities. Rather than focus on our differences, organizations like this bring us together in support of those who need it the most. Please donate today.

Last I checked we have over 10,000 smart, caring people on our weekly email list and I’m happy to highlight other worthy organizations in future letters. If you know of a non-profit that deserves our support, send me an email: jyc3@alhambrapartners.com.

Question Time

It’s question time again. I ask myself questions all the time about the economy and markets. I don’t have all the answers but I think it’s important to know what you don’t know and be alert when the markets or the economy offer answers. There’s a lot to think about today so let’s get started:

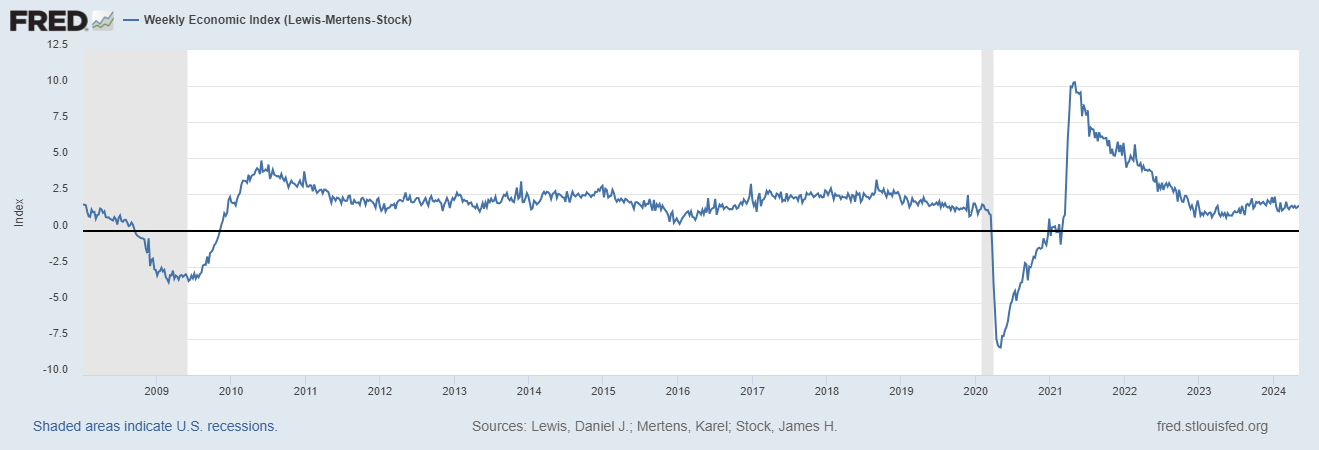

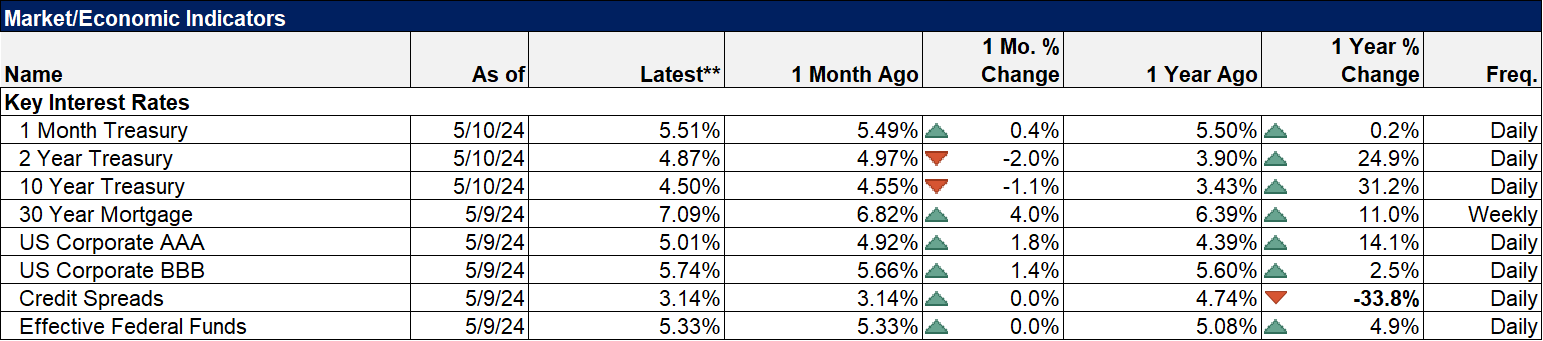

- When will the next recession arrive? The answer, of course, is that we don’t know. We never know because there are no reliable indicators that can tell us what the future economy will look like. I know no one wants to say “it’s different this time” but it actually is different – every time. The economy, especially the US economy, is not a stagnant thing that just repeats the past in some infinite loop. The only constant is change. So where are we today? Well, I think we can all agree that we aren’t in recession right this moment. We just completed the first quarter of 2024 and the US economy grew by 1.6%, which was somewhat less than expected but still a pretty positive start to the year. Since the start of the second quarter we have had some weak reports, such as the ISM manufacturing and services reports which are both below 50 (indicating contraction), but overall the economy continues to surprise to the upside. The current Atlanta Fed GDPNow estimate for Q2 is +4.2%, the 3 month average of the CFNAI (Chicago Fed National Activity Index) is -0.19 which indicates growth slightly below trend, the Weekly Economic Index is 1.74 and steady, credit spreads are near their lows for this cycle and the yield curve has steepened over the last three months. None of those is pointing to recession right now.

