Trump 2.0 Vs Trump 1.0 - The First 200 Days

Image Source: Pixabay

With little fanfare last Friday, President Trump’s second term in office reached the 200-day mark. As with anything related to Donald Trump, there wasn’t a dull moment during the first 200 days of the President’s second term, but despite the volatility and massive swings, the S&P 500 and most sectors made it through with gains.

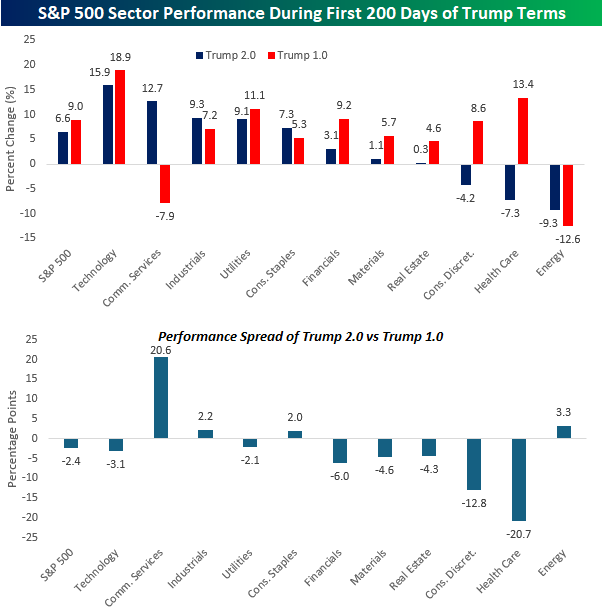

The chart below compares the performance of the S&P 500 and all eleven sectors during the first 200 days of President Trump’s two terms. The S&P 500’s 6.6% gain this time around trailed the 9.0% gain during Trump 1.0 by 2.4 percentage points. At the sector level, eight gained during the first 200 days of Trump 2.0 compared to nine sectors with gains in the first go around. The second chart below shows the performance spread for the S&P 500 and each sector during each period, and for most sectors, the performance disparity has been relatively narrow at less than five percentage points.

The big exceptions were Communication Services, Consumer Discretionary, and Health Care. Communication Services is performing much better this time around than during Trump 1.0, while the latter two sectors are performing much worse. The underperformance of Consumer Discretionary is largely the result of weakness in Tesla (TSLA), which is ironic given that the stock surged immediately after the election on expectations that Musk would be one of the biggest beneficiaries of a Trump Presidency.

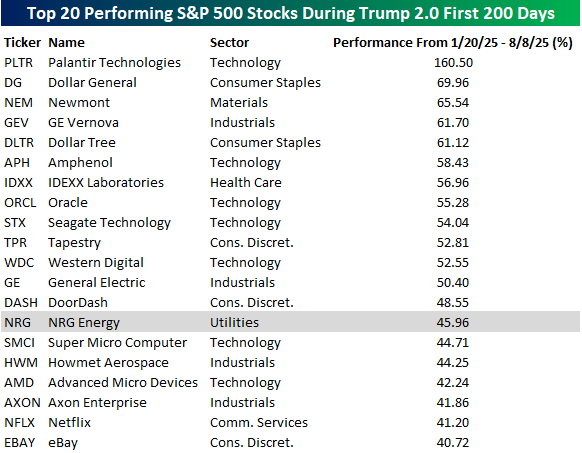

In the tables below, we list the 20 best-performing stocks during the first 200 days of President Trump’s two terms. Starting with Trump 2.0, all 20 of the best-performing stocks have rallied at least 40%, but the far leader has been Palantir (PLTR), which is up over 160%. That’s over 90 percentage points more than the next closest stock – Dollar General (DG). Besides PLTR, six more of the top 20 performing stocks are from the Technology sector, which is more than any other sector, and the only ones with multiple stocks are Industrials (4), Consumer Discretionary (3), and Consumer Staples (2).

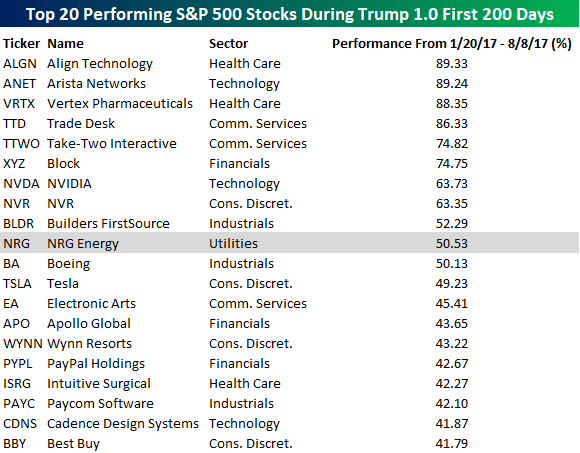

During Trump 1.0, the top-performing stock in the first 200 days was from the Health Care sector as Align Technology (ALGN) surged 89.3%. Behind ALGN, Arista Networks (ANET), Vertex Pharma (VRTX), and Trade Desk (TTD) were all up over 80%. In terms of sector representation, Consumer Discretionary led the way with four, followed by Communication Services, Financials, Health Care, Industrials, and Technology had three each.

One of the most surprising aspects of the two lists to us was that of all the stocks listed, there was only one that showed up on both lists, and it was Utility! That’s right, NRG Energy (NRG) rallied 50.5% during the first 200 days of Trump 1.0 and 46.0% during Trump 2.0. If you had asked us to guess, NRG wouldn’t have been anywhere near the top of our list!

More By This Author:

Large-Cap Left Behinds

Economic Optimism Returns Among Small Businesses

The Rich Get Richer

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more