Thoughts For Thursday: Grinding Higher

Stocks have continued to climb higher this week, though grindingly, so. Wheat prices are soaring as Putin pulls out of the Black Sea safe shipping agreement and bombs the port of Odesa.

The next FOMC meeting is less than a week away, and the CME Fed Watch Tool currently indicates that 99.8% of respondents believe the Fed will raise rates by 25 bps.

On Wednesday, the S&P 500 closed at 4,566, up 11 points, the Dow closed at 35,061, up 109 points, and the Nasdaq Composite closed at 14,358, up 4 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), -0.7%, followed by AT&T (T), up 8.5%, after tumbling earlier in the week, and Apple (AAPL), up 0.7%.

Chart: The New York Times

In morning futures activity, S&P market futures are down 10 points, Dow market futures are up 12 points and Nasdaq 100 market futures are down 96 points.

TalkMarkets contributor Greg Feirman tries his hand at Psychoanalyzing The Market. Below are some of his thoughts and actions.

"On Tuesday afternoon, I experienced a wave of anxiety over my market positioning. I own long term treasuries, consumer staples, and other defensive stocks and am short many of the large tech stocks that have been powering the market higher this year. And it finally got to me. “Am I wrong?” I asked myself. “Should I cover my short positions?” I wondered."

"One thing I know about myself is that I am a very independent thinker which can bleed into stubbornness. The paradigmatic example of my stubbornness was in 2020 when I held onto – and added to – my short positions into the post-COVID melt up...Because I’m a very independent thinker, if I’m experiencing anxiety about my bearish positioning than almost every other bear is likely to be as well. In fact, most bears have probably already capitulated to the market action. The one exception is permabears who are bearish at all times and will never change their minds or adjust their positioning. To connect the dots, my countertransference to the market action is telling me that I’m close to the point of needing to change my mind...One thought I had was to simply cover all my short positions during Wednesday’s trading session ahead of Tesla and Netflix (NFLX) earnings to avoid any further losses. Upon further reflection – however – I decided that that would be impulsive. I decided to see what the market reaction would be to TSLA and NFLX earnings given their extended run into earnings. And – as I hoped – each stock sold off in the after hours after their reports."

More musings in the full article.

Contributor Michael Ashton weighs in and says Inflation Volatility Tells Us This Is Probably Not Over.

"I’ve written and talked about the oft-overlooked fact that when inflation rises for some time above about 2.5%-3%, stocks, and bonds become correlated rather than inversely correlated, and this has a significant effect on portfolio risk that insightful investment managers will take into account.

What I haven’t written about much is the fact that problems are also caused by the volatility of inflation. While this tends to go hand-in-hand with higher inflation, the problems caused by inflation’s volatility are somewhat different than those caused by its level."

"The current episode follows a 15-year period during which inflation was both low and stable. The thirty years prior to that, from 1973-2003, the level of inflation was a bit more than twice the 2004-2018 period average but the volatility of inflation was tripled.

The importance of inflation volatility is that it operates on inflation expectations in a very different way than the inflation level does...Higher inflation volatility is what causes the inflation factor to carry more weight in the minds of consumers and investors, which in turn is what induces the aforementioned positive correlation between stocks and bonds. When inflation is low (but more importantly stable), the importance of inflation to investors is also low and variations in inflation are given less weight than variations in growth. Since stocks and bonds behave similarly with respect to inflation, but inversely with respect to economic growth, the dampening of the inflation factor is the reason that stocks and bonds are inversely-correlated in low-and-stable inflation regimes...

Here is headline CPI’s volatility.

I will just say that it is a good thing that inflation dealers no longer really trade inflation options. Because, if they did, they not only would be generally short a whole lot of in-the-money inflation cap delta in the book but also would be short a bunch of vega too and implied vol would probably be a lot higher. But the importance of this picture is that while headline inflation has been receding (largely due to energy) and core inflation has been dropping too (not-insignificantly due to Health Insurance and Used Cars), the volatility of inflation does not yet look like it’s calming down in a decisive way.

Until it does, I think it would be cavalier to assume that we are heading back to the low-and-stable inflation regime, even if the last few months’ out-turns for CPI have been agreeable. Volatility, and not just the level of inflation, matters."

In the full article Ashton also charts the volatilities of the different components of the CPI.

Contributor Patrick Munnelly reports on positive developments in the UK, in Inflation Flops FTSE Flies.

"FTSE 100 index is up 2.1% as UK housebuilders and property firms experienced significant gains as inflation slowed sharply in the country. The UK housebuilders' index surged by 6.4%, on track for its best day since November 2008. The housing index rose sharply for the second consecutive day. The FTSE Real Estate index, which includes commercial property firms and real estate investment trusts (REITs), also jumped by 5.3%, heading for its best day since February 2.

British inflation in June fell more than expected, reaching its slowest pace in over a year at 7.9%. This easing of inflationary pressures relieved some of the pressure on the Bank of England to continue raising interest rates sharply. As expectations grew that UK rates might peak sooner than initially feared, the housing index gained about 4% on Tuesday. FTSE 100 homebuilder Persimmon was the top percentage gainer in the index, rising by 9.8%. Barratt and Taylor Wimpey saw gains of 5.7% and 6.7%, respectively. All 28 constituents currently trading on the Real Estate index saw gains. Among commercial property firms, Segro and Land Securities were among the top percentage gainers on the FTSE 100, rising by approximately 6% and 5%, respectively. The strong performance of housebuilders and property firms was driven by the significant slowdown in inflation, signaling the potential for a sooner-than-expected peak in interest rates in the UK."

