Should We Care About Another Shutdown?

Yesterday afternoon featured a much-anticipated White House meeting between Congressional leaders and the President that was intended to avert a government shutdown.When Vice President Vance emerged saying, “I think we’re headed to a shutdown,” that seemed to have sealed the negotiations’ fate.As I type this, there are still more than 12 hours remaining before one occurs, but with the “US Government Shutdown” contract onIBKR ForecastTrader showing a roughly 90% probability of a shutdown, it seems increasingly inevitable.Yet investors don’t seem to mind.Should they?

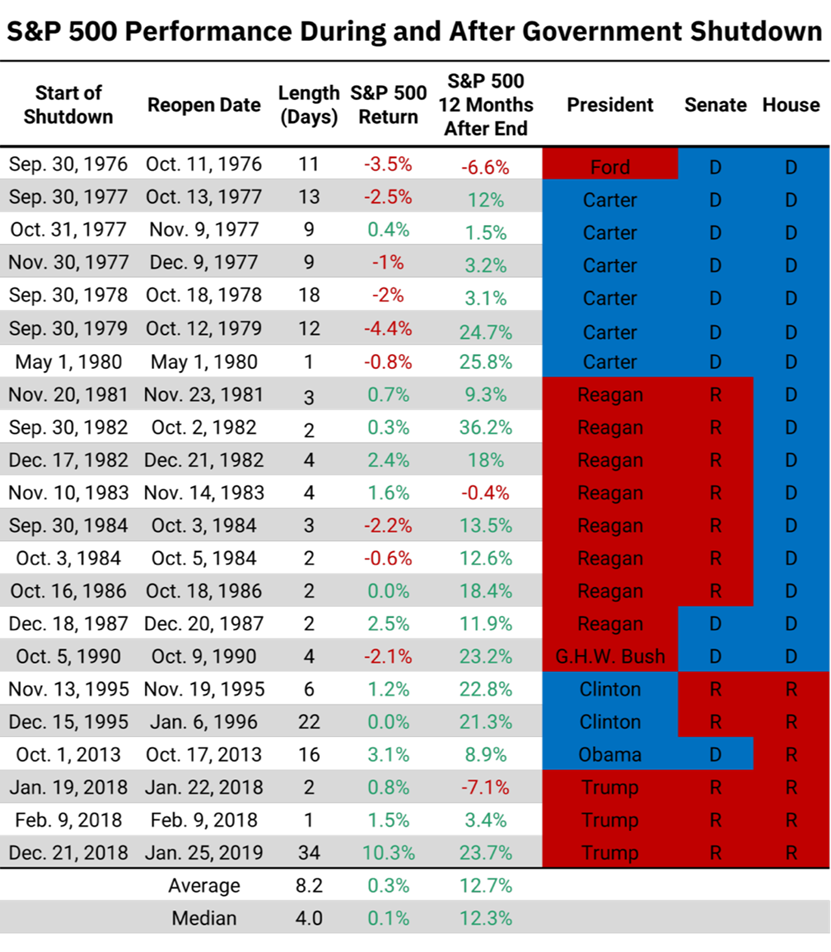

The short answer is not really, at least not for now. While it is difficult to spin a shutdown as a positive, it is not an obvious negative – at least for now. Shutdowns tend to be short-lived and ultimately don’t lead to much lasting damage to the economy or specific companies. They occur regardless of who controls the Presidency, the Senate or the House, and history shows that they neither offer much of an impact to stocks in either the short- or long-term.I offer the following chart, courtesy of my friend Steve Wyett at BOK Financial:

Source: BOK Financial

Over the past 40 years, we’ve had 22 shutdowns, though the bulk of them occurred during the Carter and Reagan administrations.The average length of a shutdown is 8.2 days, with a median of 4 days.That is not enough time to significantly impair an economy or market.We also see that both the mean and the median return over those events is just above zero.

The results actually look better if we constrain ourselves to the current century.We had four shutdowns so far, with one under Obama in 2013, and three under Trump in 2018.The first two in the first Trump administration lasted only 1 and 2 days, respectively.The Obama shutdown was a more substantial 16 days, and third Trump shutdown stretched 34 days, from just before Christmas 2018 through most of January 2019.All showed positive returns over those periods, with a double-digit bump in the most recent event.

