Tomorrow’s Forecast Trades For EU Unemployment, Fed’s Weekly Index

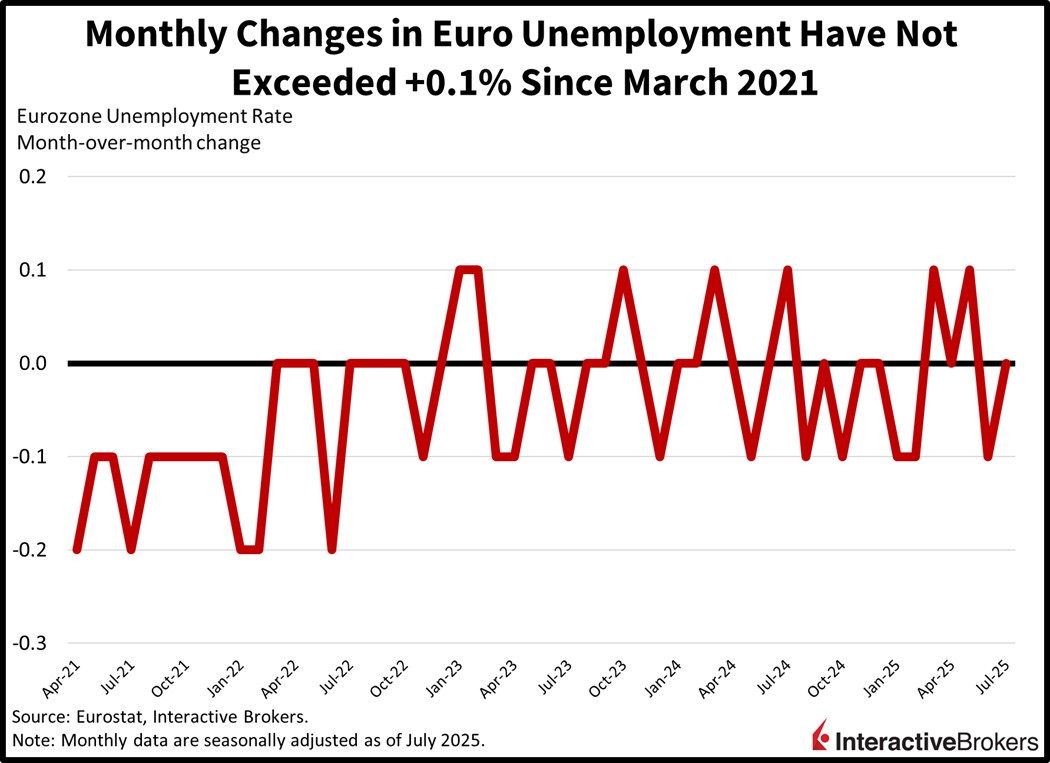

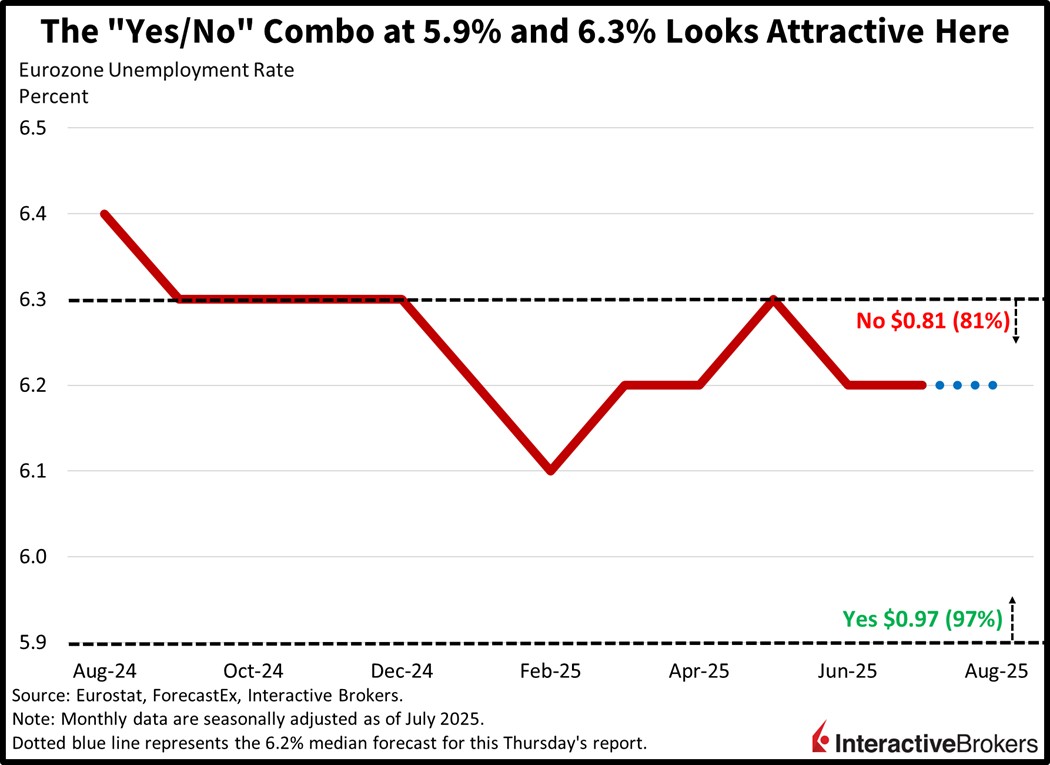

The European Union’s unemployment figure has a subdued deviation rate and rarely increases by more than 0.1% on a month over month basis; it hasn’t since early 2021, shortly after the depths of the COVID-19 pandemic. It’s expected to remain unchanged at 6.2%, and out of the 30 forecasters surveyed in the monthly Reuters poll, the projections range from 6.2% to 6.3% in narrow fashion. Against this backdrop I find the risk-reward profile of the “No” at 6.3% attractive, as it’s going for $0.81. I also think the “Yes” at 5.9% is undervalued at $0.97, as a drop of 0.3% is similarly unlikely.

(Click on image to enlarge)

“Team Yes” On Weekly Fed Index

The Dallas Fed’s Weekly Economic Index has exceeded 1.6 every week since May 2024 and has been tracking in the mid 2s in the past few weeks and throughout most of this year. I think the “Yes” at 1.6 is undervalued at $0.89, since conditions didn’t weaken meaningfully last week in my view to drop the number from 2.05 to 1.6 in just 7 days.

