Transportation Stocks Are At Odds With Truck Sales

Image Source: Unsplash

Yesterday’s Commentary noted the recent strength in transportation stocks. For example, the transportation ETF (XTN) has outperformed the S&P 500 by more than 9% over the last 25 trading days. The leading stocks within the ETF over this period include. ARCB (trucking), MATX (shipping), WERN (freight shipping), and FedEx FDX (shipping). Some of the recent gains are catch-up, as the sector has generally underperformed for much of the past two years. However, expectations for a reflationary economic resurgence are benefiting this economically sensitive sector.

While investor expectations for transportation stocks are bullish, the graphs below raise questions about the recent strength. For instance, heavy truck sales (blue) are nearing pandemic lows, set when the economy was effectively shut down. Moreover, TruckClub, a magazine for the trucking industry, recently published an article entitled “Freight Volumes Drop Again in 2025, Are We Entering a New Recession Cycle for Trucking?” If demand were increasing, one would expect demand for heavy-weight trucks to increase as well. Similarly, the Cass Freight Index, which measures the volume of freight shipments and expenditures across multiple transportation modes in North America, has been steadily declining.

Are the transportation stocks getting ahead of themselves, or are the indexes below on the verge of turning higher? We presume investor rotations are playing a big hand in the outperformance of the transportation sector. But if the economy is strong in 2026, the indexes should turn higher, supporting recent performance in transportation stocks.

(Click on image to enlarge)

What To Watch Today

Earnings

(Click on image to enlarge)

Economy

(Click on image to enlarge)

Market Trading Update

Yesterday, we touched on the idea of the “reflation” trade, which is the new narrative that has gripped the market early in the New Year.

While the “hope” is that a confluence of events will drive economic growth without an increase in inflation, the question is whether the market has already priced such a “Goldilocks” outcome in. While we have previously discussed the issue of valuations, which, when at elevated levels, tends to lead to market fragility, valuations are just a reflection of near time sentiment.

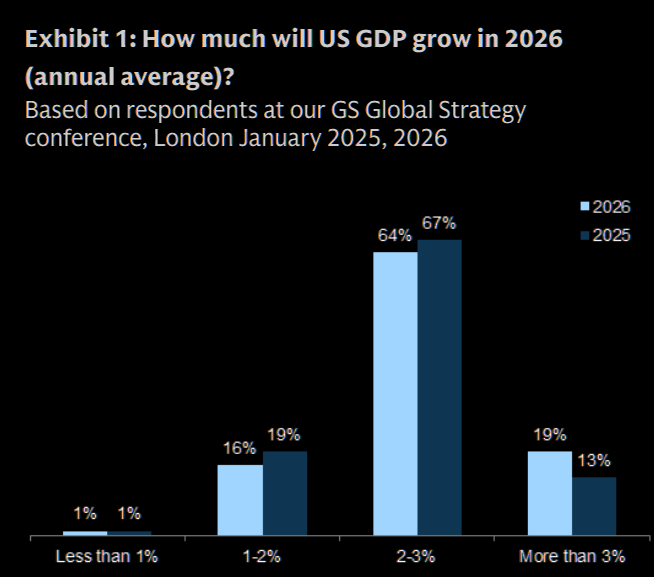

For example, Goldman Sachs just recently surveyed 400 investment managers, and as shown, almost all were bullish, expecting stronger economic growth this year.

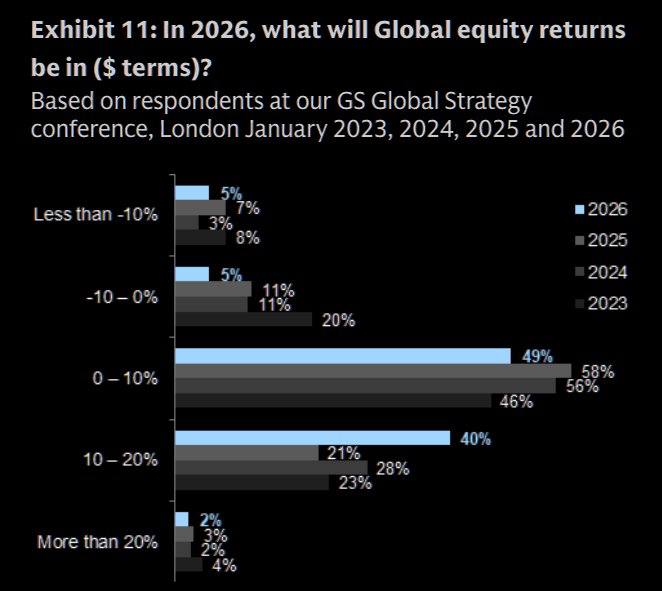

Of course, with stronger growth, the majority is also bullish on positive returns from global equities.

However, given that markets are trading at the top of their long-term trend channel, the question for investors should be “how much is already priced in?”

(Click on image to enlarge)

With markets very overbought on a weekly basis, very deviated above long-term means, and pushing trend resistance, it would seem that the risk of disappointment over the next 12-months is rising. Of course, with valuations elevated, such would suggests that such a disappointment could precede a rather significant repricing in equities.

While there is no guarantee of anything, it seems prudent to at least consider the risk and impose some risk management discipline on your strategy for the coming year.

When the message from Wall Street is: “Everything is bullish, everywhere, all at once,” just ask the question. As Bob Farrell noted:

“When all experts agree, something else tends to happen.”

CPI Inflation

CPI and Core CPI came in as expected at +0.3% and +0.2%. Following last month’s unexpectedly low inflation data, many on Wall Street expected yesterday’s CPI data to exceed expectations, effectively correcting the prior months’ readings. That didn’t happen. As shown below, core CPI, the Fed’s preferred measure of CPI, is now at its lowest level since 2021 and declining, albeit slowly.

The bond market was little moved by the data. This suggests the market is comfortable, given recent employment data and the CPI print, in pricing in a slim chance of a Fed rate cut on January 28 and a 50/50 chance of a cut by mid-year.

(Click on image to enlarge)

JPM Earnings And Economic Outlook

JP Morgan (JPM) kicked off the fourth quarter earnings season by largely beating estimates. Revenues and earnings per share exceeded forecasts. The only concern in their announcement was their investment-banking revenues, including underwriting and merger consulting. Revenue from this segment was decently below their own estimates released just last month. Equity capital market fees declined sharply by over 15%, and debt underwriting revenues were softer than expected. Given that JPM is the largest bank in the US and a global banking powerhouse, this suggests that corporations relied less on capital markets for financing than is typical. Given the substantial surge in AI-related spending and projections of solid economic growth, we should not expect this segment to remain weak. Regarding the economy, JPM’s CEO Jamie Dimon stated:

The U.S. economy has remained resilient. While labor markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy. These conditions could persist for some time

Tweet of the Day

More By This Author:

DOJ Investigates Powell: Implications For Fed Policy?

2026 Earnings Outlook: Another Year Of Optimism

Fannie And Freddie To The Rescue

Disclaimer: Click here to read the full disclaimer.