Thoughts For Thursday: Market Zig Continues

With two trading days left in the week the market looks as if it is set to continue its downward zig, though yesterday's top gainers had a particularly robust day. Wednesday the S&P 500 closed at 4,514, down 6 pts. but still above the 4,500 level. The Dow Jones Industrial Average closed at 35,031, down 69 pts. and the Nasdaq Composite closed at 15,287, down 88 pts. US market futures are currently trading in the red with the S&P down 6 pts, the Dow Jones down 77 pts and the Nasdaq down 39 points. In Asia the Hang Seng is trading down, while the Nikkei is maintaining its positive momentum from yesterday. In Europe both the FTSE and the Dax are trading lower.

The pharmaceutical company Perrigo (PRGO) was the top gainer on the NYSE yesterday spiking 9% with auto reseller CarMax (KMX) bringing up the rear with a gain of 3.5%.

Chart: The New York Times

In a TalkMarkets Editor's Choice piece entitled September Smackdown Coming Next?, contributor Monica Kingsley gives her take on the markets' latest zigs and zags.

"S&P 500 declined, with tech holding up best – the volatility spike is here as real economy deceleration is joined by Evergrande fears. Both paper and real assets took it on the chin, and yields together with the dollar rose.

Precious metals, copper and oil bore the brunt of souring sentiment, with cryptocurrencies joining in the slide later through the day. But have the material facts changed, or all we got was a whiff of risk-off? September is likely to be volatile, it seasonally is, and August had been a surprisingly calm month. You know what they say about periods of lower volatility giving way to those of higher readings… Time to buckle up."

Kingsley takes a look at the major charts (S&P, Credit, Metals, Commodities, Crypto) with comments about each sector. Below are a couple of those. See the full article for the rest.

(The) Credit market slide would have to stop before the stock market bulls can think about recovery – yesterday‘s picture gives a daily scare impression.

Bitcoin looks to have found a temporary floor, but it would be very premature to declare a fresh upswing to be about to start – medium-term chart damage has been done.

Kingsley's summary take on Wednesday's zig is this:

"Yesterday‘s risk-off day is likely to get at least partially reversed today, and I‘m not looking for it to break the stock market and commodity bull runs. As for precious metals and cryptos, I‘m looking for their recovery to start in earnest once the dollar and yields once again paint a favorable picture."

TM contributor Martin Armstrong in his article Market Talk - Wednesday, Sept. 8 also, runs through yesterday's events with comments concerning the major domo policy makers in Japan, Europe and the US.

"Revised gross domestic product (GDP) data by the (Japanese) Cabinet Office released on Wednesday showed the economy grew an annualized 1.9% in April-June, beating economists’ median forecast for a 1.6% gain and the initial estimate of a 1.3% expansion. The upward revision was caused by better-than-initially-estimated business spending..."

"The governor of the Bank of England, Andrew Bailey, has warned Britain’s economic recovery from COVID-19 is slowing amid supply chain disruption and staff shortages. He said the economic fallout from the disease had “attenuated a lot” over recent months, helping growth to rebound. “But it’s still within the context of this imbalance in demand for goods and services."

"Treasury Secretary Janet Yellen is warning lawmakers to raise or suspend the debt ceiling as “the most likely outcome is that cash and extraordinary measures will be exhausted during the month of October.” Former President Trump suspended the debt ceiling for two years, but the borrowing limit was reimplemented in July after lawmakers failed to act. The debt ceiling was $22 trillion in August 2019, according to the Committee for a Responsible Federal Budget (GRFB). However, the agency believes the reinstated debt will reach $28.5 trillion once lifted. Republicans and Democrats cannot agree on the next measures."

Not to be outdone by stocks and bonds Natural Gas Prices Hit Highest Level In More Than Seven Years, the Staff at contributor Bespoke Weather reminds us that the current hurricane season is not only wreaking physical damage and causing loss of life, but also contributing to strong demand fluctuations for natural gas (UNG).

"The unstoppable natural gas rally continues, even finding a way to hit another gear in today's session, as prompt month prices soared more than 30 cents, even touching the $5.00 level a couple of times.

This was the highest level prompt month has traded since February 2014, in the midst of the infamous "polar vortex" winter.

What was the driver of today's rally? We have discussed previously the supply problem we have in the current natural gas market, and this has only been exacerbated in the wake of Hurricane Ida, as it appears Gulf of Mexico production may be offline much longer than originally anticipated."

The folks at Bespoke weather include several charts and additional data in their article, but conclude with the following:

"Speaking of demand, weather, of course, is a key component, and forecasts have warmed solidly over the last week or so, with projected demand over the next 15 days running above normal levels, measured by Gas-Weighted Degree Days (GWDDs).