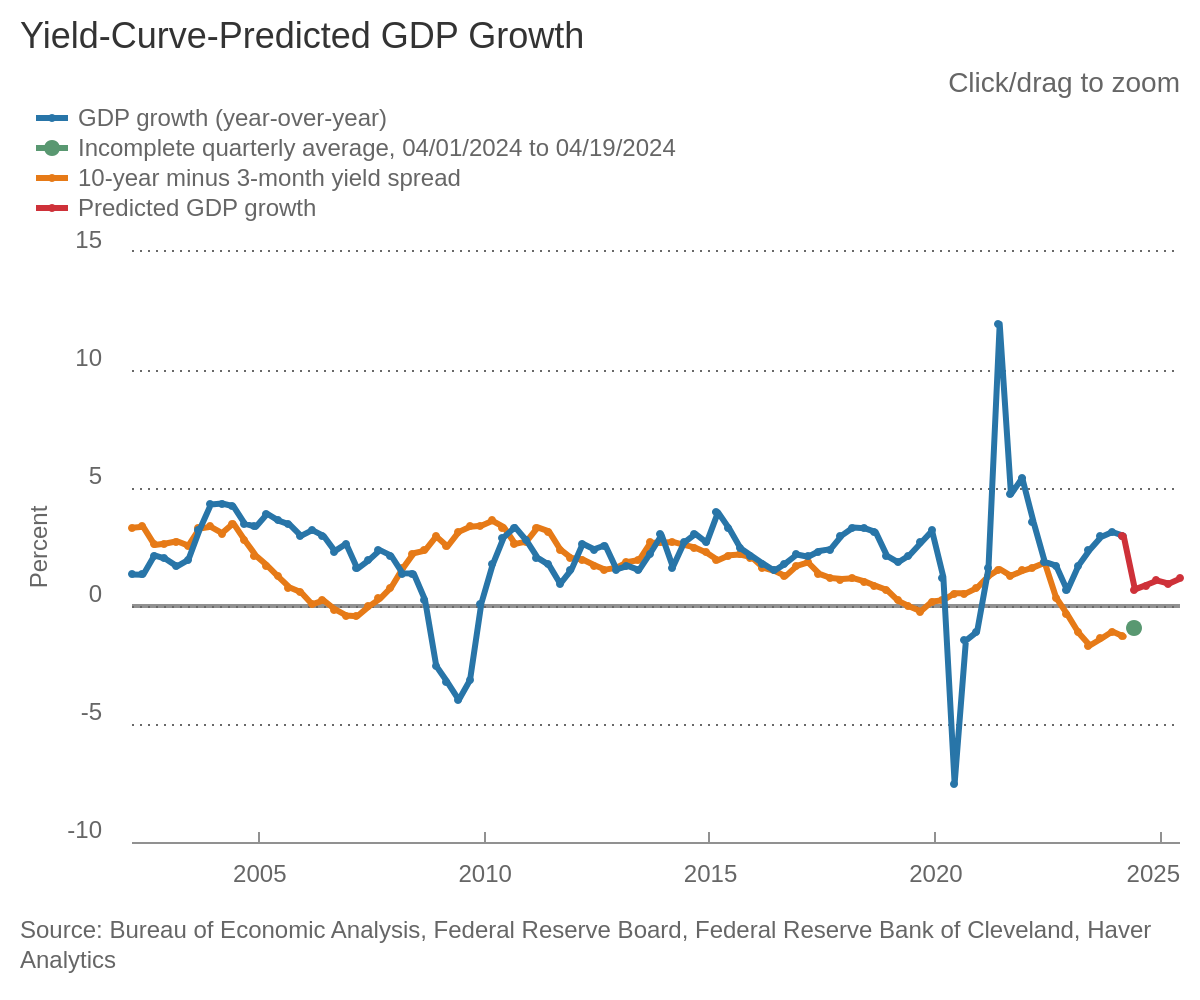

- What does the yield curve tell us about future growth? A yield curve inversion (short term rates higher than long term rates) is considered by many to be the most reliable indicator of recession because it has happened prior to every recession in the post-WWII period. The curve has been inverted for the last 21 months (10 year/2 year Treasury) or 18 months (10 year/3 month Treasury) and yet, despite numerous dire forecasts, the most anticipated recession ever hasn’t arrived. In the post-WWII period there have been only two inversions I know of where the curve righted itself without a recession. The curve inverted from December 1965 to February 1967 without a recession. It subsequently reinverted in December of 1967 but recession didn’t arrive until December of 1969, two full years later. The curve also inverted for a month in 1998 (Asian crisis) without a recession. It reinverted in April 2000 and recession arrived a year later in March of 2001. So, today’s inversion without a recession – yet – is not unprecedented. And frankly, with the lead time from inversion to recession varying from 6 months to 2 years, yield curve inversions have never been that helpful for investors. The Federal Reserve Bank of Cleveland uses the history of the slope of the yield curve to predict GDP growth a year ahead. It currently shows year ahead growth at 1.2% which isn’t great but isn’t a recession either. They also calculate a probability of recession one year ahead which is currently 55.1%. A year ago, it showed a probability of recession in April of 2024 at 75% which was higher than the peak in 2001, 2008 or 2020. So, what does the yield curve tell us about future growth? Not nearly as much as people think.

