Thoughts For Thursday: Waiting By The Fishing Hole

It's getting on towards late summer and that brings on two things, the Jackson Hole Symposium and some idle time by the fishing hole, which is what the market seems to have been up to over the last couple of days. After it's recent deep dives on Friday and Monday, the market seems to be chilling while registering some modest gains (WBD, OXY) in anticipation of Fed Chair Jerome Powell's remarks on Friday.

In a more or less green day on Wednesday the S&P 500 closed at 4,141, up 12 points, the Dow closed at 32,969, up 60 points and the Nasdaq Composite closed at 12,432, up 50 points.

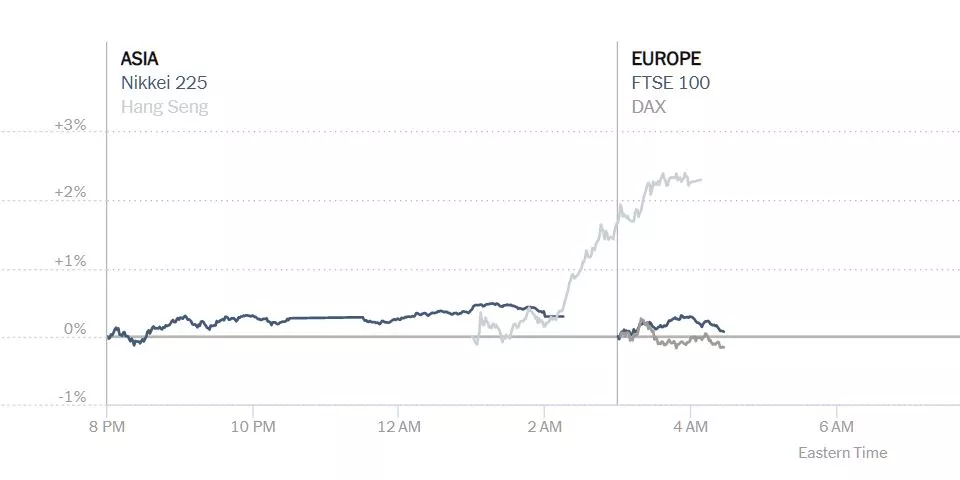

Chart: The New York Times

In Asian markets and across the pond, cowboy optimism led to positive closes in Tokyo and Hong Kong and a greenish open in London and Frankfurt.

Chart: The New York Times

Currently, US market futures are green. S&P 500 market futures are up 22 points, Dow market futures are up 98 points and Nasdaq 100 futures are up 89 points.

TalkMarkets contributor Michael Kramer writes Stocks Rise Slightly On August 24 Despite Rates Move Sharply Higher.

"Stocks had another dull day... A lot of that came in the final hour of trading. There is not much to report here on the S&P 500. We are just consolidating, and you typically continue in the previous direction after consolidation. So I don’t see any reason to think differently about my 3950 level...The 2-yr treasury note made a very big advance today and is now trading around 3.4% and is close to making a new cycle high. The 2-yr reflects the more hawkish outlook of the Fed Funds and Eurodollar futures...

Nvidia (NVDA) reported some horrible results and gave even more atrocious guidance...I think this stock will go down significantly if not make new lows. A 15% drop would take the stock down to the low 140s, and I don’t see why that isn’t possible...There is a double top on Advanced Microdevices (AMD), and it should push the shares back into the low to mid-80 region.

Salesforce (CRM) is down almost 6% after guiding third-quarter revenue to $7.82 billion to $7.83 billion, versus estimates of $8.05 billion."

Salesforce traded around $168 in post-close action, close to $165 which Kramer considers the stock's critical level. Scant optimism from Mr. Kramer, today.

In morning news contributor Emma Bonnet reports that The Euro Has Returned To Parity.

"The euro reclaimed parity with the dollar on Thursday. The recent rise (in the dollar) waned as investors waited to see if Federal Reserve Chair Jerome Powell would sound more hawkish at a meeting this week...The main driver of the US dollar’s overnight decline has been a temporary easing of global economic concerns. The dollar index, which measures the greenback against six currencies, fell 0.5% to 118.17 but was close to its highest level since September 2002, when it hit 129.29 in mid-July. The euro was 0.5% higher at $1.123 after touching a 20-year low below parity this week."

Chris Turner, Frantisek Taborsky and Francesco Pesole note the People’s Bank Of China Issues A Fixing Protest.

