Trustworthy Companies Continue To Outperform 12+ Years And Counting

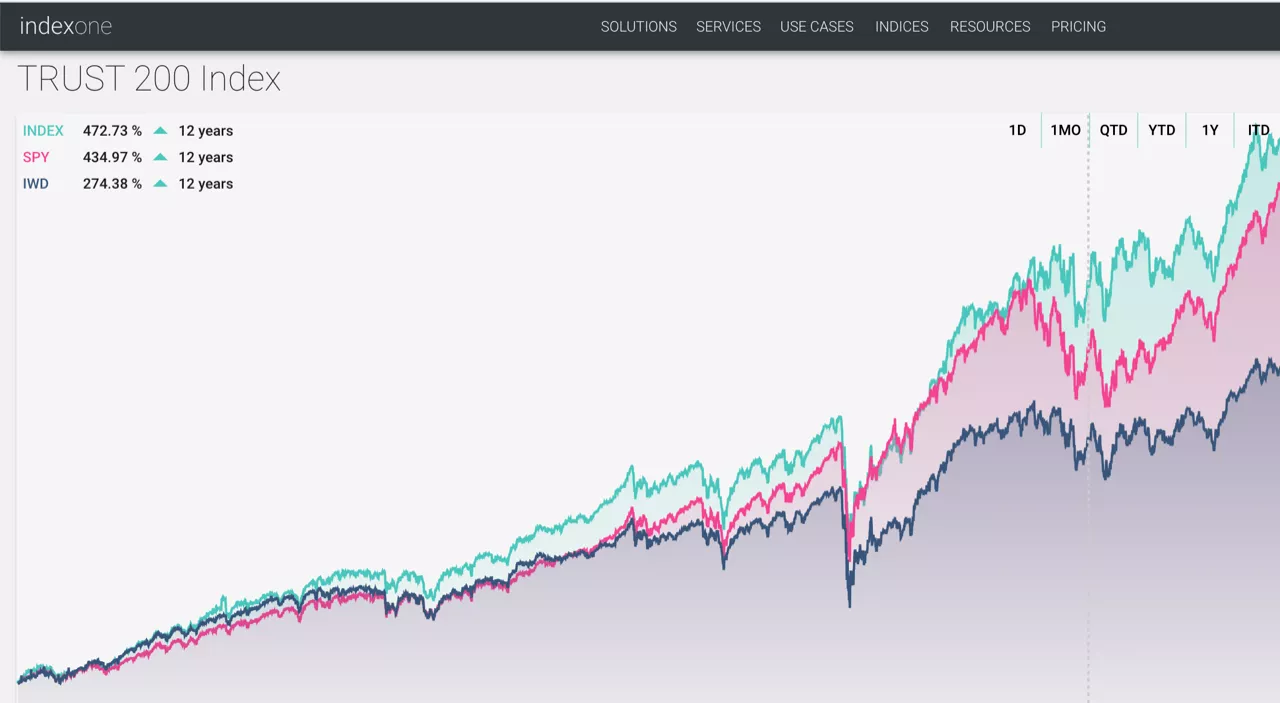

How much time should institutional and individual investors allocate to evaluating the quality of governance, or what we call the trustworthiness of public companies? Review this chart and read on.

(Click on image to enlarge)

The green line on the top of the chart is the performance of our Trust 200 Index over the past 12+ year vs. both the SPY & IWD.

A growing body of evidence shows increasing correlation between trustworthiness and superior financial performance. Over the past decade, a series of qualitative and quantitative studies have built a strong case for senior business leaders to make stakeholder trust building a high priority. For example:

- Research shows that 30% of a company's value is at risk where trust is broken with the public and external stakeholders. Those CEOs who have a proactive approach to crisis planning view simulation training and drills as an investment. They also see it as a way to test and build the trust and confidence of their teams. It hones and develops leadership and communication skills, builds coherence and cross-functional support. *McKinsey & Company research in Connect: How companies succeed by engaging radically with society – 2015 - John Browne, Robin Nuttall, Tommy Stadlen

Building a well governed trustworthy business will improve a company’s profitability and organizational sustainability.

