Thoughts For Thursday: Staying On Top - Barely

The stock market continues to be full of worry, but is managing to stay on top this week, so far. It is worth noting that yesterday's close brought levels back to those of a month ago.

Wednesday the S&P 500 closed at 4,383, up 4 points, the Dow closed at 34,112, down 40 points and the Nasdaq Composite closed at 13,650, up 11 points.

Chart: The New York Times

Top losers on the day were Warner Brothers Discovery (WBD), down a whopping 19%, Paramount Global (PGRE), down 7.9%, and Biogen (BIIB), down 5.7%.

Chart: The New York Times

In morning futures trading, S&P 500 market futures are flat (up 1 point), Dow market futures are up 36 points, and Nasdaq 100 market futures are down 12 points.

TalkMarkets contributor Patrick Munnelly updates his take on things in his Daily Market Outlook - Thursday, Nov. 9.

"Asia - stocks were mostly on the rise today, taking cues from a positive trend on Wall Street. Across most major markets in the Asia-Pacific region, things were looking green, although Chinese markets didn't quite keep up the momentum. The Nikkei 225 had a strong start, benefiting from recent weakness in the JPY, which gave exporters a boost. The index eventually crossed the 32.5k handle. In contrast, the Hang Seng and Shanghai Composite had a mixed day. Mainland China saw a flat to firmer trend, but the latest Chinese inflation metrics hinted at economic fragility, with the nation slipping back into deflation. Hong Kong, particularly affected by a drag from the Property sector, underperformed, leading to a lower index.

Europe - The European data docket is scant today as such investor attention will turn to Central Bank officials. The Bank of England's Chief Economist, Pill, is set to make remarks for the second time this week. Earlier this week, on Monday, his comments hinted at a possible agreement with market expectations of a rate cut in the upcoming spring. However, Governor Bailey's remarks yesterday struck a more cautious tone, echoing sentiments from last week's policy update, where he indicated that a rate cut might not happen for a significant period. Meanwhile, European Central Bank President Lagarde and Chief Economist Logan are also scheduled to speak. Despite some colleagues expressing that it's too early to discuss ECB interest rate cuts, it would be quite surprising if either Lagarde or Logan deviate from this stance in today's speeches.

US - Stateside, the spotlight in today's data lies on US jobless claims, the key metric on the economic stage. While weekly initial jobless claims have seen a modest uptick in the past couple of weeks, they still remain relatively low when compared to recent historical trends. This suggests that, at least for now, there is no clear indication of a significant relaxation in the tight labor market. Anticipations for today's release align with this trend, expecting to see no substantial shift in the current labor market dynamics. Federal Reserve Chair Powell is taking the stage for the second consecutive day, following his remarks yesterday where he remained silent on the immediate monetary policy outlook. The market is eagerly anticipating its response to the significant drop in bond yields since last week's Fed monetary policy update. Additionally, three other Fed officials are also scheduled to speak, adding to the potential insights into the central bank's perspective on the current economic landscape. Investors will be closely watching for any hints or guidance regarding the Fed's stance in light of recent developments."

Contributor Declan Fallon contrasts this week's selling with the chance that the bulls will show up to close out the week in his column, The Week Starts With Selling, But It's Not Too Damaging.

"After last week's buying it was expected sellers were going to make a return given the prior trend. However, the level of selling has been relatively modest, and with three days of selling banked, the chance bulls will make a reappearance is high.

The Russell 2000 (IWM) has been the weakest index to date and had sold off the hardest so far. But the selling of the last three days has only managed to close Friday's gap higher. Today's volume was the first to register as distribution, but Monday and Tuesday's selling volume was light."

"The S&P sits in a similar position to the Nasdaq having tagged the October swing high, but also doing so with a reversal candlestick. Technicals are net positive, although bullish momentum is not as strong as for the Nasdaq. However, it also has 20-day and 50-day MAs to lean on for support."

See the full article for the Nasdaq and Semiconductor Index charts.

