Tuesday Talk: Monday, Washday

Monday was something of a wash-out as concerns about the war in Ukraine, COVID in China and Fed action continued to weigh on investors. Stocks fell and Fed yields climbed.

The S&P 500 closed at 4,413, down 76 points or 1.7 percent, the Dow closed at 34,308, down 413 points or 1.2 percent and the Nasdaq Composite closed at 13,412, down 299 points or 2.2 percent. AT&T was the top loser yesterday (in action related to the finalization of the WarnerBros-Discovery spin-off), followed by energy and technology issues.

Chart: The New York Times

In morning trading S&P market futures are trading up 1/4 point, Dow futures are trading down 1 point and Nasdaq 100 futures are trading up 4 points. U.S. Treasury yields were largely higher at the close of trading on Monday.

Chart: The New York Times

Contributor Tyler Durden headlines, European Companies Plead China To Revise "COVID Zero" As Beijing Vows Stronger Policies To Reverse Economic Collapse.

"according to China television, the country's outgoing Premier Li Keqiang told some local officials that China will study and adopt stronger economic policies as needed. And needed they are, because according to Li, downward pressure on the economy is increasing and is in part from international and domestic changes that are beyond expectations.

Li urged stabilizing employment, consumer prices and keeping the economy in reasonable range; the premier also said that China must stabilize the economy via better implementation of existing macroeconomic policy. Li also urged local officials to accelerate release of coal capacity, ensure transportation and port operations.

One place which will be keeping a close eye on China’s policy response is Europe: according to the European Union Chamber of Commerce in China, the country's COVID lockdowns have caused “significant disruptions” for many companies and Beijing should look to Singapore as a model to spur economic growth.

A flash survey of German companies showed that China’s COVID Zero strategy has consequences “extending from logistics and production all the way along the entire supply chain within China,” Joerg Wuttke, the president of the chamber, wrote in a letter to Vice Premier Hu Chunhua.

51% of German companies’ logistics and warehousing and 46% of their supply chains are “completely disrupted or severely impacted” by China’s COVID situation, Wuttke wrote in the letter, which was seen by Bloomberg News and confirmed by the Chamber."

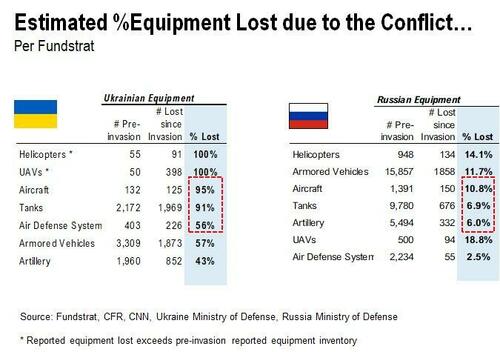

In a piece with some interesting information TalkMarkets contributor David Pinsen notes that the impact of the Ukraine war on Russia may be less severe than what many media outlets report, Economic War Against A Real Economy.

"Judging by the coverage in most of the Western media, Russia is getting soundly beaten in its war with Ukraine. That may be an artifact of the West's (and Ukraine's) superiority at electronic media...the picture looks starkly different. "

"Over the weekend, the Financial Times expressed incredulity that "contrarian" fund manager Dave Iben hadn't written down his position in Gazprom--which has shipped record amounts of gas to Europe throughout the war--to zero."

Contrarian fund manager cautions against writing off Russia assets https://t.co/z4Cm226dxq

— Financial Times (@FT) April 10, 2022

"Similarly, President Biden quipped after levying unprecedented sanctions on Russia that the ruble was now "rubble", but Russia's currency has already recovered to pre-war levels. It appears that the laptop class in the West has underestimated the resilience and size of Russia's economy because it's more based on the physical world than ours is."

See the rest of Pinsen's article for more quips.

TM contibutors Chris Turner, Francesco Pesole and Frantisek Taborsky note that markets are Bracing For US March CPI Reading.

"All eyes today are on the US March CPI reading, expected to hit a new cycle high at 8.4% year-on-year. A number in that vicinity should maintain aggressive Fed tightening expectations and keep the dollar supported across the board...

USD: High CPI to support aggressive Fed

Consensus expects today's US March CPI release to push up to a new cycle high of 8.4% year-on-year and core rising to 6.6% year-on-year. Although it seems extreme, this kind of number should support market expectations that the Fed will take the policy rate towards the 2.50% area by year-end. Notably, market-derived inflation expectations such as the 5Y5Y inflation swap forward and inflation-protected Treasuries still show longer-term inflation expectations on their highs in the 2.80-3.00% area. This will serve as a reminder that the Fed is still in the mode of gaining control of inflation expectations – i.e. sounding very hawkish.

On the subject of the Fed sounding hawkish, Fed dove Lael Brainard speaks at 1810CET today. Recall how she triggered a sell-off in the US Treasury market last week by suggesting the Fed needed to shrink its balance sheet and fast. US 10 year Treasury yields are now close to 2.80%, with 3.00% beckoning.

