Why 10-Year Yields Are Easing – And What It Means For Stocks

Image Source: Pixabay

A little over a month ago as Donald Trump was about to take office as President, the 10-year Treasury note yield hit 4.80%. Almost every economist and strategist was writing and putting out that the 10-year would hit 5% due to inflation from tariffs. I disagreed – and I still do, writes Ryan Edwards, author at The Investing Authority.

I wrote a piece a month ago titled, “The 10-year will not pass 5%.” I wrote how the inflation fears regarding tariffs were overblown and that a 5% 10-year yield would not hold under current market conditions.

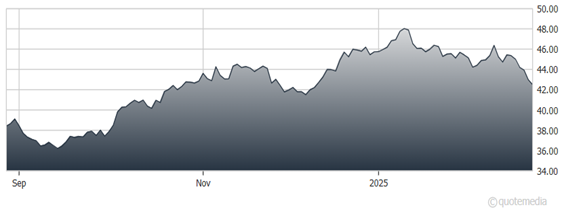

CBOE Interest Rate 10-Year Treasury Note Index Chart

Scott Bessent was confirmed as Treasury Secretary a few weeks ago, and the administration started talking about their focus on the 10-year yield. This made sense for Trump, as he wants to lower mortgage rates and the 10-year is the interest rate linked to mortgages.

As the administration's focus has shifted to the 10-year, the rate has dropped from 4.80% to 4.25% recently. The main reason the rate has dropped, in my opinion, is fear of an economic slowdown. Recent economic data has been relatively weak, and recent consumer confidence reports have also been lacking.

Some investors have stated that we could be facing stagflation. I disagree with this notion, and I believe that even if growth slows slightly, inflation will not rise. I personally believe that if bond investors were worried about inflation, the 10-year would be much higher than it is. It doesn’t make sense that the 10-year yield would decrease 11.5% if bond investors truly believed that inflation would reignite.

The 10-year yield declining is also positive for equities, and it will be a helpful catalyst for the market once we get out of this current-period tariff scare. I also think that the fear of slowing economic growth is overblown.

We will likely see a continued period of choppiness in the market. With constant news and updates from Washington, investors will continue to stay on edge. But I believe that the market will understand more of the Trump administration’s policies by the summer, and the market will ultimately have a good year.

About the Author

Ryan Edwards is a junior at Florida Gulf Coast University, double majoring in Finance and Economics. Mr. Edwards writes a dual weekly blog about the economy and financial markets. He has also hosted many interviews for his blog with individuals in the investment management space, including Liz Ann Sonders, Tom Lee, and Josh Brown.

Mr. Edwards is the lead contributor at The Investing Authority and also writes for Wolf Financial. He focuses on the global and domestic economy and how it impacts financial markets. He tries to bring a Gen Z perspective to finance and investing.

More By This Author:

Crypto 101: How To Invest (And Why)Air Lease Corp: An Aircraft Leasing Play With A Full Order Book

Buffett: Key Investor Takeaways From Berkshire's Latest Annual Letter

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more