Yesterday oil prices made an impact on trading and will continue to do so as long as the conflict in the Middle East stays hot and lower economic forecasts across the globe signal lower demand for crude. Below is a round-up of thoughts from some TM contributors.

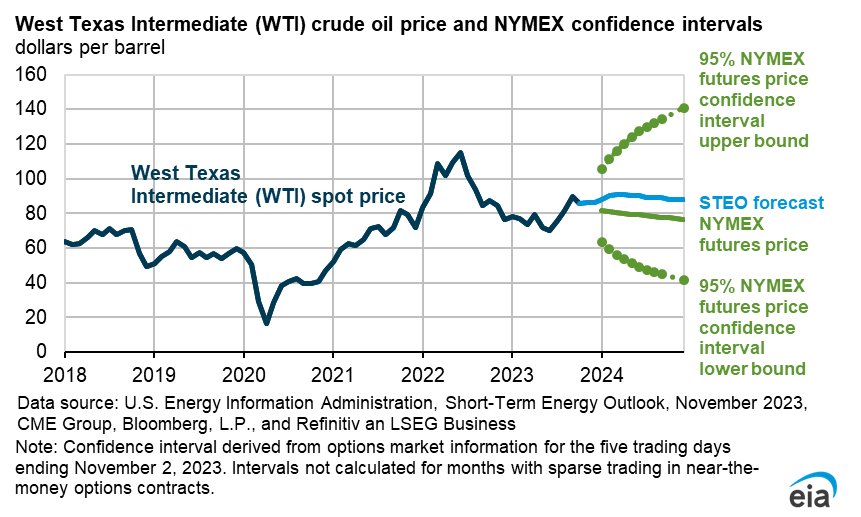

Menzie Chinn takes a look at the EIA Short Term Energy Outlook Forecast For Oil, And The Impact Of Sanctions.

"As reported yesterday:

Source: EIA.

