AL: An Aircraft Leasing Play With A Full Order Book

Image Source: Unsplash

Fewer aircraft returns in the quarter than expected resulted in lower end-of-lease revenue payments received. Non-GAAP EPS were $1.34, down 30.2%.

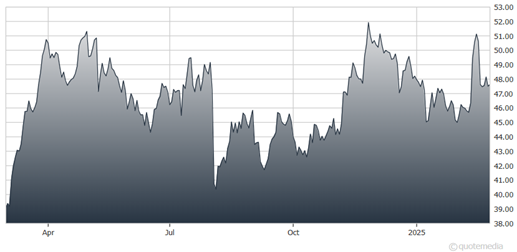

Air Lease Corp. (AL)

During the fourth quarter, Air Lease took delivery of 18 aircraft from its order book, representing $1.3 billion in aircraft investments. The company sold 14 aircraft for $544 million and ended the year with 489 aircraft in its owned fleet and $32 billion in total assets.

Air Lease reports $1.1 billion of aircraft is in its sales pipeline, including $1 billion in flight equipment held for sale as of Dec. 31 and $178 million of aircraft subject to letters of intent. Some 100% and 85% of its expected order book has been placed on long-term leases for aircraft delivering through the ends of 2026 and 2027, respectively. Plus, 62% of its entire order book is filled with deliveries through 2029.

At year-end, Air Lease had $29.5 billion in committed minimum future lease payments on the books, totaling $18.3 billion in contracted minimum rentals on the aircraft in its existing fleet and $11.2 billion in minimum future rental payments related to aircraft to be delivered between 2025 through 2029.

Recommended Action: Buy AL.

More By This Author:

SPY: Stocks Sending Out More "Risk Off" SignalsMicron: New High-Bandwidth Memory Tech Push Should Boost Sales Growth

Why 10-Year Yields Are Easing – And What It Means For Stocks

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more