Now, we are inching closer to the time when warmth becomes bearish, as orange / red maps in three to four weeks will mean below normal demand, but we are not quite there yet. Needless to say, once to the winter months, weather's importance in the natural gas market will be even more elevated than usual, as the difference for natural gas prices between a warm and cold winter can be measured in dollars..."

In the where to/where not invest realm TM contributors Tim Knight and Chris Katje take a look at two stocks that have garnered more than their fair share of attention in 2021, thus far.

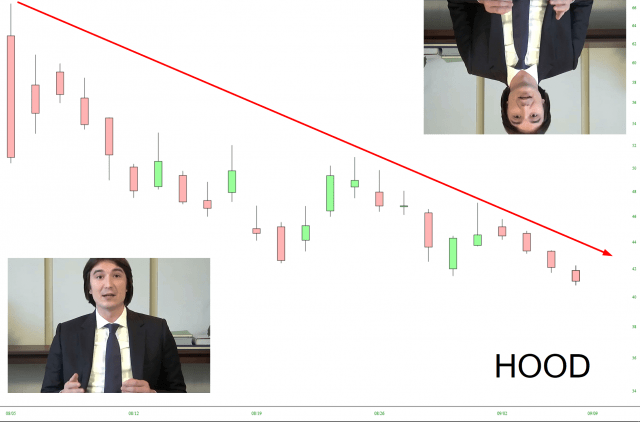

Knight in his article Robinhood The Garbage Stock throws up the Robinhood (hood) candlestick chart since its IPO at the end of July. In this case far fewer than 1,000 words are needed to explain the picture.

What Knight postulates is simply this:

"And to think how many people were breathlessly awaiting the deployment of this security. Can you imagine what it would be worth in a normal, organic market? No, you can’t. Because it would never have gone public in the first place."

Chris Katje reports that GameStop Shares Fall On Q2 EPS Miss, Revenue Beat.

"GameStop Corp (GME) net sales of $1.18 billion in the second quarter. The total was up 26% year-over-year and came in ahead of the Street estimate of $1.12 billion.

Earnings came in at a loss of 76 cents per share, which missed estimates by 10 cents. GameStop ended the quarter with cash of $1.78 billion. The company reports it has no long-term debt, other than a $47.5 million loan that is associated with the French government’s response to the COVID-19 pandemic...

GameStop shares were down 2.3% to $194.20 in after-hours trading."

Chart: Google

Turning to the week in crypto TM contributor Tammy Da Costa writing in Bitcoin Finds Support Above $45,000 After Steep Decline.

"It’s been an interesting week for Bitcoin (BITCOMP). US dollar weakness boosted sentiment for the major cryptocurrency. After a dismal NFP (Non-Farm Payroll) report saw Bitcoin peak above the key psychological level of $50,000, bulls were able to push higher before running into a wall of resistance just below $53,000.

Despite the adoption of BTC/USD as a legal tender for El Salvador, the rally came to a rapid halt as the upward momentum faltered, allowing sellers to push prices back below $50,000 and towards the $45,000 mark...price action currently remains above both the 50- and 200-day moving average on the daily chart whilst the MACD remains above the zero line. This suggests that the upward trajectory may still be relevant..."

Caveat Emptor, folks!

Rounding out today's column is a detailed look at the US labor market by economist and TM contributor Timothy Taylor . His piece The US Labor Market Struggles To Reorient tries to make sense of what (in my mind) can be described as a "hot" and "cold" job market. It's a good read. Here is some of what Taylor has to say:

"There’s a sort of paradox in the current US labor market. By a standard measure, there is strong demand by employers to hire more workers. By a standard measure, there is strong supply of workers willing to take these jobs. But even if there appears to be strong demand and supply for labor at first glance, the number of jobs remains well below pre-pandemic levels.

"First, unemployment shot up up with very little change in job openings. Since then, the job openings rate has been climbing to very high levels, and while unemployment has declined, the job openings rate is far higher that at other times when the unemployment rate has been in the range of 5.2%."

"Every recession involves a reorganization and restructuring of the economy. In a standard recession, this involves a larger-than-usual number of companies going broke, and workers needing to scramble for different jobs. But the restructuring in the pandemic recession–and in continuing restructuring in the pandemic that has continued even though the pandemic recession ended back in April 2020–is of a different sort.

There are new dividing lines across the labor force, like who can work from home, and what sectors of the economy have been more affected by the pandemic on an ongoing basis, and whether parents can rely on sending their children physically off to school. There are concerns about what working environments are more or less safe."

"The strange mixture of conditions in the labor market has occurred as millions of potential workers hold their collective breath, and decide when or if they are willing to jump back into the labor market."

If you are one of those holding your breath, just remember you can't do it forever (that stimulus money will run out) and if you are a relatively young worker the damage to your career may be more permanent than you imagine.

Have a good week and get vaccinated. I'll be back next Tuesday.

Certainly covered a lot, and spared nobody.