Weekly Market Pulse: Fat Pitch?

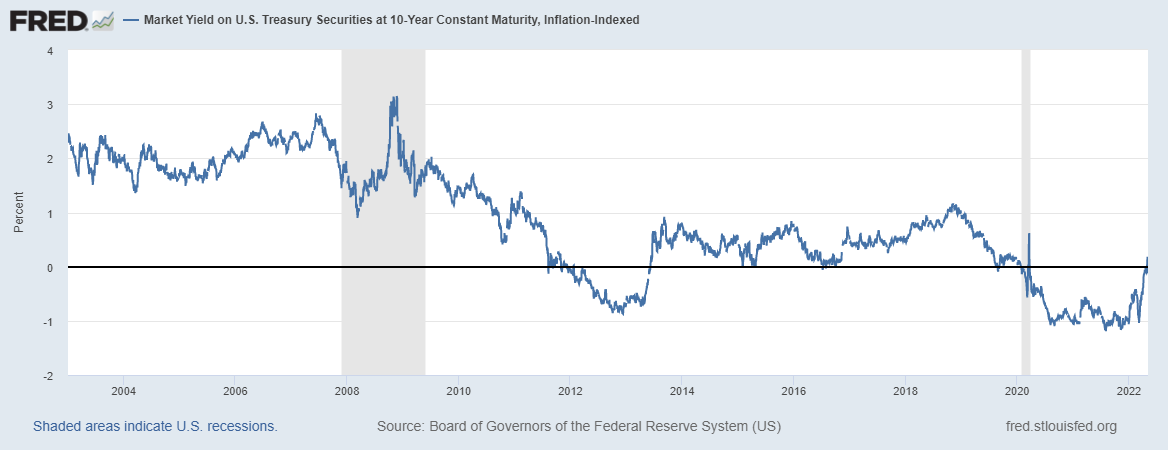

Something very important happened last week. No, it had nothing to do with the stock market, at least not directly. There was a lot of volatility in stocks last week but in the end, the S&P 500 was down a mere 21 basis points (0.21%). Yes, growth stocks continued their march toward reality with the Nasdaq 100 down 1.25% but even that isn’t much of a move in the big scheme of things. No, the really big news happened in a part of the market that doesn’t get a lot of attention but is actually quite important. Real interest rates, as measured by 10-year TIPS yields, turned positive last week. Except for a brief spike during the onset of COVID, 10-year TIPS yields have been negative since late January of 2020. With markets supposedly on edge about inflation, it seems like pretty important news that investors have been aggressively selling inflation protection for the last month.

Real interest rates are the intersection of savings and investment and in general, higher real rates are associated with higher rates of investment in the economy. A lot of economists – especially at the Fed – seem to think that low real rates will induce more investment – cheaper to borrow – but the evidence doesn’t support that view. Low and negative real rates were a feature of the 1970s while high and positive real rates were the default in the 1980s which really settles that debate in my opinion. Low real rates are generally associated with inflationary eras so investors are preoccupied with preserving their purchasing power and neglect investments in the real economy. I don’t think it is a coincidence that real rates have been low since the GFC (and falling since the 1980s although not in a straight line) and we find ourselves stuck in a low growth environment. Why real rates have been falling – and near-zero or negative for large stretches of the last decade-plus – is debatable, a discussion that could include demographics, monetary systems, tax policy, trade policy, immigration policy, and any number of other variables. But we don’t need to know the reason to know that negative real rates are an obvious negative signal about the real economy. Or that positive real rates are an improvement.

In the long term, if investment in the real economy follows real rates higher, the result should be higher productivity, higher rates of growth, and lower rates of inflation. Of course, that won’t happen immediately as investments take time to produce results, but positive real rates are certainly a step in the right direction. Inflation expectations, as measured through the TIPS market, haven’t really come down much yet as nominal rates have been rising right along with real rates but if history is a guide that should come soon. Of course, real rates are still quite low – just 26 basis points on the 10-year – and this is very tentative as yet. There is a long way to go before we can say that this inflation episode – or supply shock or whatever you want to call it – is over. But getting to positive territory is good news and we shouldn’t ignore it.

