Today’s Activity: Referendum Or Ongoing Rally?

Image Source: Unsplash

I have spent much of the past 36 hours discussing the potential market impacts of the weekend’s events. Even after analyzing the various political ramifications, it’s not clear to me that the market reaction is about much other than a continuation of the ongoing momentum-based rally. As of midday, most of the market is doing what it does anyway – move higher led by megacap technology.

I was asked several times about how to discern the broad market impact of the attempted assassination of a Presidential candidate. The key, as always, is to try our best to remove emotions and bias from our response – even though it is almost always impossible to do that, especially in this case. And I offered my typical disclaimer: equity traders are not particularly good at interpreting the effects of geopolitical events on stock prices unless the events could have a direct impact on a company’s revenues, earnings, or cash flows. Investors are very good at determining direct effects, much less so at indirect impacts.

That is why we see some specific items leading the rally. Trump Media & Technology (DJT) is an obvious beneficiary, off its knee-jerk highs, but still up about 25% around midday. Put simply, this company is far more relevant and thus has greater profit potential if its namesake returns to the Presidency. Bitcoin is up over 4%, perhaps on a bit of a flight to safety (though gold is up less than 1%), but more likely because a Trump administration is perceived as being more crypto-friendly than Biden’s.Tesla (TSLA) is among the day’s best performers, up over 4%, likely benefitting from the former President’s seemingly cordial relationship with Elon Musk.

Energy-related shares are mostly higher even as crude is essentially unchanged, thanks to the perception that a Trump administration would be more friendly to that industry. Firearms manufacturers are also generally higher, thanks to traders’ knee-jerk reaction to buy those stocks after any major gun-related incident in the US. It can be seen as perverse, but remember, it’s about the bottom line, for better or worse. Gun-related tragedies often spur more firearm purchases.

To get the broader market opinion, I proposed two metrics that could cut through some of the market noise:

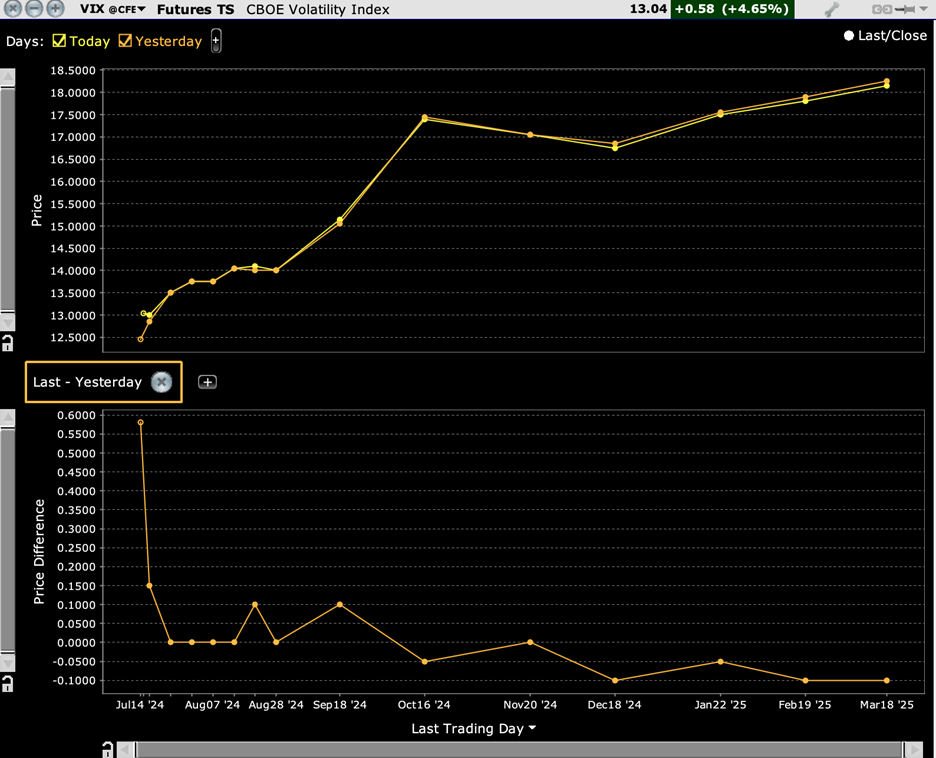

- Is there any significant change in the VIX futures curve, particularly in the October-December period?

- Did the Treasury yield curve steepen meaningfully?

Regarding futures on the Cboe Volatility Index (VIX), if there was a meaningful change in the prospects for volatility around the election, it would show up in October VIX futures. Remember, VIX is the market’s best estimate of volatility over the coming 30-day period, so VIX futures that expire in mid-October would cover the early November elections. There has been a bump in the futures curve in that segment of the curve since the October futures and beyond were listed. As of today, the graph below demonstrates that there is virtually no change in the futures that cover the election and post-election period. Certainly, there is no significant change in perceptions about volatility in the months to come.

VIX Futures Curves, Today (yellow, top), Yesterday (orange, top), with One-Day Change (bottom)

(Click on image to enlarge)

Source: Interactive Brokers

As for the yield curve: after the debate, we noted that the Treasury yield curve steepened notably in the two trading days that followed. The reaction was attributable to bond market concerns about the former President’s preference for a set tariff hikes and tax cuts that could expand the government deficit. The steepening actually became more pronounced and obviously election-related on the following Monday, when yields rose despite ISM statistics that pointed to economic weakness. Since then, yields have subsided across the curve as bond investors focused on other economic factors rather than the election. Thus, when I see 2-year yields lower by 1 basis point, 10-years higher by 3bp, and 30-years up by 4bp, I interpret that as the bond market placing a greater likelihood on Trump beating Biden, but hardly a referendum.

I’m finishing this just before Federal Reserve Chair Powell begins an economic discussion that could involve more clarity about near-term Fed policy. In the immediate term, this could outweigh anything that involves the further-away election.

More By This Author:

Today, Higher Inflation + Lousy Consumer = Buy

Has Healthy Rotation Become Potentially Toxic?

Stocks Rally On Labor Deceleration

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to ...

more