Thoughts For Thursday: Breaking The Nasdaq

The Dow and the Nasdaq went in opposite directions in Wednesday's trading. The Nasdaq stands lower than where it was a year ago, illustrating the rough ride it has been for growth and technology stocks. The latest casualty to pull the index down was Netflix (NFLX) which fell $122 yesterday, or 35% to close at $226 per share, on news that it ended the quarter with 200,000 fewer subscribers that it had at the beginning of the year and expectations that it will lose up to 2 million subscribers in Q2.

Yesterday the S&P 500 closed at 4,459, down 3 points, the Dow closed at 35,160, up 250 points and the Nasdaq Composite closed at 13,453 down 167 points. Most active issues were largely down, including tech heavyweights Advanced Micro Devices (AMD) and Nvidia (NVDA) which were down 3% and 3.2%, respectively.

Chart: The New York Times

Currently in early trading S&P 500 market futures are trading up 30 points, Dow market futures are trading up 185 points and Nasdaq 100 market futures are trading up 129 points.

Contributor Stephen Innes in an exclusive for TalkMarkets writes that Investors (Are) Acclimatizing To Headline Discomfort.

"In the wake of the Netflix debacle, US equities traded flat overnight as Netflix is less than 1% in S&P 500 (SPX).

The beige book release was non-alarmist, cushioning some extreme growth fears. Still, no one is willing to call an all-clear, despite signs that investors are acclimatizing to the constant headline discomfort as a bid returns to the US bond markets. Softer bond yields typically provide buoyancy to stocks.

Oil prices are still lower, a soothing balm for EU stocks. Europe traded extraordinary strong with Tech, Banks, and Industrials outperforming, while Resources Energy lagged on the pullback in metals ad oil.

The narrative for retail investors to sell ahead of Tax Day (April 18) has played to perfection. Retail investors were net sellers April 4-13 before turning small to buy over the past two days.

It was not surprising to see the reversal in equity markets on Tuesday as investors followed that playbook. While the relief rally was expected, the magnitude was not. Nevertheless, it is too early to call for a shift in retail sentiment."

TM contributor Diego Colman notes that the Dow Jones Outperforms Wall Street Peers As Netflix’s Collapse Drags Tech Shares

"The Dow Jones Industrial Average (DIA) outperformed the other two major averages on Wednesday, rising 0.72% to 35,160, its best level since late March, supported by a strong advance in shares of Goldman Sachs (GS), Home Depot (HD), and IBM (IBM). "

"After decent gains on Wednesday, the Dow Jones accomplished a notable feat – it broke above cluster resistance and reclaimed its 200-day moving average. The index, however, fell short of printing a new higher high and overtaking the March peak, a sign that bullish momentum is not yet strong enough. While sentiment appears to be on the mend, bulls need to clear the 35,350 area decisively to convince traders on the fence to jump back in. If we do see a move above this resistance in the coming sessions, buying interest could accelerate, paving the way for a move towards 35,820, followed by 36,550.

On the flip side, if sellers return and regain control of the market, initial support appears at 34,955. If this floor is breached, the index could correct lower and head towards its 50-day SMA. On further weakness, the focus shifts down to the 34,100 zone."

In the commodities markets contributors Warren Patterson and Wenyu Yao note that US Oil Exports Surge.

"EIA weekly numbers were constructive with US commercial crude oil inventories declining by 8.02MMbbls over the last week, which would be the largest weekly decline in crude inventories since January 2021. Factoring in SPR releases, total US crude oil inventories declined by 12.72MMbbls over the week. The decline was largely driven by crude oil exports, which averaged 4.27MMbbls/d, up 2.090MMbbls/d WoW. In fact, total oil and refined product exports hit a record level of 10.6MMbbls/d, exceeding the previous record of 10.13MMbbls/d seen in late 2019. This saw net exports of oil and product grow to more than 2.9MMbbls/d last week, which is also a record. Given the structural changes we are seeing in the global oil market regarding Russian supply, along with the expected growth in US crude oil output, we would expect that the US becomes an even larger net exporter of oil and products in the months and years ahead."

See the rest of the article for a metals markets update.

In the gold market contributor Mike Zaccardi writes that Gold Climbs Despite Macro Headwinds.

- "A multi-year high in the US Dollar seems to be no problem for the price of gold

- Rising real yields, typically a bearish macro driver, have not stopped the shiny metal

- Stock market sentiment is pessimistic and bond flows are downright bearish. Amid a rebound in commodities, gold ETF flows have been robust.

Gold (GLD) prices approach $2,000 once again. After spiking to an all-time high in early March at $2,080, the yellow metal dropped under $1,900, albeit briefly, twice in March. Geopolitical fears tied to Russia’s invasion of Ukraine sparked a buying spree across most commodities, and gold was among those bids. A troy ounce rose more than 10% from its January trough under $1,800. After a reset lower over the latter three weeks in March, another commodity revival brings us back to the psychological $2,000 figure...Investors are finding solace in commodities.

