VWIGX: An International Fund For This Evolving Market

Image Source: Pexels

The amazing pace of news from the new administration since Jan. 20 has stunned analysts and investors alike. Among the array of new policy items, the threats, implementation, and potential effects of tariffs have been the most disruptive. One fund I like here is the Vanguard International Growth Fund (VWIGX), says Brian Kelly, editor of MoneyLetter.

Levies on our three biggest trading partners (Canada, Mexico, and China) have officially been applied, and now it looks like Europe will be part of the mix. The concept of widespread tariffs — all three trading partners have announced retaliatory tariffs on US goods — has stoked worries about inflation and (slower) economic growth.

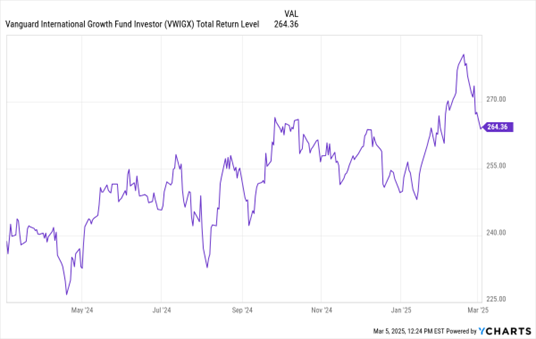

Vanguard International Growth Fund (VWIGX) Chart

Data by YCharts

These concerns are legitimate. However, as we mentioned in a previous issue, we don’t really know (and won’t know for some time) what the end effects will be. It is this uncertainty that has been fueling market volatility.

After two years of relatively smooth sailing, we’ve hit some turbulence. We get it, it’s not fun. But in a way, investors are spoiled. A 10% pullback is probably overdue after two consecutive years of 20%+ gains in the S&P 500. We have been talking about potential volatility for quite a while.

As for VWIGX, it can benefit from a pivot toward foreign market outperformance. The fund invests mainly in the stocks of companies located outside the US and is expected to diversify its assets in countries across developed and emerging markets. In selecting stocks, the fund's advisors evaluate foreign markets around the world and choose large-, mid-, and small-capitalization companies considered to have above-average growth potential.

My recommended action would be to consider buying VWIGX.

About the Author

Brian Kelly has enjoyed a long career in newsletter publishing and has maintained involvement with MoneyLetter continuously since 1984. He has been a member of the MoneyLetter Investment Committee for over 30 years.

As vice president and product manager for IBC/Donoghue Inc., and IBC USA (Publications) Inc., Mr. Kelly was responsible for all aspects of the MoneyLetter group of products including planning, marketing, fulfillment, customer service, and public relations.

More By This Author:

Agco Corp.: An Agriculture Stock For The Post-Mag-7 World

AL: An Aircraft Leasing Play With A Full Order Book

SPY: Stocks Sending Out More "Risk Off" Signals

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more