At this point, it is important to remember the nature of markets.If an unpleasant event is widely expected – and government shutdowns are certainly well-reported and widely anticipated – it often results in “sell the rumor, buy the news.” In 2013, the S&P 500 (SPX) was moving sideways to lower as the shutdown loomed.We then saw a modest selloff in the midst of the shutdown, and stocks resumed their upward path afterwards.

SPX September 16 to October 31, 2013

(Click on image to enlarge)

Source: Bloomberg

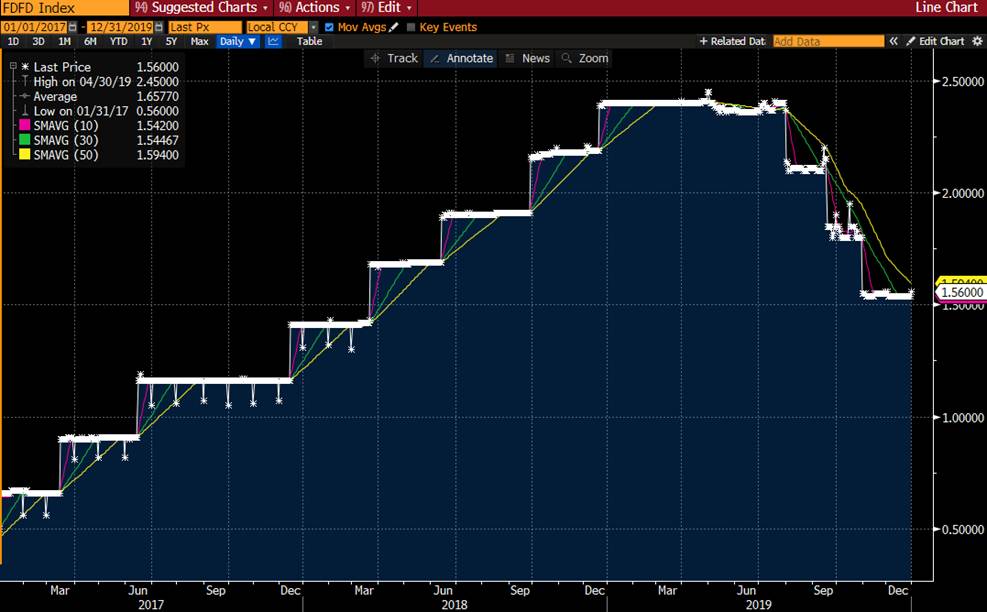

The situation in December 2018 was far different.The Federal Reserve had been raising rates throughout the year, and stocks fell in response.We had “Volmaggedon” in February, recovered to fresh highs in September, and sank 10% again in October. An attempted recovery stalled at the end of November, and stocks began to sink further before the shutdown.The FOMC met on December 19th and raised rates for the final time in that cycle.In hindsight, it is difficult to disentangle how much of the 10.3% rally that occurred during that shutdown was the result of a changing Fed rate cycle, the January effect, and easing governmental tensions.The big bounce only recouped the levels that prevailed during the shutdown, though the rate cutting cycle boosted stocks in the ensuing year.

SPX November 7, 2018 – February 15, 2019

(Click on image to enlarge)

Source: Bloomberg

It would seem as though the 2013 scenario would be better precedent for the current situation, even if the current political lineup is identical to that of 2018.The earlier example was a relatively low volatility environment with stock prices modestly reflecting the impending news.The 2018-2019 scenario was a high volatility environment coming at the culmination of a difficult year for stock investors.That is hardly the case now.Hence, investors are not necessarily wrong to be relatively sanguine ahead of another government shutdown.

Fed Funds Rate 2017-2019

(Click on image to enlarge)

Source: Bloomberg

SPX in 2018

(Click on image to enlarge)

Source: Bloomberg

More By This Author:

What Comes Next?

Sometimes “In-line” Is Just OK

Where Comes The Sun?

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx ...

more