SPY: Stocks Sending Out More "Risk Off" Signals

Image Source: Pexels

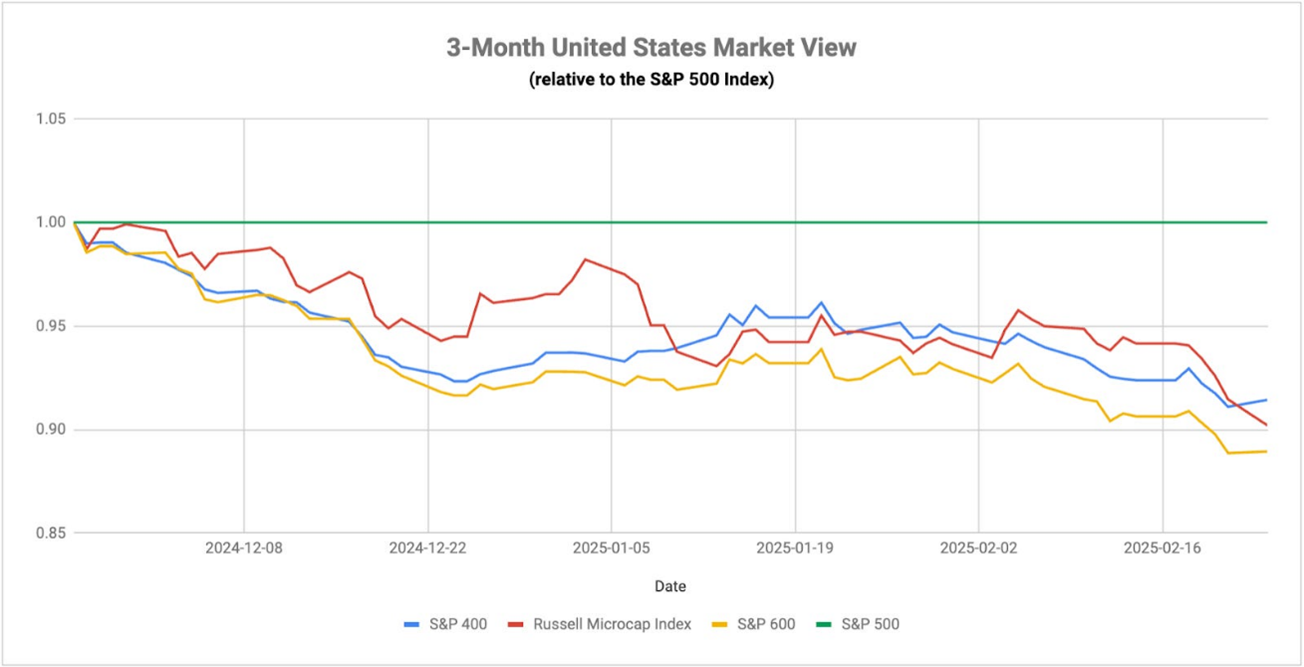

Look at the sectors and asset classes that have outperformed the S&P 500 over the past month or so: Utilities, consumer staples, healthcare, value, quality, and dividends. The market started pivoting defensive more than a month ago – and the shift has only gotten more decisive since then.

Plus, there are developed market and emerging market equities, long-term Treasuries, and gold. All of these things are beating the broader market. The “Magnificent Seven” is actually one of the worst-performing groups thus far in 2025. Don’t let the fact that the S&P 500 was hitting new all-time highs as recently as last week fool you.

The data is backing up the slowing-economy narrative. The composite PMI in the US plunged for the second straight month to its lowest level since September 2023. The services PMI actually slipped into contraction for the first time in two years.

January retail sales dropped by a much larger-than-expected 0.9%, the biggest single month decline in nearly two years. The University of Michigan consumer sentiment reading for January hit its lowest level since late 2023. Consumer confidence just registered its largest monthly decline since August 2021. Inflation expectations soared to their highest level since late 2023.

Despite concerns about inflation or credit conditions looming in the background, the markets always took solace in the idea that the US economy was healthy and the labor market was tight. Those assumptions may no longer apply.

The latest data suggests the economy is slowing down, and the DOGE layoffs are certainly giving the impression that jobs are at risk. Recent layoff announcements at Starbucks Corp. (SBUX), Chevron Corp. (CVX), Workday Inc. (WDAY), and Salesforce Inc. (CRM) won’t help. The actual number of those affected probably won’t be known for months. But if we see a reversal in net job creation and a rise in the unemployment rate, a broad risk-off environment may be imminent.

More By This Author:

Micron: New High-Bandwidth Memory Tech Push Should Boost Sales Growth

Why 10-Year Yields Are Easing – And What It Means For Stocks

Crypto 101: How To Invest (And Why)

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more