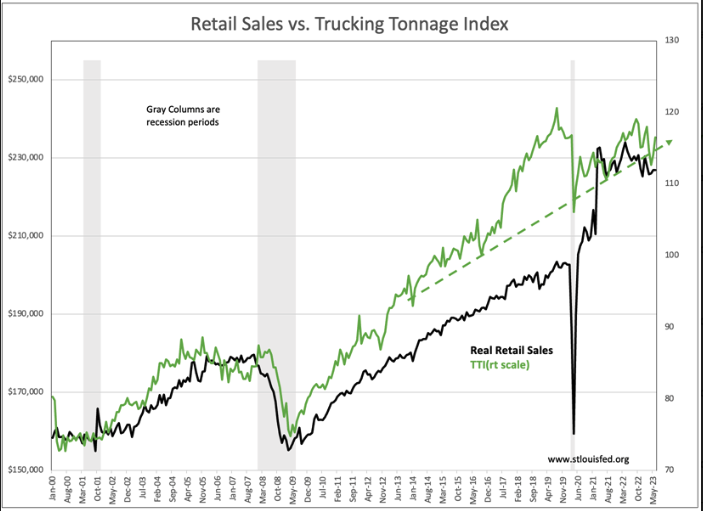

TM contributor Todd Sullivan finds strong economic activity in the transportation sector in More Good News… Truck Tonnage Rises.

"Adding another positive data point to others indicating economic expansion is the Trucking Tonnage Index. This is a volatile series that should only be monitored as a multi-month trend and in conjunction with other related economic series. The June report rose 2.1% vs May with a downward revision with the net effect being a rise above the trend line.

Within the last 10 days, Tom Lee and Ed Yardeni have both forecasted SP500 higher than $5,000 by year-end. Just 1mo ago, the SP500 having pierced the artificial “up-20% from Oct lows”, was declared a “Bull Market”. For those tracking fundamentals, we have been in an expanding economy since April 2020 with many recession forecasts unsupported. Equity prices swooned with market psychology but now appear to be turning positive."

Contributor Joshua Warner writing in a TalkMarkets Editor's choice piece looks at what's been happening in the Tech sector in Nasdaq 100 Analysis: Big Tech Q2 Earnings Preview.

Big Tech earnings consensus

"Below is a table showing consensus figures for each company’s headline earnings per share figure for the most recent quarter:

|

Headline EPS |

Year ago quarter result |

Consensus for this quarter |

YoY Growth |

|

Apple |

$1.20 |

$1.20 |

0.2% |

|

Microsoft |

$2.23 |

$2.55 |

14.5% |

|

Meta |

$2.46 |

$2.92 |

18.6% |

|

Alphabet |

$1.21 |

$1.32 |

9.1% |

|

Amazon |

($0.20) |

$0.35 |

- |

(Source: Bloomberg)

Growth, however varied across the group, will be welcomed considering profits have been falling over the past year. Earnings growth is expected to accelerate significantly in the second half, according to analysts, partly because they will face easier comparatives.

(Source: Company reports, with estimates from Bloomberg)

Wall Street has incorrectly predicted that earnings have bottomed-out in recent quarters, although the easier comps suggest this is less likely this time around. Still, they should be taken with a pinch of salt considering the performance of markets could still be largely at the behest of macroeconomic conditions.

Confidence is growing that interest rates are approaching their peak after inflation slowed in June while a cooling – but far from faltering – jobs market is providing hope that the US can avoid a severe recession. But the fight against inflation is far from over, a pivot won’t happen until 2024 at the earliest and a downturn is still on the cards. This threatens the optimism surrounding the second half and poses a risk to estimates...

Valuations have exploded this year, albeit from a low-base following the selloff we saw in 2022. The group of five alone has added over $3 trillion in value in just over six months, and that has led to higher multiples. That means the bar is getting higher and the outlook more challenging and this could make it harder for them to find higher ground for the remainder of this year, but Big Tech has what it takes to keep outperforming the wider market - especially if they reap rewards from AI catalysts, which should start coming into play later this year before taking-off in 2024.

Any disappointment this earnings season could result in a pullback in these valuations, and AI-boosted premiums could erode if they fail to monetize them quickly enough this year. It is worth remembering that Big Tech tends to outperform the markets when they are rising, but usually underperform when markets are in decline."

There is much more in the full article including earnings previews for Amazon, Apple, Alphabet, Microsoft and Meta.

TM contributor Wajeeh Khan closes out the column today with a Cisco Stock Outlook: JPMorgan Sees Upside To $62.

"Cisco Systems Inc (CSCO) has gained more than 10% since early May but a JPMorgan analyst is convinced that it’s still trading at a discount. On Wednesday, Samik Chatterjee upgraded the multinational to “overweight” and raised his price target to $62 that signals a 20% upside from here...

Cisco Systems Inc will report its Q4 results next month. Consensus is for it to earn 95 cents a share this quarter versus 74 cents per share a year ago.

The JPMorgan analyst likes Cisco stock also because he sees margins improving in fiscal 2024...Cisco Systems currently pays a dividend yield of 2.99% that makes for an additional reason to invest in it. Last month, the legacy tech company launched AI networking chips to better compete with rivals, including Broadcom and Marvell."

As always, caveat emptor.

Have a good one.

More By This Author:

Tuesday Talk: Sniffing Bears Chased Out For Now

Thoughts For Thursday: One Down, One To Go!