Air Lease Corp: An Aircraft Leasing Play With A Full Order Book

Image Source: Unsplash

Air Lease Corp. (AL) delivered better-than expected results in its fourth quarter ended Dec. 31, 2024, with revenues of $712.9 million, down 0.5% from Q4 2023, and GAAP EPS of $0.83, down 56.1%. Ironically, the EPS decline was due to demand trends, notes Doug Gerlach, editor of Small Cap Informer.

Fewer aircraft returns in the quarter than expected resulted in lower end-of-lease revenue payments received. Non-GAAP EPS were $1.34, down 30.2%.

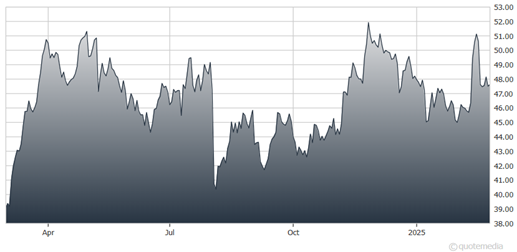

Air Lease Corp. (AL) Chart

During the fourth quarter, Air Lease took delivery of 18 aircraft from its order book, representing $1.3 billion in aircraft investments. The company sold 14 aircraft for $544 million, and it ended the year with 489 aircraft in its owned fleet and $32 billion in total assets.

Air Lease reported $1.1 billion of aircraft is in its sales pipeline, including $1 billion in flight equipment held for sale as of Dec. 31 and $178 million of aircraft subject to letters of intent. Some 100% and 85% of its expected order book has been placed on long-term leases for aircraft delivering through the ends of 2026 and 2027, respectively. Plus, 62% of its entire order book is filled with deliveries through 2029.

At year-end, Air Lease had $29.5 billion in committed minimum future lease payments on the books, totaling $18.3 billion in contracted minimum rentals on the aircraft in its existing fleet and $11.2 billion in minimum future rental payments related to aircraft to be delivered between 2025 through 2029.

My recommended action would be to consider buying shares of Air Lease Corp.

About the Author

Doug Gerlach is the senior equity analyst with Equity Research Service, a division of the National Association of Investors (NAIC), and editor-in-chief of its stock newsletters including the award-winning Investor Advisory Service, the market-beating SmallCap Informer, and a dividend-focused newsletter.

NAIC is also the home of the BetterInvesting Stock Selection Guide and other tools for stock analysis including StockCentral.com and MyStockProspector.com. Mr. Gerlach is the author of six books, including Investment Clubs for Dummies and The Armchair Millionaire.

More By This Author:

Buffett: Key Investor Takeaways From Berkshire's Latest Annual LetterCELH: Alani Nu Deal Gives This Energy Drink Maker A Jolt

KMI: New Pipeline Shows Attractiveness Of US Midstream Energy Plays

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more