"For the first time in recent weeks, the PBoC has fixed the renminbi (CYB) stronger than model-based estimates had suggested – fixing USD/CNY at 6.8536 versus 6.8635 from the models. The PBOC typically uses fixings to direct market sentiment and today's message seems to be that the renminbi might have fallen too fast...News from China may be enough to slow dollar strength today but looks unlikely to reverse core trends of higher energy prices weighing on the importers in Europe and Asia, plus the Fed having unfinished business with inflation. On this latter subject, today sees a raft of Fed speakers before tomorrow's main event of the week – Fed Chair Jerome Powell's keynote speech on the economic outlook. What impact could he have on markets? Well, US yields have firmed back up this week and our colleagues in the rates strategy department have made the good point that market-based inflation expectations are rising even as rates are going higher – suggesting the Fed will be in no mood to soften its stance. The hawkish Fed should keep the dollar supported on dips."

I turn your attention to contributor and economist Scott Sumner who in a very matter of fact way reminds us that we need to consider if the economy is Still Overheating?

Here is some of what is on his mind as summer winds down:

"Readers of this blog know that inflation is a pretty meaningless indicator. Biden didn’t lie when he said inflation fell to zero in July, but he also didn’t tell us anything useful...

Commodity prices rose very fast in the first half of 2022. That doesn’t mean the inflation problem was all supply-side—nominal wages also rose rapidly. We have a supply problem and a demand problem. In the second half of 2022, it seems likely that commodity prices will be trending lower, often sharply lower. Obviously, this will make the headline inflation figures almost meaningless...

A mild slowdown in NGDP (nominal gross domestic product) growth in the second half will not represent progress in the Fed’s anti-inflation program unless accompanied by a slowdown in nominal wage growth...

A few weeks back, I suggested that I wasn’t too worried about a rising stock market, as bond market indicators continued to signal slower nominal growth ahead. Thus, it’s slightly worrisome that bond yields and TIPS spreads have been rising in recent weeks...

We keep getting really bullish data, such as the July industrial production and payroll employment data. It still looks like a flat out boom. As of today, I’m with the Fed hawks."

TM contributor Steve Sosnick warns that King Dollar can pose problems for US companies as well as for European economies.

"It is apparent that the Fed is much further along its rate-hiking path than most of its peers. All things being equal (and they rarely are), a currency with higher risk-free rates should trade at a premium to a lower-yielding alternative."

"The ramifications for a stronger dollar are manifold. Strong inflows into US fixed income can suppress Treasury and other yields, complicating the interest rate messages sent by the bond market. Those inflows could also find their way into equities, which benefit from foreign buying. At the same time, however, a stronger dollar can be a headwind for multinational corporations.

US-domiciled companies that sell goods and services in a wide range of countries find that their non-US revenues and profits suffer when converted back to USD. A Euro earned in say, Spain, is worth less on a USD income statement than it was just a few months ago... if the dollar continues onto further strength, we can expect to see a negative impact on major US companies. That can have a profound effect on equity valuations, and not in a good way. Of course, if the dollar reverses its recent uptrend, the opposite will be true."

