Sometimes “In-line” Is Just OK

Image Source: Pexels

This morning brought one of the key economic statistics in any given month when the Core PCE Deflator was released at 8:30 EDT. Compiled by the Bureau of Economic Analysis (BEA), this is known to be the Federal Reserve’s preferred inflation measure. Thus, today’s in-line report was originally interpreted as reason for a rally, especially after three days of (oh my!) modest declines in the S&P 500 and other key indices. As I type this later in the morning, stocks are higher, but only modestly so.

Quite frankly, I’d always simply accepted the common refrain that Core PCE was the Fed’s inflation measure of choice, but I had long forgotten the reason why. Then, while I searched for one of the links above, I went down a rabbit hole to learn more about the central bank’s reasons and found this convenient explanation:

Why does the Fed target PCE inflation instead of the CPI?

To measure inflation across the entire economy, economists produce price indexes to see how overall prices for goods and services are changing. Two common price indexes are the consumer price index (CPI) and the personal consumption expenditures (PCE) price index. While the two are similar, the PCE index is constructed in a way that accounts for how Americans are spending their money at a given time and more quickly adapts to changes in spending patterns.

A link on the Fed’s website pointed me to this more detailed explanation from the BEA:

BEA’s closely followed personal consumption expenditures price index, or PCE price index, is a narrower measure. It looks at the changing prices of goods and services purchased by consumers in the United States. It’s similar to the Bureau of Labor Statistics’ consumer price index for urban consumers. The two indexes, which have their own purposes and uses, are constructed differently, resulting in different inflation rates.

The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and for reflecting changes in consumer behavior. For example, if the price of beef rises, shoppers may buy less beef and more chicken. Also, BEA revises previously published PCE data to reflect updated information or new methodology, providing consistency across decades of data that’s valuable for researchers. The PCE price index is used primarily for macroeconomic analysis and forecasting.

A variation is the personal consumption expenditures price index, excluding food and energy, also known as the core PCE price index. The core index makes it easier to see the underlying inflation trend by excluding two categories – food and energy – where prices tend to swing up and down more dramatically and more often than other prices. The core PCE price index is closely watched by the Federal Reserve as it conducts monetary policy.

Pardon the digression. I hope you found as useful of a reminder as I did. Moving on to today’s activity…

As mentioned above, the PCE report was essentially in-line. The monthly and yearly increases for both the headline and core readings all matched consensus expectations (0.3% and 0.2% for monthly headline and core; 2.7% and 2.9% for each measured yearly), and last month’s core PCE was revised down from 0.3% to 0.2%. All are obviously above the Fed’s 2% inflation target, but if that didn’t dissuade them from cutting recently, why would this?

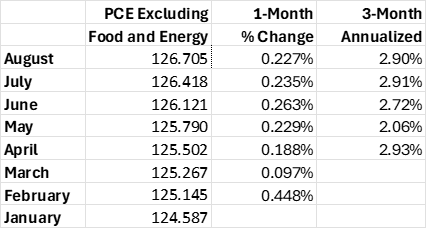

On a more granular basis, we see that Core PCE is now moving slightly lower, though on an annualized basis it is still closer to flirting with 3% than 2%:

Sources: BEA, Interactive Brokers

Why, then, are we not seeing more robust dip buying this morning? A set of as-expected numbers that leave the preferred monetary narrative intact are usually a good reason for a rally, especially when they offer the opportunity for some dip buying. Perhaps it is because the desired outcomes are largely priced in, or maybe there is some fatigue after some relentless rallies. There were some new tariffs on drugs, trucks, and furniture announced overnight, but those were not weighing on overnight markets.

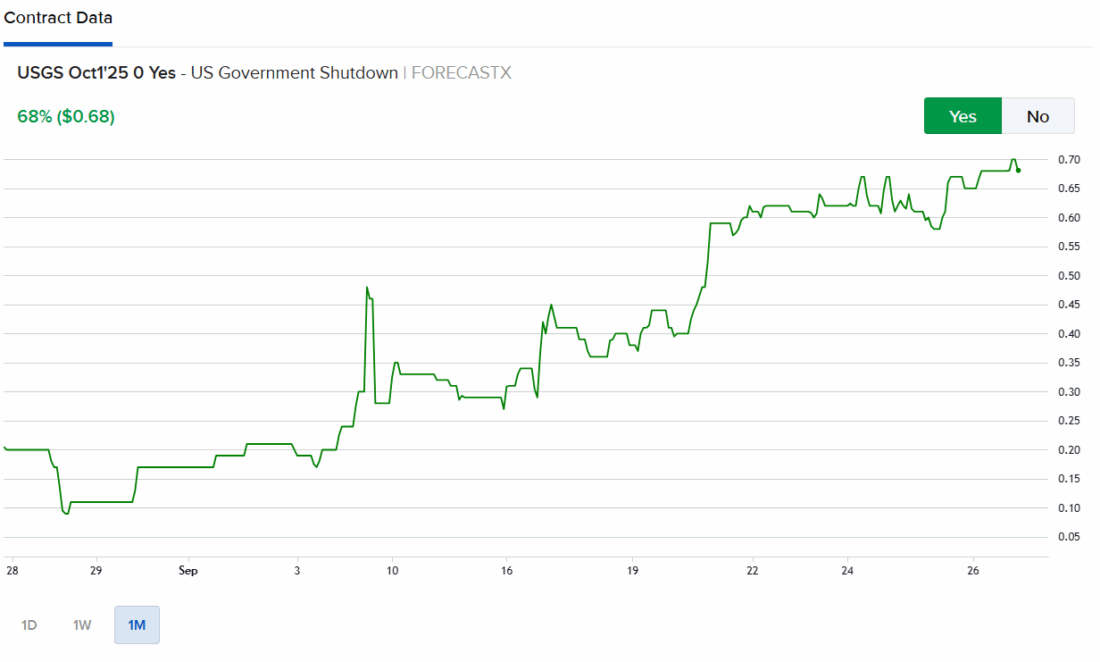

Of course, there is the looming threat of a government shutdown early next week, but stock traders typically don’t fret about them until they are inevitable – or sometimes not until they drag on for a few days. The odds of a shutdown have been steadily increasing on IBKR ForecastTrader, with a current price of 69 for a “yes”, so it is possible that they might be mildly weighing upon sentiment.

And of course, don’t rule out the likelihood of the “Freaky Fridays”, when traders exploit expiring weekly options to create market advances. Considering that algorithms don’t get distracted by outside events like the Ryder Cup in the same way that human traders might, that possibility remains distinct.

IBKR ForecastTrader Contract for US Government Shutdown

(Click on image to enlarge)

Source: Interactive Brokers

More By This Author:

Where Comes The Sun?Alas, Poor Triple Witching…

Small K, Capital K, Or Special K?

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing ...

more