History and Fast Facts

In the wake of the 2008 financial crisis Trust Across America-Trust Around the World (TAA-TAW) began to develop a Framework called FACTS, seeking the input from a cross-silo multidisciplinary team of professionals from leadership, compliance and ethics, governance, accounting, finance, HR, corporate social responsibility, ESG, and other disciplines, The goal was to create a sustainable model that would reduce corporate risk and maximize profitability. FACTS was finalized in 2010. It evaluates, on an annual basis, the trustworthiness of over 1500 US public companies.

How we describe trustworthiness: In the context of FACTS we describe trustworthiness as “the outcome of principled behavior”as outlined in our Framework. We do not attempt to define it.

Methodology: Now in its 14th year, Trust Across America performs an independent annual analysis using its rigorous and unique FACTS Framework. Companies do not participate, nor do they know they are being analyzed.

Framework Components: The FACTS Framework incorporates proprietary metrics and evaluates the trustworthiness of public companies based on five equally weighted indicators that form the FACTS acronym: Financial stability, Accounting Conservativeness, Corporate Integrity, Transparency & Sustainability.

Our analysis has never identified a “perfect” company. In fact, on our 1-100 scale, it is unusual for a company to score above an 80%. For example, in 2021, 59 companies in our database scored a 70% or above.

Trust 200 Index

In June 2022 we retained Index One, a global back testing and index creation firm based in London to evaluate FACTS versus major US indexes. They were given ten years of annual FACTS scores for 800+ of the largest companies. More information on Index One can be found at www.indexone.io

Methodology and Results

iShares Russell 1000 Value ETF (IWD) was chosen by independent consultants as the most suitable comparison.

Through its focus on “values with value” FACTS screens out high price to earnings and high price to sales companies found in growth indexes.

- Annual rebalancing was applied

- Top Ranked 50 and 100 companies were compared to the IWD

- The top 50 FACTS® companies outperformed IWD by 47%, 15.46% vs.10.51%

- The top 100 FACTS® companies outperformed IWD by 52.9%, 16.07% vs. 10.51% for IWD

Index One also performed the same analysis using the SPDR S&P 500 (SPY) ETF.

- 16.07% (50 companies) and 15.46% (100 companies) respectively vs. 15.27% for SPY.

- FACTS® companies outperformed despite trading at significantly lower valuations as measured by price to earnings and price to sales.

Achieving a higher return than SPY with lower risk over these last twelve years strengthens the “Business Case for Trust.”

2024 Trust 200 Index Data Details

Our Index is rebalanced on January 1st of each year. Here are some facts about the 2024 companies comprising the index.

- The average market cap per company is $145 billion. The mean is $33 billion.

- The average daily PVOL is $993 million, the median is about $220 million.

- Virtually all companies have positive annual operating margins, with an average of 14%.

- Virtually every company in the index has annual positive revenue growth, with an average of 11%.

- Approximately 50% of the companies have a price-to-sales below 2.

- Approximately 75% of the companies pay a dividend, with 25% of them greater than 2%, with the average 1.4%.

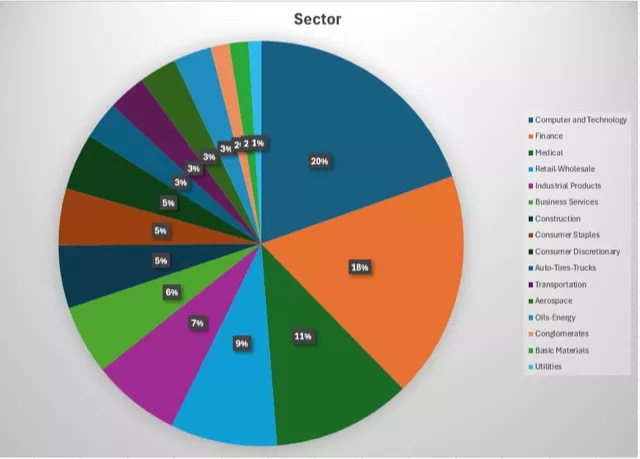

This is a chart of the sector breakdown.

