This Is Becoming A Bit Of A Habit

Image Source: Pexels

Today seemed to be another morning when the rotation (“routation”?) out of big cap tech and into value had continued, though with less ferocity than we have seen in prior sessions, but by midday it had morphed into a bit more of a broad-based selloff. It would be tempting to think that the gloom was related to the cloud outages affecting Microsoft (MSFT) Azure and caused by a software glitch at Crowdstrike (CRWD) but considering that MSFT is only modestly lower (though CRWD is -9%), I find it hard to believe that is the cause. Today is more about fading momentum and overall concerns.

We of course had the requisite attempt at our daily “buy the dip” opening rally, but the bounce in the S&P 500 (SPX) was partly driven by this morning’s monthly expiration of AM-expiring index options (yes, we still have them). The expiring open interest in both SPX and Russell 2000 (RTY) options was not historically significant, but it was enough to drive SPX up toward 5550 while driving RTY down toward 2200 before they both went on their way. Remember that expiring open interest in near-the-money options can act as a slingshot or a magnet. This morning they had a modest magnetic attraction that weakened almost immediately after the markets opened.

My main theme this week, expressed multiple times, has been that the most popular trades got so crowded that when investors tried to do some normal profit-taking, they brought major indices with them. The major cap-weighted indices had become so top-heavy with tech that they had no choice but to heavily pressure SPX, NDX (Nasdaq100), and the like when people tried to exit. The market internals did not reflect a broad-based selloff, even if those indices gave that appearance. Today, however, rather than seeing a day when other measures like RTY or INDU (Dow Jones Industrial Average) rose despite the drops in SPX and NDX, those too are lower today. We also see a greater bias toward declining stocks over advancers, but the roughly 2.5:1 bias is hardly a massive one. As we head into the close, we’ll see if that retrenches, as we’re trying to do around midday, or accelerates like it did other afternoons this week.

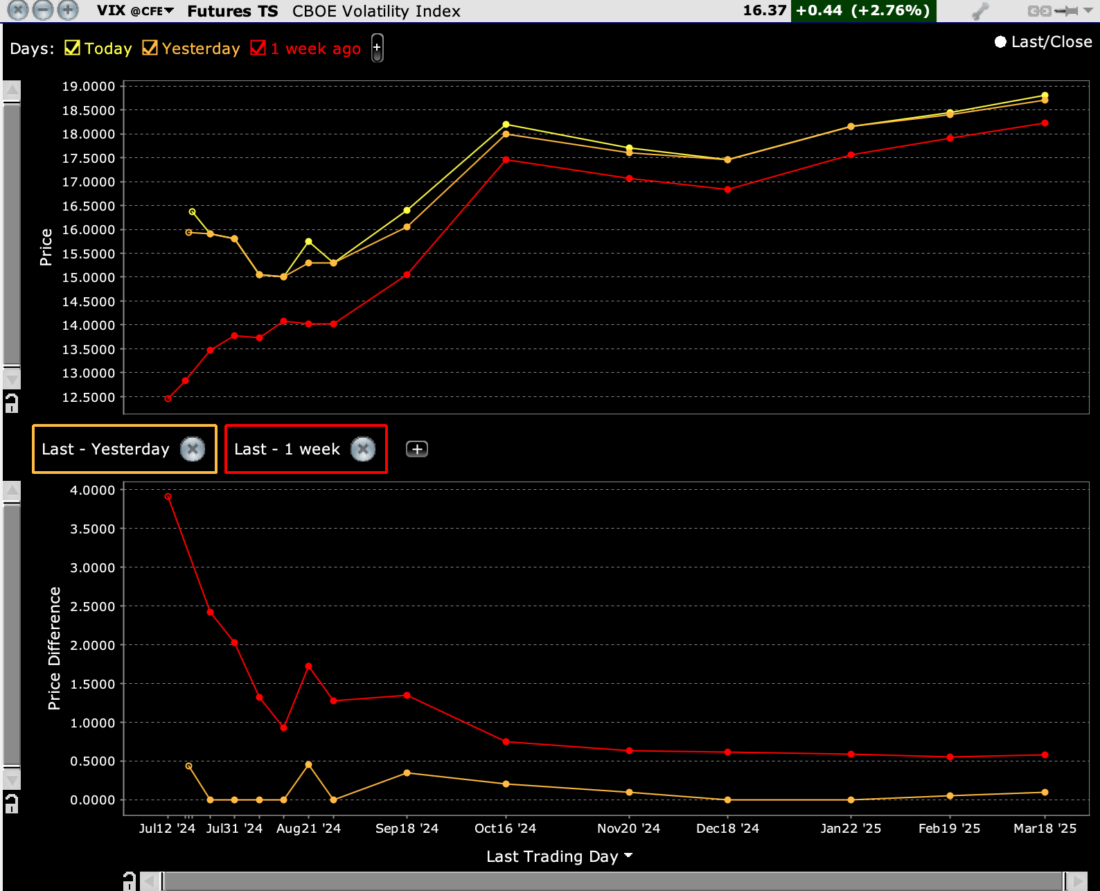

One measure that I am watching closely is of course VIX (Cboe Volatility Index). It’s very important to note that VIX is now above 16, just days after being mired around 12.5. There are a few key things to note:

First, we wrote last week about how VIX was actually reflecting a decent amount of risk aversion among institutional investors despite its low reading. The reasons for that assertion were that:

- The historical volatility of SPX was at a post-covid low,

- Dispersion (measured by DSPX) was at a post-covid high,

- Correlations among even the top 50 stocks (measured by COR1M) was at a historic low.

If VIX were to have followed them normally, the index would have been flirting with single digits.That it hadn’t told me that there was residual demand for hedging protection despite the factors that should have depressed VIX.(More about this in pieces I wrote on July 8th (VIX – It’s Not Just Complacency | Traders’ Insight (ibkrcampus.com)) and July 10th (More Quick Thoughts About Complacency | Traders’ Insight (ibkrcampus.com))

It is also important to consider VIX futures as well as the widely reported spot index level. Yesterday, a friend reached out to me to point out that August VIX calls seemed to be trading below their intrinsic values. I reminded him that VIX options (all options, for that matter) trade off their future values, not the spot price. But it points out that because spot VIX is above the August futures, that’s backwardation. It’s mild, but it’s backwardation, nonetheless. Backwardation in a futures contract implies that there is an abnormal imbalance of demand over supply for the commodity in question. In this case, the commodity is volatility protection. Investors decided quickly and en masse that they wanted protection, and they wanted it NOW. The recent bout of SPX volatility woke people up about the potential for future volatility. Just because it’s been sleepy doesn’t mean it will continue during the coming 30 days that include earnings season and an FOMC meeting. Yet the backwardation implies that they then expect the Aug-Sep period to be more like a normal summer

And by the way, the bump in October and beyond remained relatively unchanged. That showed that equity traders were not fully willing to change their opinions about electoral and post-election volatility.

Let’s see if we end this week with a bang or a whimper.

VIX Futures Term Structure, Today (yellow, top), Yesterday (orange, top), 1-Week Ago (red, top), with Changes Between Today and Yesterday (orange, bottom), and Today and 1-Week Ago (red, bottom)

(Click on image to enlarge)

Source: Interactive Brokers

More By This Author:

The “Routation” ContinuesPressure Drop

Today’s Activity: Referendum Or Ongoing Rally?

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more ...

more