- How will the election affect the markets and the economy? Historically election years are good ones for the markets because incumbent Presidents do everything in their power to make the economy look good to improve their re-election chances. And since they have the ability to time spending into the economy, their power is considerable. But this year is a bit unique because nominal growth has already been quite good; the problem is that too much of it is inflation and not enough of it is real growth and the President doesn’t have a lot of power to rein in prices. And frankly, politicians don’t have a clue what causes inflation so they are as likely to make the problem worse as better. In any case, I don’t think we’ll be in recession before the election and my best guess is that the inflation rate will continue to moderate…and that no one will care because prices will still be high. How that affects the outcome at the Presidential level I can’t say but it isn’t what really matters anyway. The best outcome for the markets and the economy is divided government and that doesn’t seem a bad bet right now.

- Is the market still the best predictor of the economy? I have always believed markets provide the best glimpse of the future we’re ever going to get. With millions of people making independent decisions, looking at all manner of economic data (actual and anecdotal), the market sniffs out the future long before any one individual could. But is that still true? I’m starting to have some doubts because of the influence of the Federal Reserve. Forward guidance by the Fed – so much forward guidance! – means that short term rates markets now reflect the Fed’s opinion about the economy and future rate moves, not the wisdom of the crowd about what the Fed ought to do based on actual economic data. Fed Funds futures markets today are no more accurate than the Fed’s dot plot and the errors are in the same direction. The Fed once could check to see if the market agreed with their internal predictions; today markets are nothing more than an echo of the Fed’s own opinion. Sadly, I think the answer to this question is no. By the way, next week there are ten speeches by Federal Reserve Governors and one by the Chairman.