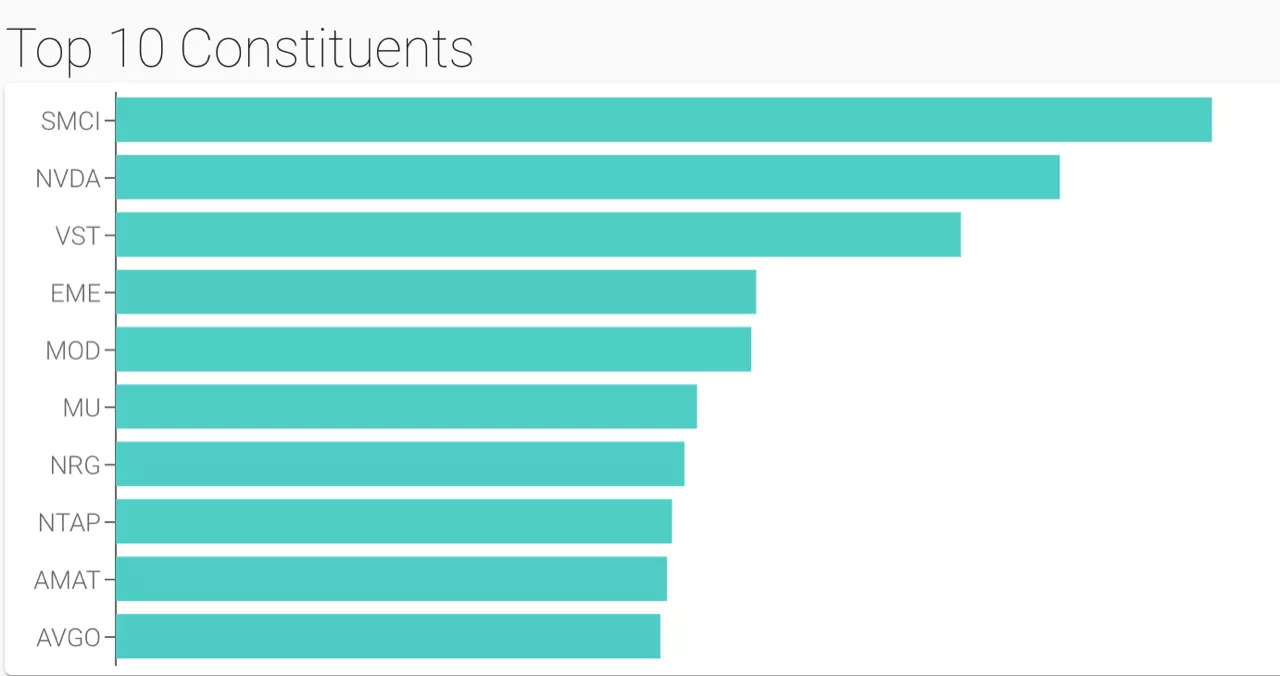

Our Current "Top 10" in the Trust 200 Index

Even after a time of dramatic returns over the past several years, vast amounts of money remain parked in low yielding money market accounts and other underperforming investments. By delivering a time tested and “beyond reproach” strategy to investors combining the key drivers of good corporate governance or trustworthiness, Trust Based Investing can become the solution that both the industry and the public has been seeking.

Trust Based Investing provides the following:

- Companies have proven through a rigorous analysis that they are well governed and trustworthy and represent lower investment risk.

- Investors can be assured that both business and investment decisions are being made ethically.

- The most trustworthy companies have stable and strong investment returns.

- A virtuous cycle is created. As investment money flows into the hands of these companies, other companies will want to follow suit and become more trustworthy.

More By This Author:

How Much Trust Do You Have In Your Stock Portfolio

Do You Trust Your Portfolio To Outperform The Market?

ESG Has A Trust Deficit And Here’s Why

For more information contact Barbara Kimmel, Founder Trust Across America at barbara@trustacrossamerica.com

Very, interesting, thanks.