Value Stock Outperformance Might Continue

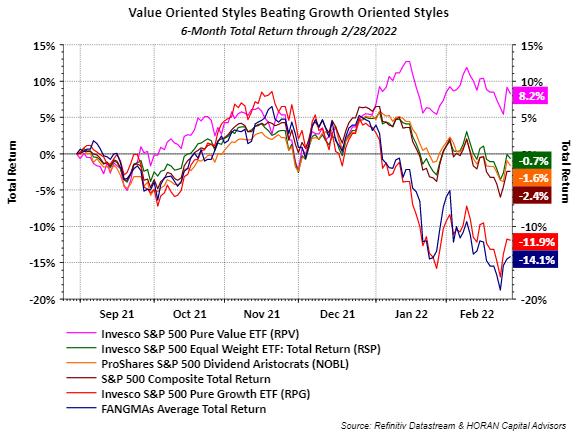

With each passing day, it seems inflation continues to remain stubbornly elevated. The war in Ukraine is contributing to the inflationary pressure as sanctions on Russia are impacting the energy markets. Also, Ukraine and Russia are leading exporters of grain and wheat and higher prices are being felt in this area as well. Certainly, this conflict is negatively impacting many asset classes; however, before the crisis erupted a transition was underway where value stocks began to outperform growth stocks as seen below. The only positive returning asset class displayed on the table is the Invesco S&P 500 Pure Value Index (RPV). The worst performance on the chart, down 14.1%, is the blue line representing the average return of the FANGMA stocks, i.e., Facebook or Meta Platforms (FB), Amazon (AMZN), Netflix (NFLX), Alphabet or Google (GOOGL), Microsoft (MSFT) and Apple (AAPL).

Driving some of this rotation out of growth stocks into value stocks is higher inflation and higher market interest rates. Growth stock investors are willing to pay a higher price for a company's stock where its earnings are growing at a high rate. In an inflationary environment though, the growth stock's future earnings are worthless in today's dollars. The result is the market revalues the growth stock lower. For value stocks though, a greater portion of their earnings are being earned near term and can be reinvested at the higher rates of return, all else being equal. As a comparison, RPV's forward price-earnings ratio (FPE) is 10.8 while RPG's FPE is 23.9. The price to book ratio for RPV's holdings is 1.3 versus 7.4 for RPG. Clearly, the growth stock portfolio, RPG, trades at a higher valuation level than RPV's.

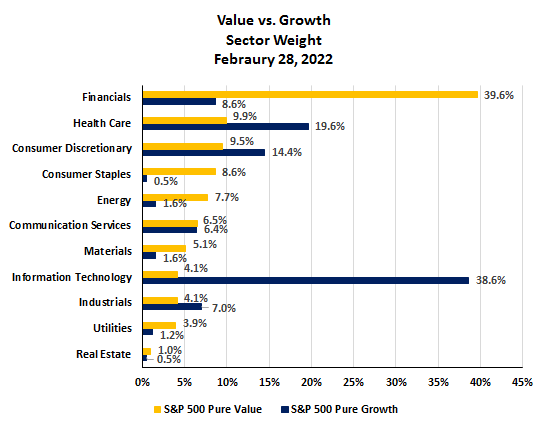

The recent outperformance of value compared to growth is the result of differing bets for each style. The below chart shows the sector weights of the Invesco S&P 500 Pure Value ETF (RPV) versus the Invesco S&P 500 Pure Growth ETF (RPG). The largest sector weighting for RPV is Financials at nearly 40%. For RPG the largest sector is Information Technology. The return for the Financials sector in RPV was 7.5% over the last six months while RPV's return for the same sector was 2.2%. The other sector that was a large contributor to value's outperformance is the Health Care sector. RPV's Health Care sector return was 15.2% over the last six months versus RPG's Health Care sector return of a negative 21.1%. Some of the growth stocks that benefited from COVID early on saw their prospects weaken as the virus has weakened and thus contributed to RPG's underperformance.

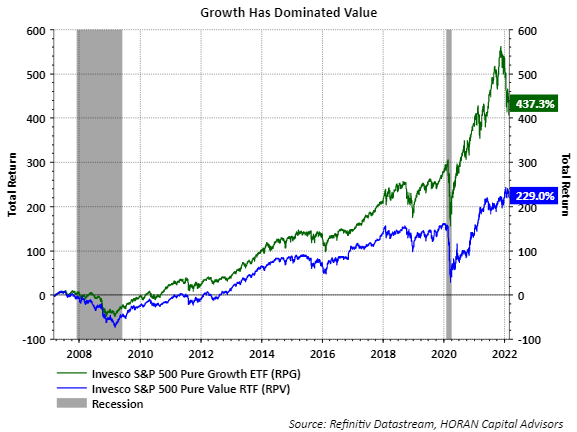

Certainly, the favorable return for value could be short-lived, however, growth has dominated returns since the end of the financial crisis in 2009 as seen in the below chart. Also, higher interest rates and elevated inflation historically tilt the scale towards value outside of recessions. For investors, it does seem appropriate to take more of a blended approach to one's investments as one looks ahead even though the value style could have more upside. A number of growth stocks are down significantly from their highs and may actually be attractive investments that investors may want to evaluate. And just because a stock down significantly does not mean the stock is still not overvalued.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more