Economic Optimism Returns Among Small Businesses

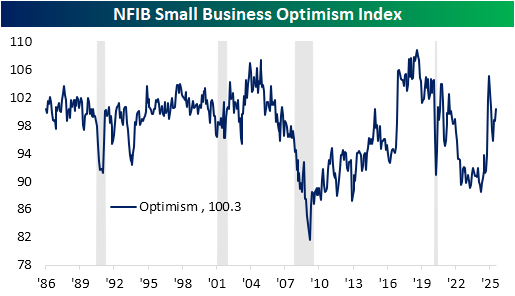

This morning's release of the NFIB's Small Business Optimism Index saw a return in positivity. After peaking post-election at 105.1 in December, the headline index went on to fall to a low of 95.8 in April and has since erased about half of that decline. At 100.3 in July, it is back above the historical median and at the highest level since February.

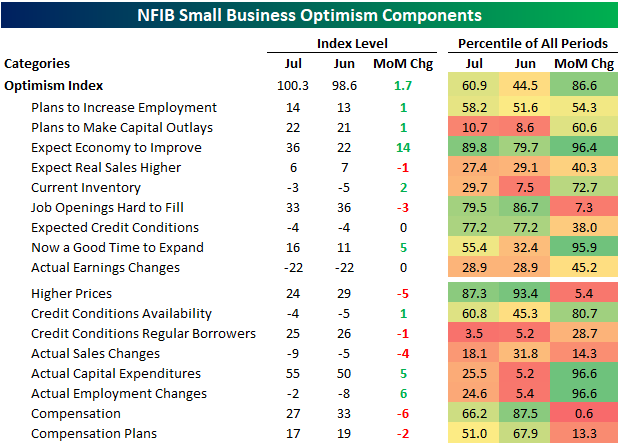

As shown in the table below, breadth throughout the sub-indices of this month's report was solid, with five inputs to the optimism index rising versus two falling and the remaining two going unchanged month over month. Categories that were not inputs to that headline number saw weaker breadth. Of those, five of the eight were lower month over month, including a couple of bottom decile declines from categories like higher prices and compensation.

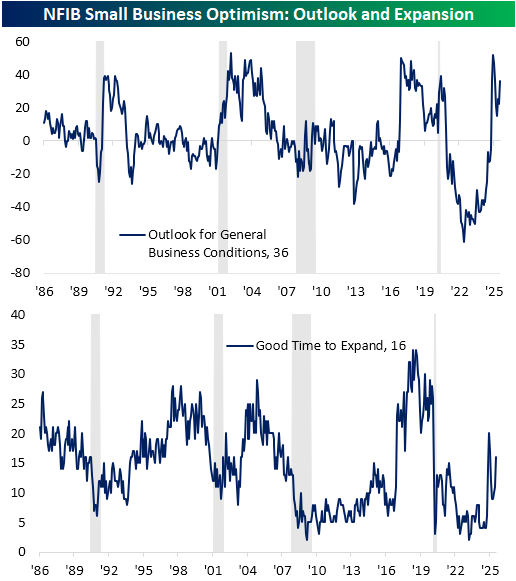

Of the rising categories, two of the most notable were for expectations for the economy to improve and evaluating now as a good time to expand. For the former, the index surged 14 points month over month to 36. While that is only the highest reading since February and the largest one-month gain since December, the monthly gain ranks in the 95th percentile of all monthly moves on record. Similarly, the 5-point jump in seeing now as a good time to expand also ranks highly in the 95th percentile of monthly changes for that index.

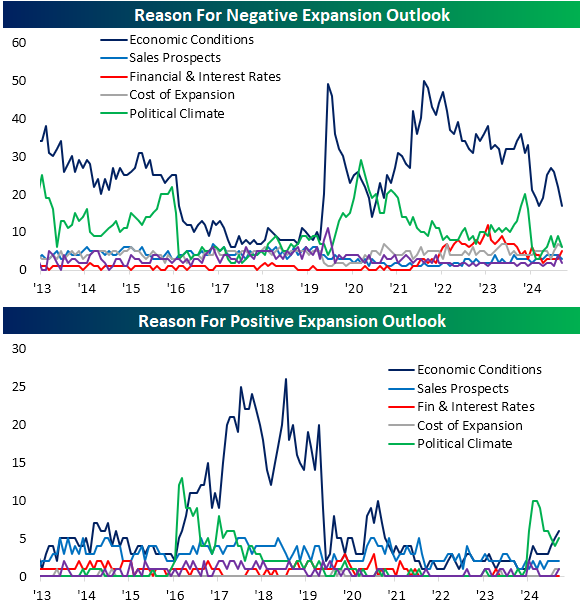

Those two indices appear to be correlated. In other words, when small businesses see the economy as healthier, they will, in turn, see it as a good time to expand. This comes up when looking at the given reasons for different expansion outlooks. For both positive and negative outlooks, economic conditions were the leading reason given as each one was at or tied with multi-year highs and lows. Additionally, as we often note, the NFIB survey has the downside of being politically sensitive. Typically, a Republican administration translates into stronger sentiment and vice versa. With regards to positive expansion outlooks, the political climate is the second most popular reason, and current levels—even though they are off recent highs—are around some of the most elevated readings since the first half of the first Trump administration.

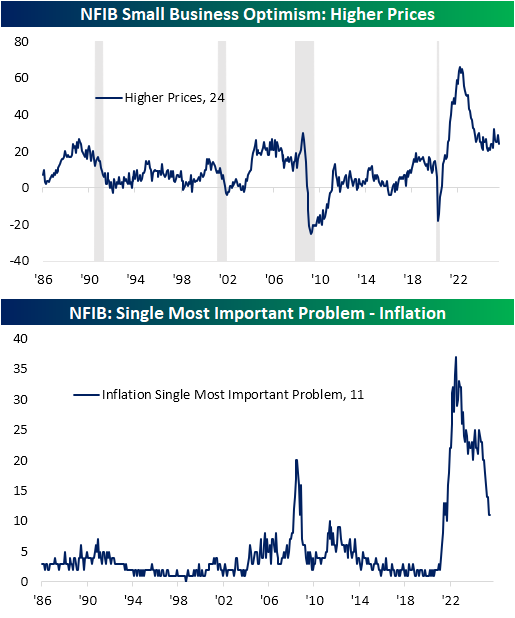

As for indices that declined, one of the bigger drops was for higher prices. While it may not jump out in looking at the chart of the index, that five-point decline ranks as a 5th percentile monthly move for its history, and current levels remain in the middle of the past couple of years' range since the peak inflation readings in 2021-2023. The reading that points to more substantial progress is with regard to the percentage of firms reporting inflation as their biggest problem. That reading is down to 11%, unchanged month over month, following a number of steep drops in the past year.

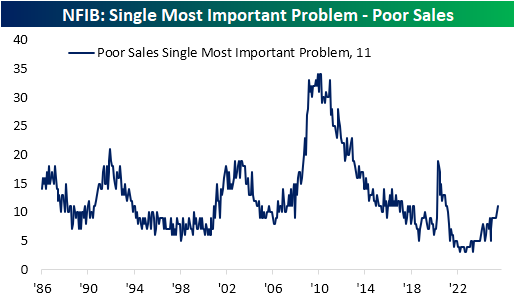

Looking across other most commonly reported problems, an equal share of respondents highlighted poor sales. That is the highest reading since February 2021, when that reading was declining off of pandemic highs. While that may sound concerning, we would note it is not far off the average reading (10.5%) observed in the five years from 2014 through 2019.

More By This Author:

The Rich Get Richer

The World's 3,028 Billionaires

Increasing Earnings Vol

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more