The old trading adage, “if you drop it on your foot and it hurts, then you want to own it” is en vogue. The theme could be long-lasting, and we expect commodity-related stocks to perform well over the coming 5-10 years. Another intriguing aspect of the recent jump in gold prices is that it comes amid a rising US Dollar. Thus, price in other currencies, gold’s jolt is even more jarring.

Bottom Line:

Gold prices have been creeping back up as investors seem focused on other commodities and asset classes. While stock market sentiment is in the doldrums and the media fixates on rates, the commodity index is not far off its Q1 high. Gold prices in particular are rallying in the face of what are usually bearish macro trends."

Hmmm...seems to be quite a bit of look for what you want to hear, here.

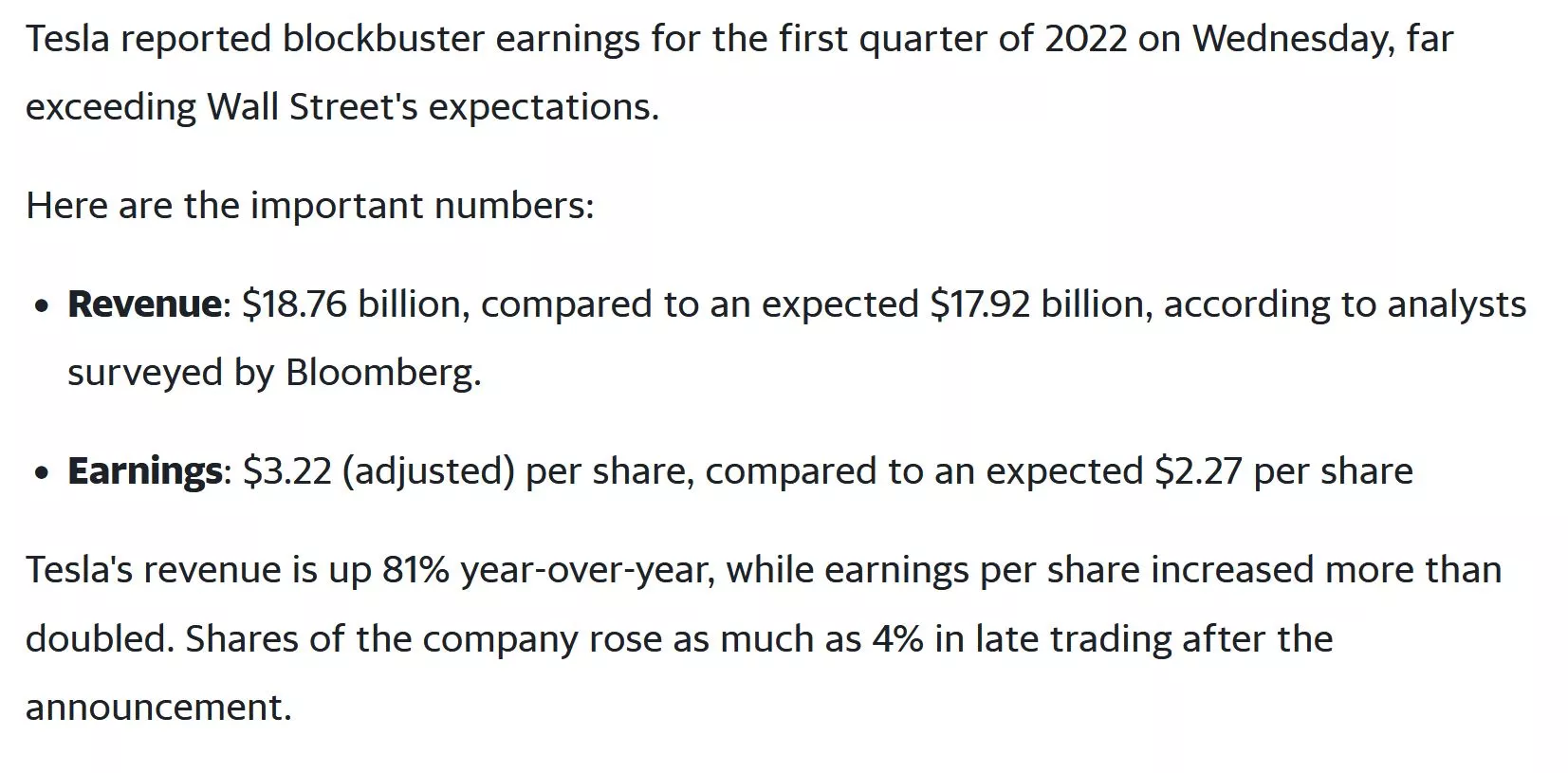

Closing out the column today TalkMarkets contributor Andy Wang has an exclusive for TM readers as regards Tesla's Record Quarter - Elon Musk Delivers Again.