(Click on image to enlarge)

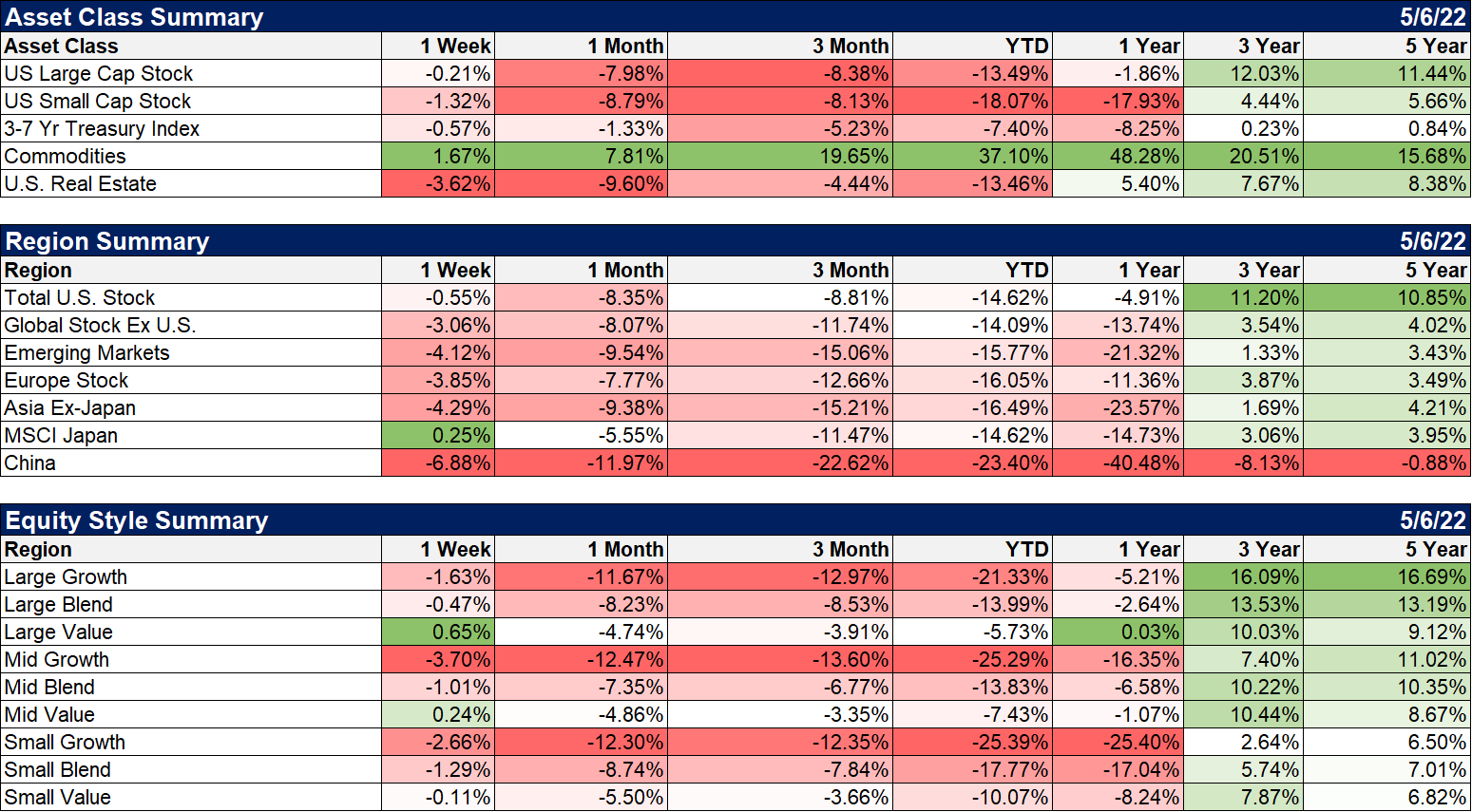

There are potentially two important implications for investors. First, if real rates stay positive and continue to rise, I would expect value stocks to continue to outperform. The speculative areas of the market have come down a lot but don’t think that means they can’t come down more. Those of us who invested through the dot com bust can certainly attest to that – and to the benefit of owning value stocks in such times. Second, if investors’ inflation fears are abating – and I think that is the obvious deduction if they are selling TIPS – then a peak in nominal rates is probably near. And if inflation expectations fall as rapidly as they rose, the fat pitch referenced in the title of this post will come in the bond market. The upside from current levels is, in my opinion, considerable. A pullback in the nominal 10-year rate to 2.5% – a rate we saw as recently as the end of March – could produce returns on longer duration bonds from 5 to 10% in a very short period of time. For moderate investors with a large allocation to bonds, that could represent a big recovery in the value of their portfolios. And rates could easily fall more than that, down to the low 2s, and still be in a solid long-term uptrend. Returns in that case could easily approach 20% for long-term bonds.

It probably isn’t a coincidence, by the way, that the last time we saw a similar surge in real rates was during the so-called Taper Tantrum back in 2013. The public perception of QE, regardless of the reality, is that it is inflationary and the obvious way to protect yourself is by buying TIPS. With the end of QE, investors’ fears of inflation ebb and so does their appetite for TIPS. The irony is that the Fed got what it wanted from QE – lower real rates – but the result wasn’t higher growth because the fear of inflation pushed investment into non-productive areas. Gold also rises during QE and when real rates are falling and negative. It isn’t a coincidence that gold peaked in November of 2013 when real rates started to rise and it isn’t a coincidence that the yellow metal has struggled recently.