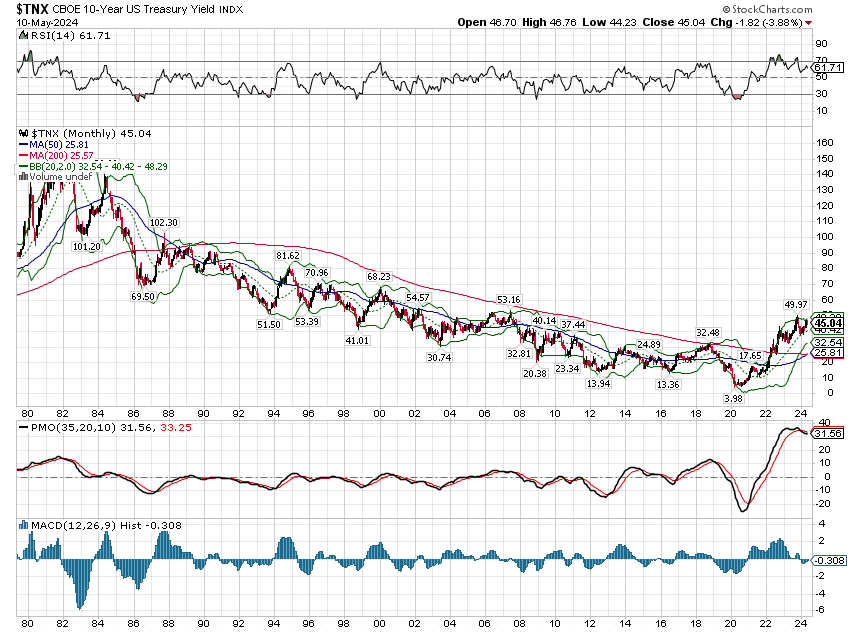

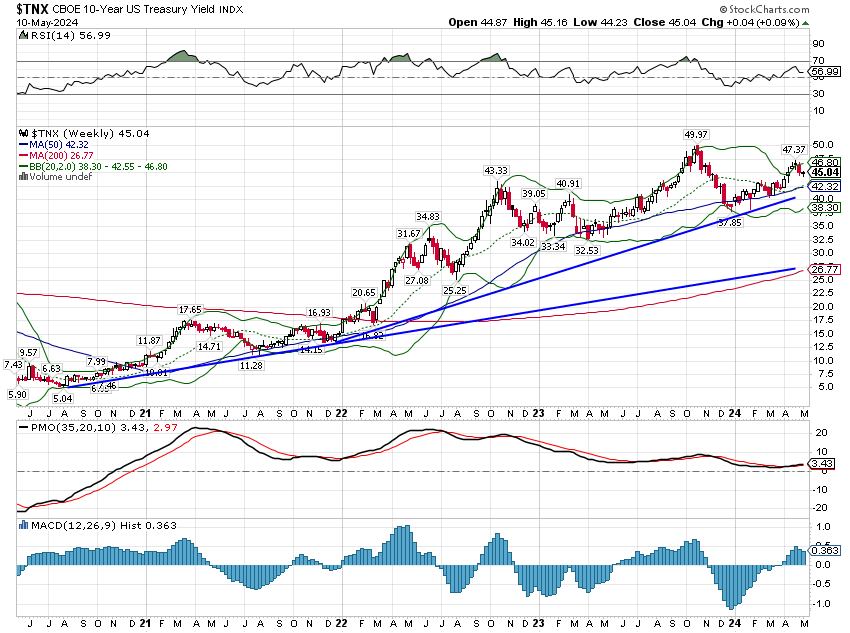

- Have interest rates peaked? You know what I’m going to say – I don’t know. I think the real question everyone wants an answer to is whether the long term, secular trend in rates has changed from down to up. The 10 year yield has been in a downtrend since peaking in 1981 around 16%. Has that now changed? Well, one way to measure such things is with moving averages and something unique just happened that is a hallmark of a trend change. For the first time since 1988, the 50 month moving average is above the 200 month moving average. The slope of the 50 month changed to positive in 2023 (something that hasn’t been true for more than a few months since 1985) but the crossover just happened. So, have rates peaked? If the economy slows and/or inflation continues to moderate, long term rates should come down in the short term, but I think the long-term trend has changed. That has implications across multiple asset classes.