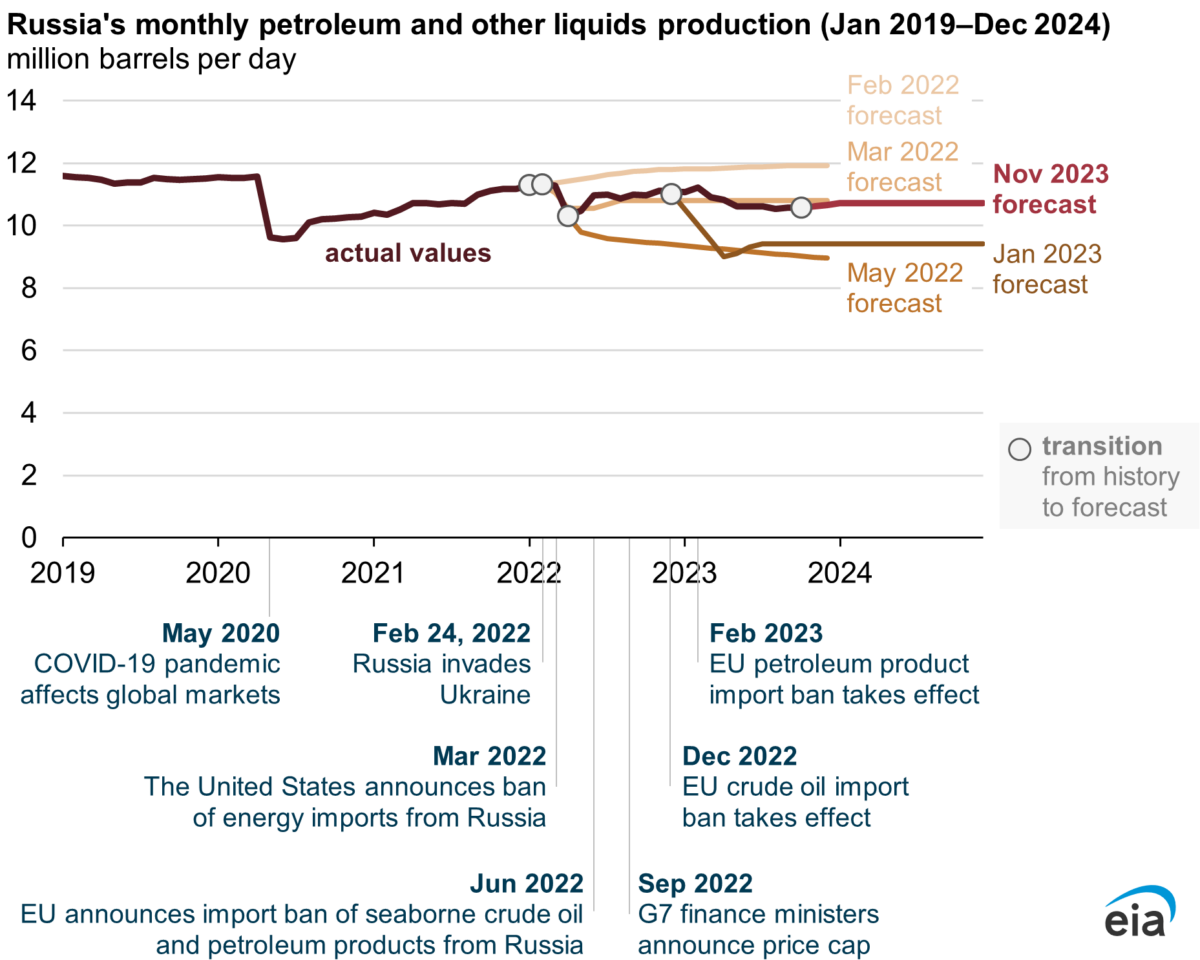

EIA also released yesterday an interesting analysis indicating that sanctions had reduced Russian oil production. No given quantity is expressed, but inferences are made on the basis of the difference between the February 2022 forecast, and actual outcomes.

Source: EIA (2023).

The impact of sanctions is also illustrated by the (continued) discount of Urals vs. Brent:

Source: TradingEconomics.com, accessed 11/8/2023.

The spread is about $11.50 latest."

Contributors Warren Patterson and Ewa Manthey note that Brent Settles Below $80.

"The downward pressure in oil continued with ICE Brent settling more than 2.5% lower, leaving it below US$80/bbl. This is the first time since July that Brent has settled below this level. A lot of support has evaporated after the market broke below the 200-day moving average earlier this week. Timespreads also continue to point towards weakness. The prompt ICE Brent spread is dangerously close to flipping into contango and is trading in a backwardation of just US$0.13/bbl, down from around US$0.60/bbl earlier this month. Meanwhile, for WTI, the prompt spread is in even bigger danger of slipping into contango with the spread trading flat this morning.

The degree of weakness seen in recent days will be a concern for OPEC+, particularly as we move into 1Q24, a period where we see the market returning to surplus in the absence of an extension to Saudi cuts. Noise from the group, particularly Saudi Arabia will likely grow, given that we are now trading below the Saudi’s fiscal breakeven level, a level they have been keen to keep oil above. It is looking very likely that both Saudi Arabia and Russia will extend their additional voluntary cuts through into early next year. Although, whether Russia actually sticks to its announced cuts is another story, given that their seaborne crude oil exports have been edging higher in recent months.

The demand side is also becoming a concern, which is evident with the broader weakness seen in refinery margins since the end of the northern hemisphere summer. Weaker margins suggest possibly weaker end-use demand, which ultimately could feed through to weaker crude oil demand from refiners. In addition, there are worries over Chinese demand going into the winter, though for much of the year, while there has been concern about the Chinese economy, oil demand numbers have performed strongly up until this point.

While indicators suggest that the market is not as tight as originally expected, the tightness we see in the market next year (particularly 2H24) and the high likelihood of further intervention from OPEC+ (or at least from some of its members) if needed, suggests that significant further downside in the market is limited. We hold onto our forecast for Brent to average US$90/bbl over 2024."