All of this is very early and could easily be reversed. And merely, barely positive real rates do not mean we are headed for a boom. Take a look at that chart above. It is a visual representation of a decade of weak growth. Real rates never even approached the levels of the period prior to the GFC. Real growth didn’t either and that wasn’t even a particularly good period for growth. To get out of the malaise of the last 14 years we need to see real rates get back to the 2 to 3% rates we saw in the 80s and 90s. What combination of economic policies would produce that outcome? I don’t know for sure but it seems rather obvious that monetary policy alone – and especially QE – won’t get the job done.

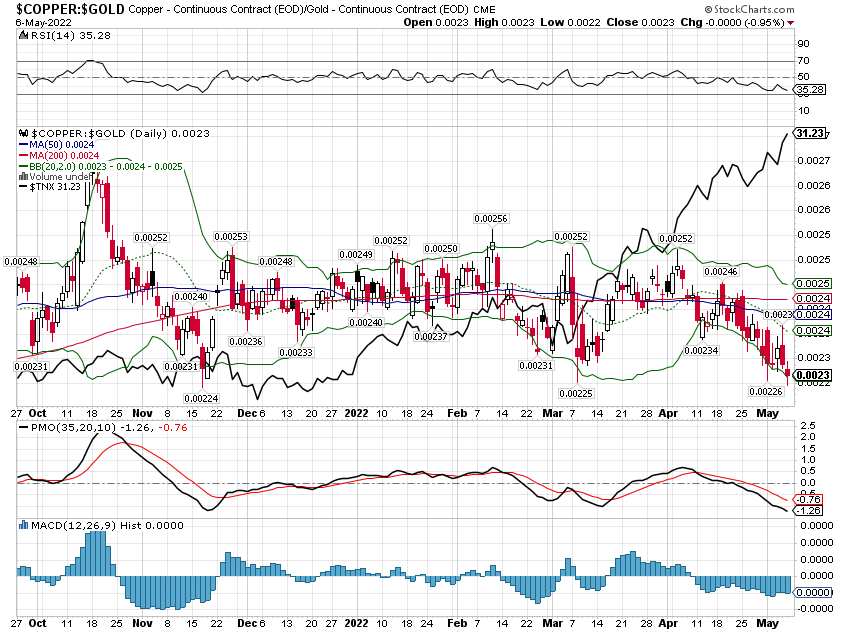

The rising-rate, rising dollar environment continues. The dollar strength has been broadening recently as the Yuan joined the weak currency bloc. That seems to be the typical China playbook when their economy goes south, although it may be less intentional than it appears. Ironically, to wean themselves from export-led growth, as they claim to want to do, would require a continued strong Yuan to bolster domestic purchasing power. But like a lot of countries that find themselves in the middle-income trap, China is finding this hard to pull off. A rising currency is presumably negative for the export sector and positive for domestic purchasing power. But of course, a lot of Chinese employment is dependent on the export economy and one’s purchasing power is fairly limited without a job. This, of course, is why it’s called the middle-income trap. Admiral Ackbar would approve.