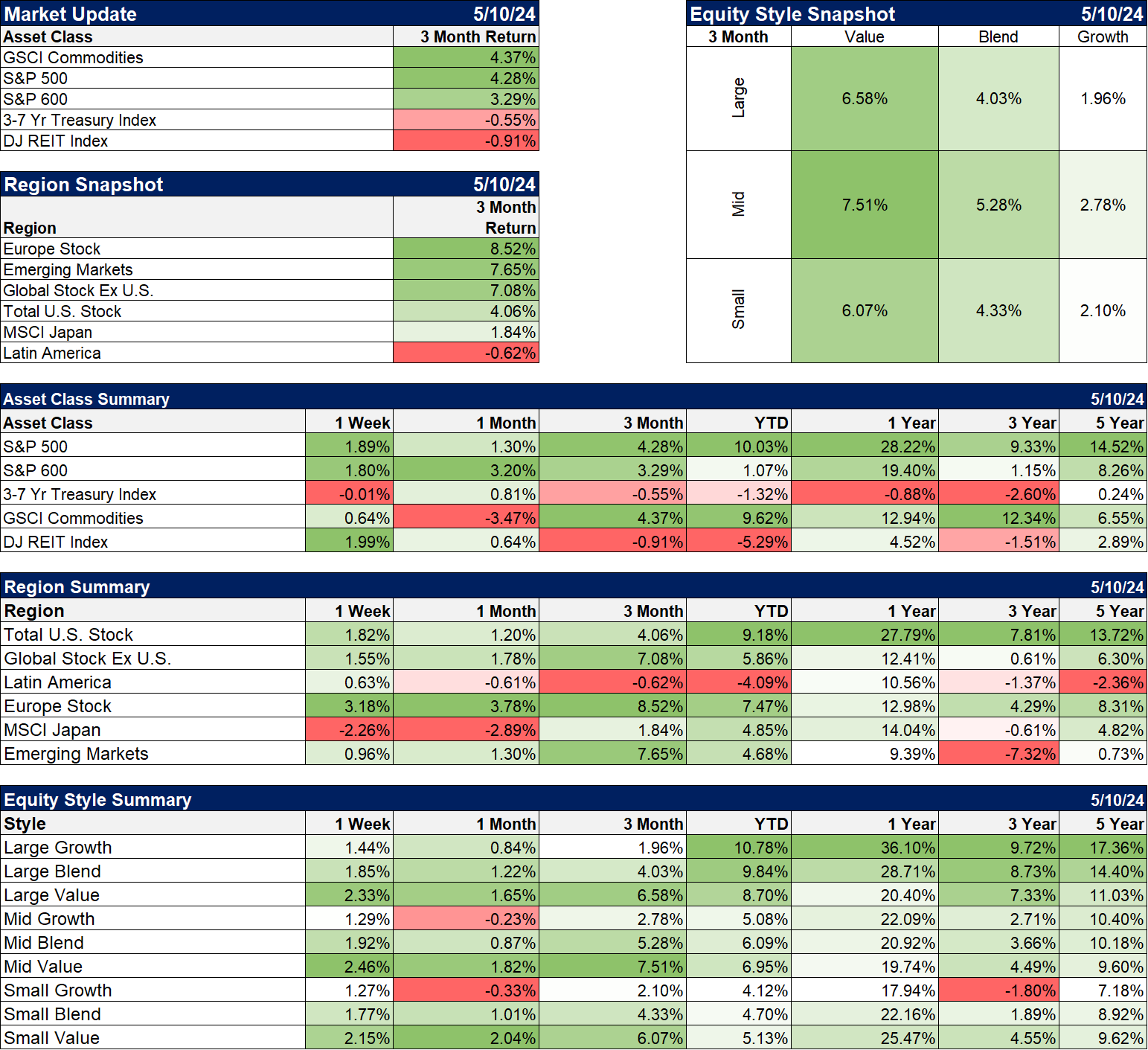

- Have technology stocks peaked? Or are they just resting? If you’re only paying attention to the financial media you might think that technology stocks and drug companies with obesity drugs are still leading the market. But that hasn’t been true over the last three months. Of the top 9 holdings in the S&P 500 (2 share classes of Alphabet nee Google take up two places in the top 10), only 3 have outperformed the index over the last three months. And the S&P 500 value index has outperformed the S&P 500 growth index by over 2%.