Tesla (TSLA) reported a record quarter after the market today, sending its stock up +5.57% aftermarket:

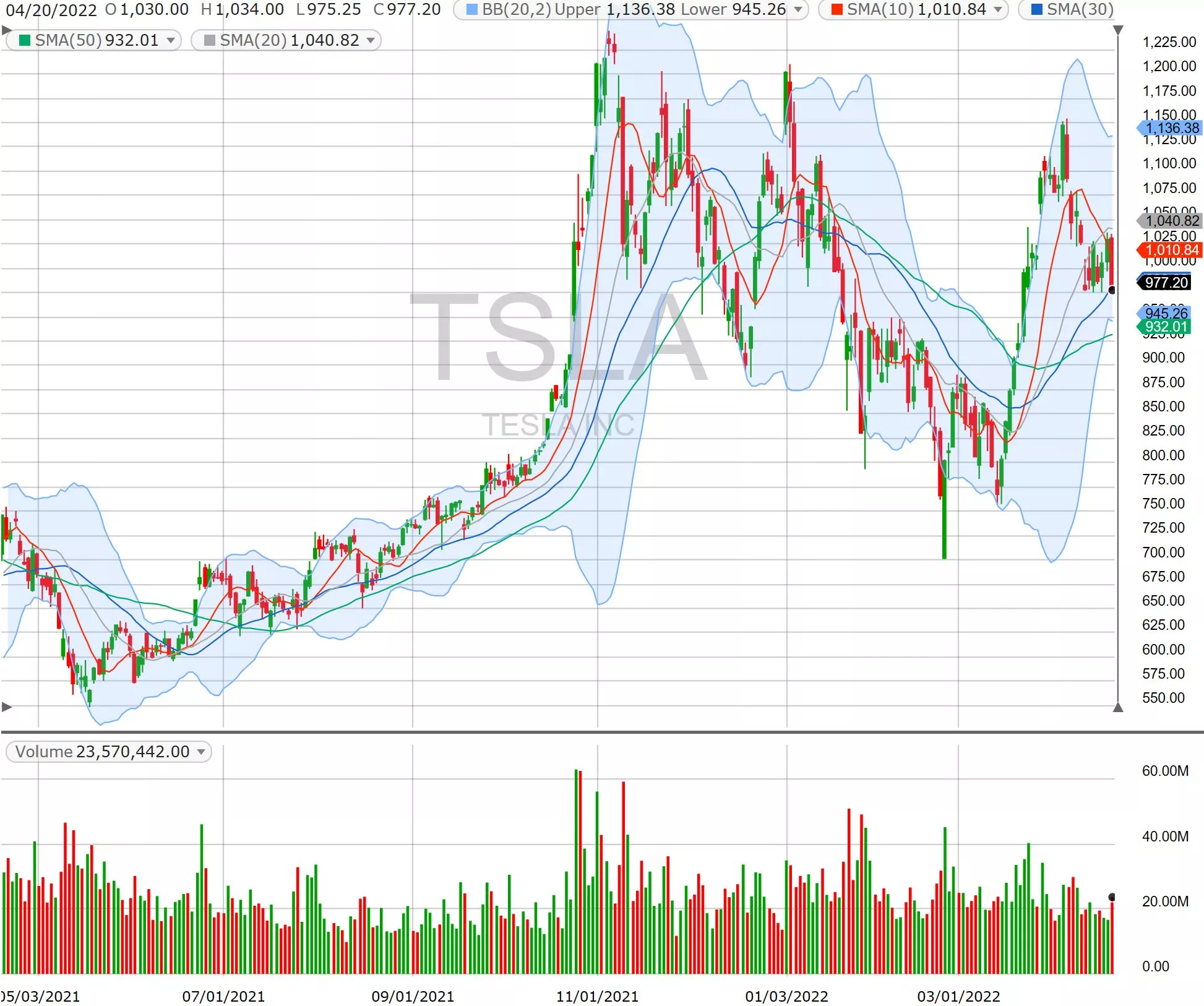

With a record quarterly report, and the stock is merely up +5.57% in the after-hours trading - this tells you something about the over market conditions. TSLA closed at $977.2 and traded at $1031.6 at the time of this writing:

"Looking at TSLA's daily chart, it seems that TSLA can go higher tomorrow. We could see a test to $1100, although it might take a few days. TSLA's good fortune will spill to other EV-car makers in China tomorrow. So, take a peek into the likes of NIO and XPEV.

With this earnings performance, Elon Musk is primed to gain a $23 billion compensation. Joking aside, this bonus is more than half of his bid of $43 billion for Twitter (TWTR)."

Cowabunga, dude!

As always, caveat emptor.

Have a good one.

Image: David Marshall