Still Overheating?

Readers of this blog know that inflation is a pretty meaningless indicator. Biden didn’t lie when he said inflation fell to zero in July, but he also didn’t tell us anything useful.

NGDP is a much better indicator, but still not perfect. If we assume the key macro problem is business cycles created by nominal shocks interacting with sticky wages, then aggregate wage income may be a better cyclical indicator than NGDP. I usually focus on NGDP because in the US the two figures track each other pretty closely. But if I were a Kuwaiti macroeconomist I’d focus on aggregate wage income when trying to ascertain whether the domestic economy was out of equilibrium.

Commodity prices rose very fast in the first half of 2022. That doesn’t mean the inflation problem was all supply-side—nominal wages also rose rapidly. We have a supply problem and a demand problem.

In the second half of 2022, it seems likely that commodity prices will be trending lower, often sharply lower. Obviously, this will make the headline inflation figures almost meaningless. Less obviously, it will subtly distort even NGDP. That’s right, NGDP is not a perfect indicator even in America; aggregate wages are slightly better. Fast rising commodity prices slightly boosted NGDP in the first half (relative to wage growth), and will probably slightly reduce NGDP growth in the second half.

A mild slowdown in NGDP growth in the second half will not represent progress in the Fed’s anti-inflation program unless accompanied by a slowdown in nominal wage growth. At a minimum, aggregate nominal wages must slow. Ideally, hourly nominal wages would also slow.

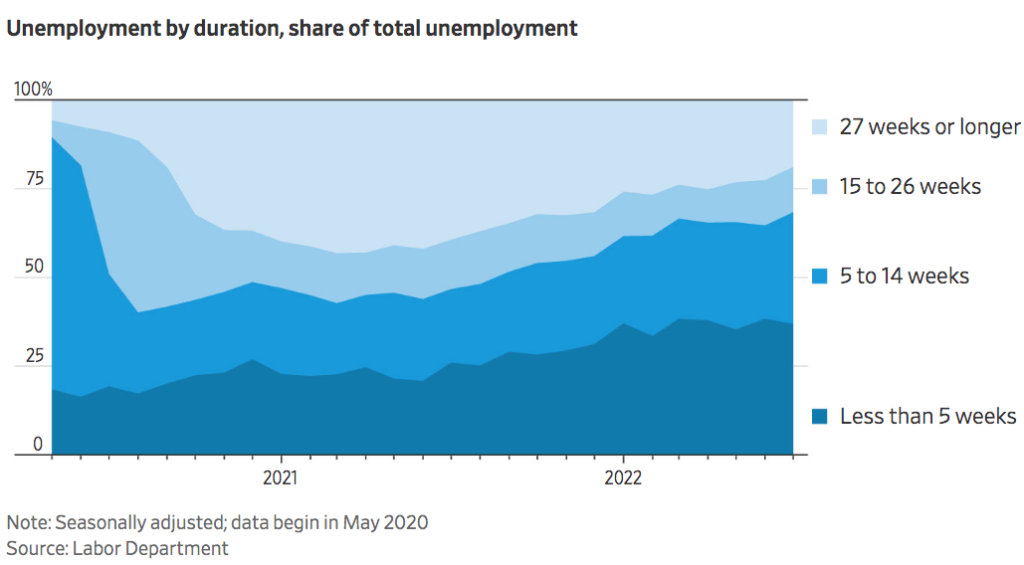

Today’s WSJ has an article suggesting that the labor market continues to tighten, with ever shorter periods of unemployment and fast wage growth. Some of it is anecdotal, but if true then the Fed may still be behind the curve.

(Click on image to enlarge)

A few weeks back, I suggested that I wasn’t too worried about a rising stock market, as bond market indicators continued to signal slower nominal growth ahead. Thus, it’s slightly worrisome that bond yields and TIPS spreads have been rising in recent weeks.

In its attempt to avoid a hard landing, is the Fed in danger of pulling up before the plane even hits the runway? We keep getting really bullish data, such as the July industrial production and payroll employment data. It still looks like a flat out boom. As of today, I’m with the Fed hawks.

And LOL at those Trumpistas who mocked me for suggesting that the US economy wasn’t in recession last winter. As of today, you look as foolish as the 2020 election deniers (which many of you are). The QAnon fantasy world becomes ever more all-encompassing each day. Soon they’ll be peddling theories of fake moon landings, grassy knolls, microchips in vaccines, and alien spacecraft coverups.

“But two-quarters of falling GDP . . . “

More By This Author:

What Would It Mean To Abolish The Bank Of Canada?

How Much Choice Do You Want?

Monetary Conflation