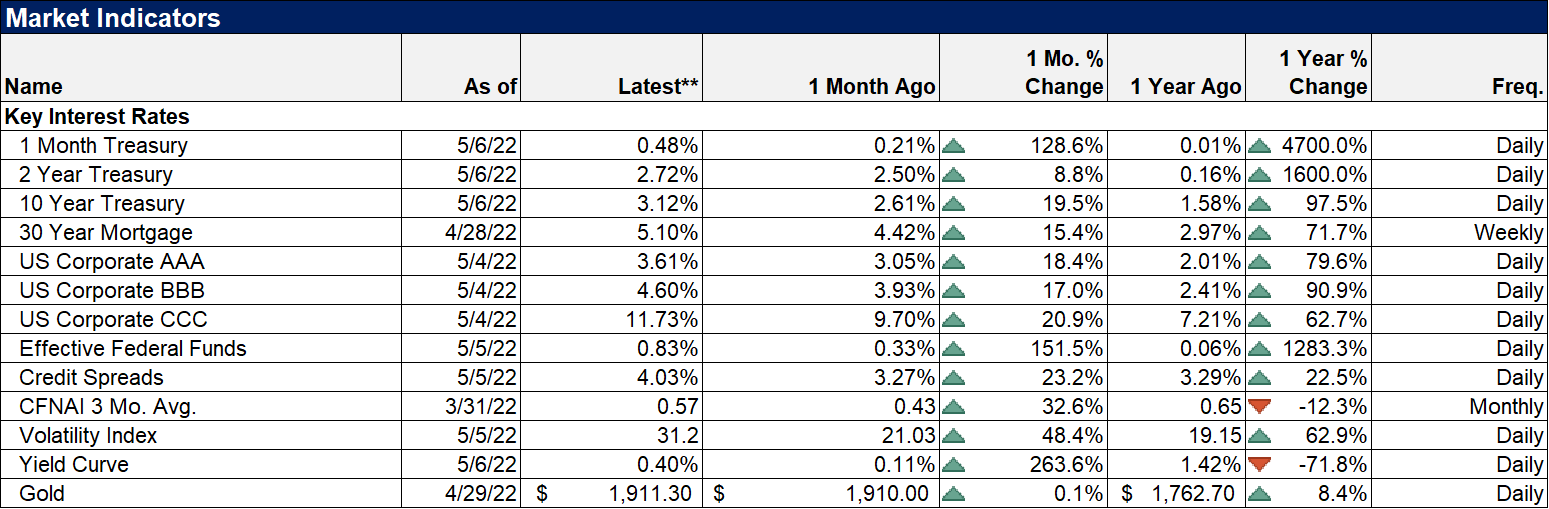

Rates surged last week as the Fed met and did what everyone expected them to do and raised the Fed funds target by 50 basis points. The yield curve also steepened as the 10/2 curve increased to 40 basis points. It is still a bear steepener with the 10-year rate rising faster than the 2-year rate. The 2-year rate has basically stalled, no higher now than on April 28th. Bear steepeners are generally associated with inflation fears but with the selling in TIPS, I expect that to end soon. What the curve does once rates start to come down a little will be very interesting and hopefully illuminating.

Markets

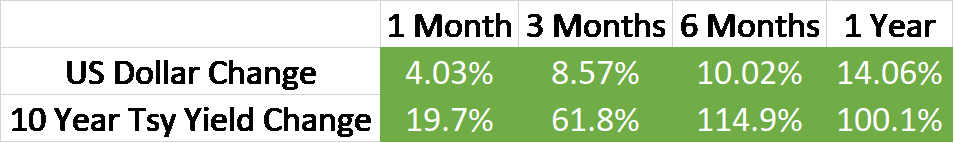

Stocks were very volatile in the wake of the Fed’s decision, soaring Wednesday and plummeting Thursday. But for the full week, it was the interest-sensitive sectors that took the biggest hit. Real estate was down over 3% as were long-term bonds (TLT). Commodities were up again but that was almost entirely from the energy complex with natural gas again up double digits. Nat Gas was down big Friday though (-8.4%) and upside momentum appears to have peaked. One other item of note in commodities is the action in copper which was down 3.2% last week. The copper to gold ratio, which tends to track the nominal 10-year rate, is threatening to break down.