In a TalkMarkets "In The Spotlight" column Stephen Innes says Oil Markets: I Dare You To Cut More Mode.

"US crude oil prices have dropped to their lowest levels since late July. This is due to concerns about an unusually high build-up in commercial crude oil inventories. Additionally, fuel demand has been lagging behind its seasonal average, which has raised concerns about demand destruction.

According to the American Petroleum Institute's data, US crude oil stocks surged by 11.9 million barrels during the week ending November 3, significantly exceeding expectations for a 200,000-barrel increase. This would be the third-largest inventory build in the US this year if confirmed by the more definitive EIA report. Additionally, supply at the Cushing, Oklahoma, tank farm, which serves as the delivery point for West Texas Intermediate futures, increased by 1.1 million barrels.

Oil prices have faced steady downward pressure this week. This can be attributed to the vanishing Middle East risk premium and the global economic data that is showing a declining trend. The decrease in demand from China and the United States has led to hedge fund longs pulling out, intensifying the situation...

Several vital trends display a softer tone, such as the softening prompt time spreads, the impact of unseasonably warm weather on oil demand, and the decline in net managed money positioning, all of which contribute to the overall weakness in the market.

So now it seems like traders are moving into " I dare you to cut more mode" after the Saudi energy ministry hinted that unilateral cuts could extend into 2024, ostensibly reflecting concerns about weaker demand.

From a macroeconomic perspective, the Saudis face enormous challenges to maintaining a price floor and incredible risks. By artificially keeping oil prices higher with China experiencing difficulties and consumers in developed countries cutting back, the possible intervention bounce in oil prices could exacerbate the issue by further reducing demand at the pump."

And Arnie Singer writes Economic Conditions Outweigh Geopolitical Concerns In Oil Prices.

"When the war between Israel and Hamas began, crude oil prices spiked due to concern that the conflict would spread to affect Iranian oil production and cause supply disruptions in the region. At the time WTI (Western Texas Intermediate) was trading in the low 80’s and then spiked to just below 90 on 10/20. From there the price has dropped to just above 75 today (11/8).

Why has the price of crude dropped so far and fast?

- A general demand decline in the US and Western Europe due to a slowing economic climate and a warm winter.

- China demand is slowing, based on the latest data released yesterday (11/7).

- The Israel-Hamas war is being viewed as a localized conflict that will not spill over to the broader region. As long as Hezbollah, a proxy of Iran, stays out of the conflict, Iranian oil production and exports seem safe."

"In my personal opinion, I think there’s a good chance that Hezbollah will attack Israel and the conflict will, regretfully, expand. If that does happen, crude will rip higher.

However, the chart does not seem to agree with me, at least at this time. For the time being, oil looks like it’s either headed even lower or will stabilize and stagnate in the mid-70s until there is a catalyst to take it higher.

Oil and gas equities such as CVX, XOM, EOG, COP, and most others have gone along with crude for the ride down and, although they seem to be at at attractive levels now, it doesn’t look like they’ll be going higher, fast, any time soon.

Of course, everything could change if the war in the Middle East goes regional. But unless that happens, all the economic and technical signs are pointing to crude staying in the 70’s for the near future."

We close out today's column with a Bitcoin update from James Harte with his Bitcoin Commentary - Thursday, Nov. 9.

"Bitcoin is trading at fresh year-to-date highs today as excitement builds around potential SEC approval of BTC ETF applications...

Technical Views

_638351202893523950.webp)

The BTC (BITCOMP) rally continues, with gains of over 120% YTD. Price recently broke above the 32185 level and is now testing resistance at 37030. This is a key level for the market and a break higher here will open the way for a test of 39860 next. To the downside, while bulls defend 32185, focus remains on further upside near-term.

Caveat Emptor.

Have a good one.

More By This Author:

Tuesday Talk: Market Is Up, But Uncertainty Lingers

Thoughts For Thursday: Grinding Higher

Webull 4 You: A Review of Webull's New Desktop 4.0 Trading Application