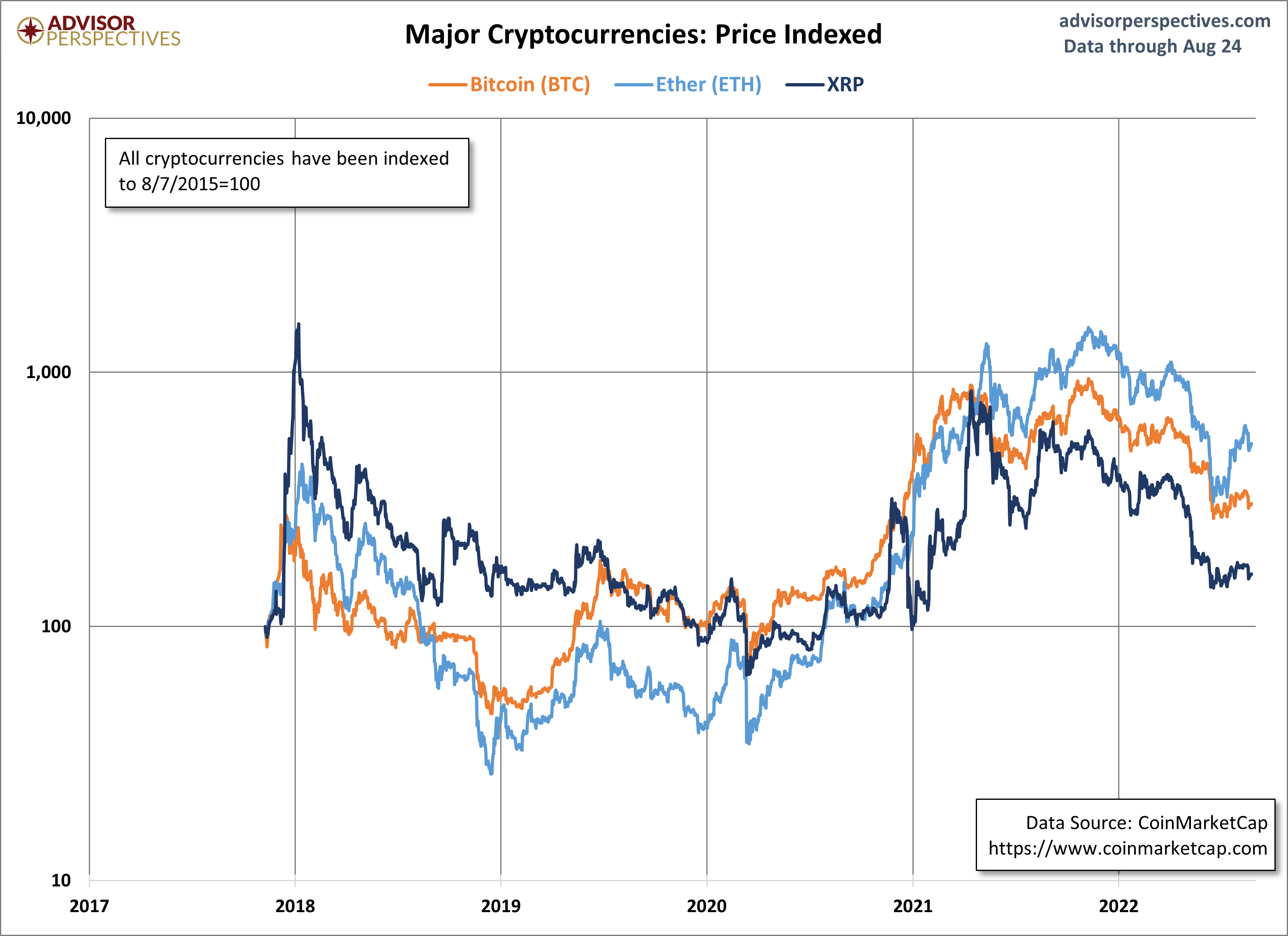

Contributor Jill Mislinski looks at Cryptocurrencies Through Wednesday, Aug. 24. Mislinski provides individual charts for the major cryptos. I have posted the multi-currency view below:

"Notice that Ether tops the chart - the price of an ether has changed the most out of all three cryptocurrencies."

Closing out the column today we highlight a TalkMarkets Editor's Choice column by contributor Sheraz Mian who looks at Making Sense Of Fading Earnings Estimates. Below are some of Mian's takeaways.

"The overall corporate profitability picture emerging from the Q2 earnings season, with 96% of S&P 500 results out, continues to show stability and resilience in key earnings drivers like consumer and business spending.

While this stability and resilience run contrary to worries of an imminent economic slowdown or even a recession, we are starting to see tell-tale signs of emerging weakness in both consumer and business spending...

A slowdown has gotten underway, but there is nothing in the earnings data, management commentary, or guidance that would suggest the U.S. economy heading into a major economic downturn. That said, estimates have started coming down, with the overall revisions trend turning negative...

As strong as the full-year 2022 earnings growth picture is expected to be, it’s worth remembering that a big part of it is due to the unprecedented Energy sector momentum...

There is a rising degree of uncertainty about the outlook, reflecting a lack of macroeconomic visibility in a backdrop of Fed monetary policy tightening. The evolving earnings revisions trend will reflect this macro backdrop."

See Mian's article for several bar charts which plot his thinking.

If the fish aren't biting, all this and more at the TalkMarkets homepage should keep you occupied between now and Fed Chair Powell's talk tomorrow.

Have a good one.

More By This Author:

TalkMarkets Image Library

Tuesday Talk: The Moose In The Room

Thoughts For Thursday: Back To The Races