Agco Corp.: An Agriculture Stock For The Post-Mag-7 World

Image Source: Pexels

The world is not coming to an end. It is starting to reprice, though, and the excesses will be disgorged. I've previously said that the Mag 7 was the same as the Nifty Fifty. There is nothing new under the sun. Meanwhile, I like Agco Corp. (AGCO), says Kelley Wright, editor of IQ Trends.

Founded in 1990 and headquartered in Duluth, Georgia, Agco is a leading global manufacturer and distributor of agricultural equipment and precision agriculture technology. Agco operates across approximately 140 countries and offers a diverse range of products.

They include high-horsepower tractors for large-scale farming operations, utility and compact tractors for smaller farms, and specialized equipment for various agricultural industries. The company also provides combines, hay tools, forage equipment, grain storage systems, and precision agriculture solutions to enhance farming efficiency and sustainability.

The company markets its products under several well-known brands, such as Fendt, MasseyFerguson, Valtra, and Precision Planting. These brands cater to different market segments.

Agco faces competition from several key players in the agricultural machinery industry, primarily Deere & Co. (DE) and CNH Industrial NV (CNH), which offer similar products and services. Agco’s strength lies in its comprehensive range of products and its focus on precision agriculture technology.

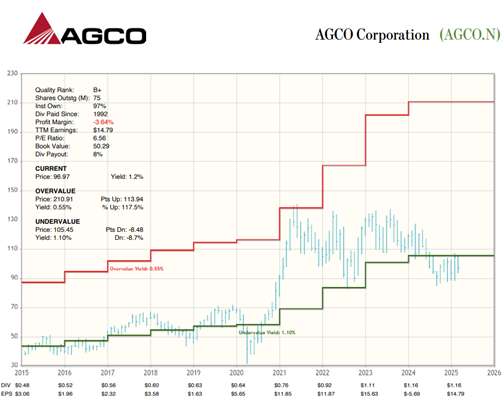

The ROIC, FCFY, and PVR are 8%, 0%, and 1, respectively. Economic Earnings are $0.02 vs. $14.79 reported (GAAP). Economic Book Value = $102.20 per share.

My recommended action would be to consider buying shares of Agco Corp.

About the Author

Kelley Wright entered the financial services industry in 1984 as a stock broker, first with a private investment boutique in La Jolla and later with Dean Witter Reynolds. In 1990, he left the retail side of the industry for private portfolio management. In 2002, Mr. Wright succeeded Geraldine Weiss as the managing editor of the Investment Quality Trends newsletter as well as the chief investment officer and portfolio manager for IQ Trends Private Client.

His commentaries have been published in Barron's, Forbes, BusinessWeek, Dow Jones MarketWatch, The Economist, and many other business and financial periodicals. Mr. Wright is an active speaker at trade shows and investment conferences, and is a frequent guest and contributor to radio and CNBC. He is the author of Dividends Still Don't Lie, which was published in February, 2010, by John Wiley & Sons, Inc.

More By This Author:

AL: An Aircraft Leasing Play With A Full Order BookSPY: Stocks Sending Out More "Risk Off" Signals

Micron: New High-Bandwidth Memory Tech Push Should Boost Sales Growth

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more