A hawkish Fed remains very much behind dollar strength – as is the war in Europe. DXY is now nudging above the 100 area and we see no reason why it cannot continue to push on to 100.80/101.00. Equally, USD/JPY has broken clear of the 125.00 area and gains could accelerate on a technical break of 125.85 – the high in 2015."

Contributor Danielle Park cautions, in an interesting article, that Fast Price Moves Break Things and investors should beware of the bear.

"Gasoline prices leaped 45% over the past year, and the UN Food and Agriculture food price index, rose 34 percent to an all-time high in March. In the process, expectations for central bank rate hikes have triggered an abrupt sell-off in financial markets...

Fast price moves tend to break things, especially when market participants are highly leveraged, and long-duration assets are most sensitive to the rate of change.

Equities have a virtually infinite duration (no maturity dates), so it’s not surprising that the average stock is down significantly. This is especially true in the most rate-sensitive areas. Here’s some of the downside progress from key sectors as of Friday’s close:

- Auto parts: –36%

- Consumer electronics: –36%

- Homebuilders: –33%

- Airlines: –32%

- Trucking: –24%

- Asset managers: –21%

- US Banks: –19%, Canadian financials (XFN) -7%

- Russell 2000: –18%

- Retailers: –16%

- Transports: –15%

- Consumer services: –14%

- Rails: –11%

This Treemap of S&P 500 component returns year-to-date shows individual losses in red (from Markets and Mayhem) and the fewer winners (so far) in green.

Mean reversion is the law of market cycles, and the higher the starting valuation, the deeper the bear market to follow."

Parks has additional data points and charts in the full article.

In today's Where To Invest Department contributor Sweta Killa finds 4 ETFs To Make The Most From A Strong Dollar.

"The Federal Reserve raised the interest rates by 25 bps for the first time in three years and is expected to follow a more aggressive path in raising rates to fight the 40-year high inflation. Fed Chair Jerome Powell showed confidence that the American economy is strong enough to withstand a tighter monetary policy. The move indicates a a healthy economy and is expected to pull in more capital into the country and lead to the appreciation of the U.S. dollar...Fed funds futures traders expect the Fed's benchmark rate to rise to 2.60% by February from the current 0.33% According to the CME Group's FedWatch, traders are betting on half-point moves higher in the Fed Funds rate at the next three Fed meetings in May, June and July."

"Investors seeking to make a play from this trend could consider ETFs such as Invesco DB US Dollar Index Bullish Fund (UUP), WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU), iShares Russell 2000 ETF (IWM) and iShares Currency Hedged MSCI EAFE ETF (HEFA)."

"UUP

Invesco DB US Dollar Index Bullish Fund is the prime beneficiary of the rising dollar as it offers exposure against a basket of six world currencies. This is done by tracking the Deutsche Bank Long USD Currency Portfolio Index - Excess Return plus the interest income from the fund’s holdings of U.S. Treasury securities. In terms of holdings, Invesco DB US Dollar Index Bullish Fund allocates nearly 57.6% in euro and 25.5% collectively in the Japanese yen and British pound.

The fund has so far managed an asset base of $993.2 million while seeing an average daily volume of around 1.8 million shares. UUP charges 78 bps in annual fees and has a Zacks ETF Rank #2 (Buy) with a Medium risk outlook.

USDU

WisdomTree Bloomberg U.S. Dollar Bullish Fund is another way to play the rise in dollar directly. It offers exposure to the U.S. dollar against a basket of foreign currencies by tracking the Bloomberg Dollar Total Return Index. WisdomTree Bloomberg U.S. Dollar Bullish Fund exhibits strong negative correlations to international equity and bond portfolios.

WisdomTree Bloomberg U.S. Dollar Bullish Fund has amassed $436.7 million in AUM and trades in a lower volume of about 346,000 shares per day on average. It charges 50 bps in annual fees.

IWM

A strong dollar provides an edge to the domestic-focused companies as small caps do not have much exposure to the international market. iShares Russell 2000 ETF will benefit from a rising dollar. It provides exposure to a broad basket of 2,0215 stocks by tracking the Russell 2000 Index, with none holding more than 0.52% of assets. iShares Russell 2000 ETF is the most popular and liquid choice in the small-cap space, with AUM of $60.1 billion and an average trading volume of around 28.1 million shares.

iShares Russell 2000 ETF charges 19 bps in annual fees and has a Zacks ETF Rank #3 (Hold) with a Medium risk outlook.

HEFA

The strength in the greenback would compel investors to recycle their portfolios into the currency-hedged ETFs. For those seeking exposure to the developed market, iShares Currency Hedged MSCI EAFE ETF could be an intriguing pick. It targets the developed international stock market in Europe, Australasia, and the Far East with no currency risk. iShares Currency Hedged MSCI EAFE ETF tracks the MSCI EAFE 100% Hedged to USD Index.

The fund has AUM of $3.4 billion and trades in a solid volume of 708,000 shares. HEFA charges 35 bps in fees per year from investors and has a Zacks ETF Rank #3 with a Medium risk outlook."

As always, caveat emptor.

I'll be back on Thursday. Take some time to enjoy the Spring (or Fall) weather wherever you are.