(Click on image to enlarge)

That wide gap between the 10-year rate (solid line) and the copper to gold ratio will be resolved. How is something we can’t know in advance but if real rates keep rising and inflation expectations keep falling, the logical expectation would be for rates to fall and the ratio to rise (as gold falls). Gaps this wide are rare and one of the reasons I think a big move is coming.

Value stocks continue their outperformance with large and mid-value up on the week and small-cap down slightly.

Japan may be starting to make a bottom after the big fall in the Yen.

(Click on image to enlarge)

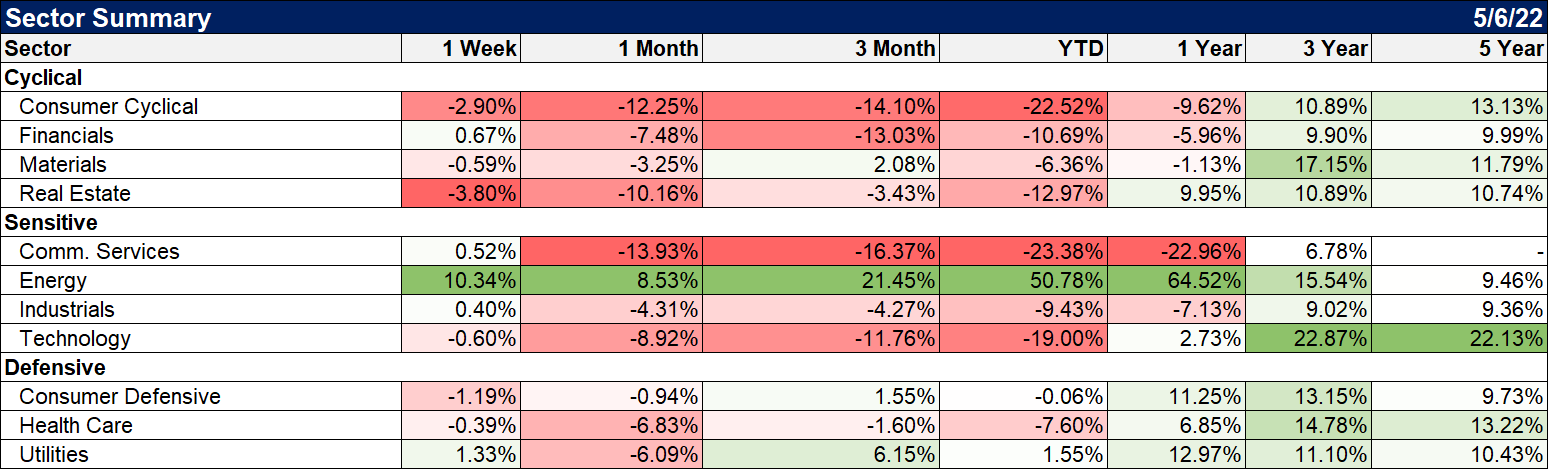

On a sector basis, there were several winners last week with Financials, Communications, Industrials, and Utilities all up on the week. The energy was the big winner again.

(Click on image to enlarge)

(Click on image to enlarge)

The real interest rate has been called the single most important price in an economy. It is a factor in just about every financial decision made by households, businesses, and governments. It is also not paid much attention by most investors and I think that is a big mistake. Real rates provide information that nominal bonds cannot and can help investors determine when moves in other markets are noise and when they really mean something. They provide critical information about investment and future real economic growth. And more than anything TIPS tell us about the investors who are buying and selling them, whether they are concentrating on protecting themselves from inflation or investing for the future. Right now it is a little less of the former and a little more of the latter. And we should all hope it continues.

P.S. I know there are a lot of problems with the TIPS market and the end of QE is probably having some impact on the market just as it is on nominal bonds. Other measures of real rates have not risen as much as the TIPS market but they all rely on lagged economic data, a lot of which will get updated this week. I suspect the TIPS market is just ahead of the data but we’ll see.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more