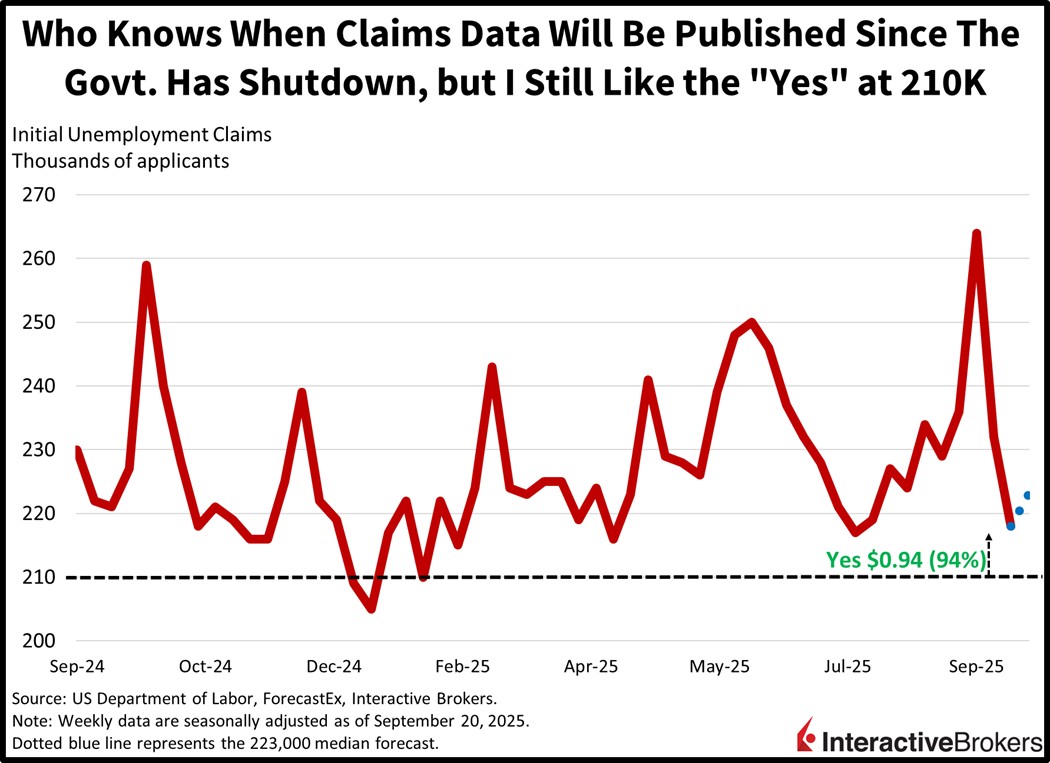

Who Knows When Claims Data Will Arrive

Who knows when the government will reopen and provide unemployment claim data for the week ended September 27. Still, labor conditions have been softening and the “Yes” at 210k costs $0.94 and sports an attractive risk-reward profile in my opinion. The level hasn’t been touched since January and the weekly Reuters poll consisting of 35 forecasters ranges from a minimum projection of 218k to a maximum of 236k.

(Click on image to enlarge)

Source for images: ForecastEx

Note: Prices are highest bids as of the morning of October 1, 2025. Red circles around the thresholds were inserted by J. Torres to highlight his preferred “Yes” and “No” answers throughout different levels.

More By This Author:

Should We Care About Another Shutdown?

What Comes Next?

Sometimes “In-line” Is Just OK

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx ...

more