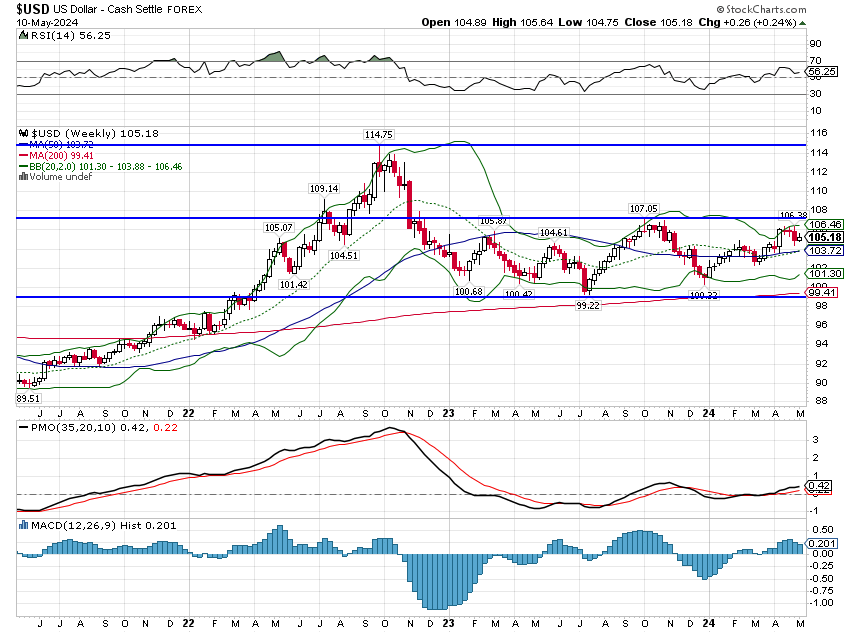

- Is international diversification finally paying off? International markets have lagged the US for a long time. Over the last 10 years the return of the S&P 500 is nearly 10 times that of the EAFE (diversified, developed international markets), 176.6% vs 17.77%. But since the bear market bottomed on October 13th, 2022, international stocks have performed in line with the US. And if you think Europe is a mess, you might consider what it says about the US that European stocks have outperformed the S&P 500 by nearly 17% over that time. And while Japanese stocks have gotten a lot of press recently, Europe has outperformed Japan by 20% since the bear market low. Whether this lasts or not will likely depend on the dollar. International markets strongly outperform when the dollar is falling.

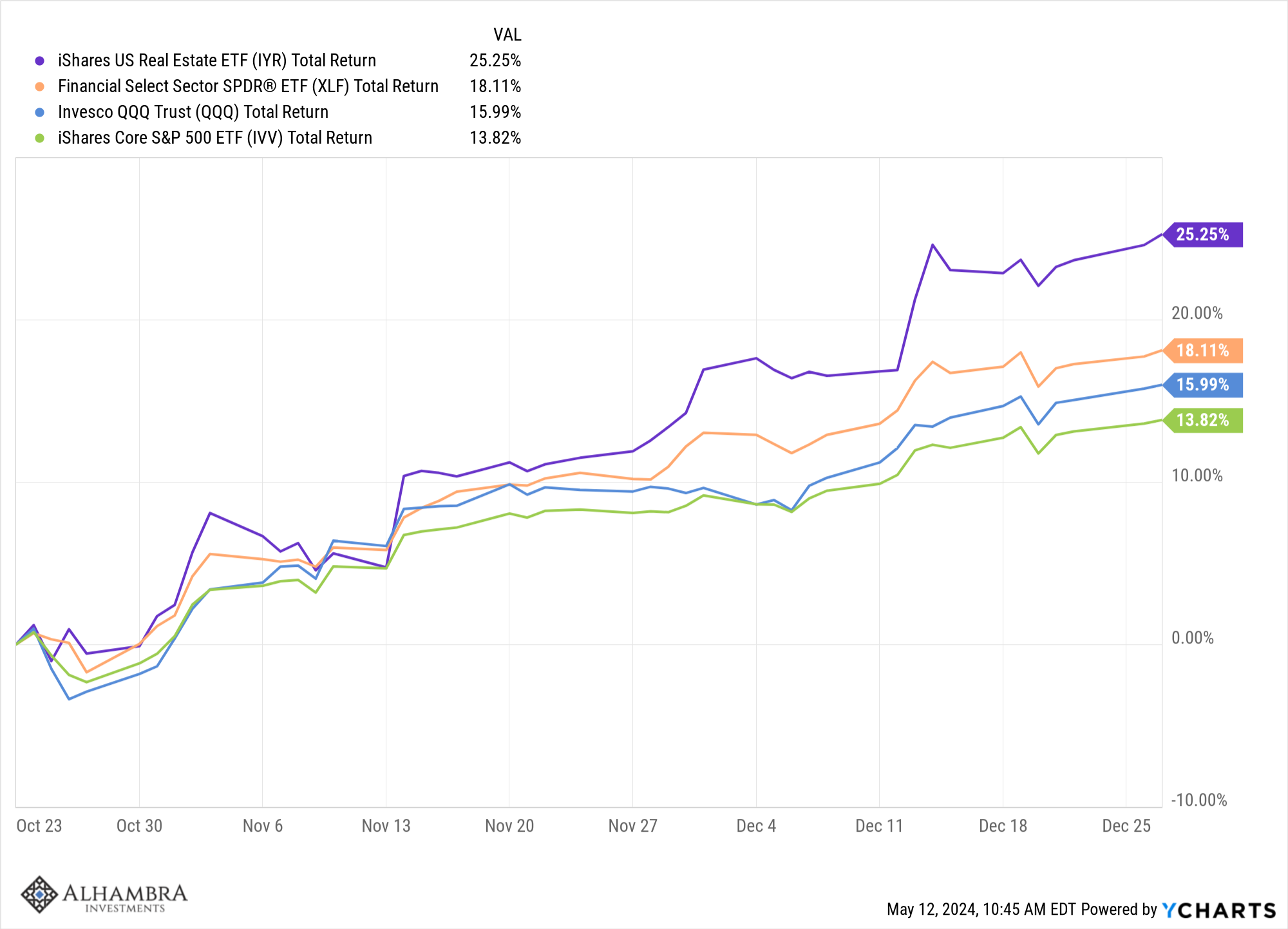

- If the Fed cuts rates, this year what will be the impact on stocks and other asset classes? If the Fed does cut rates it will be because nominal growth and inflation have slowed. But a slowing economy also probably means slowing earnings growth so how will stocks respond? I think that depends on how fast growth slows. If the economy slows gradually, there will be a time when market participants believe the Fed will be able to arrest the fall before a recession sets in; the fabled soft landing. Even if the economy ultimately falls into contraction, that period of optimism will still prevail for a while. You may not remember this now but there was a period in 2008 when a lot of people thought the economy would avoid recession; from mid-March, after Bear Stearns, to mid-May the S&P 500 rose nearly 12%. So what should we expect? Cui bono? The two sectors hit hardest by higher rates are real estate and financials, which are obviously related. And they were the two best performing sectors when rates fell late last year.

There are a near infinite number of questions when it comes to markets and the economy. Most of the best ones can’t be answered until the future unfolds but that doesn’t mean that thinking about them isn’t valuable. If prediction is not a viable alternative – and for big questions it isn’t – then reaction time becomes all important. If you’ve already thought through the potential outcomes of some question you are less likely to be surprised by it. The boy scout motto seems apt here.

A far from exhaustive list:

- How will the increased use of tariffs affect the quality of goods?

- Will we be able to get the power we need from renewables? If not, what role will nuclear play?

- Is deglobalization really happening?

- Will the world move to regional trading blocks? Will the US be more integrated with Latin America?

- Will commodities continue to outperform?

- Why is gold rising so much with the dollar stable? Is it saying something about the future of the dollar?

- Is indexing ruining markets?

- How long can the US run large deficits that continue to worsen the debt/gdp ratio?

- Will productivity rise fast enough to offset the demographic drag on US growth?

- How long before shale oil production really peaks in the US?

- When shale oil production peaks what will be the impact on natural gas prices?

- How vulnerable is our power grid to cyber warfare?

- Will Europe be forced to enter the Ukraine conflict?

Environment

Six months of nothing. The dollar and interest rates have done absolutely nothing over the last six months. Does this period of stagnation signal anything about the future? Not really. It is tempting to say this is the calm before the storm but history doesn’t support that view. There have been longer periods where rates did little and the economy was fine. And there have been stable periods that were followed by extreme volatility and recession.

The short to intermediate term trend for the 10 year Treasury rate, despite no movement for the last six months, is still up but there are some technical signs the rate may be peaking and I still think that is the likely outcome. But I wouldn’t make any big bets either way; just wait for it to resolve one way or the other and respond accordingly.

The dollar’s trend hasn’t changed either. The trend since late 2022 is neutral. I do wonder if gold is trying to tell us something about the future value of the dollar. We don’t usually see such strong gains in gold without a falling dollar.

The overall environment is about as neutral as I’ve ever seen it. There is no signal here, just noise. But it is interesting that commodities, gold and international stocks – all of which outperform when the dollar is falling – are performing so well.

Markets

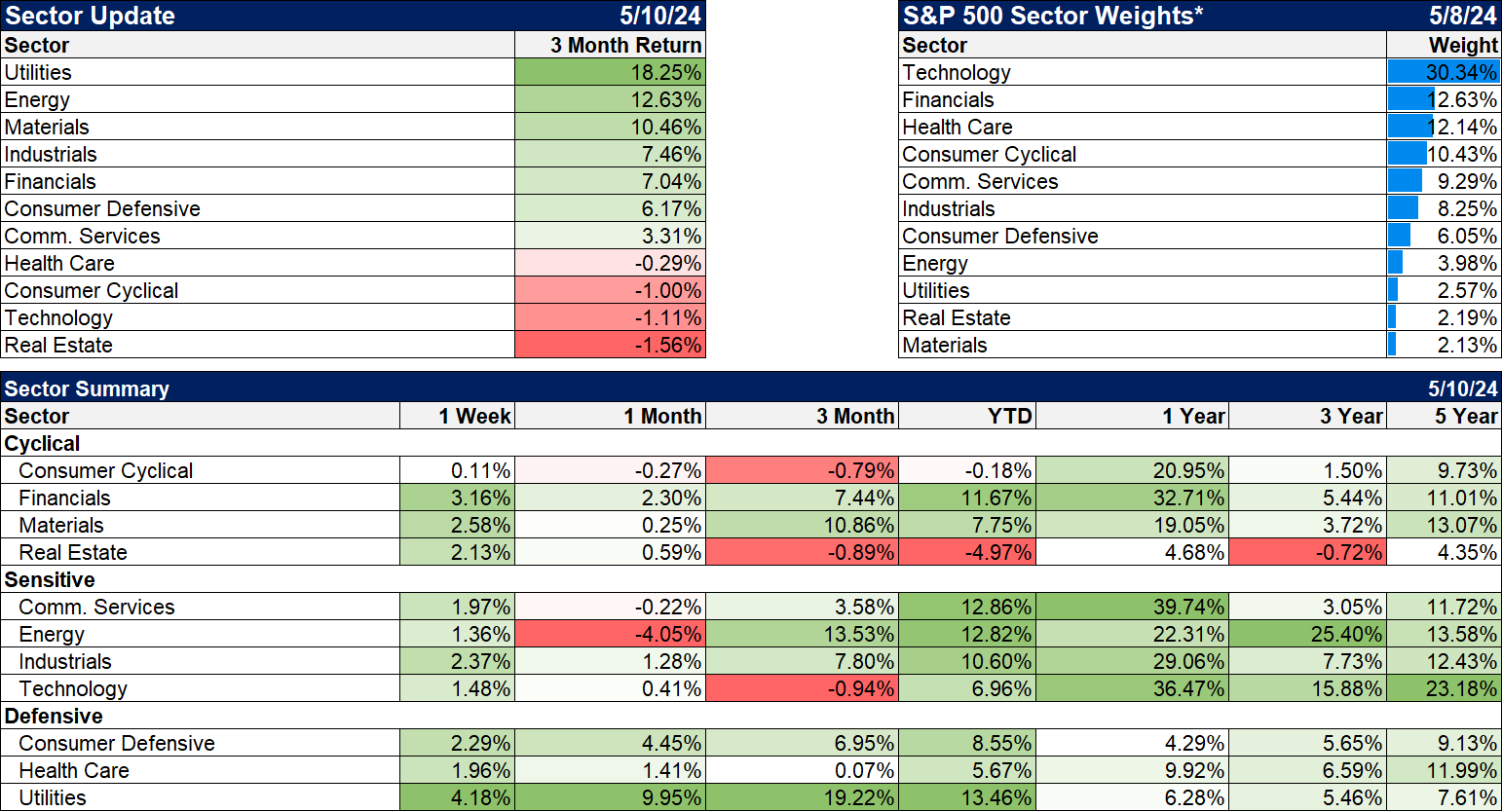

Over the last three months markets have bucked the popular narrative. Commodities, gold and international stocks are all outperforming US stocks. While Japanese stocks have gotten a lot of press it is Europe and EM stocks leading the international markets.

In the US over the last three months it is value stocks, including small and mid cap, that are outperforming. Is that the start of a trend? Well, maybe, but the long term trends haven’t changed yet.

Year to date the lagging asset classes, bonds and real estate, are interest rate sensitive. If that changes, both are so unloved a big rally seems likely.

Sectors

Utilities?? Yes, the utes are outperforming over the last three months by a pretty wide margin. This is about electrification, not interest rates but it does seem a little over done. I’d be careful chasing these stocks right now; they aren’t particularly cheap. The utilities sector trades for about 17 times next year’s earnings estimate and has an expected long term growth rate of less than 8%.

Market/Economic Indicators

There was very little data released last week but this week we get both PPI and CPI. The Cleveland Fed’s nowcast of CPI is anticipating 0.41% on headline and 0.31% for core. The consensus of analysts is for 0.3% on both. Chance for a negative surprise? Maybe, but the market mostly focuses on core which came in at 0.4% last month. A drop to 0.3% may be enough to placate the market.

In addition to the inflation reports we’ll also get reports on:

- Retail Sales

- Empire State manufacturing survey

- Business inventories

- Housing market index

- Housing starts and building permits

- Import and export prices

- Philly Fed manufacturing index

- Industrial production

- Leading economic indicators

Add in 11 speeches from the Fed and it could be a big week.

Joe Calhoun

More By This Author:

Weekly Market Pulse: What Did He Say?Weekly Market Pulse: Be Careful What You Wish For

Weekly Market Pulse: Situation Normal

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more